2Ban

Investment Thesis

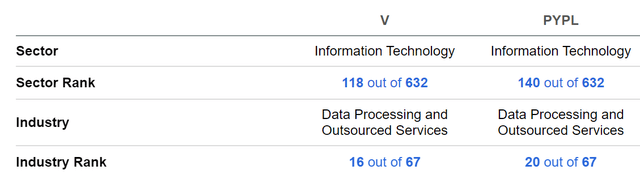

- According to the Seeking Alpha Quant Ranking, Visa (NYSE:NYSE:V) is ahead of PayPal (NASDAQ:NASDAQ:PYPL): in the Data Processing and Outsources Services Industry, Visa is ranked 16th while PayPal is 20th (out of 67). Within the Information Technology Sector, Visa is also in front of PayPal in 118th place while PayPal is ranked 140th (out of 632).

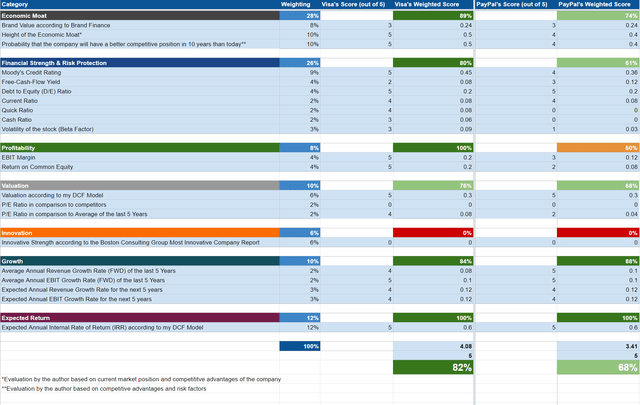

- Visa scores 82/100 points on the HQC Scorecard, which is a very attractive overall rating in terms of risk and reward. As according to the Scorecard, the company is rated as very attractive in the categories of Economic Moat (89/100), Financial Strength (80/100), Profitability (100/100), Growth (84/100) and Expected Return (100/100).

- PayPal currently scores 68/100 points as according to the HQC Scorecard, showing an attractive overall rating in terms of risk and reward. The company achieves very attractive results in the categories of Growth (88/100) and Expected Return (80/100). However, when it comes to Profitability (50/100), it’s only rated as moderately attractive.

- The overall rankings of the HQC Scorecard reinforce my opinion to rate PayPal as a buy and Visa as a strong buy. However, if I had to pick one out of the two, I would choose Visa.

- Taking into account Visa’s current stock price of $193.30, my DCF Model calculates an Internal Rate of Return of 14% for Visa. Considering PayPal’s current stock price of $94, my DCF Model calculates an Internal Rate of Return of 16% for PayPal.

Visa and PayPal’s Competitive Positions

In a previous analysis on Visa, I discussed the company’s wide economic moat:

“Despite the high profit margins when compared to other industries, it is hard for Visa’s competitors to enter into the market. Visa’s reliable payments network, the company’s technological knowledge as well as its broad network within the financial service industry in combination with a strong brand image, protect the company from additional competitors entering the business segment.”

Visa’s high EBIT Margin of 67.48% provides a strong indicator of the company’s excellent competitive position. Its Average Dividend Growth Rate of 17.84% over the last five years shows that the company is on track when it comes to growth.

PayPal, however, has shown an even higher Revenue and EBIT Growth Rate [FWD] over the last 5 years: while PayPal has an Average Revenue Growth Rate of 17.55% and an Average EBIT Growth Rate of 21.34% over the last five years, Visa’s 5 Year Average Revenue Growth Rate is 10.83% and its 5 Year Average EBIT Growth Rate is 12.13%.

In 2Q22, PayPal released figures that suggest it currently has 429M active accounts including 35M active merchant accounts. At the same time, the company’s Total Payment Volume was $340B in 2Q22 and its Payment Transactions Per Active Account [TPA] were 48.7. This implies an increase of 12% as compared to the same quarter of the previous year.

PayPal has been able to create a payment ecosystem, which provides the company with a wide economic moat over its competitors. The company’s high Free Cash Flow Yield of about 4.7% signifies another competitive advantage over less financially strong companies within the digital payment industry. This high Free Cash Flow Yield contributes to my buy rating for the company.

The Valuation of Visa and PayPal

Discounted Cash Flow [DCF]-Model

I have used the DCF Model to determine the intrinsic value of Visa and PayPal. The method calculates a fair value of $248.98 for Visa and $126.06 for PayPal. At the current stock prices, this gives Visa an upside of 28.8% and PayPal an upside of 34.1%.

My calculations are based on the following assumptions as presented below (in $ millions except per share items):

|

Visa |

PayPal |

|

|

Company Ticker |

V |

PYPL |

|

Revenue Growth Rate for the next 5 years |

10% |

11% |

|

EBIT Growth Rate for the next 5 years |

10% |

11% |

|

Tax Rate |

23.4% |

19.3% |

|

Discount Rate [WACC] |

7.50% |

8.3% |

|

Perpetual Growth Rate |

4% |

4% |

|

EV/EBITDA Multiple |

22.7x |

23.4x |

|

Current Price/Share |

$193.30 |

$94 |

|

Shares Outstanding |

2,069 |

1,157 |

|

Debt |

$23,795 |

$11,381 |

|

Cash |

$14,047 |

$4,583 |

|

Capex |

$883 |

$806 |

Source: The Author

Based on the above, I calculated the following results:

Market Value vs. Intrinsic Value

|

Visa |

PayPal |

|

|

Market Value |

$193.30 |

$94.00 |

|

Upside |

28.80% |

34.10% |

|

Intrinsic Value |

$248.98 |

$126.06 |

Source: The Author

Internal Rate of Return for Visa

The Internal Rate of Return [IRR] is defined as the expected compound annual rate of return that will be earned on an investment. Below you can find the Internal Rate of Return as according to my DCF Model, when assuming different purchase prices for the Visa stock. The lower the purchasing price, the higher the Internal Rate of Return. At Visa’s current stock price of $193.30, my DCF Model indicates an Internal Rate of Return of approximately 14%, while assuming a Revenue and EBIT Growth Rate of 10% for the company over the next five years. (In bold you can see the Internal Rate of Return for Visa’s current stock price of $193.30.)

|

Purchase Price of the Visa Stock |

Internal Rate of Return as according to my DCF Model |

|

$150.00 |

21% |

|

$160.00 |

20% |

|

$170.00 |

18% |

|

$180.00 |

16% |

|

$190.00 |

15% |

|

$193.30 |

14% |

|

$200.00 |

13% |

|

$210.00 |

12% |

|

$220.00 |

11% |

|

$230.00 |

10% |

|

$240.00 |

9% |

|

$250.00 |

7% |

Source: The Author

Internal Rate of Return for PayPal

At PayPal’s current stock price of $94, my DCF Model indicates an Internal Rate of Return of 16%, while assuming a Revenue and EBIT Growth Rate of 11% over the next 5 years. (In bold you can see the Internal Rate of Return for PayPal’s current stock price of $94.)

|

Purchase Price of the PayPal Stock |

Internal Rate of Return as according to my DCF Model |

|

$70.00 |

24% |

|

$75.00 |

22% |

|

$80.00 |

21% |

|

$85.00 |

19% |

|

$90.00 |

17% |

|

$94.00 |

16% |

|

$95.00 |

16% |

|

$100.00 |

14% |

|

$105.00 |

13% |

|

$110.00 |

12% |

|

$115.00 |

11% |

Source: The Author

Relative Valuation Models

The P/E [FWD] Ratio for Visa and PayPal

Visa’s P/E Ratio is currently 28.36, which is 13.07% below its 5 Year Average (32.62), indicating that the company is currently undervalued.

PayPal’s current P/E [FWD] Ratio is 62.57, which is 7.51% above its 5 Year Average of 58.20, showing that PayPal is currently slightly overvalued.

Fundamentals: Visa vs. PayPal

Visa’s Return on Equity [ROE] of 39.85% is significantly higher than PayPal’s (10.11%). This high ROE is proof that Visa’s management is very efficient in generating income and growth from its equity financing.

Visa and PayPal’s relatively high Free Cash Flow Yield [TTM] of 3.96% and 4.7% show that both companies have significant amounts of cash left each year to be able to pay dividends, pay down debt and also to contribute to growth. It’s also an indicator of the enormous financial strength of both companies. The low Total Debt to Equity Ratio of 67.06% for Visa and 57.58% for PayPal once again underlines this enormous financial strength.

Visa’s EBIT Growth Rate [FWD] of 16.13% and Free Cash Flow Per Share Growth Rate [FWD] of 23.98% are significantly higher in comparison to PayPal (which has an EBIT Growth Rate [FWD] of 16.13% and Free Cash Flow Per Share Growth Rate [FWD] of 11.93%). These Growth Rates confirm my assumption that Visa is currently slightly more attractive than PayPal. Below you can find an overview of some fundamental data for both companies.

|

Visa |

PayPal |

|

|

Ticker |

V |

PYPL |

|

Sector |

Information Technology |

Information Technology |

|

Industry |

Data Processing and Outsourced Services |

Data Processing and Outsourced Services |

|

Market Cap |

412.55B |

112.94B |

|

Revenue |

28.08B |

26.39B |

|

Revenue 3 Year [CAGR] |

8.03% |

17.32% |

|

Revenue Growth 5 Year [CAGR] |

9.59% |

17.55% |

|

EBITDA |

19.79B |

4.64B |

|

EBIT Margin |

67.48% |

14.00% |

|

ROE |

39.85% |

10.11% |

|

P/E GAAP [FWD] |

28.36 |

62.57 |

|

Dividend Yield [FWD] |

0.75% |

– |

|

Dividend Growth 3 Yr [CAGR] |

14.47% |

– |

|

Dividend Growth 5 Yr [CAGR] |

17.84% |

– |

|

Consecutive Years of Dividend Growth |

13 Years |

– |

|

Dividend Frequency |

Quarterly |

– |

Source: Seeking Alpha

The High-Quality Company [HQC] Scorecard

“The aim of the HQC Scorecard that I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description of how the HQC Scorecard works.

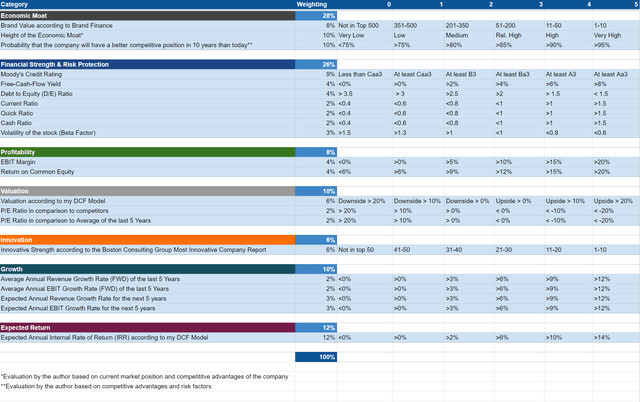

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

Visa and PayPal According to the HQC Scorecard

As according to the HQC Scorecard, Visa scores 82/100 points. This is a very attractive overall scoring in terms of risk and reward. PayPal scores 68/100, resulting in an attractive overall rating when it comes to risk and reward.

In the category of Economic Moat, Visa achieves 89/100 points while PayPal gets 74/100.

In the category of Financial Strength, Visa scores 80/100 points compared to 61/100 for PayPal. Visa’s higher score in this category is particularly due to its higher credit rating of Aa3 by Moody’s (PayPal has an A3 rating) and also its higher Quick Ratio and Cash Ratio as compared to PayPal. While Visa has a Quick Ratio of 1.05, PayPal’s is only 0.23. Visa’s Cash Ratio was 0.9 in the last quarter, while PayPal’s was just 0.2. Visa’s higher Quick and Cash Ratio as compared to PayPal is evidence that the company has a stronger ability to meet its short-term obligations.

In terms of Profitability, Visa shows very attractive results by achieving 100/100 points while PayPal only shows moderately attractive results (50/100). The scorings in this category are a result of Visa’s higher EBIT Margin (67.48% as compared to PayPal’s 14.00%) and its higher ROE (39.85% as compared to PayPal’s 10.11%).

In the categories of Valuation, Visa (76/100 points) and PayPal (68/100) achieve attractive results. This is particularly due to the upside potential that my DCF Model shows for both companies.

In terms of Growth and Expected Return, both companies achieve very attractive results. This is especially due to the companies’ relatively high Expected Internal Rate of Return (my DCF Model indicates an IRR of 14% for Visa and 16% for PayPal).

The companies’ overall ratings as according to the HQC Scorecard, strengthen my opinion to rate PayPal as a buy and Visa as a strong buy; if having to decide between investing in Visa or in PayPal, I would choose Visa.

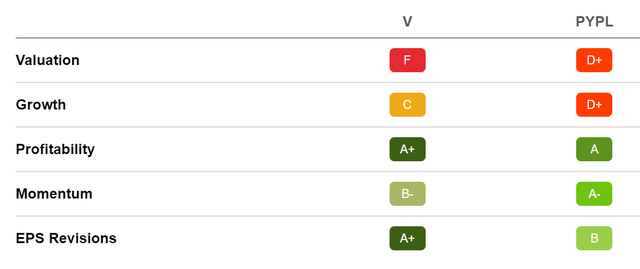

Visa and PayPal According to the Seeking Alpha Quant Factor Grades

Taking into account the Seeking Alpha Quant Factor Grades, Visa is rated with a C in terms of Growth while PayPal receives a D+. For Profitability, Visa gets an A+ while PayPal gets an A. The results in these categories reinforce my opinion to look at Visa ahead of PayPal.

Visa and PayPal According to the Seeking Alpha Quant Ranking

The results of the Seeking Alpha Quant Ranking also confirm my opinion to prefer Visa. In the Data Processing and Outsources Services Industry, Visa is ranked 16th while PayPal is ranked 20th (out of 67). Within the Information Technology Sector, Visa is also ahead in 118th place while PayPal is ranked 140th (out of 632).

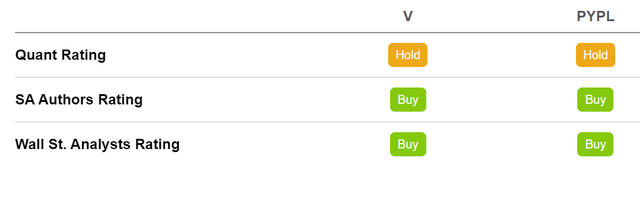

Visa and PayPal According to the Seeking Alpha Authors Rating and Wall Street Analysts Rating

According to the Seeking Alpha Quant Rating, both companies are currently a hold. However, the Seeking Alpha Authors Rating and the Wall Street Analysts Rating show both companies as a buy.

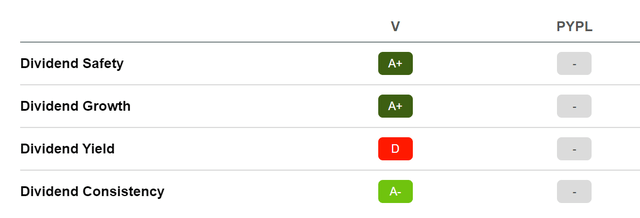

Visa and PayPal According to the Seeking Alpha Dividend Grades

The Seeking Alpha Dividend Grades further confirm that Visa is a very attractive pick for dividend growth investors. The company is rated with an A+ in terms of Dividend Safety, an A+ for Dividend Growth and an A- when it comes to Dividend Consistency. PayPal currently does not pay any dividend. However, its current Free Cash Flow Yield of 4.7% is an indication that the company could theoretically pay a relatively high dividend yield.

Risks

Visa and PayPal operate within an industry in which new technologies are developed very quickly. Additionally, new competitors emerge continuously, which makes it necessary for both companies to constantly anticipate new technologies in order to remain competitive: Visa and PayPal compete with fintech companies, digital payment providers and technology companies. Both have proved their ability to successfully anticipate new technologies and to integrate new acquisitions into their existing businesses. Due to their strong competitive advantages (such as their brand images and their relatively high free cash flow yield), I expect both Visa and PayPal to compete successfully with fintech companies and new competitors alike in the years to come.

The brand images of Visa and PayPal are characterized by a high level of trust. The trust that customers have in Visa and PayPal gives both companies an enormous competitive advantage over new competitors that still have to build a brand image and therefore have a lower level of customer trust.

For these reasons, I consider it to be much less risky to invest in companies such as Visa or PayPal than in new and not yet established payment service providers.

One of the main risk factors I see for both companies would be if their brand images got damaged and consumer trust therefore decreased. This could have a huge impact on the companies’ revenues and profit margins.

If having to decide between Visa and PayPal, I would opt for Visa, since the company shows stronger financials than PayPal. This is proved by its higher credit rating (Aa3 by Moody’s, A3 for PayPal) as well as its higher Quick Ratio and Cash Ratio. Visa’s higher Quick and Cash Ratios provide proof of its stronger ability to meet its short-term obligations in comparison to PayPal. Additionally, Visa has a lower 60M Beta (0.90) compared to PayPal (1.44). This relatively low 60M Beta is an indicator that an investment in the company comes with an even lower risk than when investing in PayPal. Furthermore, it shows that you can reduce the volatility of your investment portfolio by investing in Visa.

Industry Outlook

In general, I consider the payment industry in which Visa and PayPal operate to be highly attractive for investors. This is due to the relatively high margins that companies can generate (Visa and Mastercard (NYSE:MA) for example, have EBIT Margins of 67.48% and 56.70% while PayPal has one of 14.00%) and its excellent growth perspectives: companies in this industry benefit from different trends such as the trend towards cashless payments and the consumer trend of buying more and more online.

Companies such as Visa, Mastercard and PayPal have already managed to build a strong brand image. From my point of view, especially in the payment industry, it’s of enormous importance to build up a strong brand image that reflects a high level of consumer trust. The brand images of these companies and the trust customers have in them provide significant competitive advantages, especially over new emerging fintech companies.

For these reasons, I expect companies with broad competitive advantages in the form of a strong brand image (such as Visa, Mastercard and PayPal) to benefit significantly from the trend towards cashless payments over the long term.

The Bottom Line

The results of the HQC Scorecard places Visa in front of PayPal. While Visa receives an overall rating of 82/100 points and can be considered as very attractive in terms of risk and reward, the Scorecard rates PayPal with 68/100 points, resulting in an attractive rating for risk and reward. Visa shows particularly higher results than PayPal in the categories of Economic Moat, Financial Strength and Profitability. The results of the Scorecard strengthen my belief that Visa is currently the more attractive choice in regards to risk and reward.

The Seeking Alpha Quant Ranking also shows Visa to be slightly ahead of PayPal: Visa is ranked 16th while PayPal is ranked 20th (out of 67) within the Data Processing and Outsources Services Industry.

I rate PayPal as a buy while Visa receives my strong buy rating. For me, Visa is ahead of PayPal because of its enormous financial strength (Aa3 credit rating by Moody’s, compared to A3 for PayPal), profitability (Visa has an EBIT Margin of 67.48% while PayPal has one of 14.00%) and its current valuation.

I see both Visa and PayPal as excellent long-term investments. If deciding between one of them, I would choose Visa. In the case that you can buy both, I would recommend that you do so. However, I would slightly overweight the Visa position in comparison to PayPal in an investment portfolio, since I consider the company to be even more attractive in terms of risk and reward.

Be the first to comment