niphon/iStock via Getty Images

September Federal Reserve Meeting (FOMC)

Investors are on the prowl for investments that offer income, as portfolios have taken a hit in this volatile market environment, with no end in sight. And while not all high-yield stocks are created equal, by and large, the backdrop of the upcoming Fed meeting supports a 75- to 100-basis point hike, which bodes well for dividend-paying stocks. However, should the Fed surprise by presenting a less than 75-basis point hike, growth stocks will likely take off.

Major Indexes One-Week Decline Ending 9/16/22

Major Indexes One-Week Decline Ending 9/16/22 (FactSet via WSJ)

But the fight against inflation persists, as the major markets tanked last week on FedEx’s ominous warning of a potential global recession. FedEx sank 21% following its Q4 earnings miss, resulting in analysts downgrading the stock. In addition, several industries, not just air freight and logistics, have felt the heat that resulted in the Nasdaq -5.5% last week, followed by the Dow Jones -4.1% and the S&P 500 -4.8%, similar declines for the week ending September 16th. But the fight against inflation persists, as the major markets tanked on FedEx’s ominous warning of a potential global recession.

“Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S. We are swiftly addressing these headwinds, but given the speed at which conditions shifted, Q1 results are below our expectations,” said FedEx CEO Raj Subramaniam.

Uncertainty continues to move the markets, although the Fed drove home the message in Jackson Hole that it plans to raise rates, prompting Fed Funds futures to reprice terminal rates near 4.4% by April 2023.

Fed Funds Rates Chart (Bloomberg Finance L.P. )

And while the markets may or may not believe that the Fed will be aggressive enough in tightening for the September 20-21 FOMC meeting, as written by Mott Capital Management:

The market agrees that rates need to go higher, [but] it still believes the Fed will be cutting rates by around 40 bps by the end of next year. The spread between the April 2023 Fed Fund futures and December 2023 contracts on August 25 was 32 bps. The current spread suggests the market believes the Fed may be more aggressive in cutting rates next year.

Globally, central banks have been behind the curve, and the U.S. Fed’s inflation battle has investors uncertain about the future. Turning to high-yielding dividend stocks with Strong Buy ratings can make for an excellent portfolio rescue in either a rallying or down market. My three stock picks are fundamentally strong, with solid earnings projections and forward yields above 2.40%, and a four-year average yield above 4%, making a case for an investment rescue option.

3 Dividend Stocks with High Yields to Invest In

Underwhelming wage growth coupled with astronomical “sticky” costs of living – food, healthcare, and shelter, to name a few – spell bad news for many, who are struggling to make ends meet and keep up with the increases that have seen some of the biggest jumps since 1979. As the Fed moves to temper costs, this could spell trouble for some stocks while proving favorable for others.

Budgeting in today’s market is crucial because every dollar counts. Building a portfolio with passive income-generating stocks like LSI, MPC, and CVX offers an opportunity to hedge against potential downturns. I’ve said many times that not all dividend stocks are created equal, and it’s crucial to consider a stock’s fundamentals when picking high-yield stocks. These stocks have strong financials and excellent overall Quant Ratings & Factor Grades that complement their high yields.

1. Life Storage, Inc. (NYSE:LSI)

Ranked second in its industry and eighth out of 179 in its sector, Life Storage, Inc. (LSI) is an adjusted income self-storage REIT serving residential and commercial customers. LSI units offer a great income stream to offset the rising cost of inflation. Its business model provides an excellent solution using monthly re-pricing, whereby costs are passed onto customers, and rates adjust upwards quickly to offer more recession resilience than many other sectors.

With stellar growth and dividends, the self-storage niche offers many advantages. LSI is geographically diversified throughout the United States and Canada, with more than 1,000 locations. LSI offers low capital and operational expenses, increasing cash flows, and wide operating margins. In the current environment, self-storage REITs offer great inflation hedges with excellent yields. E-commerce is driving the need for storage facilities to house the tech industry’s servers and supplies that have built up due to labor shortages that have prevented the dissemination of products. Although the stock’s forward P/FFO of 19.76x comes at a premium, its overall valuation grade is a C-. Given the popularity of warehouses that are seeing higher income potential than other real estate offerings due to the size of warehouse space and minimal overhead, Life Storage has a growth advantage over many other REITs, making it attractive for investment.

LSI Valuation and Growth

LSI is a strong buy based on our quant ratings and given the collective characteristics of growth, profitability, momentum, and earnings. Despite the stock’s -20% YTD price performance, as fellow Seeking Alpha Marketplace author Philip Eric Jones writes:

The YTD sell-off in LSI shares appears to have little or nothing to do with the company itself, and much more to do with the huge rotation from growth to value. This company appears to be bristling with good health.

Jones not only named LSI the best Storage REIT in December and again as one of his top 12 REITs for the next 12 months, but I also wrote about LSI in April pieced titled 3 Best REITs to Buy to Fight Inflation. Despite the stock being downgraded given market volatility and looking into historical cycles back to 1994, Wall Street and our quant ratings maintain the buy ratings. LSI has maintained consistent top-and bottom-line earnings beats, with the most recent leading to an A revision grade and four FY1 Up revisions within the last 90 days. 2022 Q2 FFO of $1.65 beat by $0.12, and revenue of $257.05M beat by $13.63M (+37.3% Y/Y). Maintaining its average occupancy of 94%, 21 consecutive months of positive rent roll-ups, and the acquisition of 13 wholly owned stores and 17 third-party managed stores, it’s no wonder LSI increased its quarterly dividend by 8%, a 46% increase from the previous year.

LSI Stock EPS & Revisions (Seeking Alpha Premium)

Given the company’s healthy balance sheet, we foresee the company taking advantage of the high inflationary environment by continuing to showcase solid earnings growth, prompting this REIT to gain in popularity.

LSI Dividend Scorecard

LSI Dividend Scorecard (Seeking Alpha Premium)

LSI has a solid dividend scorecard, offering a B dividend safety rating, the company’s ability to continue paying a current dividend. Life Storage has a strong 3.67% forward dividend yield and has paid a dividend for 25 consecutive years, offering an 8.67% five-year growth rate.

“We have remained focused on strategic growth, enabling us to grow our wholly-owned portfolio close to 18% from 1 year ago. These acquisitions represent properties in top markets, including Sunbelt markets such as Florida, California, Texas, and Georgia. Slightly over 75% of what we closed year-to-date are stabilized properties, while the remaining 25% are lease-up properties that will provide strong upside in future years. Looking forward, our current acquisition pipeline remained strong with an additional $258 million under contract,” said Joe Saffire, LSI Director & CEO.

Historically, REITs and real estate stocks tend to benefit from inflation, proving to be a valuable asset for portfolios, as showcased by the recent rent hikes linked to CPI. Offering higher dividend yields and growth with potential valuation appreciation, LSI not only offers a favorable outlook but a strategic pipeline, as outlined by LSI CEO above. I believe this stock is ripe for the picking and an excellent option to fight inflation, along with my next two energy picks.

2. Marathon Petroleum Corporation (NYSE:MPC)

-

Market Capitalization: $47.69B

-

Dividend Safety Grade: A-

-

Forward Dividend Yield: 2.43%

-

Quant Rating: Strong Buy

On a longer-term bullish uptrend, oil and gas refining company Marathon Petroleum Corporation (MPC) and its subsidiaries are a top-ranking energy company focusing on integrated segments and a geographically diverse footprint in the midcontinent, Gulf, and West Coast of the U.S.

The energy sector (XLE +35%YTD) has been full steam ahead since the pandemic, with Marathon capitalizing on rising prices, increasing profits, and cutting costs, which have proven fruitful with more than $1B in operating expense reductions meanwhile crushing its Q2 earnings.

MPC Stock Growth & Profitability

With a nearly $12B cash hoard, strong financials, and a favorable outlook, it’s no surprise that MPC’s margins continue to soar in Q2. The strong market, despite some softening, has enabled energy companies like MPC to reduce debt to pre-pandemic levels while capitalizing on crude oil streams.

MPC Stock EPS & Revisions (Seeking Alpha Premium)

Closing low-quality refineries has aided MPC’s efforts to reduce costs, meanwhile taking advantage of its global business by spreading its energy among domestic and international channels for increased market share. Showcased in both top-and bottom-line earnings over the last few quarters, the Q2 2022 EPS of $10.61 beat by $2.11, and revenue of $54.24B beat by $10B, an 81.84% Y/Y increase.

MPC Dividend Scorecard

MPC Dividend Grades (Seeking Alpha Premium)

A solid dividend scorecard illustrated above includes an A- dividend safety grade and ten years of consecutive dividend payments. Marathon has been committed to growing its dividend and returning capital to shareholders. In Q2, MPC returned $313M via dividend payments and repurchased nearly $4.1B shares since the last earnings call.

“We’re committed to a competitive dividend [and] we want to show the market that we’ll grow that dividend… We’re $12 billion through the $15 billion program. Everybody has seen the pace at which we can execute, and that’s guided by our trading volume and the programs that we have in place… we stated that we were going to maximize the share buyback program and complete that and then reset,” said Michael Hennigan, Marathon President & CEO.

With record-breaking EBITDA, attractive yields, and a valuation that offers more potential upside, it’s no wonder this stock is a strong buy, according to our quant ratings.

MPC Stock Valuation & Momentum

Marathon has a C+ valuation grade at a forward P/E ratio of 4.60x compared to the 7.69x sector median and is trading at more than a 40% relative discount. At $96.30 per share, Marathon appears to be on a bullish trend, with improving momentum, gradually outperforming its sector median peers quarterly.

MPC Stock Momentum (Seeking Alpha Premium)

Energy is the top-performing S&P 500 asset class, and MPC’s momentum and price performance remain strong, resulting in more investors purchasing shares. Given its uptrend and the sector’s bullish momentum, MPC has a strong buy rating, along with Chevron Corporation, a large competitor and high-yielding dividend stock.

3. Chevron Corporation (NYSE:CVX)

-

Market Capitalization: $306.24B

-

Dividend Safety Grade: B-

-

Forward Dividend Yield: 3.63%

-

Quant Rating: Strong Buy

A Top Stock for a Fed Rate Hike, YTD Chevron Corporation (CVX) is +31%, and over the last year, this energy stock has been crushing price performance by +65%. Integrated oil and gas behemoth Chevron is one of the biggest energy companies in the business. With global operations, Chevron’s diversified growth offers investors a great mix of upstream, midstream, and downstream segments. With solid fundamentals and crushing its competitors like Exxon in terms of shareholder returns, CVX’s Q1 earnings resulted in an EPS of $5.82, beating by $0.79, and revenue of $68.78B, beating by nearly 83% Y/Y.

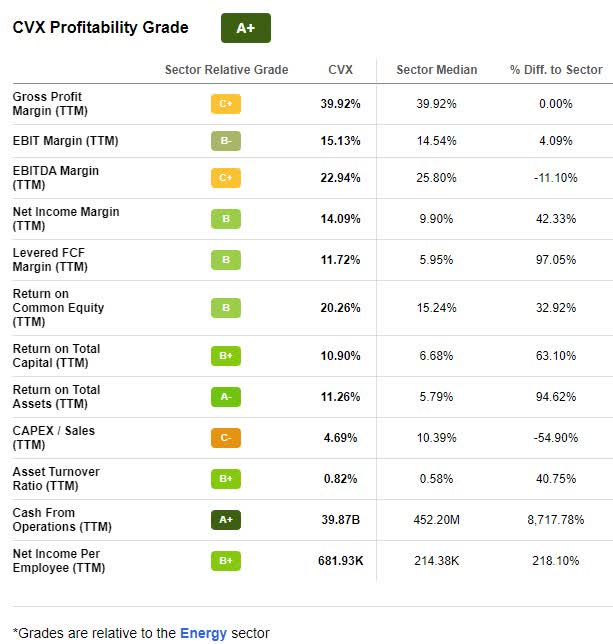

Chevron Stock Profitability (Seeking Alpha Premium)

The Atlantic Basin and globally have proven very profitable for Chevron, which has managed to navigate and maintain an active and profitable portfolio despite pricing fluctuations and the pandemic. Cash from operations is an A+ and near $40B and an overall A+ profitability grade. As pointed out by Chevron CFO Pierre Breber,

“Our U.S. oil and gas production in the first half of the year was up 7% versus last year. Our U.S. refined product sales up 10% versus last year. The administration wants energy supplies to increase, we’re doing that. Our investment globally, up 80% first half of the year. If you look at the U.S., more than double when you include REG, so Chevron is growing energy supply, increasing investment, and we are engaging constructively with Congress and this administration.”

In working with the Administration, Chevron has requested the U.S. government renew its license to operate in Venezuela, which could help replace Russian supplies in the Eurozone. In another move, Chevron is marketing three of its Alaskan oilfields, said to produce 9,400 barrels of oil and gas per day. According to U.S. government data, the oil fields’ production has been declining, with 2021 production at its lowest amount of barrels of oil per day since 1976. Given the declining production and moderating oil and gas prices, the sale should fetch between $450M to $550M, funds that can be used to fund other investments, pay down debt and return more to shareholders through dividends and buybacks.

CVX Consistency Grade (Seeking Alpha Premium)

Given its strong financial position, tailwinds through the remainder of the year, and dividend scorecard, it’s no wonder that shareholders like this stock, whose 34 years of consecutive dividend growth and payments is on fire – along with inflation! But it makes for the perfect counter, given its forward dividend yield of 3.63%, 18 recent FY1 Up analyst revisions, and solid valuation.

Chevron Stock Valuation

Chevron’s forward P/E of 8.39x is 9% higher than sector peers, indicating that it is relatively overvalued. However, CVX’s trailing PEG of 0.01x is a -77% difference from the sector, and its trailing and forward EV/Sales are more than 25% discounted relative to the sector. Trading near its 52-week high with improved earnings for 2022 and a C- overall valuation grade, some prudence is required if adding or diving into a position at its current $156.90 share price. But our Factor grades, which rate investment characteristics on a sector relative basis, maintain that CVX is relatively discounted. Investors want their stocks to make money, a benefit of many high-yielding dividend stocks, which is why I’ve chosen LSI, MPC, and CVX as three dividend stocks in the fight against inflation.

Conclusion

LSI, MPC, and CVX are stocks with strong dividends, possessing high yields and excess cash flow. Consider all three for a portfolio and diversify into different sectors and industries to combat inflation. Some energy stocks like utilities and real estate stocks are known to be defensive during periods of high inflation. LSI, MPC, and CVX offer immediate high yields for capital preservation or off-setting inflation in this environment. Each of these stocks offers an average four-year yield of over 4%, so investors should be able to thrive in a rising or falling environment without sacrificing quality or growth when the stock markets rise or fall.

As inflation and market volatility eats into portfolio returns, I believe my picks offer solid value and growth despite this highly volatile market. In addition to solid dividend safety grades, each has significant cash for operations and stellar profitability to ensure shareholders that these stocks’ dividend payout should remain consistent. In this volatile environment, you can also use Seeking Alpha’s ‘Ratings Screener’ tool to help you achieve diversification into desired sectors you like.

Be the first to comment