kokkai

Thesis

Is Victoria’s Secret & Co. (NYSE:VSCO) still the most aspirational brand in the undergarment industry? Since the company has been hit by scandals (see Epstein) and society pressured the company to become more inclusive, Victoria’s Secret has been considered as a structurally declining brand. But looking at consumer choices, Victoria’s Secret still holds lots of brand equity. That said, high brand-equity companies, especially in the fashion industry, usually trade at a premium. But Victoria’s Secret trades at a clear discount. Down >35% YTD, the company is now valued at only slightly above $2.69 billion, and trading at about x5 P/E and below x1 P/S. In my opinion, Victoria’s Secret stock is deeply undervalued. I support my argument with a residual earnings valuation and calculate a fair implied target-price of $57.12/share.

About Victoria’s Secret

Victoria’s Secret is one of the world’s most recognizable brands in the fashion industry, with an especially strong appeal in the lingerie segment. Since the late 1970s Victoria’s Secret designs, manufactures and distributes underwear, clothing and beauty products. Arguably, the company holds a prime spot in consumers mindshare when it comes to sexy underwear. The company’s strong brand image was shaped by engaging the world’s absolute supermodels (called VS Angels) and the highly popular annual Victoria’s Secret Fashion Show, which the company organized from 1995 to 2018. Since approximately 2016, however, the company begun to struggle as consumer preferences shifted to athleisure (1), society denounced the company’s glorification of almost unattainable body and beauty standards (2) and the company’s management has been found connected to the Epstein scandal (3). That said, Victoria’s Secret pushed for a company restructuring and a gradual strategic rebranding. In addition, the company’s long-term owner L Brands sold its stake and Victoria’s Secret now trades as a broadly independent entity. Victoria’s Secret operates worldwide and sells under the brands Victoria’s Secret, Victoria’s Secret Pink, Victoria’s Secret Beauty and VS&Colab.

Underappreciated Company

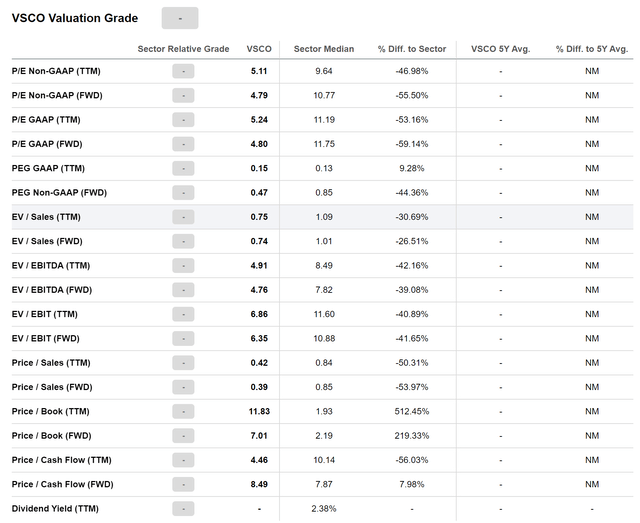

While Victoria’s Secret’s recent past has certainly been challenging for the reasons mentioned, I believe the market is strongly mispricing the company’s value. At the moment, Victoria’s Secret is trading at a steep discount to peers. According to Seeking Alpha, the P/E Non-GAAP discount is 55.5%, the EV / Sales discount is 26% and the EV / EBIT discount is 41.7%. That said, the market is almost pricing Victoria’s Secret’s equity as if the company would have almost no consumer base or little pricing power. But this is absolutely not true, as the following section highlights. According to Data by SimilarWeb, website traffic for the company is quite strong, with approximately 25 million monthly visitors on average. Moreover, more than 50% of this traffic is organic. And most notably, 25% of visitors search directly for the brand.

Financial Performance

The company’s financials seam to support my thesis. In 2021, Victoria’s Secret generated total revenues of $6.785 million. For reference, the company’s revenue is higher than the revenue of Lululemon-a company valued at more than $34 billion. Notably, Victoria’s Secret is also profitable, with an operating income and income attributable to shareholders equal to $870 million and $646 million respectively ($7.34/share). That said, VSCO stock is currently trading at only slightly above x5 P/E and below x1 P/S.

The company’s balance sheet is not stellar, but relatively healthy. As of December 2021, Victoria’s Secret recorded $490 million of cash and cash equivalents and $2.636 million of debt. Cash from operations was $851 million, and thus, the company’s net debt position of $2.146 million should be more than sustainable, in my opinion. Notably, in Q4 2021, Victoria’s Secret announced a $250 million share repurchase program.

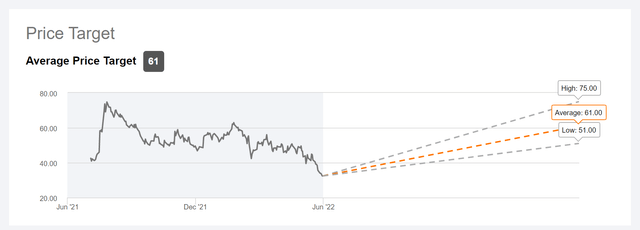

How analysts see it

In general, analysts are very bullish on Victoria’s Secret, with an average consensus target price of $61/share. Most notably, this target price would indicate almost 100% upside. According to the Bloomberg Terminal, as of June 2022, analyst see Victoria’s Secret’s revenues in 2025 at $7.37 billion. This would equal a 3-year CAGR of almost 10%, from 2022 to 2025. Moreover, for 2022, 2023 and 2024 EPS are expected at $6.87, $7.39 and $7.72.

Valuation

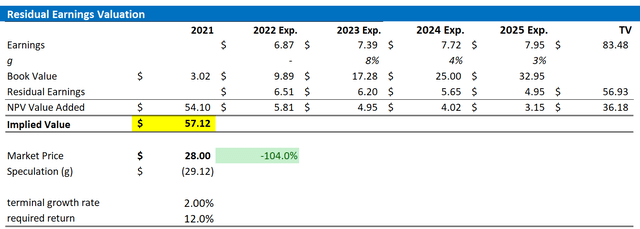

If management predictions and analyst consensus is correct, what should be a reasonable price target for Victoria’s Secret? To answer that question, I propose to value VSCO stock based on a residual earnings framework and anchor on the following assumptions:

- Base my EPS estimates on the analyst consensus until 2025.

- I apply a 9% cost of capital, which is consistent with the WACC model and my personal required return.

- With regards to the terminal growth rate, I use nominal long-term GDP growth of 3.5%.

Given my assumptions and calculation, Victoria’s Secret appears materially undervalued. My calculation returns a fair base-case target price of $57.12, implying >100% upside.

Analyst Consensus Estimates; Author’s Calculation

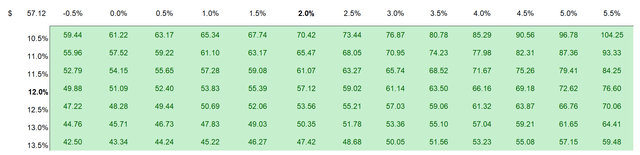

I appreciate that investors might want to apply different valuation assumptions to VSCO’s WACC and terminal value growth. That said, I have also enclosed a sensitivity table. Feel free to select the scenario that best reflects your assumptions.

Analyst Consensus Estimates; Author’s Calculation

Risks

Investors are advised to note the following downside risks that could cause VSCO stock to substantially differ from my target price as calculated in the valuation section:

First, a slowing macro-environment caused amongst others by inflation, rising interest rates and supply-chain challenges could negatively the buying power of Victoria’s Secret’s customer base. If challenges turn out to be more severe and/or last longer than expected, the company’s financial outlook should be adjusted accordingly.

Second, Victoria’s Secret success and growth strategy is deeply intertwined with the company’s brand equity. That said, if the company’s public image were to deteriorate considerably, the company’s sales and pricing power would be strongly impacted.

Third, in an environment of falling asset prices and cautious sentiment towards risk assets, much of VSCO’s share price volatility is currently not driven by business fundamentals, but by investor sentiment. Thus, investors should expect price volatility even though Victoria’s Secret business outlook remains unchanged.

Conclusion

VSCO stock is deeply undervalued, in my opinion. The company’s one-year forward EV/EBITDA is only x5.9 and thus considerably lower than the same metric for industry peers. Based on a residual earnings framework – which I anchor on analyst EPS consensus – I calculate a fair base-case target price of $57.12. That said, I see more than 100% upside. Strong Buy.

Be the first to comment