Justin Sullivan/Getty Images News

General Mills (NYSE:GIS) is often seen as a company with little pricing power that is now in the crosshairs of rising inflationary pressures. In addition, the high dividend yields associated with large cap consumer staple companies are less of an incentive for shareholders in a world where the percentage change in CPI numbers are approaching double digits.

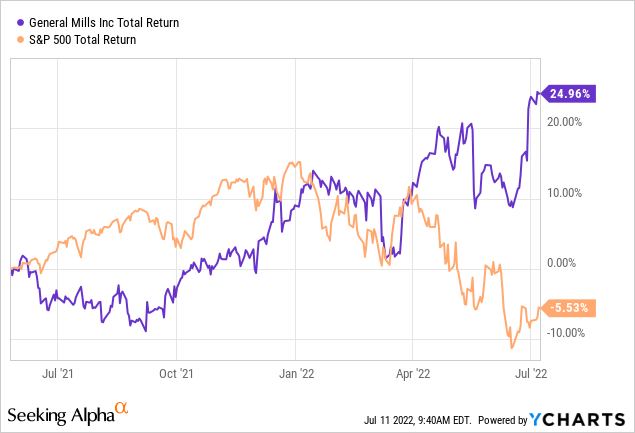

In stark contrast with this simplistic view outlined above, however, GIS has defied all pessimistic expectations and achieved a total return of close to 25% at a time when the broader market declined by more than 5% (the starting point of the graph below is 26th of May 2021, when I first covered the company)

From a business point of view, GIS management has solidified the company’s existing competitive advantages through some recent capital allocation decisions and have repositioned the business to more attractive product segments of the Packaged Food industry. I recently covered all that in a thought piece called ‘General Mills: Capital Allocation Matters‘.

In the meantime, the management has also announced a recent dividend increase, which although is not enough to offset current inflation, is a positive sign for long-term investors.

Seeking Alpha

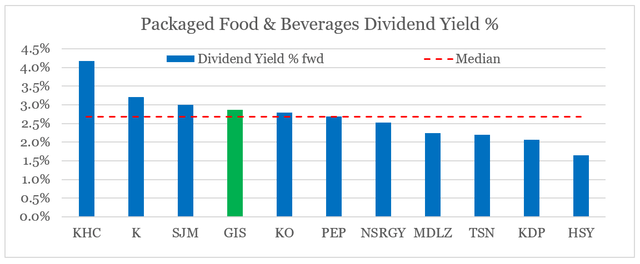

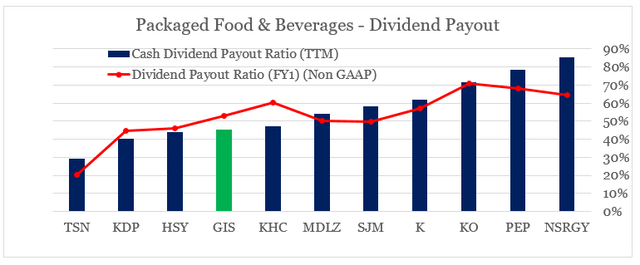

Consequently, the forward dividend yield of around 2.9% sets GIS among the highest yield large cap consumer staples in the packaged food space.

prepared by the author, using data from Seeking Alpha

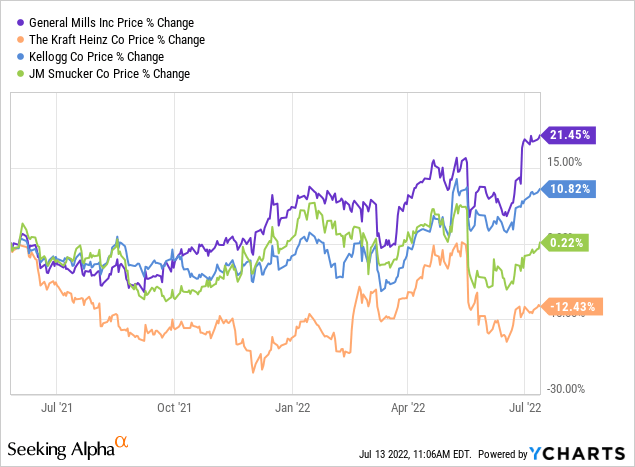

Of the peers listed above, those with higher forward dividend yield are only: Kraft Heinz (KHC), Kellogg (K) and J. M. Smucker (SJM). However, each of these three companies had far worse returns since May of last year. Moreover, each of these three companies face significant obstacles from an overall strategy and business positioning (for more information on all that check here, here and here).

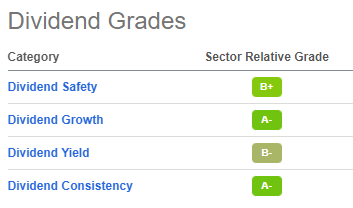

Additionally, GIS leading dividend yield is also accompanied by very strong ratings on safety, growth and consistency.

Seeking Alpha

In the following lines I will go deeper into these ratings and show why GIS’ dividend is yet another key feature of the company that makes it an attractive long-term investment.

General Mills’ affordability and safety

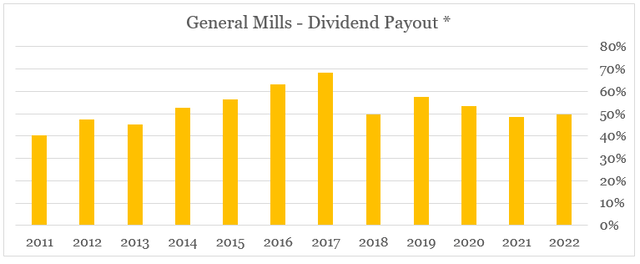

After reaching nearly 70%, GIS dividend payout ratio has declined to roughly 50% in recent years which is in-line with the long-term historical average.

prepared by the author, using data from SEC Filings

On a cross-sectional basis, the company’s cash dividend payout and the forward payout ratio are both one of the lowest within the peer group.

prepared by the author, using data from Seeking Alpha

Although high quality consumer staple businesses could support much higher payout ratios for very long periods, GIS is well-positioned to continue its recent path towards more dividend increases. Equally important, the current dividend is also one of the safest within the peer group which is key feature for investors looking for shelter in lower risk parts of the equity market.

In addition to the current snapshot of GIS dividend payout ratio, we also need to evaluate the company’s profitability to assess the safety of the current dividend. Rising raw material costs is one of the major short-term risks for the dividend, given the company’s lower gross margin relative to the peer group.

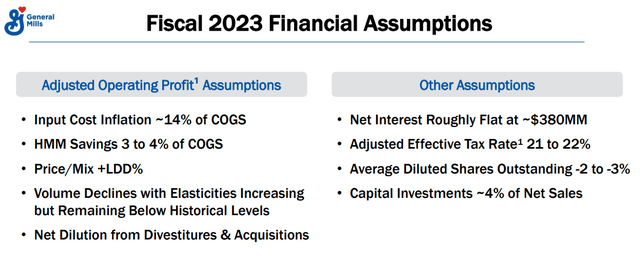

Although GIS is not the most profitable business on a gross margin basis, its competitive positioning and iconic brands give the company significant pricing power, which so far is able to offset the rising costs of raw materials. For the company’s next fiscal year, the management expects price realization and certain cost savings to once again offset expected inflation.

So as we think about our approach to the next fiscal year, we’re thinking about it much the same way. We’re expecting only a modest decline in the level of supply chain disruption. We expect, as you mentioned, our price realization, and the combination of HMM to largely offset the dollar cost of the 14% inflation that we’ve called. And our expectation is that the remainder costs from disruption, we would work out over time to the extent that we see the environment stabilize.

Source: GIS Q4 2022 Earnings Transcript

All that is already reflected within the company’s adjusted operating profit assumptions for the next fiscal year.

General Mills Investor Presentation

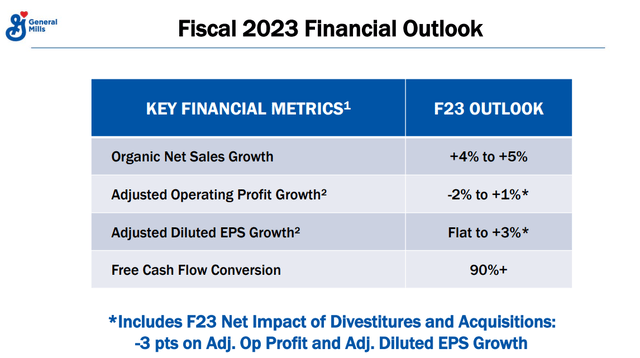

Given the net impact of divestitures and acquisitions, GIS is also in a good position to retain its operating profitability even as inflationary pressures increase.

General Mills Investor Presentation

Scope for future increases

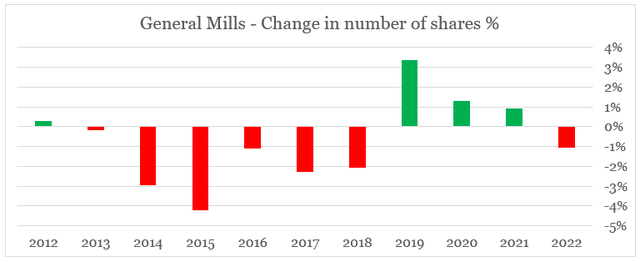

Even though GIS total number of shares outstanding has fluctuated in recent years, the current number of 613m is not materially different from the 612m shares outstanding as of the end of fiscal year 2016.

prepared by the author, using data from SEC Filings

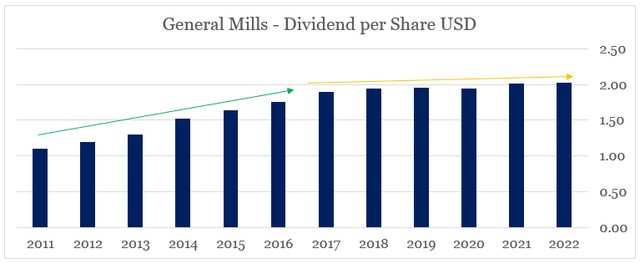

During the same period, however, the company’s dividend per share has stayed relatively flat.

prepared by the author, using data from SEC Filings

This was long-enough period for some investors to throw in the towel and conclude that GIS is unable to consistently raise dividends. However, it was during this period that the company made a meaningful move into the pet food business, which is now one of the crown jewels of the company. Moreover, the business was restructured through a number of smaller deals and divestitures in order to reinvigorate topline growth and better position the company. That is why future growth in dividend per share should not be judged based on recent history.

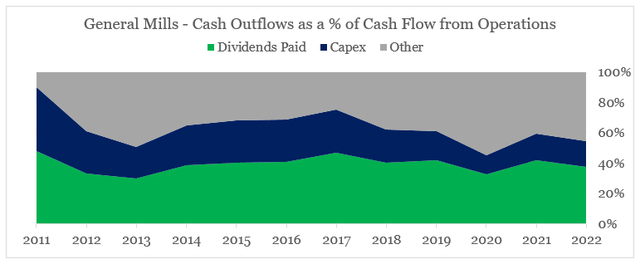

From a cash flow perspective, GIS is also in a good position to continue to raise its dividends in the foreseeable future. On the graph below we see the annual dividend payments and capital expenditures as a percentage of the company’s cash flow from operations.

prepared by the author, using data from SEC Filings

As clearly illustrated, GIS cash flow cushion (marked in grey) has improved significantly since fiscal year 2017 and the current dividend is well covered.

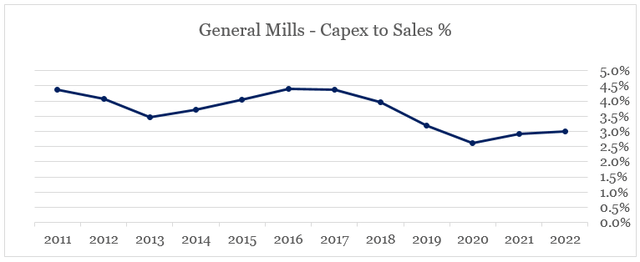

However, we should also note that the level of capital expenditure has been steadily falling, reaching its lowest point in fiscal year 2020. Therefore, long-term investors should account for any potential increases in capex, as it returns to normal levels.

We already saw in GIS assumptions for FY 2023, that the company expects capital expenditure to run at roughly 4% of net sales. On a historical basis, this is more in-line with the company’s long-term average and is a reasonable estimate for the time being.

prepared by the author, using data from SEC Filings

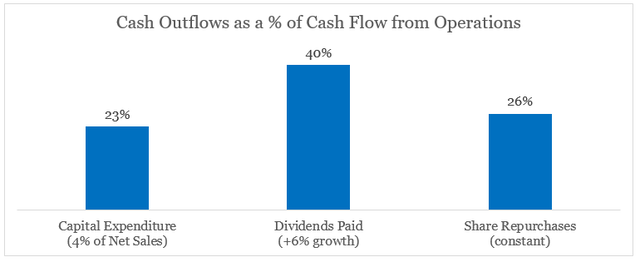

Therefore, if we assume that Capex was running at 4% of net sales during fiscal year 2022, it would have been 23% of the company’s cash flow from operations (see below). At the same time a further 6% dividend increase, would have resulted in total dividends paid being 40% of cash flow.

prepared by the author, using data from SEC Filings

All that would leave us with 37% of the company’s cash flow from operations. At present, the share buyback program runs at a rate of around 26% of cash flow, which leaves a significant cushion even in the event of the company retaining its stock repurchases.

Conclusion

In recent years General Mills has strengthened its competitive positioning and pivoted towards high margin segments of the Packaged Food sector. The strategy is now paying off in the form of more resilient margins, higher topline growth and scope for further dividend increases. In addition to the already high dividend yield, General Mills is in a good position to continue raising its dividend per share in the coming years, while at the same time not compromising its safety.

Be the first to comment