Robert Way

“If you can’t measure it, you can’t improve it,” so said W. Edwards Deming and Peter Drucker. This principle is core to the functioning of a servo or “control system“, defined as:

“A system of devices that manages, commands, directs, or regulates the behavior of other [interacting] devices or systems to achieve a desired result. A control system achieves this through control loops, which are a process designed to maintain a process variable at a desired set point [that themselves are subject to change].”

The thermostat represents a basic, but increasingly important, control system wherein it compares the temperature to a desired set point before ‘instructing’ your furnace or air conditioner to cycle on or off. If your windows are open during the dead of winter or the scorch of summer, the system must ‘work’ harder to maintain your comfort.

Now, layer on a little complexity as with millions of homes, businesses, and the growing number of EV’s that rely on utility-supplied electricity. Then, factor in weather changes suddenly putting extraordinary loads on the system. Finally, add to this the fickle nature of solar and wind energy as when the sun doesn’t shine, or turbines don’t spin. Obviously, it is not difficult to imagine the order-of-magnitude advancements required to manage the supply and demand for electric power. They include:

- Storing copious quantities of renewable electricity in anticipation of need.

- Modulating those needs continually but especially during times of peak load.

- Managing interconnected systems dynamically, in real-time, with minimal effort.

Addressing these three components, Honeywell (NASDAQ:HON) has moved into a competitive position near the center of markets that are now expanding exponentially because of climate change and the renewable revolution. And lest anyone doubts that climate change is real, read NOAA‘s collection of longitudinal research on the topic and/or observe what’s going on around the globe – melting glaciers, rising seas, disappearing rivers, draining reservoirs, unabating fires, and wildlife under threat. Open these imbedded links and you may gain insight into the enormous magnitude of what we’re dealing with here.

Flow Batteries

I’ve written before on SA about flow batteries, touching on why this technology may be central to capturing and storing solar and wind energy before it finds use on a power grid. In a nutshell:

“In contrast to traditional batteries wherein the electrolytes mix readily with conductors in a single encased cell, in flow batteries the fluid is separated into two tanks and electrons flow through electrochemical cells and a membrane which separates them; the larger the tanks, the more electricity can be generated. This gives flow batteries the distinct advantage of being able to store energy in quantity, before it is needed, as it is created, for example, by wind turbines and solar panels.”

Believing this, the Department of Defense recently tapped Lockheed Martin (LMT) to install their “GridStar” system in support of the U.S. Army’s grid at Fort Carson, Colorado. Many people, I among them, are interested to know about specifics. However, they are “top secret” only available to a select few with clearance or under NDA agreements. In addition to the classified nature of defense contracting, this designation could indicate how competitively important Lockheed views its flow battery technology.

Enter Honeywell who could become another major player in the flow batteries space and, like Lockheed, is “not talking about the exact chemistry [other than to say] it is a non-rare earth element.” Vanadium, iron, zinc bromine, or another metal, we do not know. However, we do know that Honeywell is targeting “long-duration“, “gigawatt-scale storage” with deployment of smaller pilot projects this year and next starting at Duke Energy’s North Carolina testing facility.

Smart Thermostats

Remember Honeywell’s iconic thermostat? You know that round olive-tan jobbie with the saw-toothed plastic dial used to “set” the desired temperature in front of the red arrowhead indicator. With the help of a hidden coil spring and mercury switch (not exactly solid state then), it was an effective and uncomplicated way to operate one’s home HVAC.

Fast forward to when Honeywell announced that it would provide utility companies, with the consent of their customers, the ability to control remotely wi-fi-enabled / “smart” thermostats. These so-called “demand-response thermostats” were slow to be adopted but are now expected to grow at a compound annual growth rate (CAGR) of 23% over the next few years. In 2021, Texans experienced this future.

“When a cold snap melted down the Electric Reliability Council of Texas’ grid, some Lone Star State residential electric customers were shocked to learn they had enrolled in programs that charged them for power at the rate it was going for on ERCOT’s market at the moment they were consuming it.”

… Moreover …

“[That summer’s] heat wave in Texas brought another surprise, this time to residential electric customers who had enrolled in programs that allowed their power providers to jack up their thermostat a few degrees during a heat wave to reduce overall load.”

Energy Management

I am also intrigued that Honeywell is moving aggressively forward with quantum computing, which, coupled with applications, could help us manage complex environmental challenges. To this end, Honeywell claims on its website to be: “…the only industrial company with the advantage of owning the supply chain of technology assets to produce quantum systems – from refrigeration units to control logic”; hmm.

Grid-level flow batteries buffering supply-side renewable energy, smart thermostats regulating demand, and quantum computing for overall energy system management. In the words of Chairman & CEO, Darius Adamczyk:

“Much of Honeywell’s history is rooted in technologies that optimize energy efficiency. Developing solutions in controls and automation that today connect to the Internet of Things is an important part of our company’s legacy, and in many instances, these controls and automation help optimize energy usage – whether for buildings, energy grids or aviation.”

The makings of a vision, supported by a solid P&L, cash flow, liquidity, and capitalization. In the table below, you will find Honeywell’s most recent annual numbers with comparisons to 2020. (Financials courtesy of SA):

|

Honeywell |

2021 / 2020 |

|

Revenue / Growth |

$34.4B / +5.4% |

|

Gross Profit / Growth |

$11.0B / +5.1% |

|

Op. Income / Growth |

$7.5B / +12.3% |

|

Net Income / Growth |

$5.5B / +16.0% |

|

Op. Cash Flow / Growth |

n/a |

|

Liquidity / Current Ratio |

1.4x |

|

Capital / Liabs. to Equity |

2.4x |

|

Price-to-Earnings Ratio |

n/a |

|

Dividend Yield |

n/a |

|

Payout Ratio |

47.4% |

|

Full Time Employees |

99,000 |

We bought HON on June 30th for $171.34. Then, twenty-eight professional analysts covered HON with 11 having the stock as a “buy”, 4 an “overweight”, 12 a “hold”, and 1 a “sell”. They targeted a median price of $218 tracking to the growth in earnings-per-share they forecast from $8.03 in 2021, to $8.73 this year, and to $9.74 in 2023. (These now dated numbers are compliments of MarketWatch.)

SA’s authors and quants were blasé with both groups having HON as a “hold” with factor grades of: Valuation D, Growth D-, Profitability A+, and Momentum and Revisions both at B’s. SA’s quants specifically ranked Honeywell in their industry at 5 out of 9, in their sector at 208 out of 611, and overall, at 1527 out of 4617. No reason here to get excited, then again that was at the end of June.

Since then, ha, Honeywell delivered a strong Q2 in which it beat expectations on the top and bottom lines even as we teeter on recession.

|

Honeywell |

Q2 2022 / Q1 2022 |

|

Revenue / Growth |

$8.9B / +6.9% |

|

Gross Profit / Growth |

$2.9B / +7.6% |

|

Op. Income / Growth |

$1.9B / +20.9% |

|

Net Income / Growth |

$1.3B / +11.7% |

|

Op. Cash Flow / Growth |

$0.8B / +2,091.7% |

|

Liquidity / Current Ratio |

1.2x |

|

Capital / Liabs. to Equity |

2.4x |

|

Price-to-Earnings Ratio |

22.2x |

|

Dividend Yield |

2.0% |

|

Payout Ratio |

55.8% |

|

Full Time Employees |

n/a |

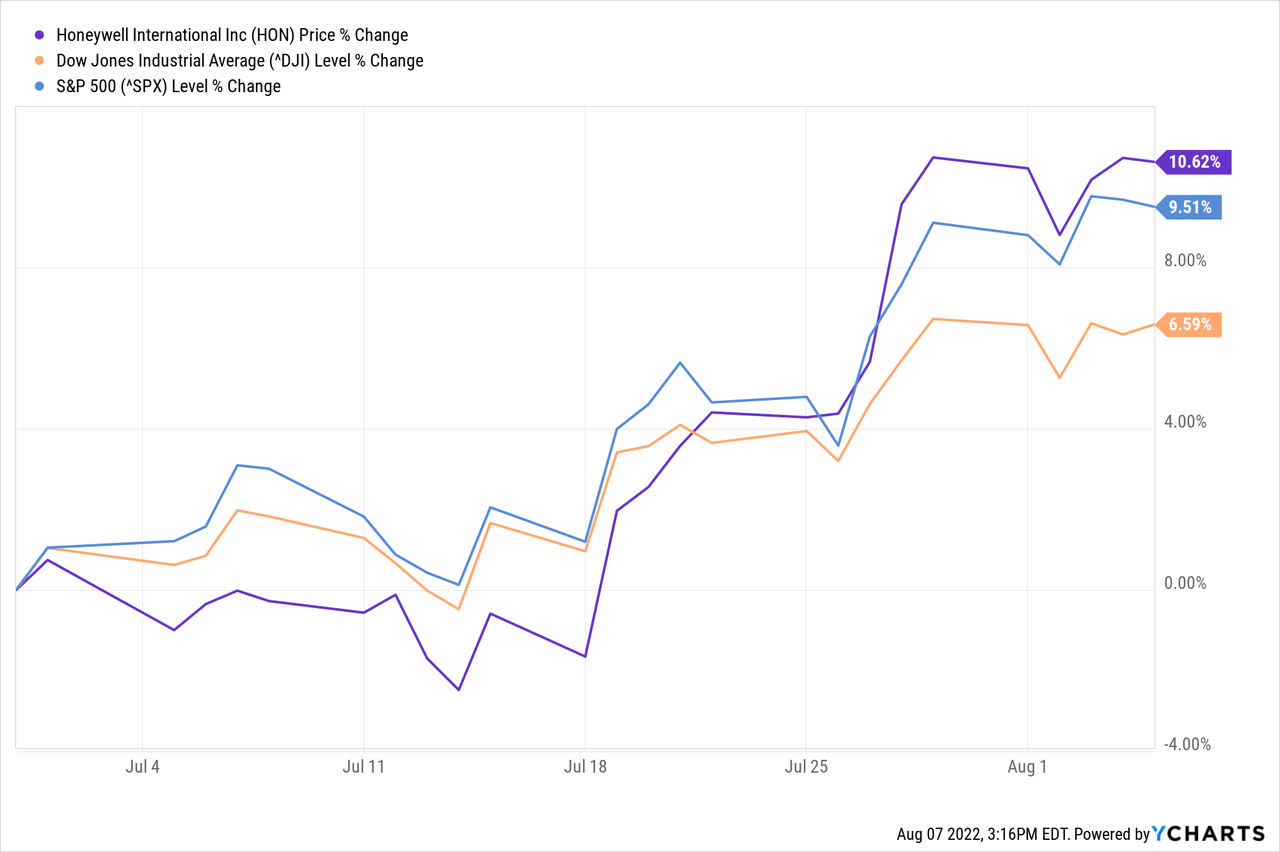

Add to that major anticipated legislation, that passed the Senate as I was putting the final touches on this article, and includes a renewable energy package, read: external stimuli for the vision that Honeywell may have already conceived. It is therefore not surprising that HON has outperformed the comparable indexes, alpha.

My instincts tell me that most analysts and investors ‘don’t get it’ when it comes to Honeywell. To be sure, the company’s service-products extend well beyond flow batteries and thermostats into areas such as robotics, aircraft controls, and space technology. In addition, notwithstanding their 1990 divestment of defense contractor ATK / Alliant Techsystems, Honeywell still ranks #11 as a government contractor.

No, I believe that Honeywell still struggles with its rap as a conglomerate. It’s not easy to associate Honeywell with a single unifying mission. Were it up to me, against the background of the profound stresses brought about by global warming and changing consumer preferences, I’d focus on the company on the title of this article – “Balancing Energy Supply and Demand”. I’m bullish, we’re long.

Be the first to comment