Gerasimov174

Introduction

The booming operating conditions for oil and gas producers thus far into 2022 have seen the energy sector enjoying a wave of earnings not thought possible merely one year prior. Naturally, this has also seen a wave of shareholder returns lining the pockets of investors, such as TransGlobe Energy (NASDAQ:TGA), who recently reinstated their dividends on a semi-annual basis, thereby launching a high yield of 6.29% right out of the gate. When looking ahead, this only appears to be the start with their guidance pointing towards massive shareholder returns, although disappointingly for investors, there is one big problem.

Executive Summary & Ratings

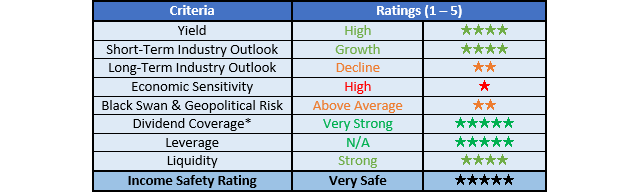

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

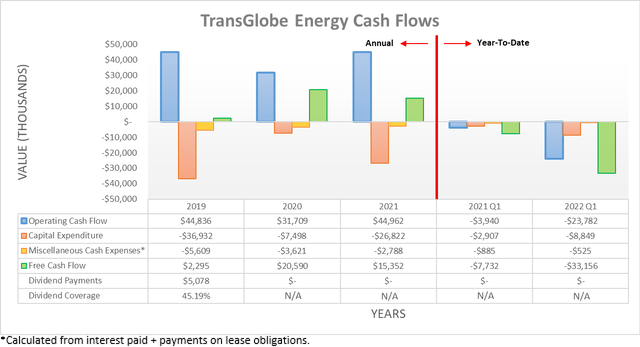

When reviewing their cash flow performance across their recent history, unsurprisingly, it fluctuated along with the prevailing operating conditions. This saw their operating cash flow during 2020 of $31.7m enduring a large dip versus their previous result of $44.8m during 2019 due to the Covid-19 pandemic, before subsequently recovering in 2021 to end the year at $45m. On the surface, their cash flow performance during the first quarter of 2022 appears terrible and defies the booming operating conditions, with their operating cash flow falling to negative $23.8m, which is down year-on-year versus their previous result of negative $3.9m during the first quarter of 2021.

Thankfully, this was simply due to the first quarter of 2022 seeing a freakishly large working capital build of $50.9m that, if removed, shows that their underlying operating cash flow was actually $27.1m and thus much higher year-on-year versus their equivalent result of negative $1.7m during the first quarter of 2021. When looking ahead into the remainder of 2022 and beyond, the outlook for their cash flow performance and by extension, their freshly reinstated shareholder returns appears very desirable, as the table included below displays.

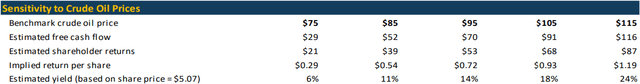

TransGlobe Energy June 2022 Corporate Presentation

It can be seen that management has laid out a number of different scenarios for their free cash flow at various oil prices ranging from $75 per barrel to $115 per barrel. Following the otherwise tragic Russian invasion of Ukraine in early 2022, oil prices have frequently traded for north of $100 per barrel with the already tightly supplied market facing further supply losses from sanctions. Despite the recent slump on the back of recession fears, oil prices remain north of $90 per barrel, and with the International Energy Agency warning of further market tightness still to come regardless of these economic risks, it seems most reasonable to expect their free cash flow to broadly align with their $105 per barrel scenario, which is estimated at $91m.

Due to their variable shareholder returns policy that aims to return 75% of their free cash flow via a combination of dividends and share buybacks, this translates into an estimated $68m being sent to the pockets of shareholders. It was particularly handy of management to make it especially easy for investors by dividing this guidance into a per share amount of $0.93, which on their current share price of $3.18 equals a massive near 30% shareholder yield. Since their dividends were only recently reinstated at $0.10 per share on a semi-annual basis, it remains to be seen whether management opts for higher dividends given this very strong coverage or bridging the gap completely with share buybacks. Even if oil and gas prices revert lower in 2023 and beyond, even under their bearish $75 per barrel scenario, they would still see shareholder returns of $0.29 per share that translate into a high circa 9% shareholder yield on current cost, thereby providing a very solid backstop that should limit downside risk.

Whilst this sounds very desirable, there remains one big problem that counteracts their very desirable massive shareholder returns after considering their reserves. Unlike most other companies, those engaged in the extraction of natural resources unavoidably deplete their assets and thus investors need to also consider their reserves because obviously, you cannot pump oil unless there you first have oil in the ground. This aspect is especially important for a small oil and gas producer because, unlike the supermajors, such as Exxon Mobil (XOM), they have fewer financial resources to simply acquire reserves from other companies or diversify into new areas.

When they last tallied their resources, they saw proven reserves of 28 million boe, as per their 2021 annual report and thus see a proven reserve life of only a mere six years given their 2022 guidance for production of 12,900 boe/d at the midpoint, as per slide four of their June 2022 corporate presentation. It does not take a petroleum engineer to know that only six years of production remaining is quite a short length of time. To put this into perspective, Exxon Mobil has 18.536 billion boe of proven reserves and thus given their production of around 1.35 billion boe per annum, sees a proven reserve life of circa 13.7 years, as per their 2021 annual report.

They are likely to continue converting a portion of their contingent resources into proven and probable resources, although new oil and gas discoveries will only continue getting more difficult given their finite and depleting nature. Even if their reserve life is assessed through their proven plus probable reserves, which are 46.1 million boe, this is still only just shy of ten years and thus still rather short for a small company with no downstream refining or chemical operations. Even though this does not necessarily pose any short-term risks and possibly not any in the medium-term either when thinking ahead to the long-term, this creates a cloudy outlook for their production and thus financial performance that counteracts their otherwise very desirable massive shareholder returns currently on offer.

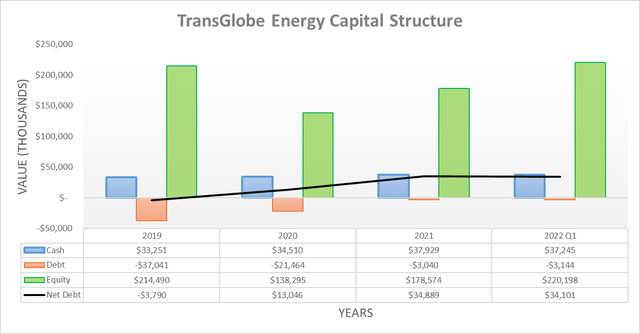

Whilst forgoing any shareholder returns was not enjoyable during 2020 and 2021, thankfully, this was not in vain, with their shareholders now able to enjoy a capital structure where they undeniably reign supreme with a net cash position of $34.1m. Apart from equalling an impressive near 15% of their current market capitalization of approximately $233m, it would be pointless to assess their leverage in detail, as practically speaking, they have no leverage.

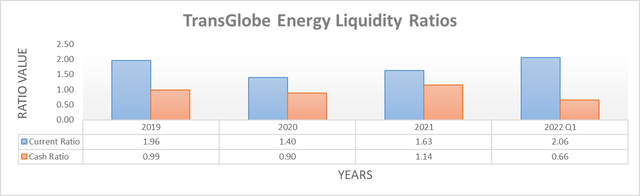

Following their non-existent leverage, it was not surprising to see their very healthy financial position also sporting strong liquidity with their current ratio at 2.06 and their cash ratio at 0.66. Since they plan to scale their shareholder returns with their free cash flow, this should not change in the future even if oil and gas prices revert lower. Apart from their absence of debt removing any maturity pressure, it also means that they can enjoy the benefits of these booming oil and gas prices without seeing any drawbacks as interest rates are increased.

Conclusion

When initially reviewing their shares, they appear to be a steal given their outlook for a massive near 30% shareholder yield on current cost that stands to line the pockets of investors. Once digging deeper into their resources, one big problem lays within their reserve life of only six to ten years, that is rather short and thus creates a cloudy outlook for their production and by extension, their long-term financial performance. Since this counteracts their otherwise very desirable massive shareholder returns currently on offer, disappointingly, I believe that only a hold rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from TransGlobe Energy’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment