deepblue4you

Thesis

Suncor Energy Inc. (NYSE:SU) is a leading Canadian integrated oil and gas player, benefiting from the massive surge in energy stocks over the past year. However, its upward momentum has stalled since staging its recent highs in June, as SU continued to struggle for buying upside.

We noted that its recent struggles are consistent with the increasingly weak price action in Brent (CO1:COM) and WTI crude (CL1:COM). Therefore, we posit that further weakness in the underlying markets could continue to pressure SU’s buying upside.

Notwithstanding, SU’s low payout ratio suggests that its dividend should be sustainable, even if the broad market weakness could impact its underlying metrics. Furthermore, its robust stock repurchase program suggests that management remains confident in its capital allocation strategy.

Coupled with what appears to be a potential near-term bottoming process and a low valuation, SU could regain its buying upside subsequently. Therefore, we urge investors to be patient as we parse the price action in SU and its underlying markets.

As such, we rate SU as a Hold for now.

Weakness In Brent And WTI Crude Could Unsettle Investors

The narrative in the energy markets has become even more worrying recently as OPEC+ cut production by 100K barrels per day. The nominal cut followed hawkish commentary by Saudi Arabia, as it was not impressed with how the market has perceived the current supply dynamics.

Furthermore, Russia has continued to heap pressure on Europe, as it closed the Nord Stream pipeline indefinitely in response to western sanctions. Therefore, we think there’s no doubt the energy crisis appears to be getting worse.

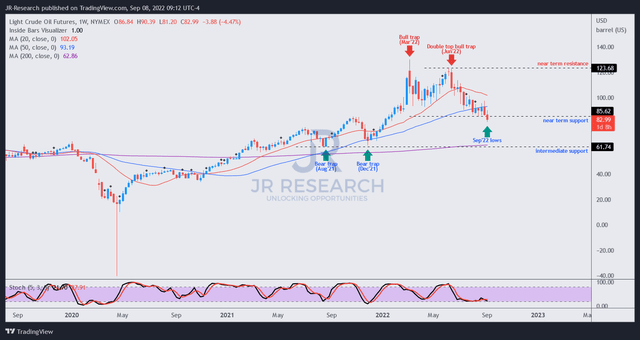

WTI crude futures price chart (weekly) (TradingView)

Despite that, the market remains unperturbed by the narrative or the rhetoric. As seen above, CL1’s current contract pricing appears to be breaking below a critical support zone ($90). Investors should note that the zone has supported the recent bottoming process in WTI crude. Therefore, the market continues to focus on potential demand destruction, given the looming recession in the US and Europe, driven by the rate hikes.

Furthermore, China’s continued and unpredictable COVID lockdowns (the latest being Chengdu) are primed to weaken its industrial activity further. S&P Global Commodity Insights highlighted further weakness as it articulated:

The next two months are usually a busy period for travel due to two national festivals. But the recent virus flareups have dimmed the outlook for transport fuels. We expect that gasoline, diesel, and jet fuel demand over September and October will continue to fall short of pre-Covid levels. – Bloomberg

As a result, we believe the market has been adjusting its expectation on whether oil demand could be sustained at the current levels as the recessionary fears overwhelmed the supply dynamics.

Suncor’s Growth Could Continue To Slow

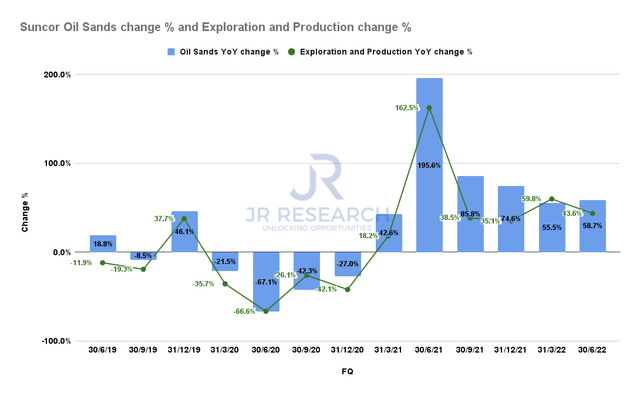

Suncor oil sands change % and E&P change % (Company filings)

Suncor’s critical oil sands and E&P growth have continued to moderate through FQ2. While its growth remains elevated, we believe the downward pressure in the underlying markets should impact its growth momentum, coupled with more challenging comps.

Investors should note that management highlighted that Q2’s environment saw an average of $97 in WTI crude and $101 in Brent. However, as we highlighted earlier, the current WTI and Brent pricing has moderated further, with the potential for a steeper fall.

As a result, we believe that investors need to factor in less aggressive growth estimates for Suncor moving ahead.

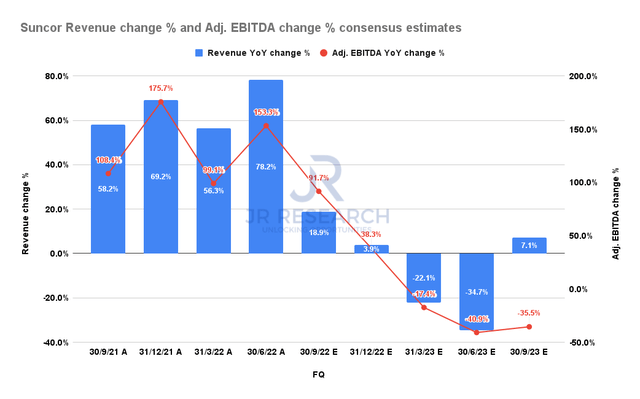

Suncor revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

As a result, we believe the revised consensus estimates (bullish) are prudent, indicating that Q3’s revenue and adjusted EBITDA growth could moderate further.

Furthermore, the normalization is expected to follow through to FY23, suggesting that Suncor is unlikely to sustain its current growth momentum. Given the weakness in the energy markets, we believe a further de-rating could follow if it impacts Suncor’s Q3 performance. Therefore, investors are urged to carefully parse the price action in the energy markets.

Suncor’s Dividend Yields Should Support Its Valuation

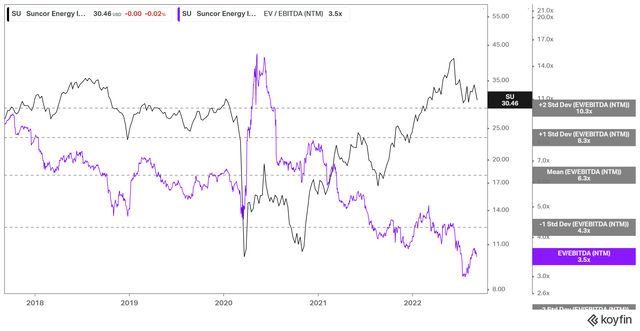

SU NTM EBITDA multiples valuation trend (koyfin)

SU’s valuation remains well below its 5Y mean, as it last traded at an NTM EBITDA multiple of 3.5x. Therefore, we believe that the market remains concerned about the sustainability of the underlying dynamics. As a result, energy investors have been surprised that the market has “refused” to re-rate leading energy stocks like SU, despite robust earnings and topline growth.

However, we believe caution is warranted, given the significant moderation in its underlying metrics through FY23. Therefore, we surmise that the market has been adjusting its expectations appropriately, not necessarily re-rating SU even higher.

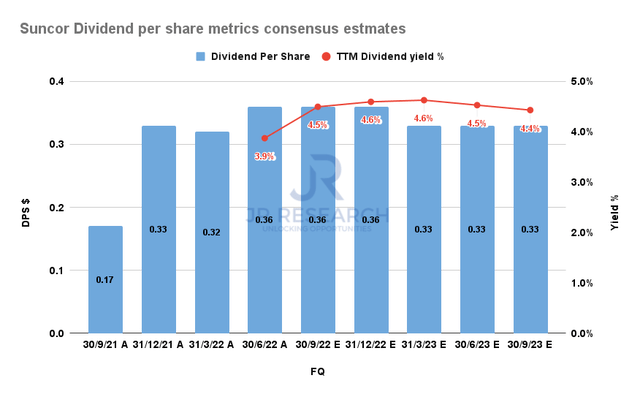

Suncor dividend per share metrics consensus estimates (S&P Cap IQ)

Notwithstanding, Suncor’s near-term dividends are expected to be maintained through FY23. We noted that its payout ratio remains prudent, as it posted a TTM payout ratio of 23.2%. As a result, we are confident that its above 4% dividend yield could be sustained through FY23, underpinning its valuation.

Furthermore, management has been aggressive with its share repurchase program, as it posted a TTM buyback yield of 7.5%, its highest over the past five years. Management also remains confident in its aggressive buyback cadence in Q2 as it articulated:

We made the decision to focus on buybacks in the second quarter. You’ll see [us] move strongly in the third and fourth quarters to taking debt down. It’s just really a function of cash flow generation and where we think the opportunities are from an economic perspective. We felt they were strongly in the buybacks area. (Suncor FQ2’22 earnings call)

Is SU Stock A Buy, Sell, Or Hold?

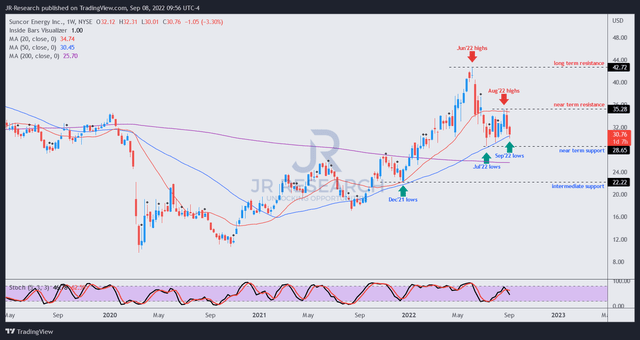

SU price chart (weekly) (TradingView)

We gleaned that SU is likely at a near-term bottom, undergirded by its near-term support at the $28.50 level. Therefore, investors should assess whether SU could continue to sustain its momentum above the support zone, despite the underlying weakness in the market.

Therefore, we urge investors to be patient, as it’s not time to pull the buy trigger yet, given growth normalization ahead.

As such, we rate SU as a Hold for now.

Be the first to comment