JHVEPhoto

BJ’s Wholesale Club (NYSE:BJ) just published excellent quarterly results. The wholesale club profits from increasing memberships and expands fast into new locations. The company is still reasonably valued as its expansion accelerates.

I recently published a list of ten stocks I considered possible “buy and hold forever” companies. BJ’s wasn’t on the list as it’s a young public company that went to the stock market in 2018. The way it has performed since then, it’s well on its way to becoming a buy-and-hold forever stock. Buy and hold forever shouldn’t be taken literally. The idea is to find profitable companies with continued growth and sound shareholder returns.

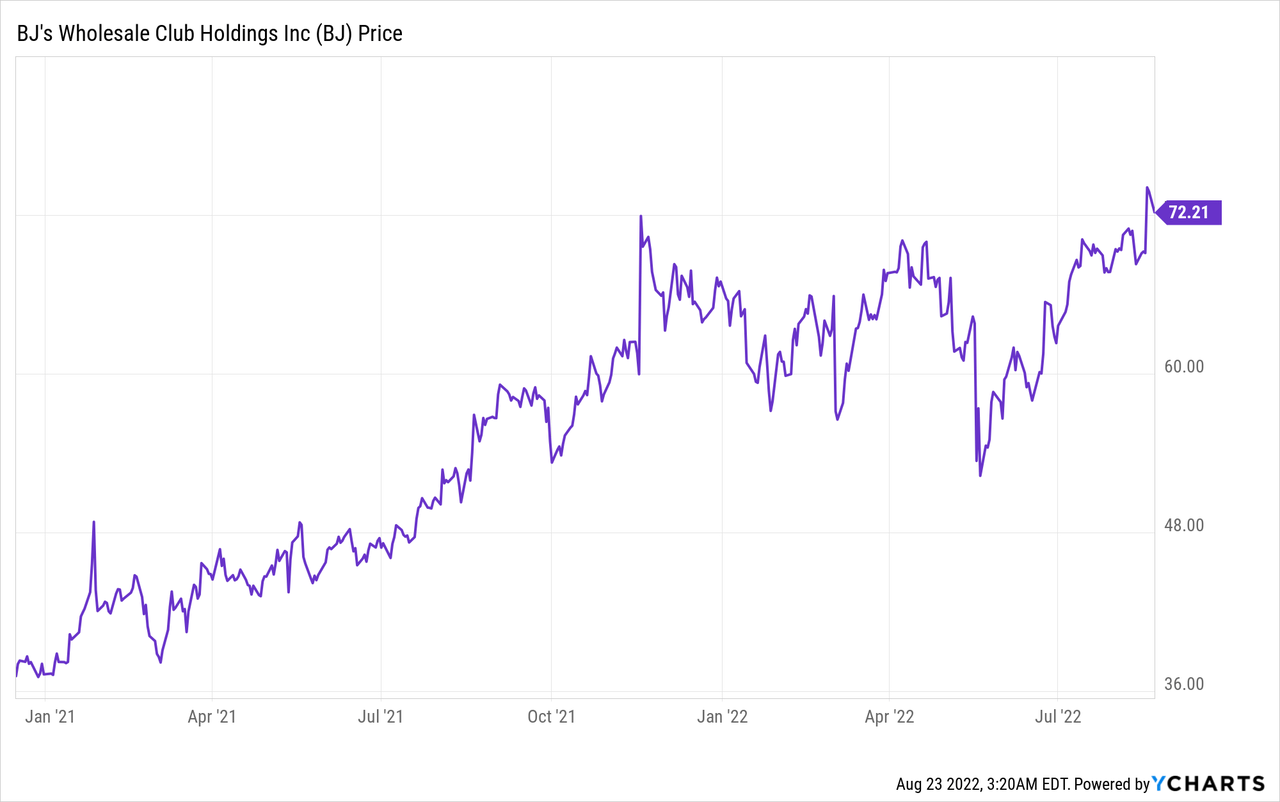

I wrote earlier about BJ’s in December 2020 when I just bought the stock. It handily beat the S&P 500 (SPY) by ~80% since then. It almost doubled and reached an all-time high, so a good time to revisit the investment case.

Potential Share Price Catalysts

I see these share price catalysts not necessarily as near-term. They could play out over the next five to ten years as the company grows and matures on the stock market.

- BJ’s surprises analysts every time with its quarterly earnings.

- Club growth increases from 1% yearly to 4%-5% yearly.

- BJ is cheap in comparison to larger peers. The discovery of the stock by more investors could lead to higher multiples.

Growth

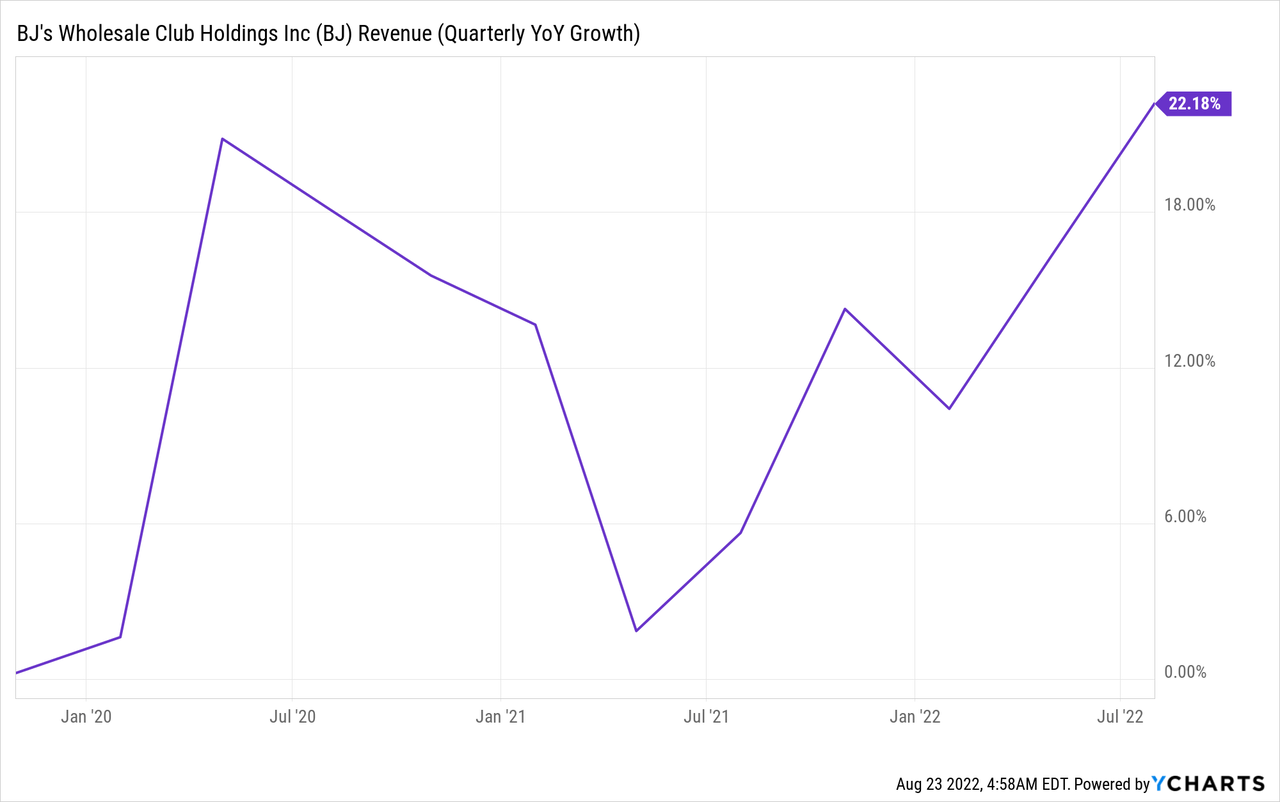

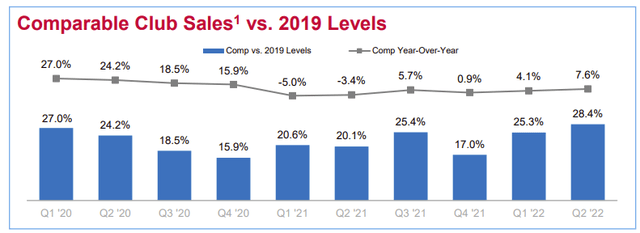

BJ’s profited from the bulk buying during the pandemic. The stimulus cheques in 2020 and 2021 benefited BJ’s as well. Despite these tailwinds gone, quarterly growth remained robust in 2022.

Gas sales deform these quarterly growth figures as fluctuating gas prices influence total revenue heavily.

The comparable club sales were outstanding too. The recent quarterly growth of 7.6% is substantial. The next quarter will be slower as management expects 1-2% in comparable sales growth and again mid-single-digit growth in Q4.

Long-Term Growth Profits From Unit Growth

BJ’s drastically increased the number of clubs it wants to open yearly. It went from four in 2020 to five in 2021 and expects to open 11 clubs in 2022. In the future, it targets a 4%-5% unit growth. That’s a substantial increase from about 1% unit growth historically. This will directly impact revenues and lead to slightly better margins as BJ’s gains buying power with larger volumes.

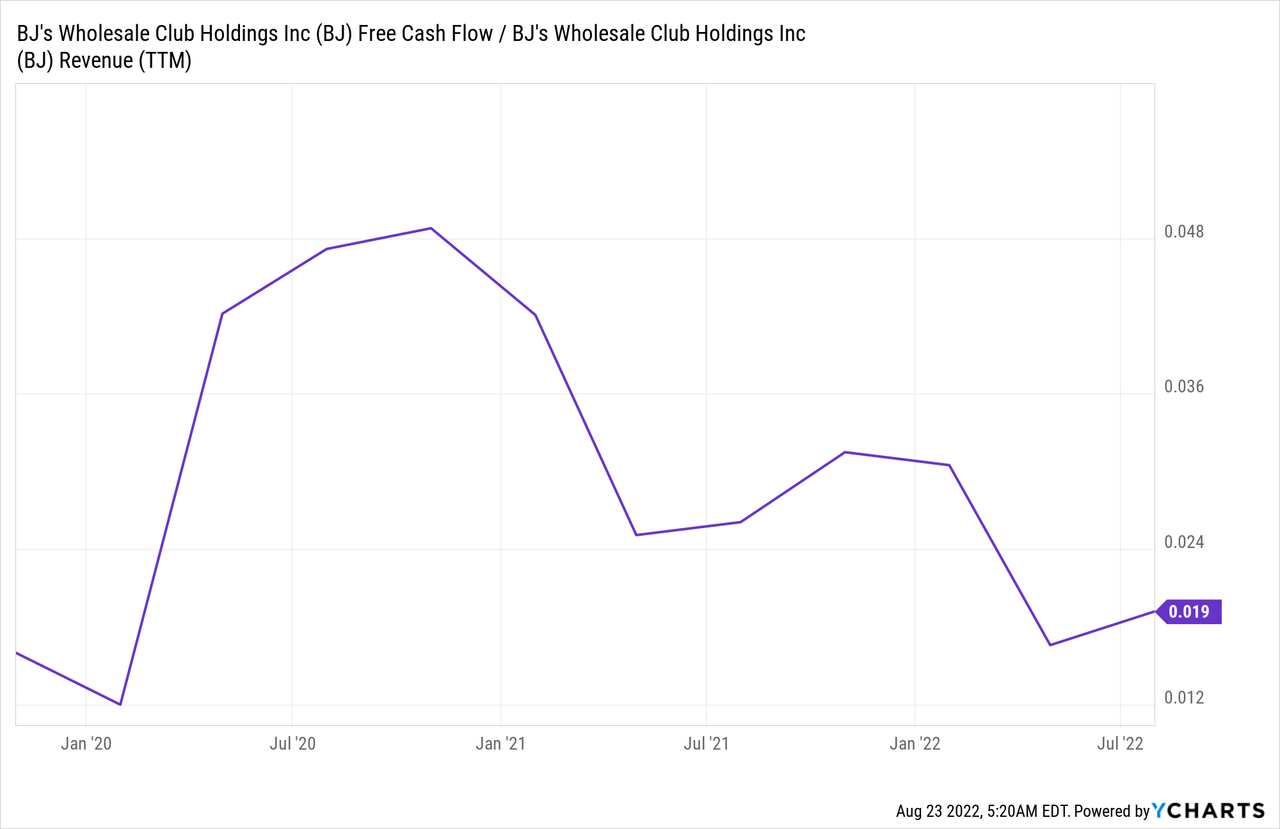

Free Cash Flows

Free cash flow is vital as this is what a company could use for shareholder returns. Potential buybacks or dividends are only possible if the company produces enough cash.

BJ’s consistently converges revenue into FCF. Its SBC isn’t large and can be ignored, in my opinion. The free cash flow tends to be lumpy quarter to quarter as inventory fluctuates. BJ’s has higher capital requirements as it opens more clubs. Its cash flow easily covers this.

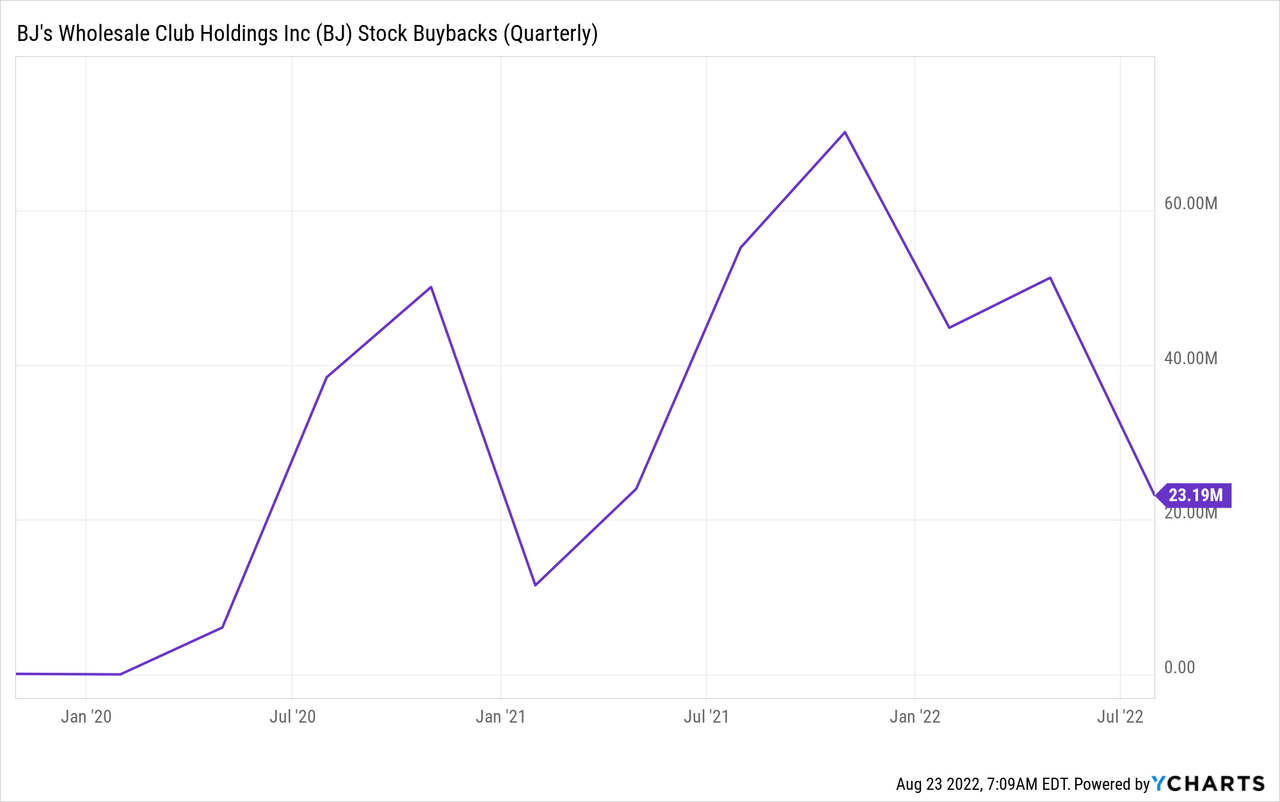

Shareholder Returns: Only Buybacks

BJ’s doesn’t pay a dividend and has no intention of paying dividends. It only returns excess cash through share repurchases. It currently has $413M remaining under its $500M buyback authorization. I expect the company will use this program slowly as it reiterated it buys back shares opportunistically. A drop in share price could incite more buybacks.

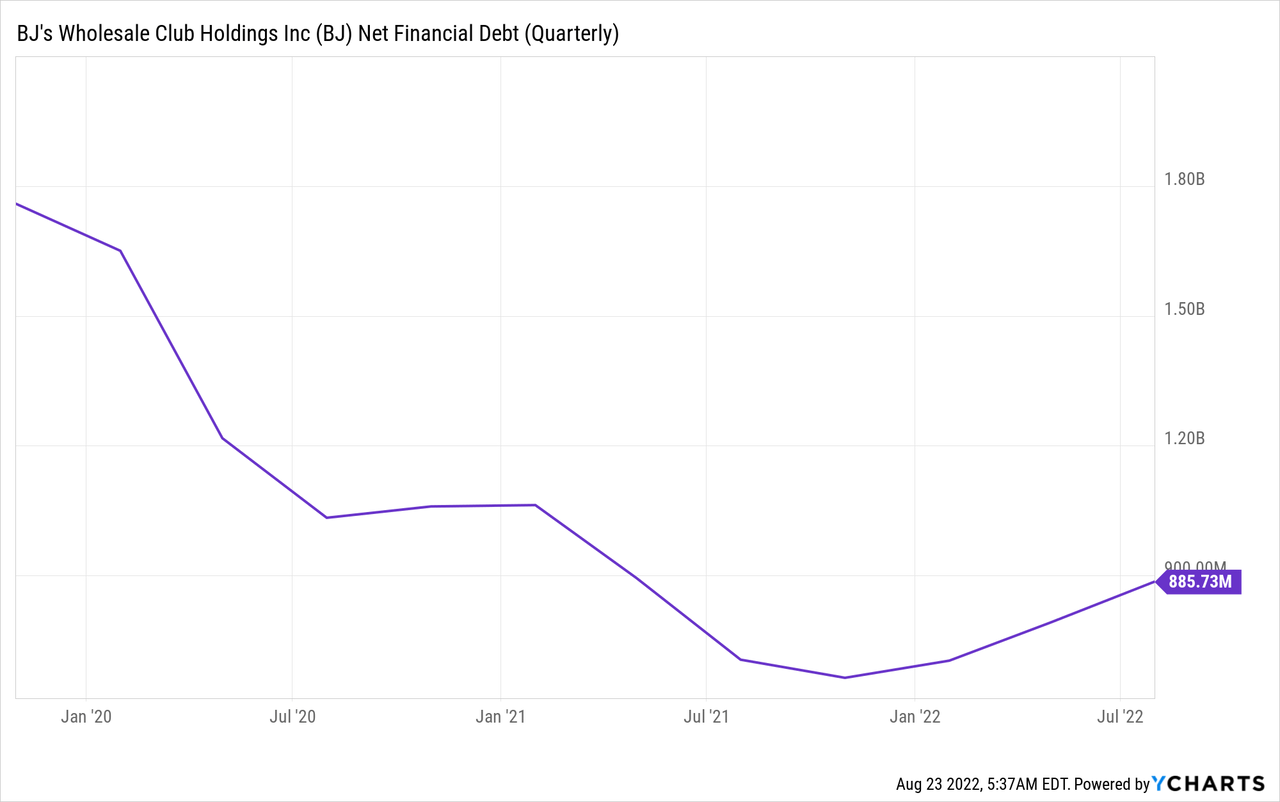

Balance Sheet: Reduced Debt

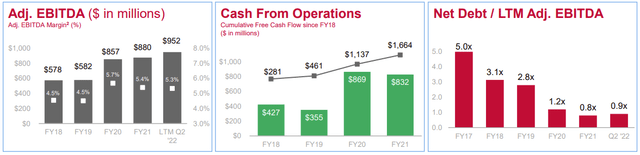

BJ’s quickly paid down debt during the past two years. It used the cash windfall well.

BJ’s

The combo of an increased adjusted EBITDA and decreased debt leads to significantly lower leverage for BJ. It’s a vital feat as it also reduces the risk for investors. The company has a strong balance sheet that backs its faster expansion.

Valuation: In Line With Its History

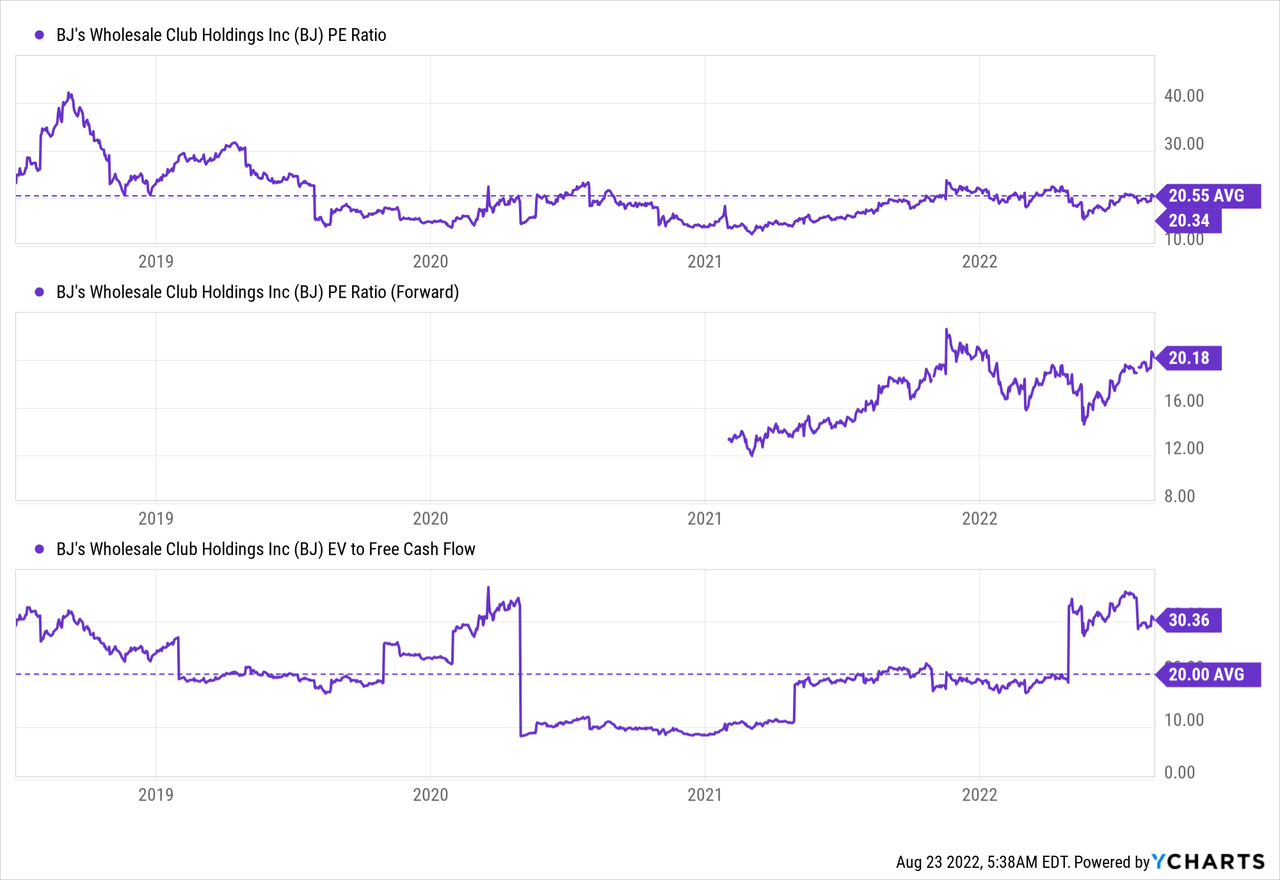

BJ’s stock price doubled since I wrote about it in December 2020 and increased 10% YTD. It’s around its all-time high and may seem expensive because of that. Its price ratios suggest it’s fairly valued today.

Both PE and FWD PE are in line with BJ’s historical average. A 20 PE ratio is reasonable for a company with an excellent operating history and probably double-digit annual EPS growth for at least the next five years. BJ’s EV/FCF looks rather expensive but is slightly deformed due to an early build-up in inventory. I expect the ratio will come down to its historical average as the year progresses.

Overall, BJ’s is fairly valued. It’s not a value play like last time. To put it in Buffet’s words:

I’d rather buy an excellent company at a fair price than a fair company at an excellent price.

Risks

The current valuation isn’t cheap anymore. The market could punish any slip in quarterly earnings.

BJ’s accelerated growth rate also comes with increased CAPEX. This could reduce free cash flow and possible buybacks over the following years.

Valuation Comparison To Costco

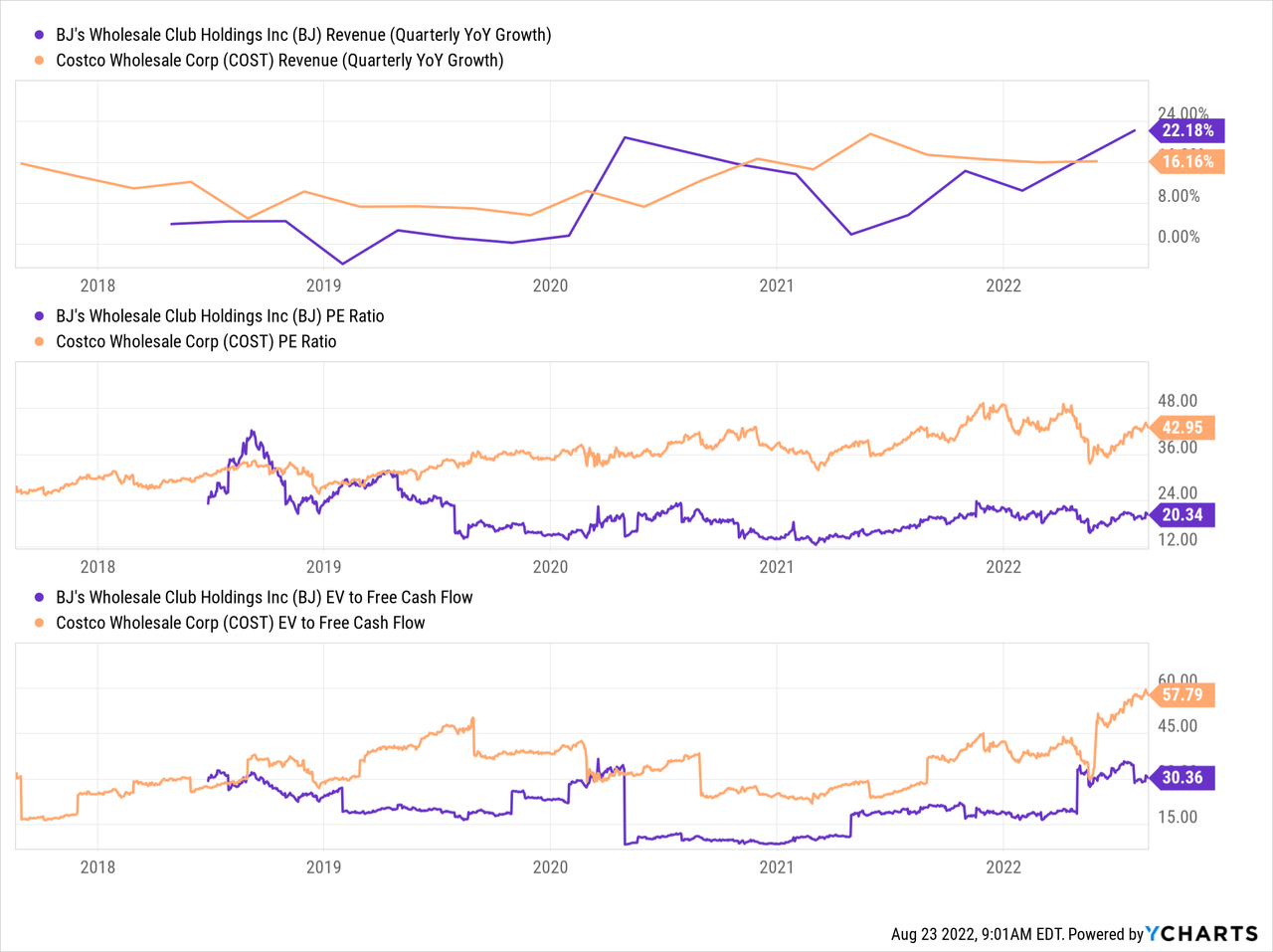

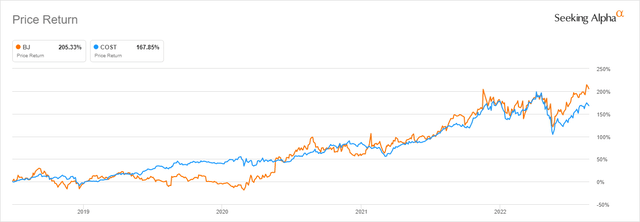

Costco (COST) is probably the most comparable stock to BJ’s. They both operate similar warehouse clubs. Their shares had similar trajectories since BJ became public.

Costco is much larger with 828 locations and is also active in Canada, and the U.S. BJ only operates 229 clubs solely in the U.S. and concentrates on the east coast for now. Costco also has a much larger market capitalization and long history in the stock market.

Costco’s long history, size, net cash position, dividends, and excellent growth rates demand a premium over BJ’s.

The premium seems rather large to me. Costco trades at the double the valuation ratios of BJ’s. BJ’s high ambitions for club openings should increase its revenue growth pace. Some catching up is due for BJ’s on the stock market.

Conclusion

BJ changed for the better in the past couple of years. It significantly reduced its debt position and deleveraged its business. It improved its growth rates and opens up more clubs in 2022. It aims to keep this acceleration going. I expect the combination of more clubs and increasing comparable sales will lead to double-digit EPS growth in the next couple of years.

The company looks reasonably valued to its historical valuations and is cheap compared to Costco.

I consider it a possible “buy and hold forever” because its growth could continue for a very long time. Compared to Costco, it could quadruple its current locations and have approximately the same amount. A company with such a perpetual growth path that’s free cash flow positive and returns cash to shareholders is worth considering.

Be the first to comment