“Hey, what’s the best side of this coin anyways?” PA Images/PA Images via Getty Images

In July 2022, I published an article regarding preferred shares of ACRES Commercial Realty Corp (NYSE:ACR), a microcap commercial mortgage REIT which has been undergoing a change in management. I suggested an investment in the fixed-to-floating (FTF) rate preferred series C shares (NYSE:ACR.PC) when it was trading at $20.05.

The annual dividend of $2.16 represented a 10.77% yield at the time. Today the preferreds trade at $21.81 with a 9.86% implied annual yield. But the change in price in July has been anything but linear.

Seeking Alpha: ACR-C 1-year chart.

In early August, the company reported earnings which beat expectations on the top and bottom line. This stabilized prices around the $22.00 range before it dipped below $20.00 again in October. Early November rolls around and ACR reports another quarter beating expectations. Despite the positive earnings momentum, shares dipped to $19.77 at the end of December providing another great entry point.

The company is expected to announce earnings sometime in early March and I thought it may be a good time to review where things are at and provide an update.

ACRES Commercial Realty Corp. Capital Stack Review

ACR has one common stock and two preferred shares. So far we’ve focused on the FTF C series shares. There are also the series D preferred shares which are at a fixed rate. Both are cumulative, perpetual, and have par value of $25.00.

|

Common |

Series C |

Series D |

|

|

Type |

— |

Fixed-to-Floating Cumulative |

Cumulative |

|

1st Call Date |

— |

07/30/2024 |

05/21/2026 |

|

Price |

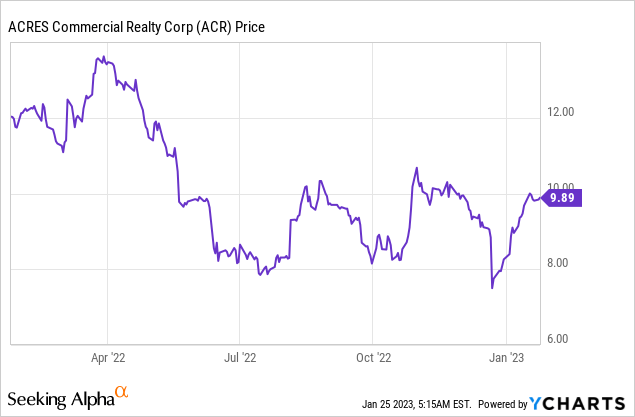

$9.89 |

$21.81 |

$20.68 |

|

Coupon |

0.00% |

8.63% |

7.88% |

|

Current Yield |

0.00% |

9.86% |

9.62% |

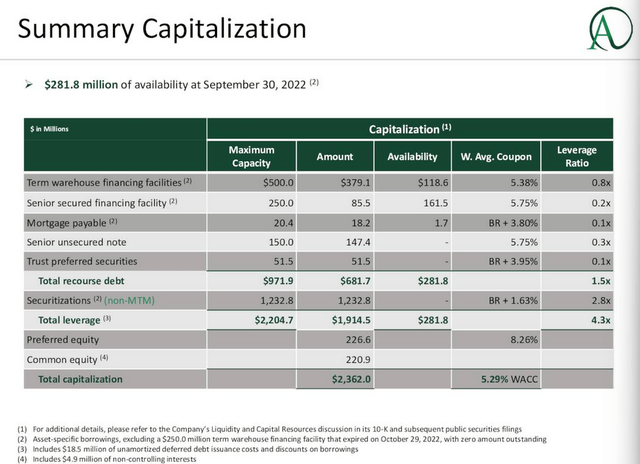

With the two quarterly updates total stockholders’ equity has increased from $442.702 million in Q1’22 to $447.479 million in Q3’22 (~1%). Preferred equity value of $226.6 million is covered by equity value of $220.9 million 0.97x.

What this means is there is a $220.9 million cushion before par value of the preferreds is affected. There is risk due to the leverage ACR employs which we can observe through their current 4.3x leverage ratio, so investors should be conscious of this in evaluating the preferreds.

Loan Portfolio Review

A $220.9 million loss on their $2.1 billion loan portfolio would represent 10.5% of loans being wiped out. That seems a bit unlikely given 99% of their portfolio is current on payment representing all but two of their 88 loans. Loan principal is additionally protected by an average 72% loan-to-value (LTV). What this means is that on average the assumed property values securing the loans are 28% higher than the loans themselves.

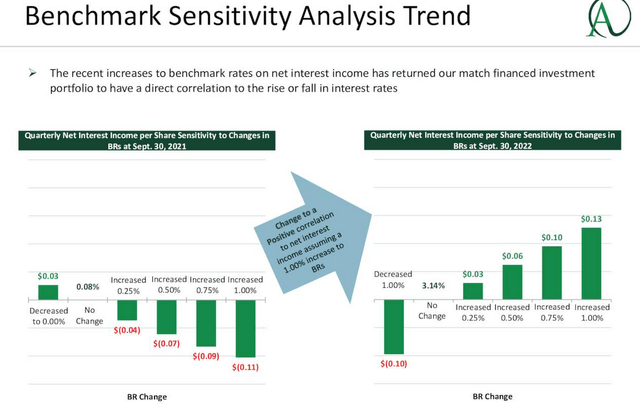

Investing in the preferred shares of ACR gives layers of protection first in the form of stock equity value then in the form of a portfolio of loans secured by real estate. A feature of the portfolio is that it became positively correlated with interest rates in Q3.

November 2022 ACR Investor Presentation.

This was announced for the quarter ending September 30th, 2022. The Fed increased rates both in November and December 2022 for a total increase of +125 basis points capping a year where rates jumped 4.25%.

|

Meeting date |

Rate change |

Target range |

|

March 15-16, 2022 |

0.25% |

0.25-0.5% |

|

May 3-4, 2022 |

0.50% |

0.75-1% |

|

June 14-15, 2022 |

0.75% |

1.50-1.75% |

|

July 26-27, 2022 |

0.75% |

2.25-2.5% |

|

Sept. 20-21, 2022 |

0.75% |

3-3.25% |

|

Nov. 1-2, 2022 |

0.75% |

3.75-4% |

|

Dec. 13-14, 2022 |

0.50% |

4.25-4.5% |

With the rise in rates since the last report net interest income should increase by $0.10 or more per share. Net interest income (NII) from the portfolio last quarter was $11.126 million and with 8.713 million shares outstanding NII per share equals $1.28. An increase of $0.10 would be around a 7.8% increase.

Unexpected trouble in the portfolio could dampen earnings, yet the rise in interest rates seems likely to drive it higher in Q4. Management has also been juicing EPS metrics through their common stock repurchase program. Book value per share was last reported to $25.08 whereas ACR’s common stock has consistently traded at well below half that. With the current stock price of $9.89 P/B sits at 0.39x. This is actually a bit on the higher end of the range that the stock has been trading in since June.

Management has decreased shares outstanding from 10.162 million in December 2020 to 8.713 million as of September (-14.26%). They still had another $8.1 million authorized for repurchases and were buying shares just last quarter.

With these things in mind I do not expect significant losses in the portfolio in the coming year. I think this means that the likelihood of a 10.5% decline in portfolio value which would then eat into preferred equity value is unlikely.

ACR-C: The Floating Shares

Both preferred shares and the common stock have started the year by steadily moving up. The result from my perspective has been that some of the margin of safety has been squeezed out of the preferred positions. My July thesis was built on an assumption that the ACR.PC FTF shares would likely be called in July 2024 when they switch over to their floating rate. My reasoning here is that the preferred shares are the highest cost of capital for the company already. When the series C preferreds switch to a floating rate, this expense could be even higher.

November 2022 ACR Investor Presentation.

When the rate starts floating it changes to 3-month LIBOR plus 5.927% with an 8.625% floor, the original coupon rate. This week 3-month LIBOR is at 4.8% which implies a floating rate of 10.727%. That’s a 24% increase to the dividend if rates remain high.

The Fed is targeting a rate range between 3.4-4.4% in 2024. If we use this as a proxy for LIBOR then we can gauge a floating rate between 9.3% – 10.3%. In this case it still implies an increase to the dividend rate, and the result is also a higher cost of capital of the preferred equity for ACR.

If I’m wrong and these shares are not called, then the higher yield will last as long as rates keep it above the 8.625% floor. So whatever the dividend is now would be locked in at the least. That current yield is 9.86% or $2.16.

Using the low range of the floating rate estimate (9.3%) means the dividend would be $2.325 which is a 10.6% dividend yield on the current price of $21.81.

|

3-Month Libor Estimate |

Rate |

FTF Coupon Rate |

Coupon Amount |

Floating Dividend Yield |

|

Fed 2024 Target Low End |

3.40% |

9.327% |

$2.33 |

10.69% |

|

Fed 2024 Target High End |

4.40% |

10.327% |

$2.58 |

11.84% |

|

Current 3-month Libor |

4.80% |

10.727% |

$2.68 |

12.30% |

If I am right about these shares being called in July 2024 we can do the math on that. These shares pay the dividend out quarterly, with one typically being announced in June and paid in July. That means that there are likely six more dividend payments between now and when it would be called.

That would equal $3.24 on top of the par value of $25.00. Total implied value then is $28.24 or a 29.48% return. I think these are relatively safe returns estimates whether the issues are called or not as I believe the company’s predominantly multifamily loan-portfolio should be able to weather any upcoming recession.

ACR-D: The Fixed Shares

On the other hand we have ACR-D which trades at $20.68 with a current 9.62% yield. These shares are at a fixed rate and are not callable until May 2026. Despite these being fixed, investors are not actually provided any further rate risk protection in these shares versus the series C. Because the series C shares have a built in floor at its current rate then even if rates do decline rapidly the current yield will still be the expected one.

I find it interesting that the shares then are trading so near each other in terms of yield. It seems to me that anyone owning ACR-D would be better off swapping for ACR-C immediately. Consider what you’d be getting in return a trade of equals in the capital stacks:

-

Dividend yield would increase by 0.24%.

-

You’d gain beneficial exposure to continued high interest rates with the FTF feature.

-

The shares would be callable nearly two years sooner.

This goes for those who are interested in investing in either of the preferreds right now. Buying ACR-C provides better yield and more features. Looking at a six-month chart we can see that the price differential between these two issues is typically wider than it is currently. And whenever they are near it doesn’t seem to last long.

Seeking Alpha: 6-month chart of ACR-C and ACR-D.

A Note On Eagle Point Credit

Eagle Point Credit Company (ECC) is a closed-end fund which invests in collateralized loan-obligations or CLOs. It’s part of a group of funds which typically have double-digit yields and have seen a lot of discussion here on Seeking Alpha. One of the most followed contributors here, Rida Morwa included ECC as one of two stocks to bet on. [The other stock highlighted incidentally is one I wrote up in September 2022: BrightSpire Capital (BRSP)].

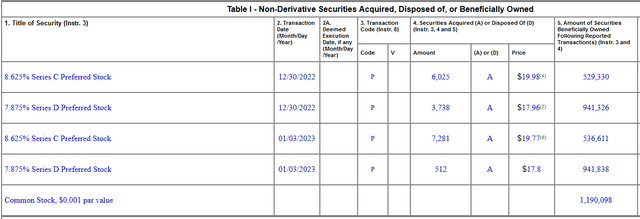

So why am I talking about it in the middle of this article about ACR? Well it turns out that they’ve been massive buyers of all three shares we’ve been discussing today. They’ve been >10% owners since March and have been buying rapidly since August. They’ve had to file 18 different Form 4s indicating activity since August – all of these forms have indicated further purchases.

Their most recent Form 4 reported a series of purchases of both the series C and D preferred shares as they bottomed from end-of-year selling.

Eagle Point Credit ACR January 2023 Form 4.

There are 4.8 million of the series C shares and 4.6 million of series D. Eagle Point are beneficial owners of 11.2% of ACR-C and 20.5% of ACR-D. They also own 13.7% of the common stock. All of these positions appear to be part of private funds, so not a direct holding for ECC.

But I bring all of this up because I’ve been critical of these types of CLO CEFs. I just published an article with a sell rating on peer fund OFS Credit Company (OCCI) in which I summarized:

“But back to the question, is OCCI a good investment? In my judgment, absolutely not. I think investors are much better off looking away from this entire category of (CLO) funds and instead looking to companies like commercial mREITs which originate these types of loans directly.”

For those that are invested in ECC for the dividend yield which is just shy of 16% currently, why not buy what they are buying? The common shares of ACR come with a set of completely different risks, but the preferred shares may be an attractive investment candidate for you. Just as it seemingly continues to be for Eagle Point Credit.

Conclusion

The series C preferred shares have seen a run-up this month which has brought them near a technical resistance point. Despite that, a long term view suggests that the dividend is safe and that these may perhaps be called within the next year and a half. If that’s the case then upside from current prices is ensured.

There are risks to the company that we should be mindful of though. We noted leverage is high at the company earlier, and in the past margin calls have eviscerated their book value. The upside is that this was under previous management and we’ve seen tangible changes since then which suggest a more conservative strategy and portfolio.

That being said, it is positively correlated to rates. We focused on the upside earlier because rates have increased since their last report. But over the long term we need to be mindful that declining rates would also decrease earnings.

Overall, I do not think that the preferred shares are at risk of capital destruction. I do think that where they are trading currently does not offer much margin of safety. I personally recently sold out of my ACR-C position and have been trading around the swings. Holding for the dividends is a reasonable approach as well.

I’d particularly be selling out of ACR-D shares (if I owned them) to swap into ACR-C given the features I noted earlier. These two issues really shouldn’t be trading in the same dividend yield range, in my opinion, and when they do it implies a pricing inefficiency.

With the wide range that both of these shares have been trading in, I suspect one might find better entry points down the line. That is unless Eagle Point Credit buys them all.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment