David Tran

A Quick Take On Telos Corporation

Telos (NASDAQ:TLS) reported its Q3 2022 financial results on November 9, 2022, beating expected revenue and EPS estimates.

The company provides IT cybersecurity software and related services for government agencies and commercial enterprises.

Until TLS management shows it can reignite revenue growth while making meaningful progress toward operating breakeven, my outlook on TLS is on Hold.

Telos Overview

Ashburn, Virginia-based Telos was founded to develop cybersecurity and information systems for federal and state government entities as well as for large enterprises.

Management is headed by president and Chief Executive Officer John B. Wood, who has been with the firm since 1992 and previously worked on Wall Street for Dean Witter Reynolds and UBS Securities.

The company’s primary offerings include:

Security Solutions:

-

Information Assurance/Xacta

-

Secure Communications

-

TSA PreCheck system [soon]

Secure Networks:

-

Secure Mobility

-

Network Management and Defense

Telos’ Market & Competition

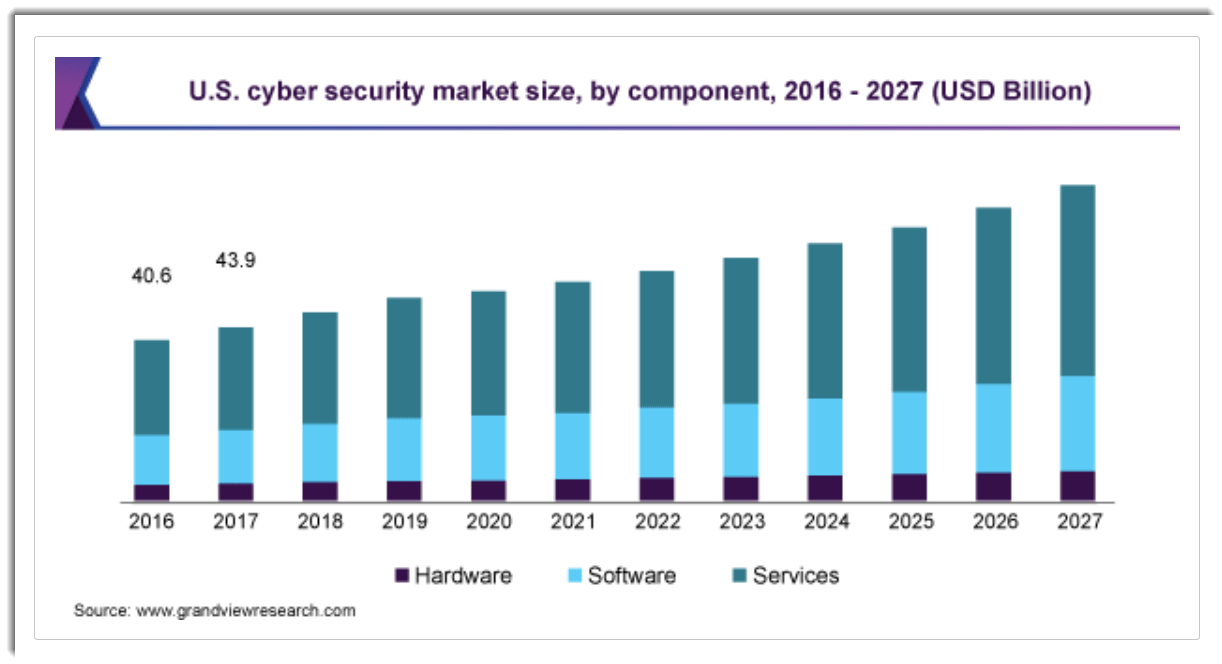

According to a 2020 market research report by Grand View Research, the global market for cybersecurity products and services was an estimated $157 billion in 2019 and is expected to reach $305 billion by 2027.

This represents a forecast CAGR of 10.0% from 2020 to 2027.

The main drivers for this expected growth are an increasing proliferation of online threats pursuing greater potential payoff in the form of stolen information.

Also, the continued transition of enterprises and agencies from legacy on-premises systems to the cloud presents new security challenges that must be addressed by the industry. Additionally, the Covid-19 pandemic has exposed firms to greater security threats, not least due to greater dispersion of company personnel in ‘work from home’ environments. Below is a chart indicating the historical and projected future U.S. cyber security market growth by component:

U.S. Cyber Security Market (Grand View Research)

Major competitive or other industry participants include:

-

CLEAR

-

Cutting Edge

-

IDEMIA

-

MetricStream

-

Palantir Technologies

-

RSA Archer

-

ServiceNow

-

Unisys

-

Booz Allen Hamilton

-

General Dynamics

-

Lockheed Martin

-

Northrop Grumman

-

Science Applications International

Telos’ Recent Financial Performance

-

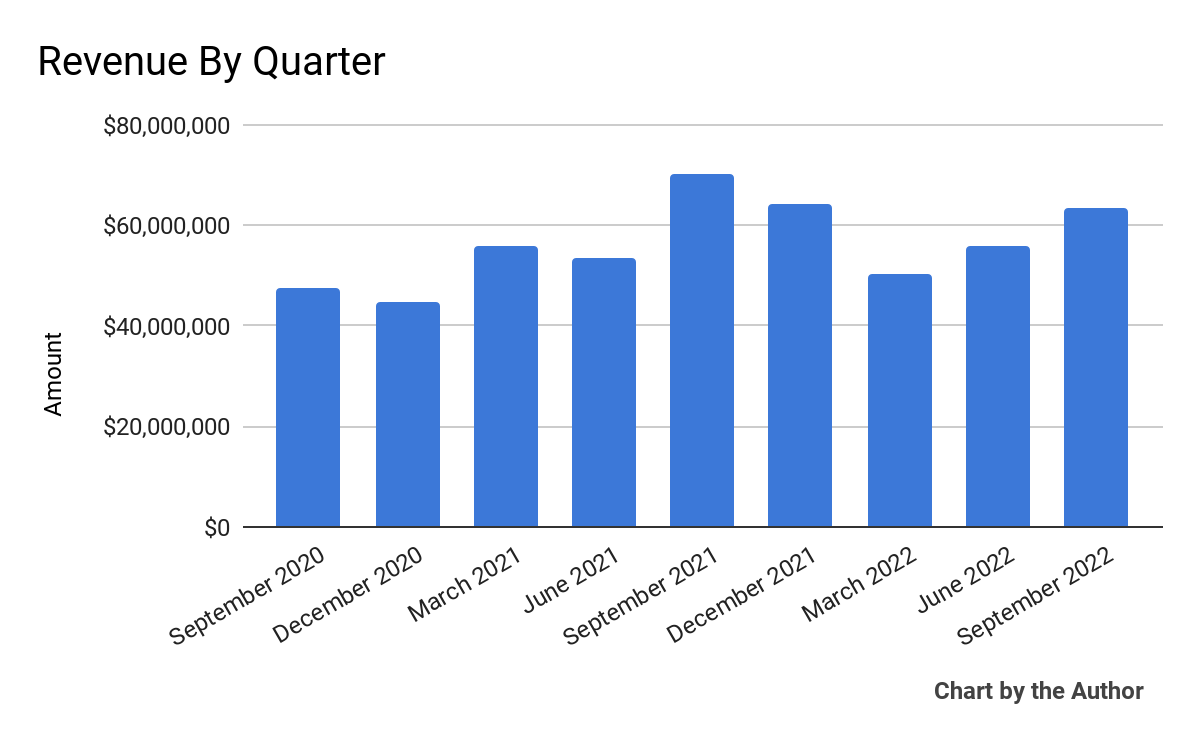

Total revenue by quarter has trended lower in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

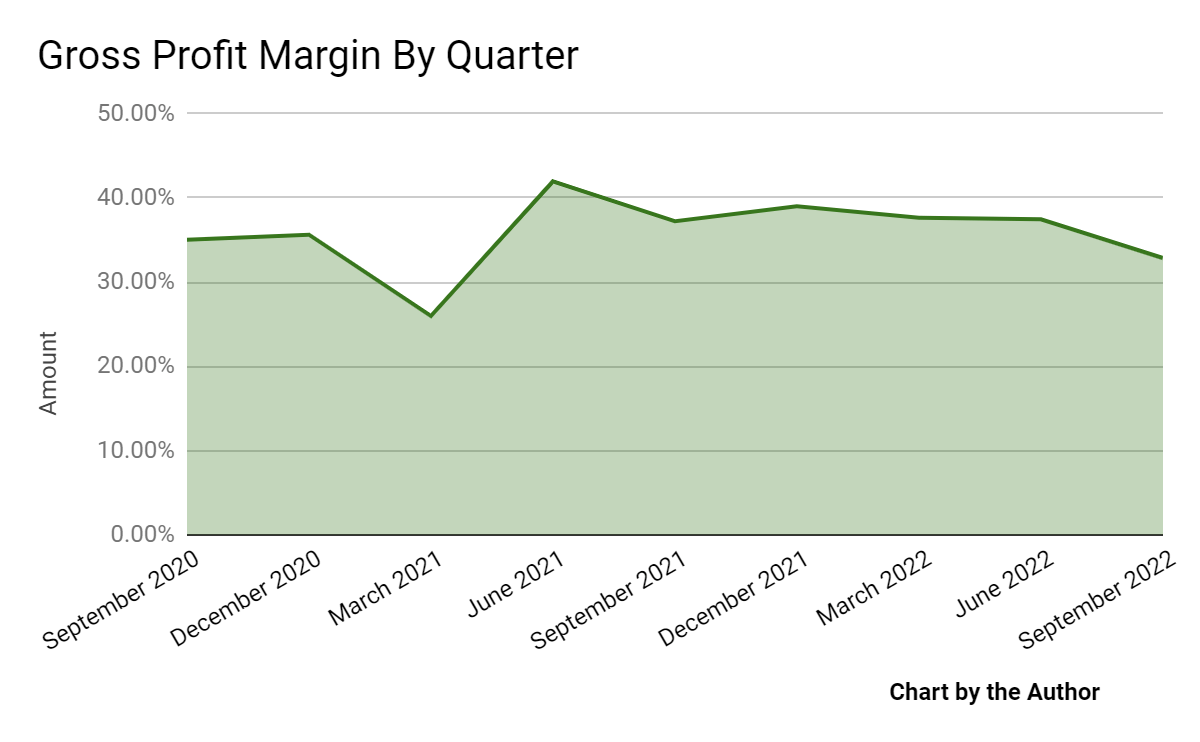

Gross profit margin by quarter has also trended lower in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

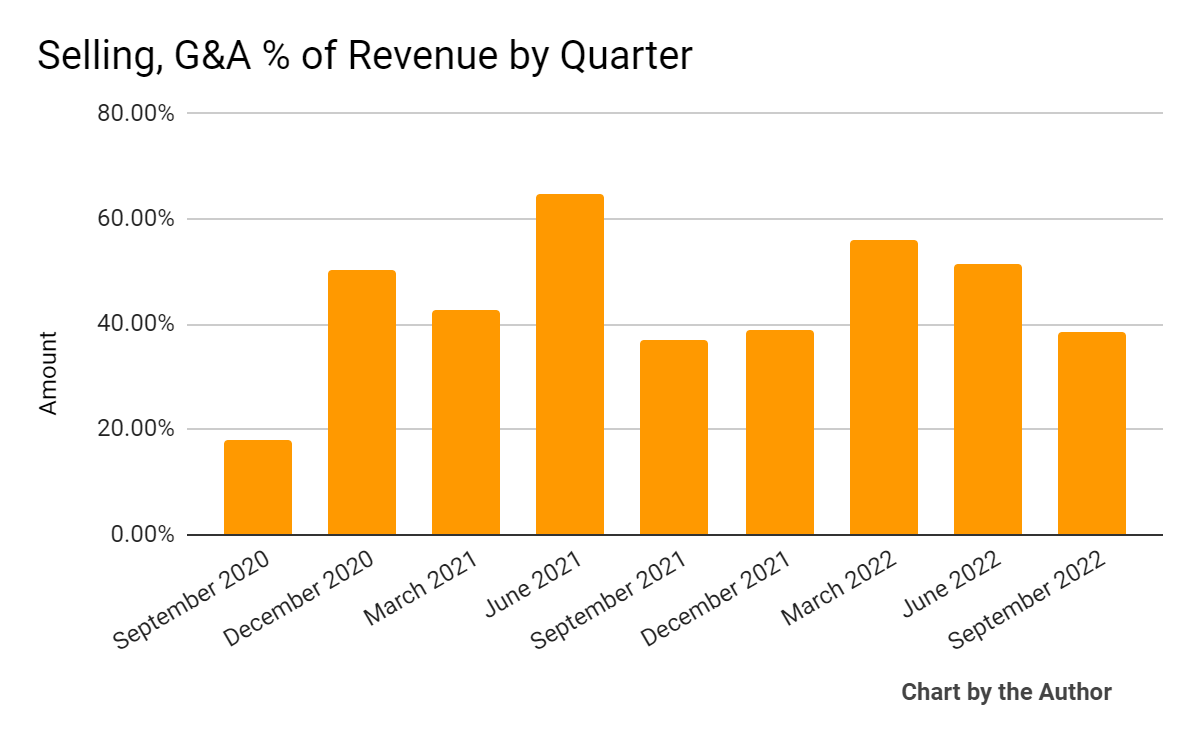

SG&A expenses as a percentage of total revenue by quarter have varied according to the following chart:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

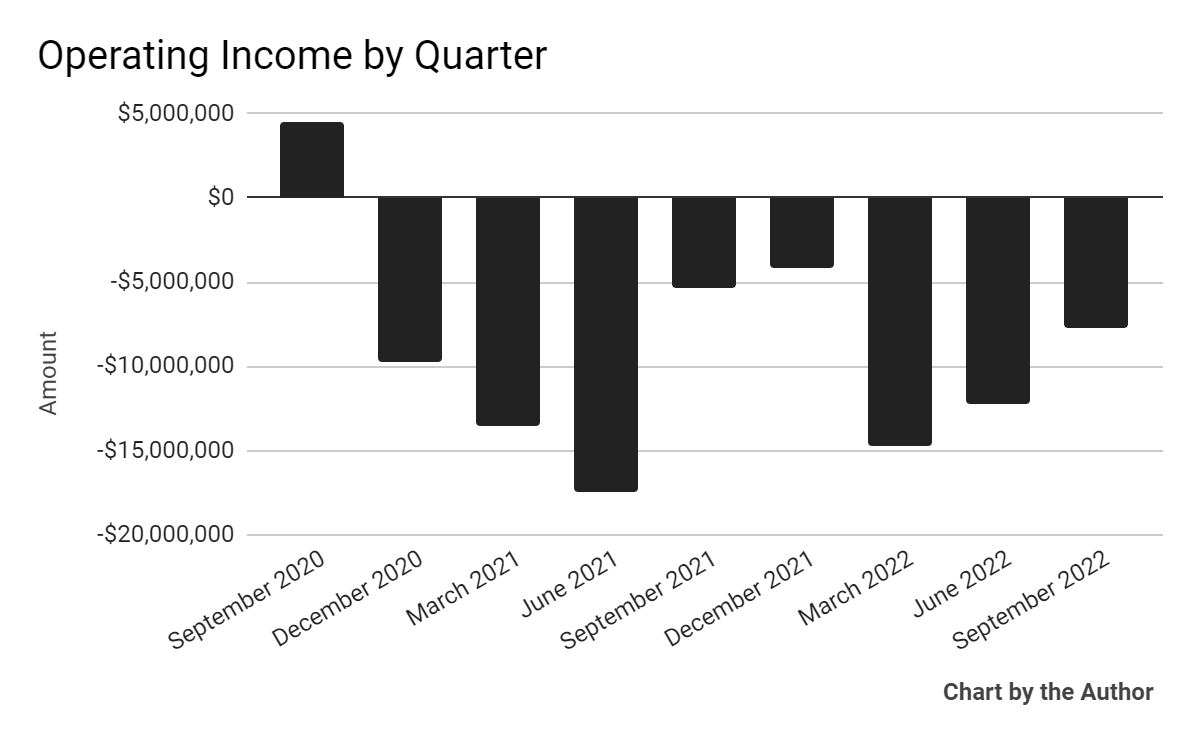

Operating income by quarter has remained substantially negative:

9 Quarter Operating Income (Seeking Alpha)

-

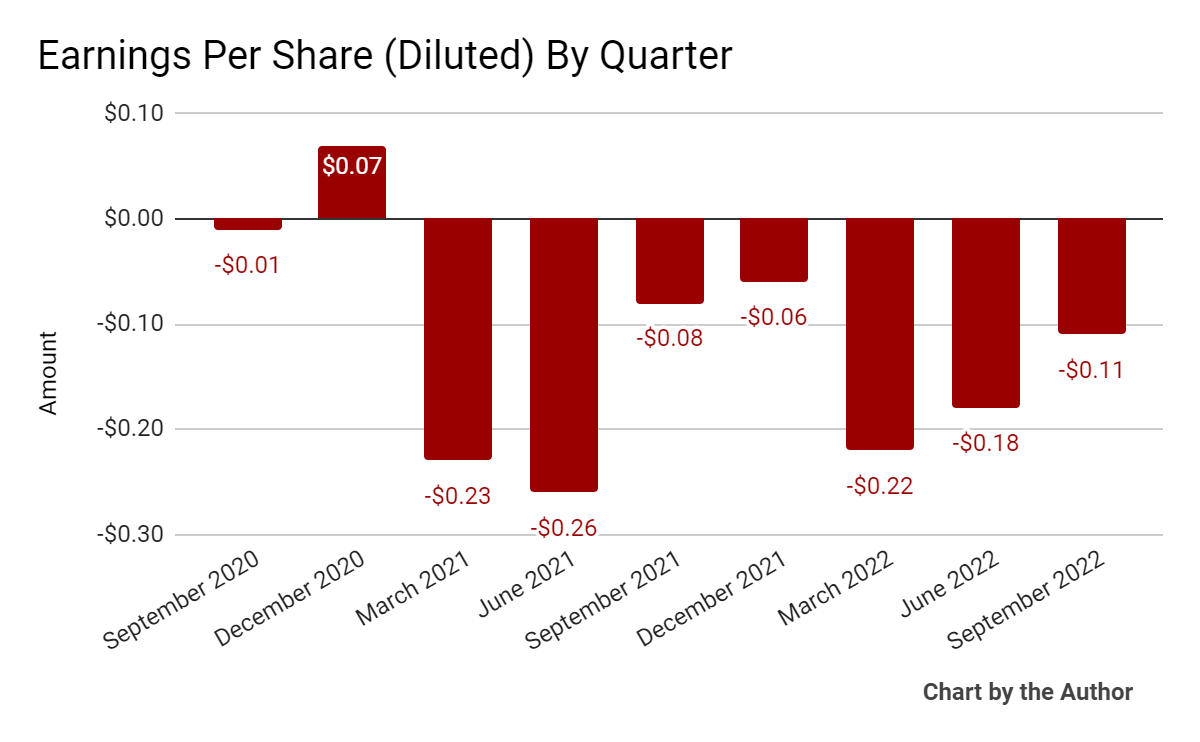

Earnings per share (Diluted) have also remained negative in the past seven quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

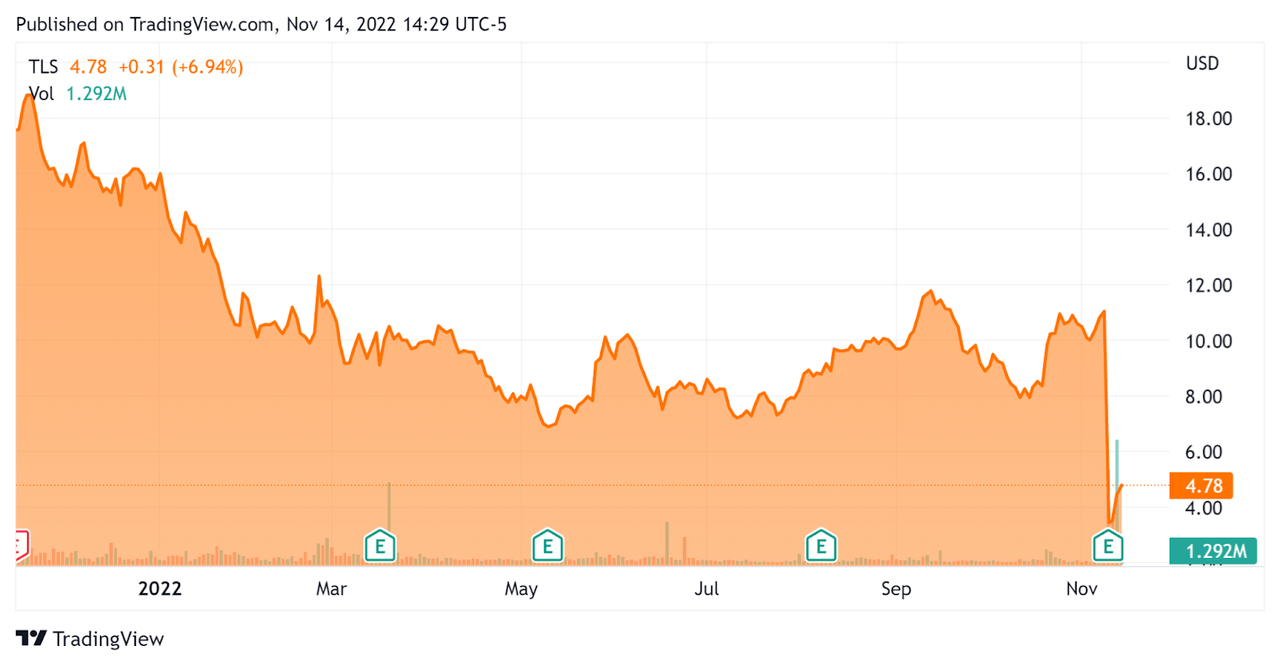

In the past 12 months, TLS’s stock price has fallen 72.8% vs. the U.S. S&P 500 index’ drop of around 14.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Telos

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.81 |

|

Revenue Growth Rate |

4.6% |

|

Net Income Margin |

-17.2% |

|

GAAP EBITDA % |

-15.4% |

|

Market Capitalization |

$300,430,000 |

|

Enterprise Value |

$188,830,000 |

|

Operating Cash Flow |

$17,740,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.57 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

TLS’s most recent GAAP Rule of 40 calculation was negative (10.8%) as of Q3 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

4.6% |

|

GAAP EBITDA % |

-15.4% |

|

Total |

-10.8% |

(Source – Seeking Alpha)

Commentary On Telos

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the receipt of an authority to operate notice from the TSA for its PreCheck system.

The company said it ‘will be providing TSA PreCheck enrollment services for a soft launch trial period to a limited population of applicants in order to validate systems and processes in advance of full implementation.’

However, in some of its larger segments, management said revenue ‘will likely begin to step down in the fourth quarter.’

As to its financial results, topline revenue fell 8% year-over-year but rose 14% sequentially.

Management did not disclose any retention rate metrics.

The firm’s Rule of 40 results have been quite poor, with negative results in the latest trailing twelve-month calculation.

TLS continues to generate operating losses, now for the eighth quarter in a row.

For the balance sheet, the company finished the quarter with cash and equivalents of $125.3 million and no debt.

Over the trailing twelve months, free cash flow was $15.3 million, with $2.4 million in capital expenditures.

Looking ahead, management expects total revenue for 2022 to be $215 million at the midpoint of the range and adjusted EBITDA (excludes stock-based compensation) of $15 million at the midpoint.

Leadership expects continued lower revenue from its Security Solutions segment partially offset by revenue from the ramp up of its TSA PreCheck program.

For 2023, revenue could contract by up to ‘mid-teens’ in percentage terms. In response, the market sold off TLS stock sharply.

Regarding valuation, the market is valuing TLS at an EV/Revenue multiple of just 0.81x, punishing the firm for its poor revenue performance and loss-making results.

Until TLS management shows it can reignite revenue growth while making meaningful progress toward operating breakeven, my outlook on TLS is on Hold.

Be the first to comment