Justin Sullivan

Investment Thesis

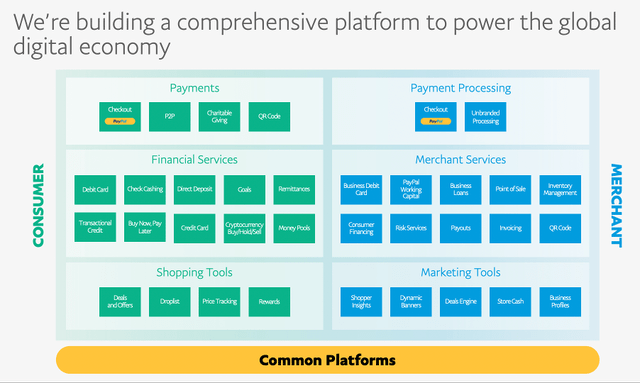

PayPal (NASDAQ:PYPL) is a leading global platform that enables digital payments and simplifies commerce for both merchants and consumers. The company covers the entire spectrum of digital payments, from online checkouts and risk management to international transfers and BNPL services.

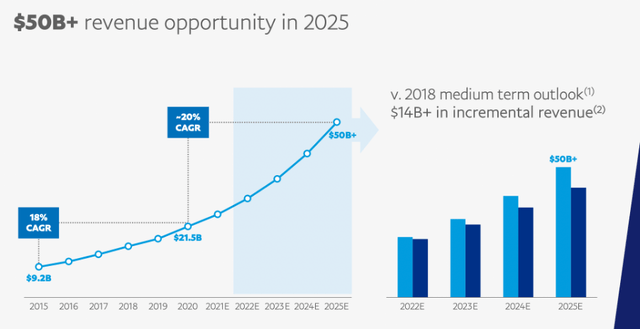

PayPal is already a leader in this industry, but the industry itself is growing – and should bring PayPal along with it, if the company can keep up with the latest technologies and consumer demands. In fact, in its 2021 Investor Day, PayPal highlighted the fact that it’s not only aiming to continue growing revenues rapidly, but that it intends to do so at a 20% CAGR from 2020 through to 2025.

All this seems great, but unfortunately the last 12 months have been anything but if you’re a PayPal shareholder. Its shares have crashed, falling 65% from their 52-week highs driven by weak performance and even weaker guidance issued by the company over the past few quarters. The company is also facing difficulties in the current tough macroeconomic environment combined with a slowdown in digital commerce now that lockdown restrictions have been lifted.

The question now is this: has all the negativity been baked into PayPal’s share price? And do Q2’22 results show some bright spots for investors?

Earnings Overview

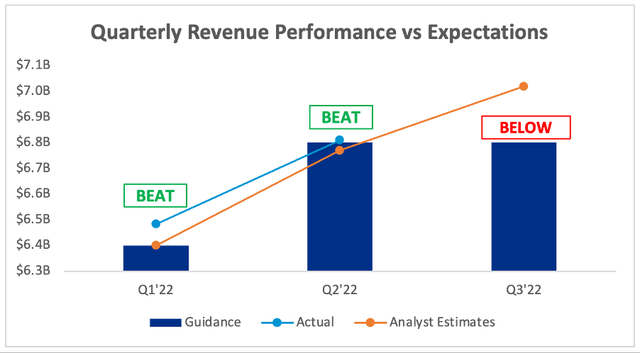

The company posted earnings of $6.806B, coming in slightly above their guidance of $6.8B and beating analysts’ estimates of $6.77B.

Investing.com / PayPal / Excel

Before diving into YoY comparisons, it’s worth highlighting that PayPal and eBay (EBAY) recently ended a decades-long agreement whereby eBay sellers would have funds from sales deposited to their PayPal account. Following the ending of this agreement, deposits from sales will now go directly to the seller’s bank account, taking a chunk of revenue away from PayPal.

This has resulted in some difficult YoY comparisons for PayPal, as the company is lapping previous quarters where they had this eBay revenue coming in – although Q2’21 was the final quarter including eBay revenue, so things will normalize next quarter.

With that said, PayPal’s YoY revenue growth was 9%, or 10% excluding foreign currency movements, or 14% excluding eBay – take your pick! Either way, PayPal continues to grow at a decent rate given the number of headwinds faced by the company. The only bad news was related to guidance for Q3’22 of $6.8B, which fell short of analysts’ estimates of $7.02B.

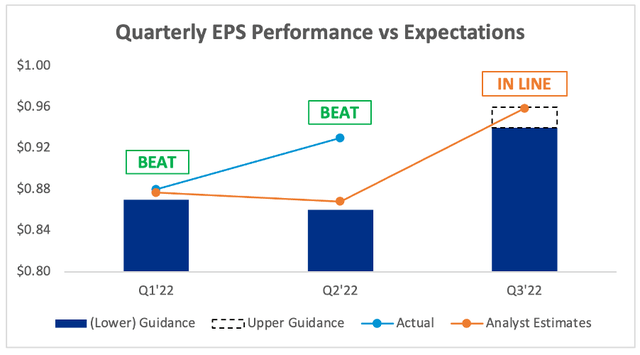

Moving onto EPS and we see a much better picture painted. PayPal produced a beat in Q2, coming in with EPS of $0.93 vs analysts’ estimates of $0.87 & beating their own guidance. The upper end of their guidance for Q3’22 was also in line with analysts’ estimates, so it appears that PayPal is continuing to deliver on the bottom line.

Investing.com / PayPal / Excel

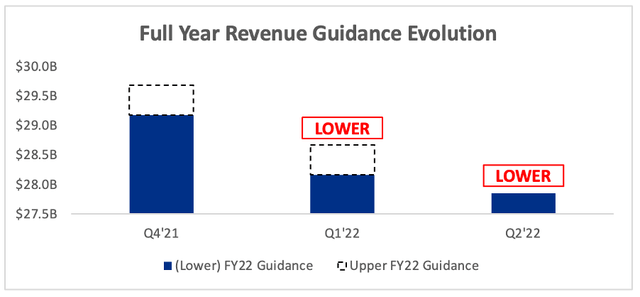

In terms of the full year outlook, it was a case of lowered guidance once again this quarter. This has been one of the items pulling PayPal shares down over the past 12 months, and another lowering of guidance is not what investors were looking for.

Investing.com / PayPal / Excel

This is what CEO Dan Schulman had to say on the earnings call about another quarter of lowered guidance:

I would now like to discuss our outlook for the remainder of 2022. When we provided guidance last quarter, we contemplated that there would be a challenging macro environment for the balance of the year. As everyone has seen across the market, macro conditions remain highly dynamic. We guided last quarter to a range of 11% to 13% revenue growth, and given today’s environment, we think it’s important to be conservative.

Accordingly, I would point you to the lower end of that range on a currency-neutral basis. While the macro remains uncertain, I also want to underscore that we have strong momentum across the business with accelerating revenue growth from April to May to June and now through July, and the team is focused on achieving our targets for the year. We expect third quarter revenue growth to accelerate 2 points to 12% on a currency-neutral basis and that we will exit the year with revenue growth of approximately 14% in the fourth quarter.

Basically, it’s a tougher environment than management first thought – and I will cut PayPal some slack, because it’s the same story I have heard from plenty of ecommerce businesses.

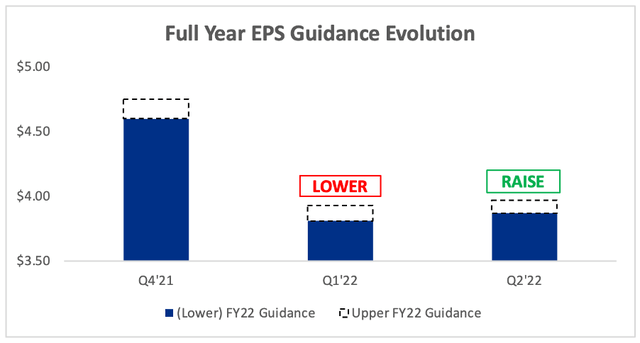

On the plus side, the company did actually raise its full year EPS guidance! Even better, Schulman highlighted that this progress will enable PayPal to deliver non-GAAP operating margin expansion in the fourth quarter and into 2023. He added that the company remains on track to generate more than $5B in free cash flow this year.

Investing.com / PayPal / Excel

As I write this, shares of PayPal are up by ~10%. This wasn’t a great quarter by any means, but there were some bright spots – so it sounds to me like the power of low expectations has helped lift PayPal shares today.

Beyond The Highlights

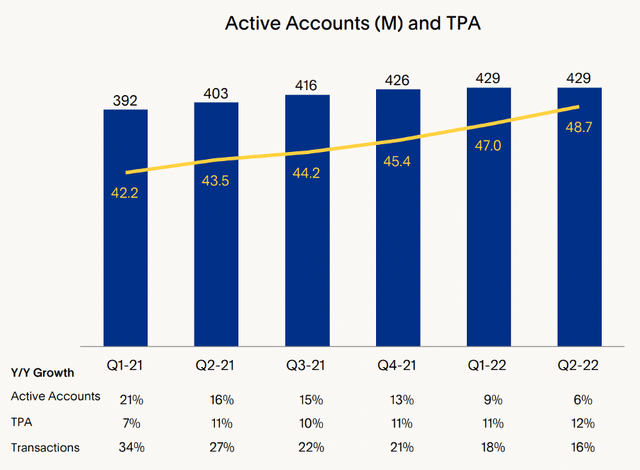

Looking past some of the top-line numbers, there are some positive trends for PayPal, albeit coupled with some less positive trends. For example, transactions per active account continues to grow, and reached an impressive 48.7 in Q2’22, up 12% YoY, with transactions rising 16% YoY. These are great results against some tough YoY comparisons. Yet, active accounts themselves remained flat QoQ, with only 0.4m net new active accounts, being driven primarily by Venmo.

PayPal Q2’22 Investor Presentation

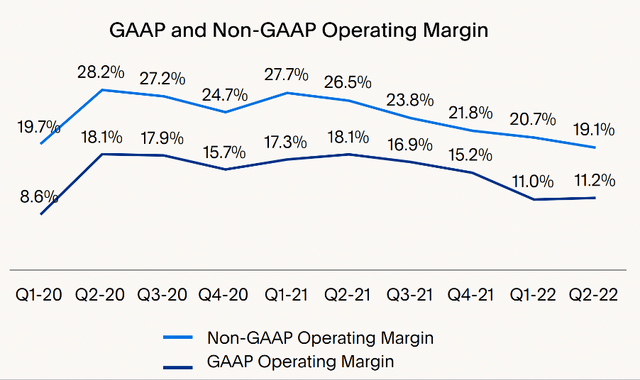

Whilst CEO Schulman touched on margin expansion next year, PayPal have unfortunately been heading in the wrong direction over the past 12 months in this respect, with non-GAAP operating margins falling from 28.2% in Q2’20 to 19.1% in Q2’22. This is driven primarily by higher transaction costs given the mix of payment volumes, but the trend is currently going against PayPal.

PayPal Q2’22 Investor Presentation

In other news, rumors of a stake from Elliot Management were confirmed, with the activist investment fund taking a $2 billion stake & becoming one of the company’s largest investors as a result. Jesse Cohn, a managing partner for Elliot, said the following:

PayPal has an unmatched and industry-leading footprint across its payments businesses and a right to win over the near- and long-term.

It can be seen as a positive sign that Elliot have taken such a substantial stake in PayPal, and they will also ensure the company is focusing on shareholder value creation – in other words, Elliot Management want to make a profit on their investment & will make sure PayPal is doing everything it can do achieve this.

An interesting coincidence perhaps is that Elliot Management also became Pinterest’s (PINS) largest shareholder, a former rumored acquisition target of PayPal. I’m a Pinterest shareholder & would rather it was left alone, but given that Elliot Management is now the largest shareholder of both companies, I would not be surprised if it started playing matchmaker if the synergies were there.

Valuation

As with all high growth, innovative companies, valuation is tough. I believe that my approach will give me an idea about whether PayPal is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

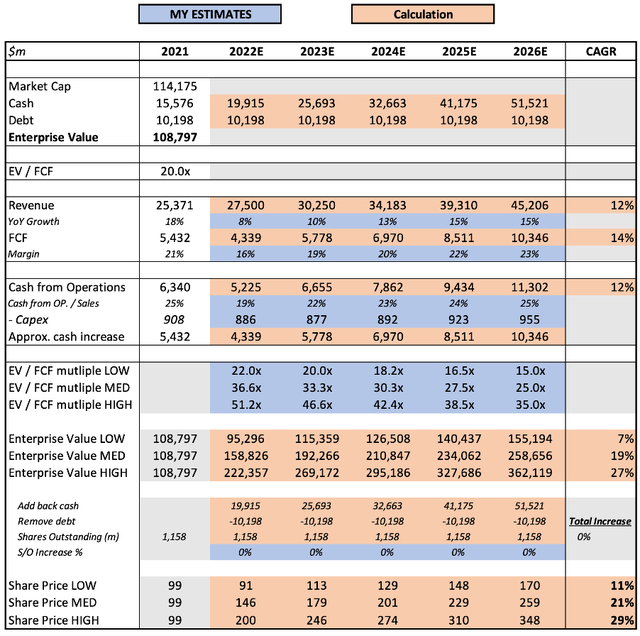

I have assumed that PayPal will come in below their latest 2022 guidance of $27.85B because, well… they keep lowering guidance, and the macroeconomic environment doesn’t seem to be easing up any time soon. I have, however, assumed that revenue will accelerate as they stated in their 2021 Investor Day Presentation, although my revenue assumption by 2025 of $39B is well below their forecast of $50B. I think the last few quarters have shown we should probably take management’s guidance with a grain of salt at the minute.

I do believe that PayPal will continue to expand margins, particularly with the ‘encouragement’ of an activist investor on board, and this will start to take effect in 2023. I have also used what I feel to be appropriate EV / FCF multiples in 2026 given PayPal’s size and growth outlook.

Put all that together, and I can see PayPal shares achieving a 21% CAGR through to 2026 in my mid-range scenario.

Bottom Line

I think investors can make a very strong case for PayPal as a value play right now. Even with my conservative assumptions, PayPal shares are still capable of achieving a CAGR in excess of 20% – so if management does execute on its vision of achieving $50B in revenue by 2025, then this share price growth could be even more enticing.

Whilst repeatedly lowering full year guidance does not give me confidence in this management team, it is undoubtedly a very difficult climate. Regardless, PayPal remains a leader in this industry, and the opportunity ahead of the company is only going to get bigger. I am not personally a PayPal shareholder, but if I were, then I would feel pretty happy with this quarter – and with shares at their current price, I could see an investment in PayPal right now seeming like a very smart decision in 5-years’ time.

Be the first to comment