Maria Vonotna

Introduction

There is no need to recount the market turmoil in 2022, higher inflation and the sharp rise in interest rates as a result of Fed moves and market action. As of this writing, the 10-year treasury bond yield sits at just below 4.0%, up from 1.8% at the start of 2022. This steep rise has led to a decline in all classes of fixed income, with the highest quality corporate bond indexes down over 20% this year (e.g. NYSEARCA:LQD, iShares Investment Grade Corporate Bond ETF). While we cannot predict where inflation and interest rates are headed next, we believe that most, if not all, of the “bad news” related to these factors has been priced into bonds. This has resulted in what we believe to be a potentially generational opportunity to lock in excellent yields in the lowest risk corporate bonds, those rated investment grade. Some analysts believe the next 10 years could be another “lost decade” for stocks where stock indexes bounce around, but in the end offer little return over this period of time. One solution to uncertain market returns and volatility, at least as it relates for new monies available for investment, is to lock in attractive yields in investment grade bonds for the next 4 to 7 years.

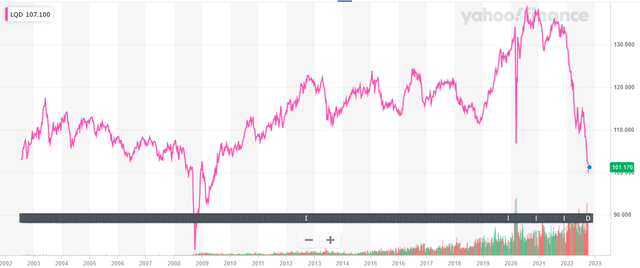

The chart below shows the sharp decline in the LQD index fund this year and comparison to prior decades. The last time the index fell to the current level was in the 2008-09 period when it seemed like the global financial system was coming apart.

LQD Price Chart (Yahoo Finance)

While investing in the index or other bond ETFs is a reasonable move, our preference is to hold individual bonds that have a known maturity date and known yield. In this way, we know exactly when our principal will be repaid in full and exactly the income earned from the bond portfolio. Assuming the portfolio of bonds is held to maturity, the only key risk is bankruptcy — if one of the bond issuers defaults they may not pay back some or all of the principal. But with investment grade bonds this possibility is extremely low based on historical data, and with bond selection and portfolio diversity, this risk can be even further mitigated.

Bond Ideas

Listed below are some specific bonds that we have added to client portfolios recently. Note that many investment grade bonds are trading at large discounts to face value, since they were issued when yields were much lower, and the market move to adjust these yields to current market conditions means the bond price must fall. Unless the current level of income is the most important factor, this should not matter to an investor, as the yield-to-maturity metric is the key indicator of annualized yield taking into account all factors.

Main Street Capital (MAIN), 3.0% of 7/14/2026, offered at about 85.1, yield-to-maturity of 7.7% (CUSIP 56035LAE4, rated BBB-). Main Street is considered one of the premier BDCs, with a $2.5 billion market cap, 2x asset coverage and consistently trades at a premium reflective of its strong performance. Note that much of this yield is embedded in its discount price; while the current yield is only 3.5%, an investor will gain another ~4% per annum when the bond repays in full in 2026 compared to the 85 purchase price. We see several attractive opportunities in large cap, investment grade BDC bonds in addition to Main Street, with yields in the 7%-8% range.

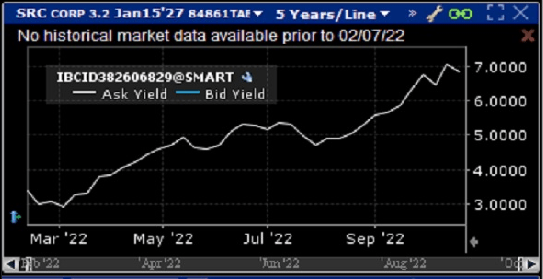

Spirit Realty (SRC), 3.2% of 1/15/2027, offered at about 87.3, yield-to-maturity of 6.7% (CUSIP 84861TAE8, rated BBB/Baa2). Spirit is a net-lease REIT with diverse portfolio of commercial and industrial properties, with a $4.8 billion market cap. The chart below shows how the yield for this bond has soared in the past months (the chart will be similar for all the bonds discussed here):

SRC Bond Price Chart (Interactive Brokers)

Kinder Morgan (KMI), 7.0% of 10/15/2028, offered at about 102.8, yield-to-maturity of 6.4% (CUSIP 880451AV1, rated BBB/Baa2; note that these bonds may be listed under the original issuing entity which was later acquired by Kinder Morgan, called Tennessee Gas Pipeline Co.). Kinder Morgan is one of the largest natural gas pipeline companies with a $38 billion market cap. This bond trades at a slight premium in contrast to the prior ideas.

For even more risk averse investors, a bond portfolio can move even a notch higher in credit quality, into A and higher graded bonds, with some yields available today in the high-5% to 6% range. (Remember, credit rating is not the final word in credit quality and should not be solely relied upon; for example, Credit Suisse (CS), which is undergoing a restructuring, is still rated A2/A). Some bonds to consider today:

Bank of America (BAC), 6.0% of 10/20/2027, offered at par 100, yield-to-maturity of 6.0% (CUSIP 06048WZ29 , rated A2/A-).

Realty Income Corp (O), 3.0% of 1/15/2027, offered at 90, yield-to-maturity of 5.7% (CUSIP 756109AS3, rated A3/A-).

Note that with the current yield curve, which envisions yields coming down in the future, going out farther in duration is not necessarily providing higher yields to bond investors and in some cases is lower. For example, some Bank of America bonds maturing in 2034 and 2036 are yielding 5.6%-5.7%. We believe the current “sweet spot” for bonds is in the 4 to 7 year range (consider a laddered portfolio of bonds from each year); this maturity range does incur high duration risk, but allows for an investor to take advantage of the excellent yields available today and lock them in for a reasonable period of time.

Conclusion

For existing bond holders, there is not much that can be done, all fixed income portfolios have declined in value this year. Our general recommendation is to continue to hold, collect the income and eventually bonds will mature or market yields will come back down again. But for new monies or investors that seek to shift away from the stock market, we see the current market for investment grade bonds as a unique opportunity to lock in 6%-7%+ annual returns with the safety of the highest credit quality corporate bonds. A diversified portfolio of individual bonds allows an investor to ignore market volatility and simply earn the yield of the portfolio each year, while holding the bond to maturity. In the interim, interest earned can be reinvested in new bonds to benefit from compounding interest. While we cannot predict where markets and rates are headed next (and after 30 years of professional investing we have learned that no one else can either), it appears to us that now may be a once in several decades opportunity to consider this asset class, and the window of opportunity to take advantage may last for much less time than might appear.

Please be aware that Downtown Investment Advisory currently holds the bonds noted in this article in client and personal accounts, and may have added/will add to positions at any time prior to or following the publication of this article. It is important to note that fixed income investments carry various risks such as default risk and interest rate risk which must be taken into consideration by investors. Please see the Downtown Investment Advisory profile page for important disclaimer language, which is an integral part of this article.

Be the first to comment