Ridofranz

Manole Capital Management:

Oct’22

Spending

Some of the fundamentals and metrics we like to follow are monthly retail spending trends. Mastercard provides monthly data in their SpendingPulse report, and they also provide estimates for the upcoming holiday shopping season. We like these MasterCard metrics, as they capture in-store and online retail sales, across all forms of payment (not just those on MA).

Before we look ahead to the important holiday season, let’s examine the last two months of spending trends. In August 2022, Mastercard SpendingPulse reported US retail sales grew +11.7% YoY and +20.4% compared to 2019. eCommerce sales in August grew +8.9% and +100.2% compared to the same period during Covid. The sectors showing strong double-digit growth were restaurants, airlines, and lodging. In September 2022, Mastercard SpendingPulse reported US retail sales accelerated sequentially and grew +11.0% YoY and +24.6% compared to 2019. eCommerce sales in September also accelerated sequentially and grew +10.7% and were +90.3% higher versus the same period during Covid. In-store sales remained strong at +11.1% YoY too. The sectors showing strong double-digit growth were electronics, as well as last month’s restaurants, airlines, and lodging, while retail sectors contracting or slowing were luxury and hardware/housing related spending.

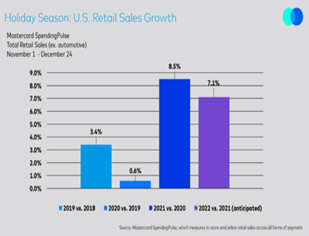

MasterCard slide on holiday spending (MasterCard)

During this upcoming holiday season (which covers November 1 through December 24), MasterCard is estimating that US retail sales will increase +7.1% YoY. Last year, US retail sales grew +8.5% YoY, as there was pandemic-induced spending and pent-up demand. Also, this was impressive growth off of a low +0.4% in 2020, which was clearly Covid-19 impacted.

Retailers are planning for certain in-store experiences, in an attempt to draw shoppers into their stores. MasterCard expects holiday doorbusters to boost traffic and drive consumers to increase spending by +7.9% YoY. eCommerce continues to grow, especially due to its convenience, and grow +4.2% YoY (up 70% pre-Covid).

Clearly, spending trends remain quite robust, despite all of the market worries. As Visa’s CEO Al Kelly just said at a business conference, “the consumer still feels quite strong, and we are just not seeing these negative impacts in our numbers.” Brian Moynihan, CEO of Bank of America, echoed those bullish sentiments when he said, “US consumers are in good shape and will continue to spend at an elevated clip.”

Growth

The payments industry has always been a staple of our FINTECH portfolio. Why are these spending metrics so resilient, despite so many economic uncertainties? We believe it has a lot to do with the slow and steady migration away from paper cash, but also due to materially growing the card acceptance footprint.

In 2012, Visa had roughly 25 million acceptance points around the world. Now, Visa has 80 million and the number exceeds 100 million, if one includes payment facilitators like Square, Adyen and Stripe. In the last decade, the number of global card acceptance points has increased by 4x. This occurs because the payment networks are leveraging technology and focusing their attention on new categories like rent, parking lots, vending machines, etc.

As we continue to highlight, global card penetration is still fairly low. While it is estimated to be at 60% to 70% in the United Kingdom, Canada, and the United States, it is only 53% in Ireland, 46% in Chile, 34% in Spain, 29% in Poland, 23% in Germany, and 21% in Mexico. Because of these factors, we are confident that we’re still in the early innings of this payment secular growth tailwind.

Senator Dick Durbin

We visited Senator Dick Durbin (Democrat, Illinois) in September 2010, just after he successfully attached his Durbin Amendment to the Dodd-Frank legislation. In fact, here’s a quick picture we took of his office nameplate. Can’t you tell how much iPhone cameras have improved over the last decade. My new iPhone definitely would have removed that annoying glare…

Senator Durbin’s nameplate in Washington DC (Warren Fisher)

During our meeting, we were disappointed to learn that not only did Senator Durbin fail to understand the ramifications of his debit legislation, but his staff was woefully uninformed about the second derivative consequences of his unnecessary (in our opinion) amendment.

We do not believe it is the job of government to get involved in pricing of certain, well-functioning private markets (i.e., debit and credit). We feel that markets should determine price, not governments. After discussing the card industry with him and his staff, we simply do not believe Senator Durbin is necessarily looking out for everyday consumers, like he claims.

Now that Senator Durbin has introduced additional credit card legislation (last month), we wonder why he seems to hate debit and credit cards so much. Requiring credit card transactions to route to at least one network that is not Visa or Mastercard is simply foolish. To summarize this bill, if a credit card gets presented for payment at a merchant, the merchant must be allowed to route that transaction on a network that isn’t both Visa and MasterCard. If one network is Visa, the other can’t be Mastercard. The hope is other networks, like American Express or Discover or Pulse or Shazam will now finally be allowed to compete for this business, driving down transaction costs for all merchants.

With so many real issues facing America today, we wonder why Senator Durbin is so focused on card legislation. Is he the last American that truly enjoys using cash? Does he not like getting miles, points, and rewards on his cards? Maybe it has something to do with political campaign donations he receives from large retailers in Illinois like Walgreens and McDonald’s? Have any of these merchants asked Senator Durbin to assist in lowering their MDR’s (merchant discount rates)? We don’t have the desire or ability to investigate why Senator Durbin hates the card networks so much, but we are prepared to discuss how his rules are impacting the payment industry.

Just like he did in the much larger Dodd-Frank legislation (following the Financial Crisis), Senator Durbin is attempting to attach these credit card rules to the pending National Defense Authorization Act, a must-pass legislation. Do you want a stat that truly highlights what’s wrong in Washington? Other senators offered up 900 various amendments, nothing to do with our defense, to this must pass defense bill. It appears that Senator Durbin’s first attempt to attach his amendment failed (mid-October), but we are sure he’ll try this again in mid-November, when the NDAA bill gets voted on again. Senator Durbin continues to work the DC system after being a Washington insider for nearly four decades of public service. Senator Durbin’s desire to require merchants to have at least two, unrelated networks for credit card transactions has nothing to do with our national defense, but neither did his debit card rules (inside of Dodd-Frank legislation) have anything to do with the Financial Crisis.

Payment Economics

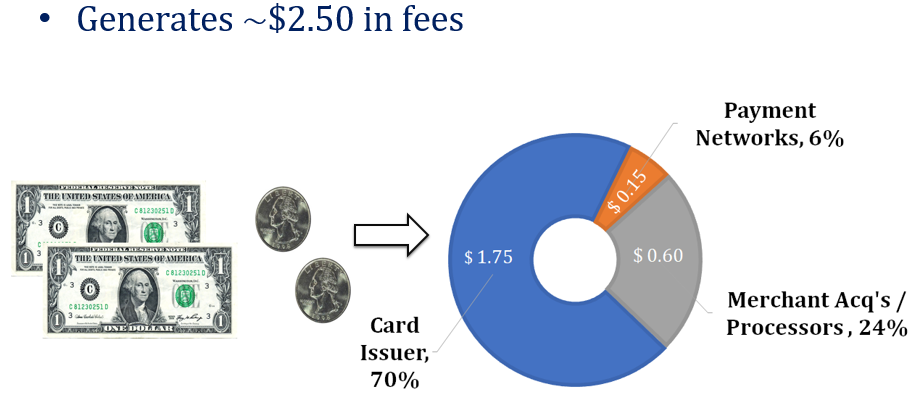

Let’s take a quick step back, to help frame this specific issue. Credit card interchange rates are set by the payment networks (Visa, MasterCard and American Express) and are then re-priced by merchant acquirers and payment processors, at a slight mark-up to merchants. This all-in cost to transact is called the MDR (merchant discount rate).

The interchange rates range from a low of 1.3% (grocery stores or gas stations) all the way up to 2.9% (pornography, tobacco, alcohol, etc.) of the sale. This wide range is dependent upon the network used, the type of merchant, the size of the transaction and a whole host of other factors. We created this pie chart to display how these fees get re-distributed to each party, so one can easily understand the economics of a typical $100 credit card transaction. As you can see, the vast majority of the economics go to the card issuers and banks, for taking the vast majority of the risk while the smallest component of these fees goes towards the payment networks.

$2.50 in Fees on $100 credit transaction (Manole Capital)

Senator Durbin’s goal is to reduce credit card processing costs for big merchants, like Walgreens. Yet, large merchants (like Walgreens, Walmart, Amazon, and Target) already have a built-in advantage versus smaller “mom and pop” stores; they pay a lower interchange rate than small businesses because they do significantly more transaction and generate much higher dollar volumes.

Does Senator Durbin not understand that Visa and MasterCard are arch enemies and compete everyday against each other for banking relationships? He acts like they are the same company, a monopoly and still owned by their founding member banks. This is clearly not the case, as MasterCard went public in 2006 and Visa in 2008. These two payment networks fight to get their logo (called a “bug”) on every card issuer’s piece of plastic or inside their digital wallet. Just because they help set interchange rates (across verticals, segments, merchant codes, etc.), Senator Durbin acts like there’s a secret hotline between Mastercard (in Purchase, New York) and Visa (in San Francisco, California) to control the entire payment industry.

If this legislation passes, the card issuers will respond by dramatically cutting available credit. Unfortunately, this will impact the lowest part of our society, who has to rely on that line of credit to survive. Not only will this legislation impact the lower-to-middle class, but it will also alter the dynamic that successfully exists in the card industry. By forcing change onto this industry, the end result will be lowering lines of credit to the lower-to-middle class. If banks do not see that segment as attractive (with these pricing restrictions), they will simply back away from that sector of the market. Not only will this impact those consumers, but merchants will also be impacted. This is the dynamic that Senator Durbin does not seem to fully grasp.

You should also expect all of your miles, points, loyalty rewards to get materially lowered and even potentially cancelled. Why should a credit card company offer you benefits for selecting their card in your wallet, if the economics of offering you that line of credit have been governmentally price capped? If you recall, there used to be rewards tied to debit cards a decade ago, but they were eliminated. If Senator Durbin’s legislation passes, it ultimately could end the rewards and loyalty programs of the credit card industry. If you don’t believe us, just look at the Australian market and what happened there.

Nobody should forget that consumer spending accounts for about 2/3rds of US economic activity. The US Bureau of Economic Analysis publishes PCE (Personal Consumption Expenditures) and it clearly displays how it has been one of the key growth components of our economy. Thank goodness that Americans love to shop and spend their hard-earned money. Legislation like Senator Durbin’s has the potential to impact consumer spending and our entire consumer-based economy.

There are tens of thousands of transactions every Friday evening at grocery stores, that would get declined, if debit cards were used. These transactions get approved only because a bank and issuer are offering credit to that consumer. Unfortunately, there are too many American families that don’t have enough in their bank account (on a Friday night before a payroll check clears) to pay for food for the weekend or next week. Without banks offering lines of credit, these transactions simply wouldn’t occur. Certain merchants understand this dynamic and appreciate the role that credit plays in everyday payments.

Another flaw in this legislation is the fallacy that merchants will pass these processing savings to their customers. It didn’t happen after debit legislation a decade ago and it won’t happen now. Merchants will never pass along those savings and instead will simply choose to pocket this governmental bonus as profit. Merchant acquirers and payment processors will also not pass along these savings to most small businesses. We believe that Senator Durbin is trying to enact legislation to benefit one of his largest constituents, without understanding all of the negative ramifications of his actions (yet again).

Before you feel too badly for Visa and MasterCard, one should understand that they have the EPC (Electronic Payments Coalition) and many other industry insiders and lobbyists on their side. The Chairman of the EPC is Jeff Tassey and he recently said, “This legislation would again boost retailers’ bottom lines at the expense of American consumers — stripping them of their credit card rewards and usurping their choice of network while leading to a less secure, less innovative, and weaker financial system.” The EPC also argues that this legislation will make transactions less secure and Tassey said “When [the] government comes in and puts hands on one side of the customer scale, like they did in the Durbin amendment [for debit networks], you have all kinds of unintended consequences.”

Conclusion

This issue pits two very powerful lobbying groups against each other – large banks vs. retailers. Will this wreak havoc on a perfectly functioning payment ecosystem? Our payment platforms handle billions of transactions and trillions of dollars in mere seconds. This back-door price control has the potential to upset the delicate balance between all of the interactions of US cardholders, merchants, acquirors, processors, and card issuers. We will continue to closely monitor Senator Durbin’s tactics and hope his legislation doesn’t get inserted into legislation at midnight, like it did back in 2010.

DISCLAIMER:

Firm: Manole Capital Management LLC is a registered investment adviser. The firm is defined to include all accounts managed by Manole Capital Management LLC. In general: This disclaimer applies to this document and the verbal or written comments of any person representing it. The information presented is available for client or potential client use only. This summary, which has been furnished on a confidential basis to the recipient, does not constitute an offer of any securities or investment advisory services, which may be made only by means of a private placement memorandum or similar materials which contain a description of material terms and risks. This summary is intended exclusively for the use of the person it has been delivered to by Warren Fisher and it is not to be reproduced or redistributed to any other person without the prior consent of Warren Fisher. Past Performance: Past performance generally is not, and should not be construed as, an indication of future results. The information provided should not be relied upon as the basis for making any investment decisions or for selecting The Firm. Past portfolio characteristics are not necessarily indicative of future portfolio characteristics and can be changed. Past strategy allocations are not necessarily indicative of future allocations. Strategy allocations are based on the capital used for the strategy mentioned. This document may contain forward-looking statements and projections that are based on current beliefs and assumptions and on information currently available. Risk of Loss: An investment involves a high degree of risk, including the possibility of a total loss thereof. Any investment or strategy managed by The Firm is speculative in nature and there can be no assurance that the investment objective(s) will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. Distribution: Manole Capital expressly prohibits any reproduction, in hard copy, electronic or any other form, or any re-distribution of this presentation to any third party without the prior written consent of Manole. This presentation is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use is contrary to local law or regulation. Additional information: Prospective investors are urged to carefully read the applicable memorandums in its entirety. All information is believed to be reasonable, but involve risks, uncertainties and assumptions and prospective investors may not put undue reliance on any of these statements. Information provided herein is presented as of the date in the header (unless otherwise noted) and is derived from sources Warren Fisher considers reliable, but it cannot guarantee its complete accuracy. Any information may be changed or updated without notice to the recipient. Tax, legal or accounting advice: This presentation is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any statements of the US federal tax consequences contained in this presentation were not intended to be used and cannot be used to avoid penalties under the US Internal Revenue Code or to promote, market or recommend to another party any tax related matters addressed herein.

Be the first to comment