By Linus Franngard, Senior Researcher for BlackRock Systematic & Scott Gladstone, Strategist for BlackRock Systematic

The Case For Thematic Investing

Thematic investing has become a compelling way for investors to align portfolios with the trends shaping the future. A spectrum of long-term and short-term themes are increasingly influencing which companies lead the way as economies grow and markets evolve. The top themes over the last four years capture nearly 25% of US equity market returns on average, a trend that’s accelerated since the emergence of COVID-19 in 2020.1 This has led to a broad industry shift, with assets managed in US-listed thematic funds growing over 10x from $13bn in 2016 to $148bn in 2021.2

Our research also indicates that themes have the potential to deliver differentiated alpha when used alongside other investment strategies. A hypothetical US thematic portfolio using a systematic approach demonstrates an average excess return correlation of -0.06 to the largest strategies in the U.S. Large Blend category and -0.02 to US factors.3 Delivering both return potential and portfolio diversification, thematic investing has risen in prominence as a way to build alpha-seeking portfolios.

Decoding Investment Themes

We think of themes as dynamic topics that are front-of-mind for investors, persist for some time, and have demonstrated an ability to drive equity market returns. Within BlackRock Systematic, we have developed a data-driven approach that seeks to identify, capture, and evaluate themes at scale.

A dynamic landscape

A broad range of structural and transitory themes drive markets at any given time. At one end of the spectrum, we have structural megatrends expected to shape the long-term trajectory of the economy like technological innovation, demographic shifts, and climate change. At the other end, we have evolving short-term trends driven by policy shifts, investor sentiment, and unforeseen developments—like a global pandemic, supply chain challenges, and inflationary pressures. Our systematic framework for thematic investing helps us to identify and reconcile both.

We can begin to understand how themes develop by assessing the attention that they receive using natural language processing (“NLP”) techniques. By nature, themes create a persistent flow of news as topics that investors are researching, corporate officers are addressing in conference calls, and the press if publishing. Leveraging this volume of textual sources, we can begin to quantify the flow of information dictating a theme’s relevance and life span.

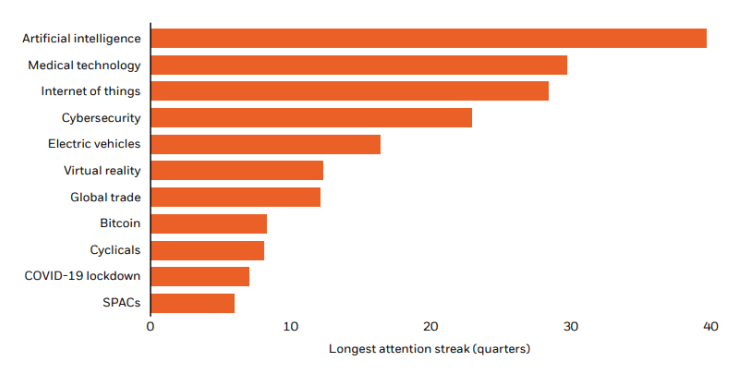

Attention metrics that count mentions of themes in financial news can help to differentiate short-term and long-term trends

Source: BlackRock, as of December 31st, 2021. Attention “streaks” are computed over the period 2006-2021, with a streak’s length defined as the number of consecutive quarters where a given topic is experiencing stable or increasing daily mentions in financial news relative to one year ago. For example, if a theme experienced an average of 15 daily article mentions over Q1 2021, an average of 20 daily article mentions over Q2 2021, and an average of 5 daily article mentions in Q3 2021, it will have experienced a two-quarter streak.

Our analysis reveals that some themes persist while others rapidly decay. In the chart above, structural themes such as artificial intelligence and medical technology demonstrate their endurance, where media coverage has perpetuated innovation and continued investment in the space. Transitory themes are equally observable in the data, garnering rapid attention during supportive macro environments but eventually declining.

To maximize return potential investing across both long-term and short-term themes, our research indicates that a systematic approach has the potential to effectively manage this spectrum through the application of data-driven insights.

Thematic + dynamic

Our alpha-seeking process uses data and scientific analysis to monitor how themes develop and interact in real time, incorporating massive (and rapidly expanding) troves of unstructured and alternative data to navigate the thematic landscape.

Identify & capture

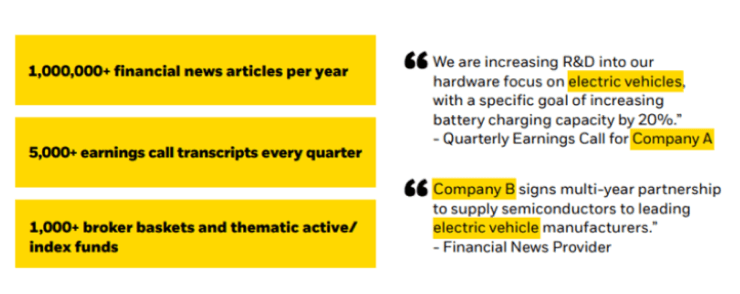

A systematic approach to identifying and capturing investible themes begins with analyzing vast datasets to understand the current thematic landscape. We apply NLP techniques across over one million financial news articles each year and more than five thousand earnings call transcripts every quarter to link companies to these evolving trends or topics.

We turn unstructured textual information into meaningful relationships across stocks & themes

Source: BlackRock, as of March 2022. For illustrative purposes only and subject to change. Examples are hypothetical and reflect sample natural language processing which searches for keywords in financial news, earnings transcripts, broker research, broker baskets, and other data points.

Our analytical capabilities help to identify a wide range of companies exposed to a theme—including more subtle linkages. Consider a theme like blockchain technology, for example. Our models first parse through baskets constructed by sell-side researchers and existing thematic funds, identifying direct exposures selected by brokers and portfolio managers. These may include firms such as cryptocurrency exchanges and bitcoin miners. Text-mining broader sets of unstructured data for associated keywords captures an expanded group including indirect, less observable connections. For example, we may discover online retailers accepting cryptocurrency or asset managers investing in the space. This robust process results in a diversified group of stocks spanning across the full scope of a theme.

Evaluate & rotate

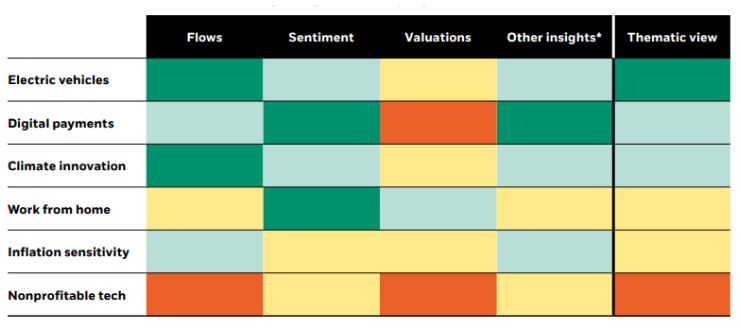

Part of an alpha-seeking, systematic approach to thematic investing is the consistent and timely analysis of existing themes. Proprietary systematic signals produce dynamic, market-aware return forecasts that shape our current view of each theme. This tends to favor themes with increasing news flow and positive investor sentiment, with awareness of potential over-crowding and over-valuation. Shown below, each theme is given an overall rating using a combination of insights.

This aggregated “thematic view” is used to determine how we rotate themes within a portfolio, overweighting themes with greater conviction and underweighting those with a less supportive outlook—adapting as conditions change and opportunities arise. Using an optimization that incorporates forecasts for individual and interacting themes, we focus on risk management and maintaining a diversified approach alongside our aim of maximizing alpha potential.

We evaluate and rank each theme daily using proprietary signals

Source: BlackRock, as of March 2022. Thematic positions provided for illustrative purposes only. Positioning represented as follows: Green: strongly positive return forecast; Light green: positive return forecast; Yellow: negative return forecast; Orange: strongly negative return forecast. Not representative of actual fund holdings. * Other insights include quantitative data such as financial metrics and alternative data sets. For illustrative purposes only and subject to change.

Enhancing Portfolios Through Themes

With nearly one-quarter of US equity market returns captured by the top themes over the last four years, it’s no surprise that thematic investing has garnered attention and investor flows.4 Our research indicates that a dynamic thematic strategy rooted in a systematic framework may enhance portfolio returns while complementing other investment strategies.

By transforming a wealth of data into valuable insights, investors can access diversified exposure to a spectrum of timely and transformational themes—making a systematic framework the future of thematic investing.

1Source: BlackRock, as of December 31, 2021. For illustrative purposes only and subject to change. Thematic market capture is defined as the product of the variance explained (R2) by the first six principal components from a principal components analysis of the S&P 500 Index® and the average R2 of stepwise regressions of the six principal components onto a set of thematic baskets where the number of regressors is capped at three.2BlackRock, as of December 31, 2021. AUM reflects a universe of 250 funds identified by BlackRock’s iShares Megatrend Classification Committee. Megatrend investing is focused on long-term growth opportunities, and the investment strategies are typically unconstrained from a geographic and sector lens. All amounts in USD.3BlackRock, Morningstar, as of December 2021. For illustrative purposes only. Correlations are calculated using monthly excess returns data over the period March 2015 to December 2021, where excess returns are calculated as portfolio returns less benchmark returns for each fund. US Large Blend strategies were selected from the top five largest funds in the category by AUM. For factors, the MSCI USA Diversified Multifactor Index was used. Excess returns for the hypothetical systematic thematic strategy are simulated and computed relative to the S&P 500® Index, and portfolio returns are based upon research conducted by BlackRock in March 2022. The figures shown relate to simulated past performance. Simulated past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index. Performance of simulated thematic long-only portfolio is based upon a US investment universe with 6% annualized active risk target.4BlackRock, as of December 2021. See Footnotes 1, 2 for additional details on market returns explained by themes and AUM, respectively.

This material is prepared by BlackRock and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of April 2022 and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents.

This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, BlackRock funds or any investment strategy nor shall any securities be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.

Stock and bond values fluctuate in price so the value of your investment can go down depending upon market conditions. The two main risks related to fixed income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. The principal on mortgage- or asset-backed securities may be prepaid at any time, which will reduce the yield and market value of these securities. Obligations of US Government agencies and authorities are supported by varying degrees of credit but generally are not backed by the full faith and credit of the US Government. Investments in non-investment-grade debt securities (“high-yield bonds” or “junk bonds”) may be subject to greater market fluctuations and risk of default or loss of income and principal than securities in higher rating categories. Income from municipal bonds may be subject to state and local taxes and at times the alternative minimum tax.

Index performance is shown for illustrative purposes only. Indexes are unmanaged and one cannot invest directly in an index.

Investing involves risk, including possible loss of principal.

©2022 BlackRock. All rights reserved. BLACKROCK is a trademark of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are the property of their respective owners.

Prepared by BlackRock Investments, LLC, member FINRA.

USRRMH0622U/S-2252139

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment