Mat Hayward/Getty Images Entertainment

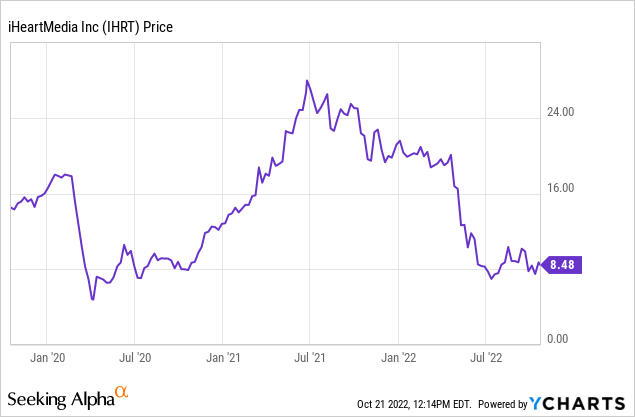

It’s been over two years since I last covered iHeartMedia (NASDAQ:IHRT) for Seeking Alpha. In August 2020, I liked enough of what I saw in the company’s revenue trend, podcasting content growth, and balance sheet situation to take a speculative long. The stock was $9.44 at the time of publishing and ultimately eclipsed $28 within 12 months. I did sell the run in 2020 and didn’t look back. Like countless other names, iHeart was almost certainly a beneficiary of central bank liquidity and the broad “stay at home” trade that benefited many of the media stocks like Roku (ROKU) and Spotify (SPOT).

Believe it or not, iHeartMedia stock has now done the full COVID round trip.

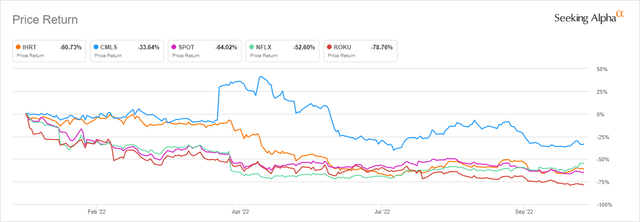

YTD performance (Seeking Alpha)

Looking at iHeart’s performance against Cumulus Media (CMLS), Netflix (NFLX), Roku, and Spotify year-to-date shows IHRT behaving more like Netflix and Spotify than closer peer Cumulus over the last several months. This is likely because it has improved digital as a percentage of total company revenue substantially.

Revenue Trend

In the company’s last earnings report, it noted $954 million in total revenue, of which $253 million came from the digital audio segment. Podcasting is clearly still the growth area for this company. CEO Bob Pittman from the Q2 conference call:

Within the Digital Audio Group, our podcast revenues, which grew 60% versus prior year, outperforming the overall broadcast industry growth of 22% according to MAGNA, and our digital ex podcast revenues were up 15% versus prior year, also outperforming the industry growth of 11% according to MAGNA.

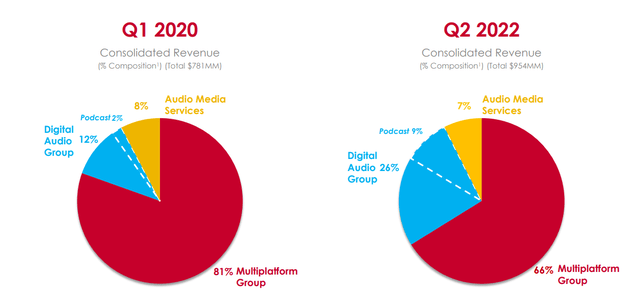

The strongest area of growth for iHeart is in its digital segment, and we can now see that digital revenue has become a much larger percentage of iHeartMedia’s total revenue over the last couple of years:

This positive trend in digital revenue has seen iHeart’s Digital Audio Group move from just 12% of total revenue in Q1-20 to 26% in Q2 of this year.

Content Trend

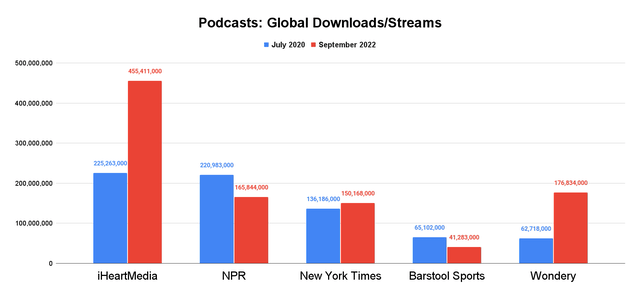

As Pittman detailed in the company’s last conference call, one of the big reasons for this growth in digital revenue is because of the company’s podcasting revenue segment. Two years ago, I shared the Top 5 podcasting publishers by downloads. At the time, iHeartMedia had the top spot for both domestic and global downloads, but the company was neck and neck with NPR. This is how global downloads for those same five publishers look now:

iHeart has grown global downloads by over 102%. Domestic unique audience reach is up 39% over the same timeframe. Only the Amazon-owned (AMZN) Wondery has a better rate of growth in both segments but is still well below iHeart in each. NPR and Barstool Sports (PENN) have both seen declines over the last two years, with Barstool falling out of the top 5 entirely. This is how those figures look as of September 2022:

| Rank | Podcast Publisher | US Unique Monthly Audience | Global Downloads & Streams |

|---|---|---|---|

| 1 | iHeartRadio | 34,242,000 | 455,411,000 |

| 2 | Wondery | 22,733,000 | 176,834,000 |

| 3 | NPR | 19,067,000 | 165,844,000 |

| 4 | New York Times | 12,452,000 | 150,168,000 |

| 5 | NBC News | 9,107,000 | 62,783,000 |

Source: Podtrac

In addition to growing its podcasting footprint considerably over the last two years, iHeart is showing an aptitude for trying out innovative ways to reach the next generation of consumers. The company recently announced a “metaverse” solution through Roblox (RBLX). This metaverse space will offer people the chance to play games and interact with iHeart-branded content.

The metaverse in Roblox will also allow iHeart to host concerts and other events in a virtual reality setting. While some may laugh at this type of fan engagement, there is already money attached to it through sponsorships with State Farm and Intel (INTC). If the metaverse is ever going to be ubiquitous with casual entertainment, incumbent players like Roblox have a strong first-mover advantage over companies like Meta Platforms (META) which are trying to build out their own new ecosystems from scratch. Point is, I think iHeart is taking the correct approach.

Furthermore, concerts and events that happen in the “metaverse” are potentially cheap to produce bonus touchpoints with fans that can ultimately create incremental revenue. It’s a very interesting idea that likely won’t result in much of a revenue bump today, but I think it says more about iHeart leadership’s ability to be forward-looking and make low-risk gambles on innovation.

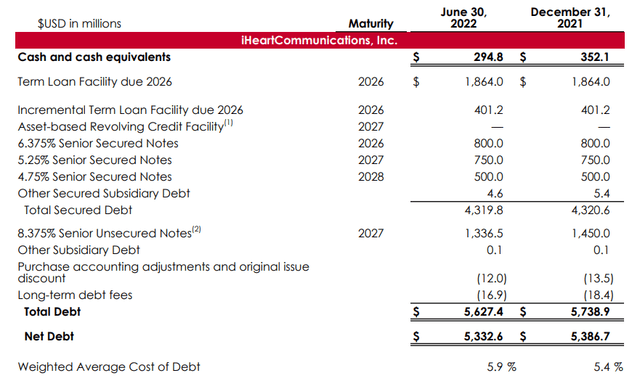

Balance Sheet

From a balance sheet standpoint, iHeart still has a large debt position, and I acknowledged that back in 2020. From a debt-to-equity standpoint, it has far more debt than terrestrial radio peer Cumulus or streaming audio peer Spotify:

| IHRT | CMLS | SPOT | |

| Total Cash | $294.8 | $108.7 | $3,738.1 |

| Total Debt | $6,528.8 | $889.6 | $1,857.5 |

| Net Debt | $6,233.9 | $780.9 | -$1,880.6 |

| Total Debt to Equity | 730.76% | 220.34% | 77.05% |

Source: Seeking Alpha, dollars in millions

What potentially makes that debt situation a bit concerning is interest rates are so much higher than they were in 2020. This could be more problematic if iHeart needed to refinance now or in the immediate future. That is currently not the case. The profile of debt maturity looks to really be in favor of iHeart at the moment:

Debt profile (iHeart investor deck)

If financing costs are still as elevated as they currently are four years from now, iHeart might have some concerns. But that is a world away from here when it comes to the forecasting abilities of the central bank.

Risks

The biggest risk I see for this name is a drastic decline in advertising spending; specifically, the kind of ad spending decline that comes when the global economy is heading into a recession – which appears to be happening. While terrestrial radio is a comparatively cheap form of advertising, there is no guarantee that marketers won’t pull spend even from radio if times get tough. Recessions result in job losses and failed businesses. We can debate which marketing budgets get slashed first in a recession if we must, but at the end of the day, ad spending getting cut isn’t good for companies that sell ads and iHeart won’t be immune from that.

Summary

Recession-risk aside, I still think there is actually quite a bit to like about iHeartMedia. I think this old-school terrestrial radio company is actually navigating a years-long transition to streaming and content on-demand pretty well. The podcast programming story really speaks for itself. I believe it’s an indication that iHeart has some of the most valuable programming IP in the streaming audio market.

The Roblox story is also very interesting because it shows there are people at iHeart who understand the way to reach consumers is changing and marketing strategies require adaptation. With the stock now having viciously sold off from the $20s in March to less than $7 over the summer, I think iHeart looks really attractive again down here. I’ve taken a small long position in the $8s.

Be the first to comment