Beo88/iStock via Getty Images

Investment Thesis

To pay or not to pay that is the question, because what price are you willing to pay for this stock? e.l.f. Beauty (NYSE:ELF) offers excellent growth rates and a high gross margin but they also have an incredibly high price to free cash flow at 54 and an operating margin of only 9.6%. At $40 this stock is carrying a ginormous premium especially since many are forecasting a recession in the near future. The problem with e.l.f. Beauty is not the business but simply the price. Therefore, I would buy the stock at $30 which is a 33% drop, and while that may seem dramatic it was at that price only four months ago in July.

Numbers

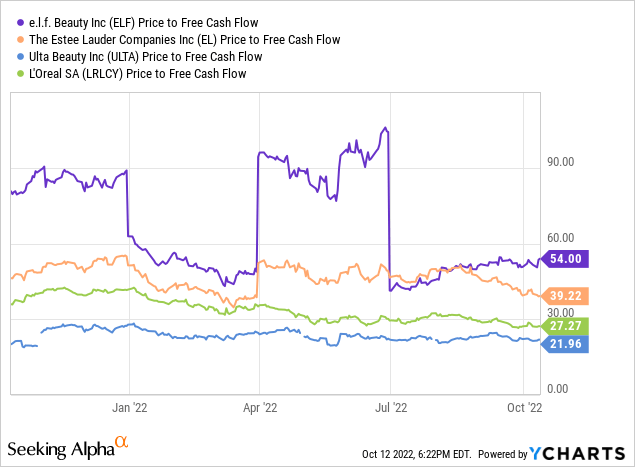

e.l.f. at this price point is significantly overvalued. They have a price-to-free cash flow of 54 which is higher than both Ulta (ULTA) and Estee Lauder (EL) who to a certain extent have more stability because their consumer is much older and has higher incomes. Additionally, e.l.f. has the highest debt to EBITDA at 1.6 and while in the grand scheme of companies that is not very high if you are going to pay a premium for e.l.f. compared to its competitors it needs to be lower.

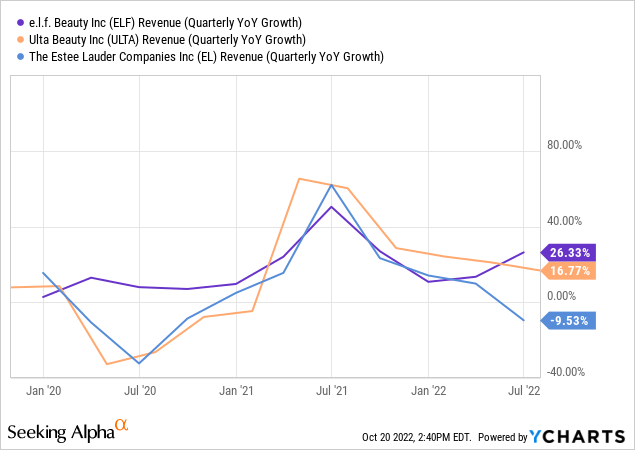

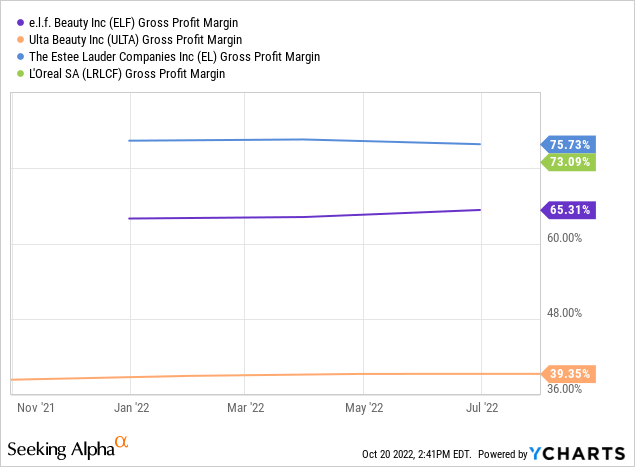

When it comes to quarterly YoY revenue growth this is where e.l.f. really shines at a 26% growth rate compared to Ulta’s 16% but e.l.f. once again ends up behind Ulta when it comes to annual YoY growth. e.l.f. Beauty once again has an excellent gross profit margin at 65% compared to Ulta’s 39%, although this is lower than Estee Lauder’s 75%. The bigger problem is e.l.f.’s operating margin which is 9.6% so their gross margin is disguising a much bleaker picture.

e.l.f.’s value really comes from its growth rates and gross margins which is why people are willing to pay a premium, but to what extent are you willing to pay? Especially since I believe the stock price has hit some resistance at $40 for the time being. While I think it is unlikely the stock is going back down to $20 I think a good price for this stock is $30 which would drop price to free cash flow back down to 40 which puts it in the range of Estee Lauder which is still a premium considering Ulta trades at a price to free cash flow ratio of 21.

Inventories are down from $85 million to $70 million due to higher than expected sell throughs, which means they are also fairly light on inventory at the moment. However, their cash balance did increase from $63 million a year ago to now $72 million. e.l.f. has a long-term debt balance of $95 million so they are nicely situated in that regard. Lastly, e.l.f. has a current ratio of 3.5 which is significantly higher than competitors. Overall, the balance sheet is strong and healthy.

Products

There should be very few concerns when it comes to e.l.f.’s core business of makeup and their skincare expansion. In their earnings call, they mentioned that “The average price point for e.l.f. is a little over $5 today as to compared to nearly $9 for legacy mass cosmetics brands.” This disparity allows them to continue to gain increasing footholds in the market especially at a time when inflation and rising rates are pinching consumers’ pockets. Even without consumer pressure e.l.f. remains a winner because they have great quality products. However, their top 5 categories are products like primers and sponges, which people tend to save money on anyway. They also addressed this point by stating that they are trying to push more into foundation and lip gloss. e.l.f. has great products but lip products and foundations could be a more high margin business for them since foundations tend to be priced higher and lip glosses are more inexpensive to make. They are a true powerhouse in affordable makeup and they are “the number five cosmetics brand with a 6.6% share…the number one brand has 17% share.” e.l.f. has the products but expanding more into underdeveloped categories like foundation could help them grow their business.

e.l.f. became a top 20 skincare brand last year and they have also been working to expand their product offerings. This revenue addition also allows them to become a more diverse set of brands. I also think they should push into haircare as well because that is also a growing business and there are very few affordable hair care brands that are also good-quality.

Technical Indicators

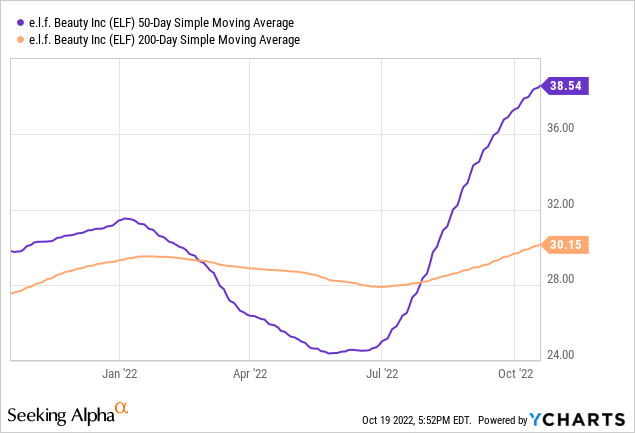

e.l.f. Beauty’s 50-day SMA is trading above the 200-day SMA creating the golden cross which is a bullish indicator. However, I think that much of the gains from the stock have already been realized. For example, when the 50-day SMA first crossed the 200-day SMA at around August 2022 the stock price was around $35 the current stock price is $40 which is a sizable gain but not as big if you had bought it at the bottom at $20 when the 50-day SMA was trading far below the 200-day SMA. I write all this to state that even though the 50-day SMA is trading far above the 200-day today it may not necessarily mean a higher price in the future but that the stock has peaked.

Conclusion

e.l.f. Beauty is a great stock but at this price point it is simply overvalued. e.l.f. Beauty is valued at a higher price to free cash flow multiple than Ulta, Estee Lauder, and L’Oreal which are all more established brands. Overall, I would wait to buy the stock at $30 for a better valuation.

Be the first to comment