SDI Productions/E+ via Getty Images

Quick Recap

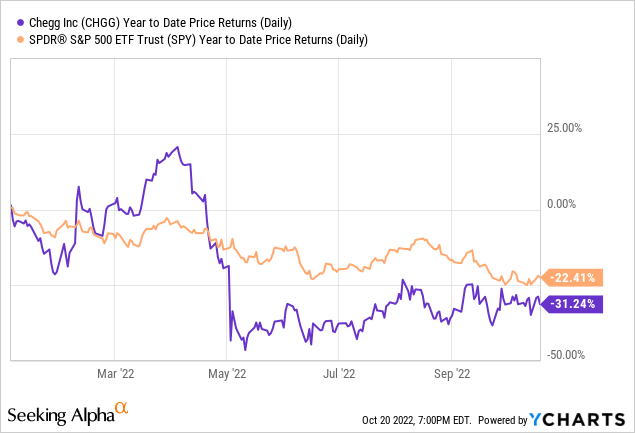

Since our last coverage on August 15, Chegg, Inc. (NYSE:CHGG) has significantly outperformed the broader index. S&P 500 declined nearly 15% since August 15, while Chegg has only declined 5.5%. We believe that the company’s outperformance is a sign that the company has seen the worst come to pass in the short-term, and that the risk/reward proposition for the company remains elevated. We reiterate our “Strong Buy” rating, and discuss an updated, but more conservative valuation model, and some of the strong tailwinds to boost the company’s performance in the medium to long term.

Recent News

Since the last article, Chegg has a couple of news that we believe are positives for investors. First and foremost, Chegg announced the appointment of Nathan Schultz as COO who has done a remarkable job leading the Learning Services division for a number of years. Under his tenure, the company created new services such as Chegg Study Pack and focused on growth initiatives such as international expansion plans and M&A activity. We believe this promotion should be a good news for the company’s commitment to growth. The company also received a couple of analyst upgrades in the last month as well. Northland Securities upgraded the stock citing “attractive valuation” and Needham upgraded the stock citing too much pessimism into the company’s performance going into next quarter’s earnings.

Strong Market Fundamentals

Chegg operates in the EdTech market and has business products and services that will benefit as the size of this market grows. One research firm estimates that the EdTech market will grow at a CAGR of 17.8% a year until 2026 (another research pegs it as 16.5% CAGR until 2030), which is tremendous growth potential of the market. By contrast, ad spending in the Social Media space is expected to grow at a 10.1% CAGR until 2027 based on available data from Statista. In other words, the EdTech market growth potential is strong, and given the non-discretionary nature of the education industry, we believe that the growth of the industry will resist economic cyclicality.

Conservative Valuation Model

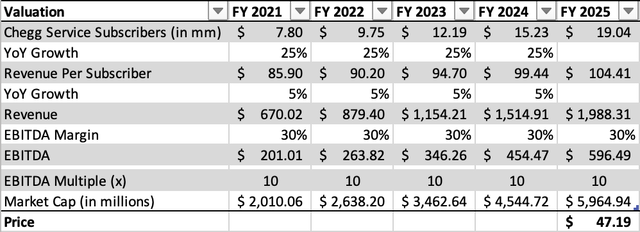

We update our previous model to reflect a weaker growth metric due to a meaningful deterioration in macroeconomic conditions. Similar to before, we derive the value of the company’s market capitalization in 2025. We have revised downwards the CAGR from 30% to 25% in the number of Chegg Services Subscribers and kept the same level of growth in the revenue per subscriber. We believe 5% YoY revenue per subscriber growth should be more than achievable given that it is marginally higher than inflation expectations for the next few years. Based on new assumptions, by 2025, the company will be generating $2.0 billion in revenue, which would translate to roughly ~$600 million in adjusted EBITDA assuming the same adjusted EBITDA margin as FY 2021. With a 10.0x P/EBITDA multiple (lower-bound of industry EBITDA multiples), the company would be valued at around $6.0 billion in FY 2025 which represents a share price of $47.19. Based on our more conservative assumptions, the investment thesis still presents more than 100% upside from current levels.

Macroeconomic Risks

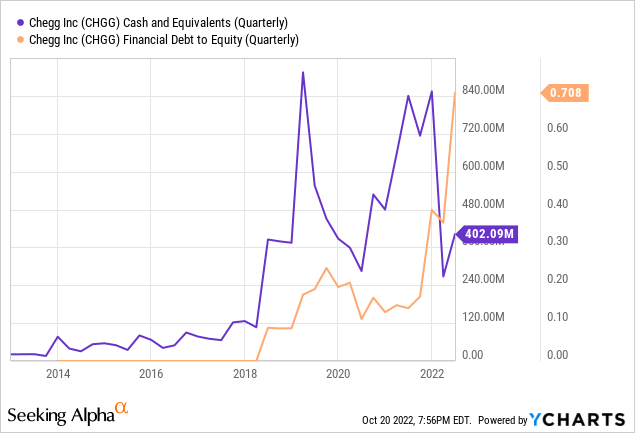

It is well known that education is one of the top recession resistant industries and Chegg will benefit from the industry fundamentals if the economy were to go into a severe recession. Nevertheless, it is reasonable to assume that Chegg will see a deceleration in growth during a period of uncertainty as the company cuts back on marketing spend, and users cut down discretionary education spending, which Chegg is part of. In the past few years, Chegg has begun to raise debt, but Chegg’s debt to equity ratio is quite low at ~0.70x. Usually when debt to equity is less than 1.0x, the company is considered to have a good debt to equity ratio, and so we see no debt related troubles for Chegg. Furthermore, the company has a cash balance of $400 million, which represents around 15% of its market capitalization. We think that the cash balance is a safe liquidity buffer for the company, and we believe that there is no major credit or liquidity issues to be had given the company’s profitability.

Conclusion

Overall, we reiterate our “Strong Buy” rating. The company has outperformed the broader index by roughly ~3x, and we believe the company is attractively valued going into Q3 earnings. The long-term growth story still remains, and Chegg continues to maintain its leading market position in the industry. Though economic risks persist, we believe Chegg is well capitalized and have a strong balance sheet, which should ease any major concerns on the company’s liquidity or default risk.

Be the first to comment