alfexe

It is hardly news that one of the biggest problems facing most people around the world is the exceptionally high rate of inflation. This has forced many people to take on second jobs in order to obtain the money that they need to feed their families and support themselves. Fortunately, as investors, we have other methods that we can use to boost our incomes besides taking on second jobs. One of these methods is to purchase shares of a closed-end fund that specializes in the generation of income. This is because these funds provide us with easy access to a diversified portfolio that can use a variety of strategies to pay out higher yields than pretty much anything else in the market. In this article, we will discuss the Voya Global Equity Dividend and Premium Opportunity Fund (NYSE:IGD), which is one fund in this category. As of the time of writing, the fund yields 9.09% so its yield is certainly high enough to turn a few eyes and it is easy to see how it can provide a nice boost to anyone’s income. I have discussed this fund before but that was much more than a year ago so obviously, a great deal has changed. This article will therefore specifically focus on these changes and provide an updated analysis of the fund’s finances so we can determine if it could be a reasonable addition to a portfolio.

About The Fund

According to the fund’s webpage, the Voya Global Equity Dividend and Premium Opportunity Fund has the stated objective of providing investors with a high level of income. It has a secondary objective of getting capital appreciation but this is not as important as the primary goal. This is actually fairly unusual for an equity fund as most of them focus on total return. After all, most equities do not have especially high yields in today’s market and equities themselves are a total return instrument, not an income vehicle. It is not an unusual goal for a fixed-income fund but this fund does not invest in fixed-income securities. The fund states that in order to achieve its goals, it invests in dividend-paying common stocks from around the world. This provides it with a source of income, but admittedly not a very high one. In order to increase its income, the fund then sells call options on both individual stocks and on indices with the hope of being able to keep the premium when the option expires out-of-the-money. This is a strategy that is used by a number of other funds that we have discussed recently but it does have a twist in that it will write options on both individual stocks and indices as opposed to just one or the other.

The fact that this fund uses an options strategy is something that may be concerning to some investors. After all, we have all heard that options can be fairly risky. That is certainly true in the case of naked call options since the losses can be unlimited. However, there are some options strategies that are reasonably safe, such as writing covered call options. This is because in that strategy, the call writer actually owns the underlying asset so all they have to do is sell it to satisfy the option in a worst-case scenario. The only potential risk with this strategy is that it caps the option writer’s upside return. The fund is using this strategy, to a point. When it writes a call option against individual stocks, the fund already owns the stock so this is a very safe covered call strategy. However, the fund does not actually own the indices that it writes options against. Thus, this could result in huge losses for the fund. The hope of management is that the underlying portfolio will perform similarly enough to the index to prevent too many losses, but this is not something that is guaranteed. Therefore, there could be some risks here because of the fund’s options strategy.

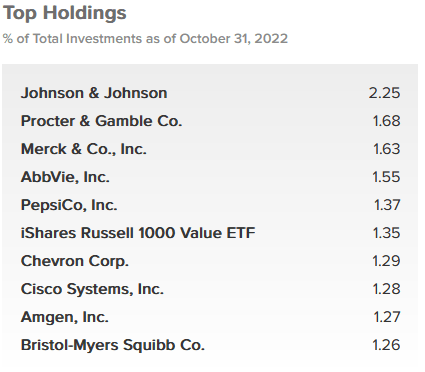

The largest positions in the fund look very different from those of most other closed-end funds, which is nice to see. Here they are:

Voya Investment Management

The reason that this is quite nice to see is that it helps us avoid concentration risk. Concentration risk is something that comes about when an investor holds multiple funds and thus believes that they have a diversified portfolio. However, that is not actually correct because all of their funds are holding the same stocks. We see this a lot with the Eaton Vance funds, which are all heavily weighted towards a few mega-cap technology stocks. However, we can see here that this fund uses a very different strategy as most of these holdings are not usually seen among the largest positions in a closed-end fund. Thus, this fund should actually help an investor achieve the diversification that they desire.

Perhaps surprisingly, there were only a few changes to the fund’s largest positions over the past eighteen months. These changes were the removal of Verizon Communications (VZ), Texas Instruments (TXN), JPMorgan Chase (JPM), and Honeywell (HON) in favor of the iShares Russell 1000 Value ETF (IWD), Chevron (CVX), Amgen (AMGN), and Bristol Myers Squibb (BMY). I cannot say that these changes were particularly bad choices as we saw the removal of a telecommunications firm, a technology company, a bank, and an appliance manufacturer in favor of an energy company and pharmaceutical firms. These new companies are all likely to perform somewhat better in the current high-interest rate and high-inflation environment. However, I would have preferred to see it more balanced between energy and healthcare. As it is now, the fund is quite heavily weighted toward healthcare with these new additions:

CEF Connect

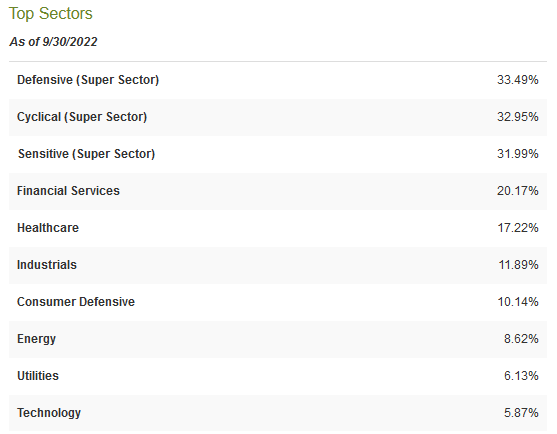

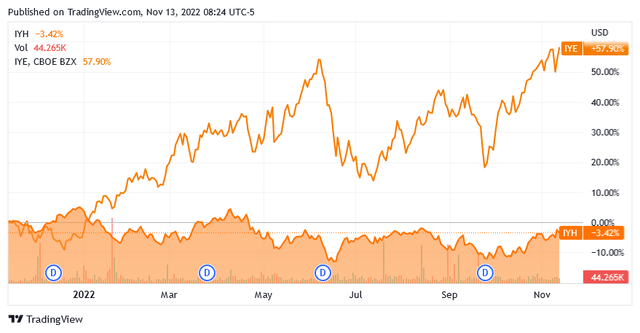

The low exposure to technology is quite nice to see as technology companies are generally not particularly attractive dividend payers and the sector has underperformed over the past year. Healthcare and energy are both reasonably good in terms of yields but energy has substantially outperformed healthcare over the past year:

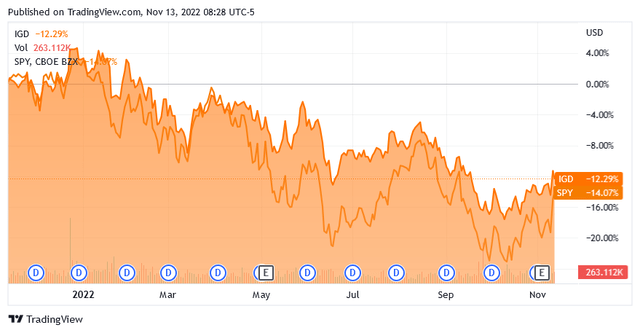

Thus, the fund probably would have been better off if it added a company like Exxon Mobil (XOM) instead of one of the healthcare companies. Admittedly though, both healthcare and energy have outperformed the S&P 500 index (SPY) over the past twelve months. This is probably one reason why the Voya Global Equity Dividend & Premium Opportunities Fund has outperformed the S&P 500 index over the past year:

This is a much better performance than most closed-end funds have handed investors over the same period and thus speaks wonders about the ability of the fund’s management. The performance gap that this fund has over the market becomes even more pronounced when we consider the fact that the Voya fund has a much higher dividend yield. Naturally, past performance is not necessarily indicative of future performance but this is still something that is very good to see.

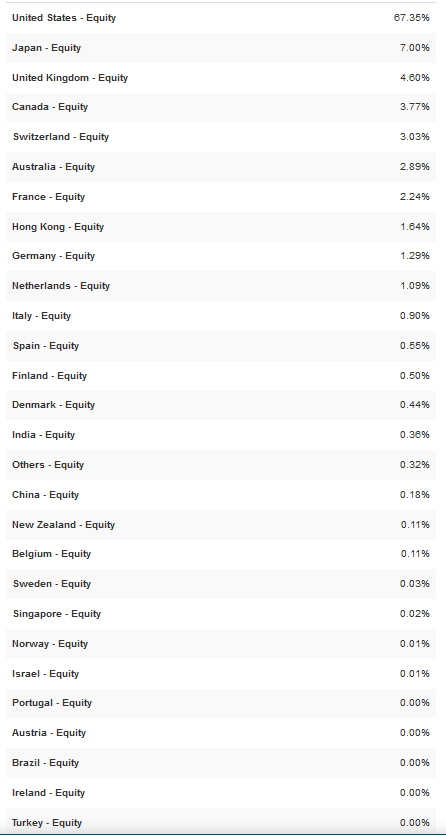

As stated earlier in the article, the Voya Global Equity Dividend & Premium Opportunities Fund states that it invests in companies from around the world. However, the majority of the companies in the top ten holdings list are American firms. Thus, we might assume that the fund is heavily weighted toward the United States. This is indeed true as 67.35% of the fund’s assets are invested in American companies:

CEF Connect

The United States accounts for a bit less than 25% of the global gross domestic product. Thus, the fund is substantially overweighted to this country relative to its actual representation in the global economy. This is not unusual for a global fund though, as most global funds have a weighting of 60% to 70% toward the United States. Unfortunately, this does not provide us with as much protection against regime risk as we would like. Regime risk is the risk that some government or other authority will take an action that proves to have an adverse impact on a company in which we are invested. We saw a great example of this back in 2021 when the incoming Biden Administration unilaterally canceled the permits for the construction of the KeystoneXL pipeline and caused all the money invested by TC Energy (TRP) into this project to be wasted. The only good way to protect ourselves against this risk is to ensure that only a limited proportion of our assets are exposed to any individual country. As we can clearly see here, the Voya Global Equity Dividend & Premium Opportunities Fund does that to a point but it is important to have other international funds in your portfolio in order to achieve appropriate global diversification.

Distribution Analysis

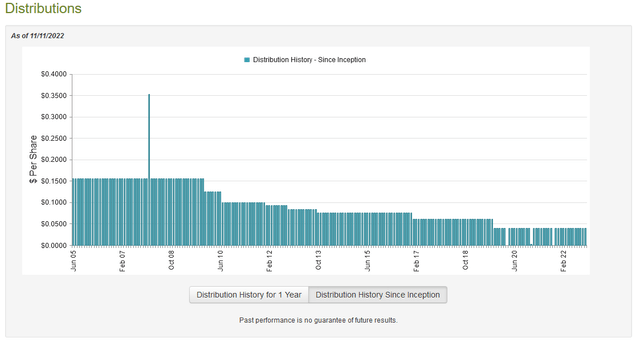

As stated earlier in this article, the primary goal of the Voya Global Equity Dividend & Premium Opportunities Fund is to provide its investors with a high level of current income. As such, we might assume that it pays out a high distribution yield. This is indeed the case as the fund currently pays a monthly distribution of $0.04 per share ($0.48 per share annually), which gives it a 9.09% yield at the current price. Unfortunately, the fund has not been particularly consistent with its distribution. In fact, it has steadily declined over time:

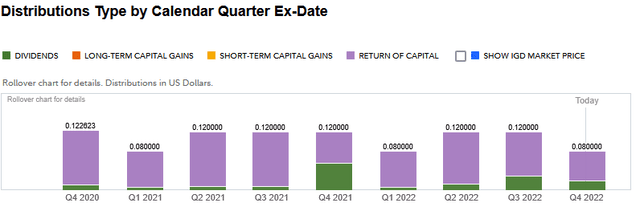

This is certain to be discouraging to those investors that are seeking a safe and secure source of income that can be used to pay their bills or otherwise finance their lifestyles. Another thing that may be concerning is that a high percentage of the distributions are considered to be a return of capital:

The reason why this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that can cause a distribution to be classified as a return of capital. These other things include both the distribution of monies received from certain options strategies as well as the distribution of unrealized capital gains, which are both things that this fund may be doing. As such, we want to conduct some further examination in order to determine exactly how the fund is financing these distributions so that we can determine how sustainable they are likely to be.

Fortunately, we have a fairly recent report that we can consult for that purpose. The fund’s most recent financial report corresponds to the six-month period that ended August 31, 2022, so it should be able to give us a good idea of how well the fund performed in the volatile markets that dominated most of this year as well as provide insight into exactly how the fund is covering those return of capital distributions. During the six-month period, the Voya Global Equity Dividend & Premium Opportunities Fund received a total of $9,327,909 in dividends and another $6,041 in interest from the assets in its portfolio. This gives the fund a total income of $9,333,950 during the period. It paid its expenses out of this amount, leaving it with $6,946,476 for the investors. This was, however, not nearly enough to cover the $19,312,736 that the fund actually paid out during the period. At first glance, this certainly looks rather concerning.

However, the fund does have other methods that it can use to acquire the money needed to cover the distribution. This includes things such as options premiums and capital gains. Unfortunately, it struggled with this during the period. The fund realized net gains of $22,177,825 but this was offset by total net unrealized losses of $36,751,229. Overall, the fund saw its assets under management decline by $30,417,876 after accounting for all inflows and outflows. The fund thus failed to cover its distributions during the six-month period. However, it did generate sufficient income and realized capital gains to cover the distribution and have a bit of money left over. The distribution is probably sustainable as long as it does not suffer too many more losses since the more losses it suffers, the higher the return it needs to generate in order to maintain the distribution. Things are probably okay for now but we will want to keep an eye on the fund’s performance going forward.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Voya Global Equity Dividend & Premium Opportunities Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the investors would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can acquire them at a price that is less than the net asset value. That is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That is fortunately the case with this fund. As of November 11, 2022 (the most recent date for which data is currently available), the Voya Global Equity Dividend & Premium Opportunities Fund had a net asset value of $5.97 per share but the shares only trade for $5.28 per share. This gives the fund a discount of 11.56% at the current price. This is reasonably in line with the 11.82% discount that the shares have traded at on average over the past month. It is also one of the larger discounts possessed by any closed-end fund. As such, the price certainly appears to be right.

Conclusion

In conclusion, there appear to be a few things to like about the Voya Global Equity Dividend & Premium Opportunities Fund right now. In particular, management appears to be focusing the fund’s investments appropriately to allow it to outperform the market. This is a much better situation than we have seen in many of the other closed-end funds that I have discussed over the past few weeks. In addition, the fund has a reasonably high distribution yield that appears to be somewhat sustainable, although like most funds we need to watch it to ensure that the losses do not continue to pile up. The price is also quite attractive today. Overall, it might be worth giving this fund some consideration if an investor is seeking income.

Be the first to comment