krblokhin/iStock Editorial via Getty Images

With Suntory’s (OTCPK:STBFY) current president Kazuhiro Saito set to be replaced by CEO of Suntory France Makiko Ono, the company is showing intent to achieve its long-term goals of expanding globally and driving structural reform. This bodes well for the mid to long-term investment case, as Suntory gains further market share for its core brands and unlocks higher profitability from its restructuring efforts. Expect an increased focus on building out the overseas operations via M&A as well, particularly in Asia Pacific, with an increase in the overseas contribution likely to expand profitability further.

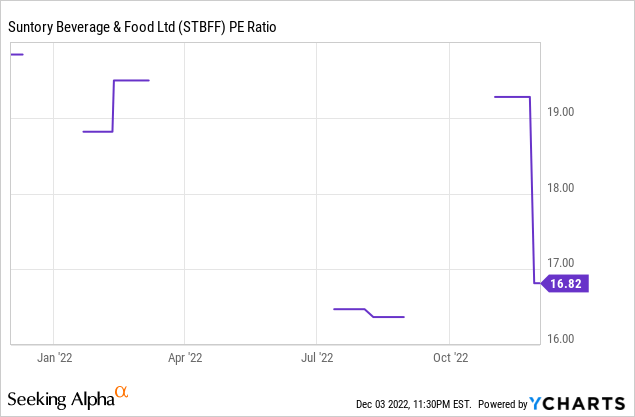

In the near term, however, the company will need to contend with cost headwinds via more price hikes (the latest round took effect in October) without impacting domestic soft drink volumes. Yet, with the stock down to a historical discount at 16-17x earnings, concerns about deteriorating domestic competitiveness are likely overblown, offering an attractive entry point to long-term-oriented investors.

Latest Management Change Marks a New Chapter in the Suntory Story

In a recent filing, Suntory Beverage & Food disclosed that its Representative Director, President & CEO, Kazuhiro Saito, will step down to be replaced by Makiko Ono, the first female president in the company’s history. Given Suntory’s focus on global expansion, Ms. Ono’s experience as the CEO of Suntory Beverage & Food France (previously known as Orangina Suntory France), as well as her Europe-focused career track record, seems like a great fit. The management change will only be finalized at the general shareholders’ meeting in March next year, though I see limited hurdles to getting shareholder approval.

Per the release, the new leadership change is aimed at driving structural reform and accelerating global expansion. This marks a new chapter in the Suntory playbook. Current president Kazuhiro Saito has played a key role in not only maintaining operational resilience through COVID but also insulating the domestic business margins via successful price increases through the inflationary headwinds. In contrast, the selection of Ms. Ono as the next president signals a shift in mindset from defense to offense – as Suntory looks to drive growth and margin expansion by going global, her experience managing the European business will be key in achieving the strategic roadmap. Her appointment also makes sense from an ESG standpoint, signaling the company’s commitment to diversity and sustainability and potentially attracting more ESG flows.

Latest Guidance Revision Defies the Inflationary Headwinds

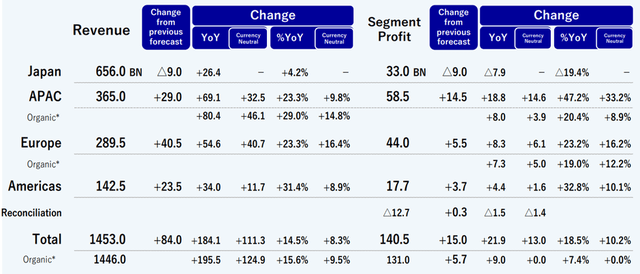

The senior executive change comes on the heels of Suntory’s upgraded full-year guidance. To recap, management raised sales guidance to JPY1,453bn (from JPY1,369bn previously) and operating profit guidance to JPY140.5bn (from JPY125.5bn previously). The headline operating profit guidance implies modest YoY growth, but on a currency-neutral basis, the operating profit guide would have been closer to JPY131bn (flat YoY). While this also implies a slight decline in operating margins, much of this was down to weakness in the domestic business; in contrast, the overseas business remains well-supported by successful price pass-throughs and a favorable FX.

By geography, the Japan business saw its YoY profit growth guidance cut to -19.4% (down from +2.6% previously), while the overseas businesses were raised across the board. Growth for the Asia Pacific region now stands at +8.9% (up from +7.2%), with Europe and the Americas at +12.2% (up from +1.6%) and +10.1% (up from +0.4%), respectively. This is consistent with the rest of the industry, particularly for companies with outsized overseas exposure, such as Ajinomoto (OTCPK:AJINY) and Toyo Suisan (OTCPK:TSUKF), as yen depreciation and pricing power provide tailwinds to the overseas P&L. Expect more price hike announcements from here, as Suntory’s pricing power remains intact across its overseas businesses, supporting a favorable mix shift in the near-term. With the company also rebalancing its earnings mix away from the lower-margin domestic business, the earnings growth runway is compelling.

Positioned for Growth Despite the Near-Term Headwinds

Despite the input cost inflation, Suntory’s pricing power has allowed for an upward revision to the full-year guidance numbers, with operating profit now up to JPY140.5bn (+18% YoY). Management has prudently budgeted for more domestic raw materials cost headwinds as well, defining a JPY60bn budget for FY22/23 as a buffer. Concerns about deteriorating competitiveness in the Japanese business are perhaps warranted, particularly given the weaker yen backdrop, but the current 16-17x earnings valuation has likely discounted an overly pessimistic view.

Among the positive catalysts from here is Suntory’s decision to replace current President Kazuhiro Saito with CEO of Suntory France Makiko Ono, highlighting its commitment to growth and structural reform going forward. Backed by ample balance sheet capacity (~JPY700bn of headroom relative to its 1x net debt/equity threshold), M&A is also an attractive growth option. Either way, a bigger overseas presence (higher margins) and better governance (more ESG flows) bode well for shareholders, supporting more upside over the long term.

Be the first to comment