AlexRaths/iStock via Getty Images

I pride myself in my conservative investment philosophy that centers around the value investing ideology. Generally speaking, this strategy has worked out well for me. Having said that, one of the downsides to this strategy is that you can often sell stock in a company earlier than you would if you knew exactly where shares were headed. One wonderful example of this can be seen by looking at MGP Ingredients (NASDAQ:MGPI), a producer and supplier of premium distilled spirits, branded spirits, and various food ingredients. With its fundamental performance continuing to improve year over year, even during uncertain economic times, shares of the business continue to rise nicely even as the stock looks pricey on an absolute basis. In retrospect, I do wish that I had kept my ‘buy’ rating on the firm longer. But given recent share price movement and how the company’s valuation has changed, I do still believe that it warrants the ‘hold’ rating I assigned it earlier this year.

A tough drink to swallow

Back in March of this year, I wrote a rather bullish article covering MGP Ingredients. In that article, I lauded the company’s growth over the prior few years, including the growth in cash flows management had achieved. I acknowledged at that time that shares were not trading on the cheap, but I also concluded that they weren’t overpriced either. Relative to similar firms, the stock looked affordable and, when coupled with its financial performance, I ended up rating it a ‘buy’ to reflect my opinion that it should generate upside that exceeds what the broader market could. But then, in June, I changed my stance, lowering my rating on the company to a ‘hold’ in response to some meaningful share price appreciation the company experienced. Since reducing my rating on the company, shares have risen another 15.8% at a time when the S&P 500 is down by 3.4%. This brings the total return for shareholders since my article published in March to 43.5% compared to the negative 6.3% the S&P 500 has seen.

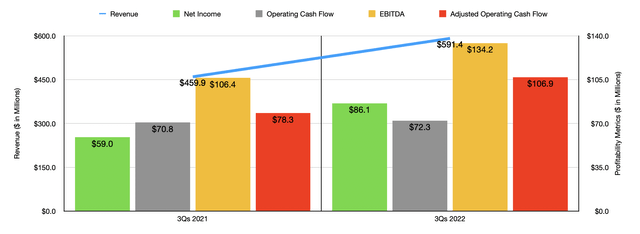

Clearly, my initial bullish stance on the company proved successful. But at the end of the day, I ended up changing my stance too early. It would be helpful when evaluating the company now to see exactly why shares have continued to rise. When I last wrote about the business, we only had data covering through the first quarter of this year. Fast forward to today, and we now have data covering the first three quarters as a whole. During this three-quarter period of time, sales for the company came in at $591.4 million. That represents an increase of 28.6% over the $459.9 million the company generated one year earlier. According to management, this increase was driven by higher sales across the company’s segments. For instance, the Distilling Solutions segment of the company saw revenue jump by around 21% thanks to an increase in the sales of brown goods within premium beverage alcohol and distillers feed and related co-products. Branded Spirits revenue jumped a very impressive 44%, thanks largely to additional brand acquisitions made in April of 2021. Meanwhile, the Ingredient Solutions segment of the company saw revenue jump by around 29%, largely due to increased sales of specialty wheat starches and proteins, as well as of commodity wheat starches.

This increase in revenue brought with it improved profitability. Net income at the firm rose from $59 million in the first nine months of the 2021 fiscal year to $86.1 million the same time this year. Operating cash flow followed a similar trajectory, climbing from $70.8 million to $72.3 million. If we adjust for changes in working capital, it would have risen even further, climbing from $78.3 million to $106.9 million. And over that same window of time, we also saw an increase in EBITDA, with the metric jumping from $106.4 million to $134.2 million.

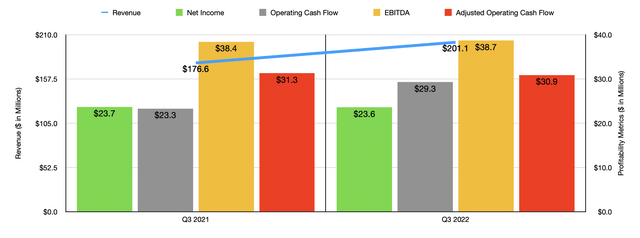

Even if you confine the timeframe that we’re looking at to the latest quarter alone, the third quarter of the 2022 fiscal year, the fundamental condition of the company looks solid. Sales of $201.1 million are 13.9% higher than the $176.6 million reported the same quarter last year. On the profitability side of the equation, however, the firm has seen a little bit of pressure. Net income is down slightly, dipping from $23.7 million to $23.6 million. Really all of this pain came from a decrease in the company’s gross profit margin from 32.3% to 29.4%, with that decline attributable to higher input costs for white goods and industrial alcohol. These more than offset price increases that the company implemented. For the quarter, operating cash flow did improve, rising from $23.3 million to $29.3 million. But if we adjust for changes in working capital, it would have fallen from $31.3 million to $30.9 million. Meanwhile, EBITDA inched up only modestly, climbing from $38.4 million to $38.7 million.

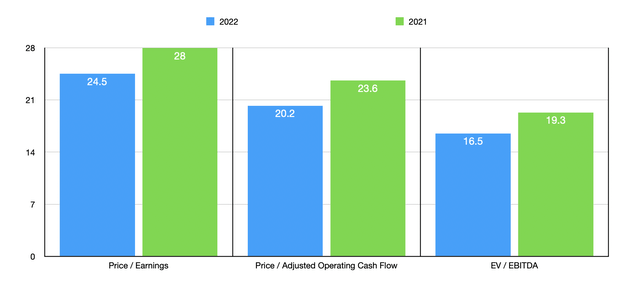

For 2022 in its entirety, management expects revenue to come in at between $765 million and $780 million. If this comes to fruition, it will translate to a nice increase of 23.3% over the $626.7 million the company reported in 2021. Earnings per share, meanwhile, should be between $4.62 and $4.80, with a midpoint figure there translating to net income of $103.6 million. Meanwhile, management is forecasting EBITDA of between $162 million and $167 million. Using the midpoint there, we can get a rough estimate for adjusted operating cash flow of $125.7 million. Based on these figures, the company is trading at a forward price-to-earnings multiple of 24.5. The forward price to adjusted operating cash flow multiple should be 20.2. And the EV to EBITDA multiple should be 16.5. To put this in perspective, using the data from the 2021 fiscal year would give us multiples of 28, 23.6, and 19.3, respectively. I also compared the business to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 23.7 to a high of 796.8. In this case, only one of the five was cheaper than our prospect. Using the price to operating cash flow approach, the range was between 12.2 and 36.2. Meanwhile, using the EV to EBITDA approach, the range was between 12.6 and 43.3. In both of these cases, two of the five companies were cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| MGP Ingredients | 24.5 | 20.2 | 16.5 |

| Diageo (DEO) | 23.7 | 19.7 | 15.7 |

| Constellation Brands (STZ) | 796.8 | 16.4 | 43.3 |

| Brown-Forman Corporation (BF.B) | 37.4 | 36.2 | 26.1 |

| The Duckhorn Portfolio (NAPA) | 27.3 | 24.2 | 16.7 |

| Vintage Wine Estates (VWE) | 32.0 | 12.2 | 12.6 |

Takeaway

In retrospect, I regret changing my rating on MGP Ingredients from a ‘hold’ to a ‘buy’ earlier this year. Clearly, I left upside on the table. Having said that, I still do believe that this is a quality operator that is now trading at levels that should be considered more or less fairly valued. Yes, the company is trading at a slight discount compared to some of its peers. But for those who want to approach investing cautiously, such a discount should be the norm. Absent something changing materially for the better, I do not believe that anything greater than a ‘hold’ is appropriate at this time.

Be the first to comment