Greg Meland

Investment Thesis

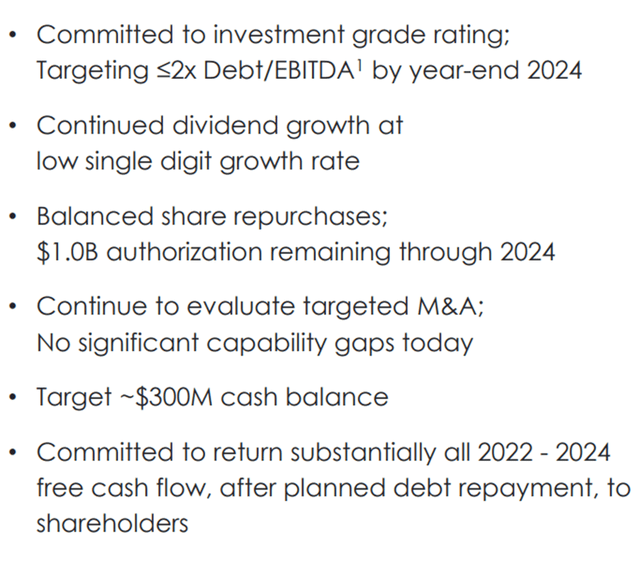

Huntington Ingalls Industries (NYSE:HII), the nation’s largest shipbuilder for the Navy, is a stock one buys for its return of capital (dividends and buybacks) to its shareholders. Although in 2022, year to date, the stock has increased 38% through October 26, while the S&P 500 had decreased 18%. HII’s P/E is 16.7.

At a market cap of about $9 billion HII is classified as a mid-cap (typically $2 B – $10B).

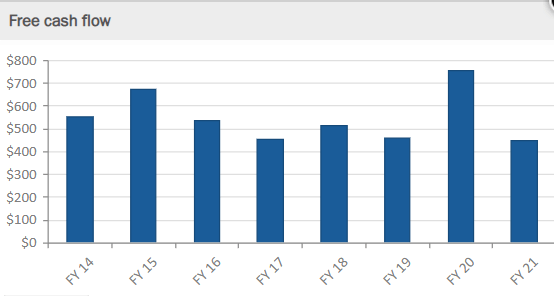

Shipbuilding is a tough business. The finances can be uneven and lumpy. HII is focused on obtaining Free Cash Flow in order to increase dividends and buyback shares. As seen below the FCF is not a smooth, increasing line due to the nature of large, complex, multi-year shipbuilding projects. And FY21 was at the height of the COVID pandemic.

From the HII website, in $ millions.

HII Website

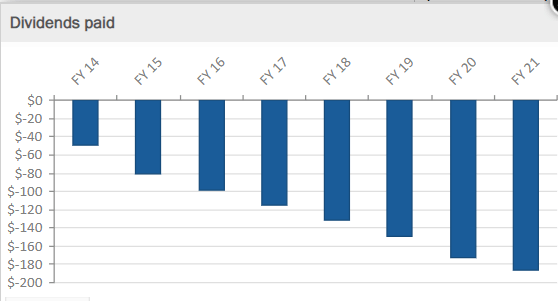

HII dividends have increased over the past ten years. The eight-year graph from HII shows it as negative since it is cash outflow. The current dividend rate is $4.72 for a current yield of 2%. As they say – this does not guarantee a sharp growth of dividends in the future, but HII has a goal of increasing in the low single digits.

Dividends paid in millions of dollars

HII Website

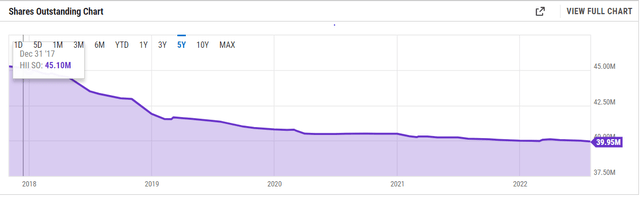

HII has also been buying back stock. At the end of 2017, 45.26 million shares were outstanding. Today it is 39.95 million shares, nearly a 12% decrease in five years.

So, I consider the above to be the reason and justification to own HII.

Nuclear Aircraft Carriers are Essential to Newport News Shipyard – An Update

New carrier design and construction, carrier maintenance/overhaul and submarine construction are the businesses that keep the Newport News shipyard booming. It is this country’s only shipyard that builds nuclear carriers. Nuclear submarines are in the mix, but the carriers are essential to keep the shipyard humming. The shipyard employs about 25,000 of the 40,000 HII employees. Shipyard workers include engineers, steelworkers, riggers, welders, electricians, and all construction crafts.

The Navy currently has 11 nuclear carriers in service. A carrier has a life of 50+ years.

The first of the new carrier class, the Gerald R. Ford (CVN 78) was delivered to the Navy in May 2017. The Ford, the first in the class, was about $13 billion. A number of new technologies caused the price to escalate beyond the original estimates. Not all of the $13 billion is passed through HII. Some major components are procured and supplied by the government/Navy (e.g. the new advanced radar). Ford is currently in a two-month operational test prior to a full deployment next year.

The second ship in the class, the John F. Kennedy (CVN 79) was initiated in 2011 and is scheduled to be delivered in 2024. Carrier construction in the shipyard exceeds a decade. And if done properly a decade or more of revenue. Two other carriers are under contract, the Enterprise (CVN 80) and the Doris Miller (CVN 81). The keel laying ceremony was held in August 2022 for the Enterprise. This is a ceremony to mark the major construction of the ship.

CVN 80 and CVN 81 were procured as a two-ship award to HII from the Navy. HII has made the case that savings can be made in the cost and schedule when procured two at a time. USNI reported that the two-carrier buy was procured for $24 billion instead of $28 billion. HII is making the case that CVN 82 and CVN 83 will save significant money if there is a two unit buy. CVN 82 and CVN 83 will be a few years off and as they say – regarding cost savings “the proof is in the pudding”.

In the past few years HII has invested $1 billion in improving the shipyard infrastructure and has developed a digital process to replace the paper drawing previously used by welders, pipe fitters, etc. during construction. The digital construction process is increasing efficiency and saving money and time.

The Navy’s force structure plans have been resulting in new Ford class large deck carriers to replace those currently in the fleet. Some argue that the Navy does not need future large deck carriers and that alternatives are available for smaller carriers. The argument against future Ford class carriers is typically based upon cost and the probability of survivability considering new weapons being developed by our adversaries. The most recent public comments show a carrier level of 8 – 12. A current law requires the Navy to have 11. If the Navy opts for the low end of the range, they could procure up to 6 light, smaller carriers that operate with the vertical take-off F-35B plane. And light carriers could possibly be constructed by HII competitors and may not be sole source, although if nuclear the field is narrow.

Note that China has embarked on a large carrier program. Two in operation, a third finishing construction and possibly a fourth in planning, which may be nuclear propulsion.

Nuclear carriers, whose design life is 50 years, undergo a mid-life complex overhaul and refueling. These typically take four years for refueling upgrades and modernization. Two are currently at Newport News. Again, significant revenue.

HII has performed the “inactivation” of the original nuclear carrier, the Enterprise (CVN 65). The fuel from the nuclear reactors has been removed by HII. The next step is to totally decommission the ship. This may be a competitive bid by the Navy in which HII certainly has the expertise if they chose to respond to the bid request.

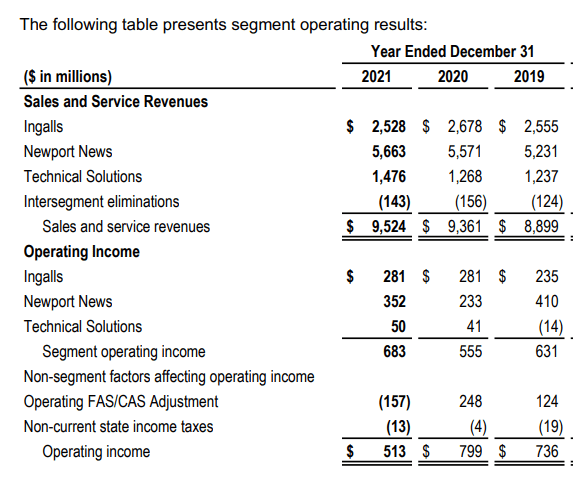

Newport News, with nuclear carriers and submarines, provides nearly 60% of the HII revenues. From the 2021 Annual Report:

HII 2021 Annual Report

The takeaway from this is that nuclear carrier construction and maintenance is the foundation of HII. The design, management and construction skills are first rate. Good performance results in good financial results.

Ship Maintenance – And Then There Were Four

Years ago, the Navy owned eight shipyards in which maintenance was performed. Reductions occurred during the President Clinton years. There are now only four US Navy shipyards available to perform major nuclear submarine and ship maintenance.

Recently the capacity and schedules for maintenance in these shipyards has been challenging. Per an August 20, 2020, Washington Times article:

Critical maintenance work on subs and carriers was late 75 percent of the time from 2015-2019 at the Navy shipyards in Norfolk, Va.; Portsmouth, Maine; Puget Sound, Wash., and Pearl Harbor, Hawaii. The Navy spent $2.8 billion during that same period to address shipyard performance issues, among other concerns.

Thus, the Navy has turned to private yard capacity for maintenance. One such place is HII. As an example, the Arleigh Burke class destroyer USS Fitzgerald, which collided with another vessel, suffered damage. At the time, the Navy yards were not able to perform the necessary repair and a contract was awarded to Ingalls. The USS Cole was also repaired at Ingalls.

According to a USNI May 11, 2022, article

All four of the public facilities are rated poor, and we are concerned about that.

The cost of the Navy’s dry dock projects in a Navy plan has, according to Navy estimates, grown by over 400 percent since 2018.

General Accounting Office Report

The Navy estimated in 2018 that its effort to improve the naval shipyards would require $21 billion over 20 years to implement. However, we reported in November 2019 that this $21 billion estimate does not include inflation and other significant costs, such as those for utilities, roads, or environmental remediation, which could add billions to the final cost.

In August 2022 HII Ingalls was awarded a $41.6 million contract for combat system activation on the Lyndon Johnson DDG 1002 destroyer built by General Dynamics (GD) Bath Iron Works. Per the August 29 HII press release:

During this availability, Ingalls will complete the installation, activation and testing of the combat systems to ensure a fully functional system is ready to operate in the Navy fleet, as part of the Navy’s phased delivery approach.

According to United States Naval Institute News:

The contract award follows a mid-August notice from Naval Sea Systems Command on the other two ships in the class. The notice said the Navy intended for Zumwalt DDG 1000 and Monsoor DDG 1001 to travel from California to Ingalls for an extensive maintenance availability.

All three of these ships were built at GD Bath Iron Works. Bath Iron Works built what is known as the Hull, Mechanical and Electrical. Much of the combat system was procured and provided by the Navy.

The takeaway is that, depending on shipyard capacity, HII is competitive for ship maintenance, repair and modernization. Especially if the Navy turns to private/commercial shipyards for maintenance.

Ingalls, on the Pascagoula River in Mississippi, is very busy. They have current contracts for 17 ships – destroyers, amphibious and Coast Guard National Security Cutter. There is uncertainty moving forward. The National Security Cutter work is winding down. The number of further amphibious building is being discussed between the Navy and Marines. Congress and the Navy plan to build more Arleigh Burke destroyers which will be split between Ingalls and GD Bath Iron Works.

HII Ingalls is preparing for the future by investing $1 billion in the shipyard over the past five years. The capital investment includes further automation and better facilities for repair and maintenance.

Conclusion

The economy may be slowing but the HII backlog in Navy and Coast Guard shipbuilding and government opportunities in the Technical Solutions division are continuing to provide cash that can be returned to shareholders.

From the Q2 2022 Earnings call:

Be the first to comment