flik47/iStock Editorial via Getty Images

Barclays (NYSE:BCS) released its third quarter earnings results on Wednesday, presenting a mixed bag of results that sent market participants into a tizzy as the stock traded inconsistently throughout the day.

Our analysis assumes a more holistic vantage point and looks at various tailwinds and headwinds that could affect Barclays in the coming quarters. In addition, we assessed the stock’s market-based characteristics and discovered numerous influential data points.

After carefully considering all the bank’s features, we assign a buy rating to Barclays’ stock. Here’s why.

Analysis of Barclays’ Operations

Earnings Review

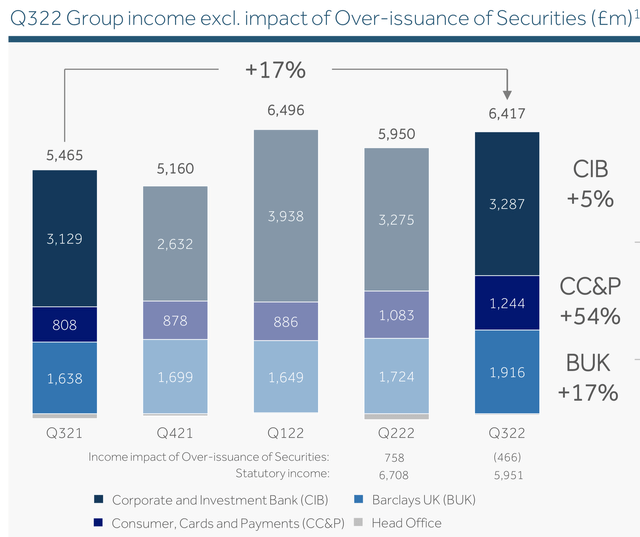

Barclays presented robust cross-sectional performance during the quarter. The bank’s broad-based earnings proliferated by 9.1% year-over-year, with key credit segments offsetting equity market induces headwinds.

The firm’s investment banking fees dropped off by 54% during the quarter amid a tame IPO market. However, as previously mentioned, Barclays produced stellar results in the fixed-income space, with FICC (Fixed Income Clearing) and transaction banking revenues surging by 63% and 57% apiece.

Most of the bank’s impressive fixed-income performance was assisted by highest global interest rates, which allowed wider spreads on credit and deposits. Rising interest rates usually provide a parsimonious indication of economic growth as its an inflation-curbing tool. However, we’re concerned that high-interest rates might be temporary due to various macroeconomic headwinds such as semiconductor supply shortages, energy shortages in Europe, and inconsistent global monetary policies. As such, we urge bank investors not to get overly attached to the rising interest rate hype.

Lastly, Barclays generated 14% year-over-year growth in its private banking assets. Additionally, the bank’s private banking division’s year-over-year income surged by 44%, driven by higher loan volumes, margins, and transactions in the private clients’ space.

Risk Analysis

Basel III

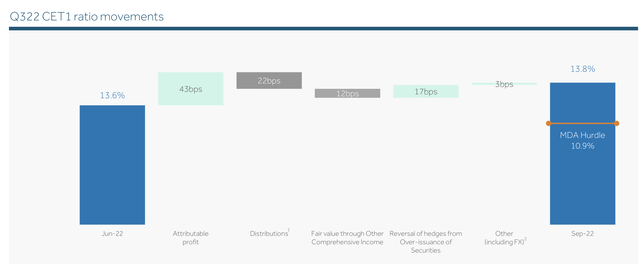

Barclays’ 13.8% CET1 Ratio indicates that it allocates its equity-based assets efficiently as the ratio exceeds the hurdle rate of 10.09%. Tracking CET1 Ratios are critical when analyzing banks as they convey management’s ability to maximize returns per unit of risk. Thus, considering Barclays’ solid CET 1, we opine that the bank is possibly “best in class” in terms of risk attribution.

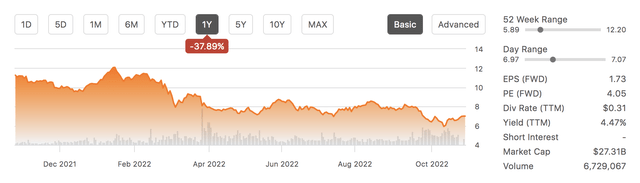

Market-Based Risk

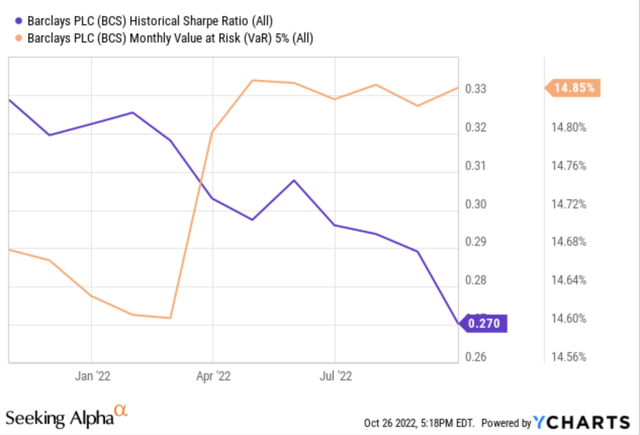

A factor that investors should take notice of is Barclays stock’s quantitative risk metrics. A Sharpe Ratio of 0.270 indicates that the stock’s retrospective returns potentially stack up unfavorably toward the stock’s volatility. In addition, Barclays stock tends to draw down by more than 14.85% in 5% of its traded months.

Cumulatively, the stock’s risk-return metrics look unfavorable, especially as we’re in a bear market with a risk-off environment. These metrics ideally shouldn’t be looked at in isolation; however, they provide a valuable indication of the stock’s risk-return profile.

BCS Stock Valuation and Dividends

At face value, Barclays seems like a deep value play with its price-to-book ratio at a mere 0.33x. A bank stock’s price-to-book ratio is often considered the cornerstone of its valuation ratios, as most of its asset base is quoted and traded.

Furthermore, Barclays’ price-to-earnings ratio is accommodated by a PEG ratio of only 0.35, indicating that the market likely underscores Barclays’ earnings-per-share growth. Barclays’ valuation metrics imply deep value when intertwined with the prospects of a stock market pivot and sustained short-end interest rate hikes.

| Price-to-Book | 0.33 |

| Price-to-Earnings | 4.80 |

| PEG | 0.45 |

Source: Seeking Alpha

Furthermore, Barclays provides a sumptuous dividend. The stock’s yield is protected by a dividend coverage ratio of 4.30, indicating that its current dividend yield likely isn’t at its cyclical peak. Moreover, with roughly $87.93 billion in operating cash to spare, Barclays has more than enough capacity to deliver attractive shareholder compensation packages for the time being.

| Dividend Yield (fwd) | 4.47% |

| Dividend Coverage | 4.30x |

| Cash from Operations | $87.93 Billion |

Source: Seeking Alpha

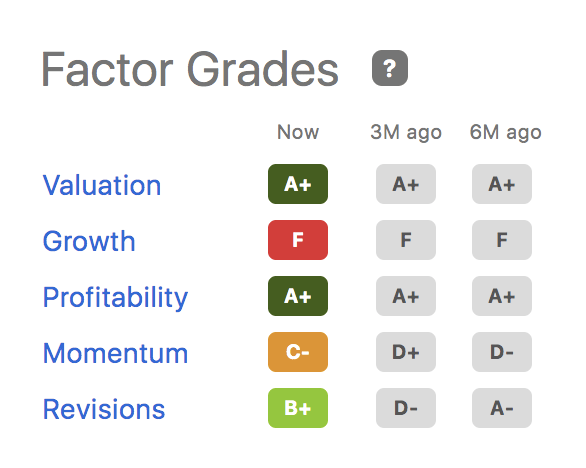

Price Action – Factor Analysis

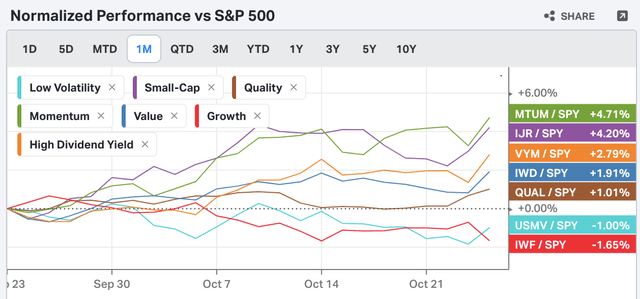

Based on Seeking Alpha’s factor grades and the content within this article, Barclays is considered a profitable, value, and high-dividend stock. These attributes could yield benefits in the coming quarters as investors are seemingly geared toward quality (profitable), value, and high-dividend stocks.

Seeking Alpha

The diagram below illustrates the market’s current factor preferences, and based on our analysis, Barclays aligns with what is currently demanded from the market.

Whenever recession risk is high, risk-off sentiment tends to settle in. In turn, investors seek high dividend, quality, and value stocks. The theory is that risk-off markets result from a receding economy, which translates into consumers (and investors) emphasizing near-term value over long-term growth stores.

Final Word On Barclays Stock

Despite numerous headwinds, we believe Barclays stock is a buy. The bank exhibits strong core growth with fixed income and cash transactions lending a helping hand. Furthermore, the firm’s private banking division is proliferating while its capital adequacy ratios are safe and sound.

Various risks pertaining to the broader economy and the stock’s quantitative metrics must be considered. However, ultimately Barclays’ deep value prospects overshadow most near-term headwinds.

Be the first to comment