mladenbalinovac

Investment Thesis

Global Partners LP (NYSE:GLP) mainly focuses on dealing in petroleum and petroleum-based products. The partnership has recently expanded its network in the Mid-Atlantic region by acquiring Tidewater Convenience. This deal includes the acquisition of gas stations and convenience stores in Virginia. I believe this acquisition can significantly contribute to the partnership’s plan to penetrate deeper into the Virginia market, accelerating its growth in the coming years. The partnership pays a high dividend payout, making it an attractive investment opportunity.

About Global Partners

Global Partners LP deals in buying, blending, selling, collecting, storing, and logistics of transporting petroleum and other petroleum-related products. The partnership owns and controls terminal networks of refined petroleum products located in Connecticut, Maine, Massachusetts, Vermont, New York, Rhode Island, New Hampshire, New Jersey, and Pennsylvania. It procures refined petroleum products, renewable fuels, crude oil, and gasoline blendstocks from domestic and foreign refiners, crude oil producers, and ethanol producers. The partnership operates its business under three business segments: Wholesale, Gasoline distribution and station operations (GDSO), and Commercial.

The Wholesale segment trades, collects, blends, and transports refined petroleum products, crude oil, renewable fuel, gasoline blendstocks, and propane. This segment’s sales contribute approximately 59% of the partnership’s total sales. The sale of branded & unbranded gasoline to the gasoline station and sub-jobbers is part of the Gasoline distribution segment. The station operations include rental income from dealers for leased gasoline stations, convenience stores & prepared food sales, and sundries such as car wash sales, lottery, and ATM commissions. The sales of the Gasoline distribution segment contribute approximately 35% of the partnership’s total sales. The commercial segment involves sales and deliveries of unbranded gasoline, diesel, kerosene, home heating oil, and banker fuel to the large commercial and industrial end users.

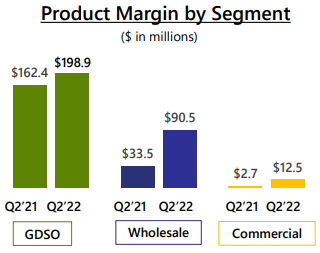

The commercial segment’s sales contribute approximately 6% of the partnership’s total sales. In February 2022, the partnership acquired retail motor fuel assets in Virginia and North Carolina from Miler Oil, which included 21 partnership-operated convenience stores, two fuel sites, and 34 fuel supply sites, primarily in Virginia. The partnership is experiencing a margin expansion in all the operating segments.

Product Margin by Segment (Q2 2022 Investor presentation: slide no: 21)

Acquisition of Tidewater Convenience

Global Partners LP has recently announced its acquisition of Tidewater Convenience, Inc. As per the acquisition, the partnership has acquired 14 company-operated gas stations and convenience stores throughout southeast Virginia. The deal includes one company-owned commission marketing location along with the gas stations. These acquisition sites are located throughout Chesapeake, Norfolk, and Virginia Beach. The management of the partnership has stated that Virginia is a key market. This acquisition synergizes perfectly with its existing portfolio and can enhance the vertically integrated network.

I believe the addition of Tidewater can greatly benefit the partnership to accelerate its growth, as it can significantly contribute to the partnership’s plan to penetrate deeper into the Virginia markets and strengthen its retail footprint in the Mid-Atlantic region with the help of a more enhanced integrated network of Tidewater Convenience. I think the addition of Tidewater Convenience can increase the profit margins in the coming quarters as it synergizes perfectly with the existing portfolio of the partnership, which might reduce the logistic time and cost in the coming years.

After considering all these factors, I believe the investors can expect a significant increase in the partnership’s sales and expanding profit margins in the coming period.

9.88% Forward Dividend Yield

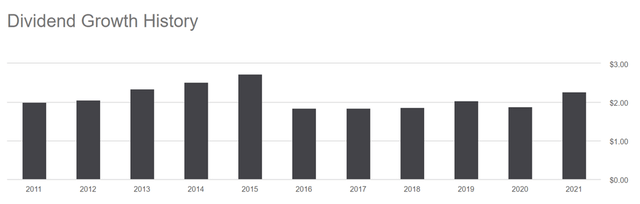

The partnership has an attractive dividend payout for the recent quarter of $0.605 per share, representing a 1.68% growth from the previous quarter and signaling a good financial position of the partnership. I believe this acquisition of Tidewater Convenience can result in higher profit margins for the partnership, increasing the dividend payout in the coming years. But to keep the conservative estimates, I think that the dividend of $0.60 might remain constant in the coming quarters, which is equivalent to an annual payment of $2.42 per share and represents a 9.88% forward dividend yield, making it an attractive investment opportunity for risk-averse investors. The partnership has a long history of dividend payments, which gives assurance to the investors about continuity of those dividend payments.

Dividend Growth Chart (Seeking Alpha)

What is the Main Risk Faced by GLP?

Rising Interest Rates

The partnership may be exposed to changes in interest rates, as the interest rates on its loan arrangement are variable. The ability to service debt could suffer if interest rates rise significantly. Finance for commercial activities might become more expensive due to the interest cost increase. These extra costs could have a negative impact on the partnership’s financial situation, operating performance, and cash available for distribution to unitholders.

In the past, credit was significantly less readily available on international financial markets. Future unfavorable effects might include a reduction in the availability of borrowings under credit agreements, a rise in counterparty credit risk on derivatives contracts, and a need for contractual counterparties post collateral. Additionally, the collaboration can see a tightening of supplier trade credit.

Currently, as we know, interest rates are rising in the global economy. If the interest rate continues to increase in the coming years, it can adversely affect the partnership’s financial conditions and cash availability.

Valuation

The recent acquisition of Tidewater Convenience can significantly help the partnership grow in terms of profit margins as it synergizes perfectly with the existing partnership portfolio and can be a significant contributor to its plan to penetrate deeper into the Virginia market with the enhanced network. That’s why I believe this acquisition can drive the future growth of the partnership.

After considering all these factors, I estimate the EPS of FY2022 to be $7.30, which gives the forward P/E ratio of 3.34x. After comparing the forward P/E ratio of 3.34x with the sector median of 6.43x, we can say that the partnership is undervalued relative to its peers. I think the partnership might trade below its sector median due to rising interest rates. That’s why I estimate the partnership might trade at a P/E ratio of 4.50x, giving the target price of $32.85, which is a 34.63% upside compared to the current share price of $24.40.

Conclusion

The recent acquisition of Tidewater Convenience store chains in Virginia can significantly help the partnership to penetrate deeper into Virginia Market. Tidewater Convenience complements the partnership’s existing portfolio, which can expand the profit margins in the coming years. The partnership is experiencing an economic headwind of rising interest rates. The partnership also has an attractive forward dividend yield of 9.88% and a potential price return of 34.63%, giving the unitholders a total return of 44.51%. After considering all the above factors, I assign a buy rating for GLP.

Be the first to comment