chaiyapruek2520

This is my first look at Heron Therapeutics (NASDAQ:HRTX), a $325 million commercial stage biotech. In this article, I review its progress as it tries to build a commercially viable business with its four FDA-approved therapies.

Heron’s first two FDA-approved therapies started strong but have since faced challenges.

Heron’s initial two FDA approvals came in 08/2016 and 11/2017. Its first approval was for SUSTOL (granisetron) extended-release injection, approved in 2016 for the prevention of acute and delayed nausea and vomiting [CINV] associated with certain chemotherapy regimens.

Its CINVANTI was approved late the next year. CINVANTI (aprepitant) is an injectable emulsion also approved for CINV. In its release announcing CINVANTI approval, Heron’s CEO Quart explained:

Since both CINVANTI and SUSTOL have been shown to significantly reduce CINV in both the acute and delayed phase, by complementary mechanisms, they are an excellent strategic and operational fit for the Heron commercial team. The commercial team is ready to launch CINVANTI in January of next year [2018].

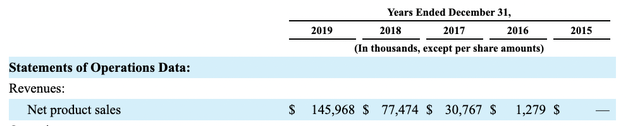

Heron’s pre-pandemic product sales from CINVANTI and SUSTOL as shown by its 2020 10-K were growing nicely:

seekingalpha.com

CINVANTI made up the lion’s share of these sales and in 10/2019 Heron made a business decision to discontinue discounting SUSTOL which would reduce sales further.

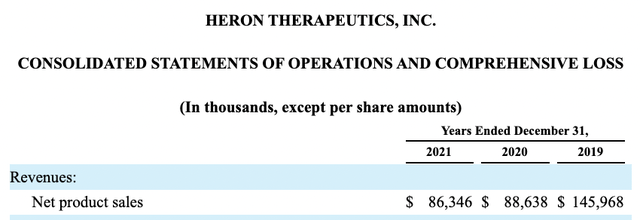

During the pandemic, product sales dropped significantly as reflected by its 2022 10-K:

seekingalpha.com

As explained by the 10-K (p. 62), this steep falloff was caused by:

…pandemic related reduction in cancer screening procedures resulting in fewer new patient treatment starts, as well as the lingering impact of generic arbitrage.

During its Q3, 2022 earnings call (the “Call“), Pres/CMO Poyhonen guided for a modest increase in these net sales. He stated that Heron was on track to net CINV sales in the range of $93-$95 million representing an 11% to 14% increase over prior year.

Heron’s third approved therapy for postoperative pain had a tough approval path and is undergoing a challenging launch.

Beyond its two CINV therapies, Heron finally notched approval for a third, its ZYNRELEF (HTX-011, bupivacaine and meloxicam extended-release solution), in 05/2021. It launched ZYNRELEF to produce postsurgical analgesia for up to 72 hours after bunionectomy, open inguinal herniorrhaphy and total knee arthroplasty.

Heron and its suffering shareholders had to deal with two successive CRL’s before HTX-011 was finally approved:

- On 12/31/2018 the FDA accepted for filing Heron’s 10/30/2018 HTX-011 NDA setting a PDUFA date of 04/30/2019;

- on 05/01/2019 Heron announced that the FDA issued a CRL for HTX-011 because it needed additional CMC and non-clinical information;

- on 10/28/2019 Heron announced that FDA accepted its resubmission of HTX-011 setting a PDUFA goal date of March 26, 2020;

- on 06/29/2020 Heron announced that it received an HTX-011 CRL because of four technical toxicology related issues; it assured that these were not significant barriers to ultimate approval;

- on 09/08/2020 Heron reported a productive Type A meeting that opened the way to refiling its NDA.

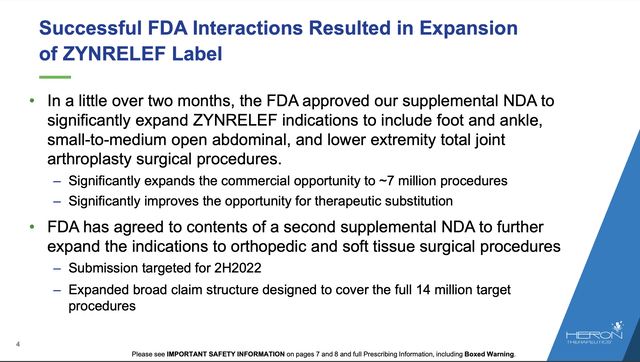

Now that it is approved for commercialization, HTX-011 has been an ongoing disappointment. ZYNRELEF continues to have issues with the FDA. Its initial label was a disappointment for Heron. It has made several efforts to get it expanded, with some success.

In 12/2021 Heron published an 8-slide deck focused on its label expansion efforts. Its slide 4 from this deck provided:

ir.herontx.com

I have been unable to find a second approval to cover the full 14 million lives as indicated so I assume that it has yet to materialize.

Heron’s product sales of $86,346 million for 2021 as reported above were not exclusively CINV sales; they included ~$2.9 million of ZYNRELEF sales. Its FDA-approved indications for ZYNRELEF have been expanded twice. So far in 2022 it has netted ~$6.3 million in ZYNRELEF sales. During the Call, CEO Quart lamented that its Q3 ZYNRELEF sales were subpar and unacceptable.

The Call included numerous references to its ZYNRELEF travails and its plans to advance this treatment which one analyst has pegged as a potential blockbuster, despite its minimal sales to date.

APONVIE, Heron’s fourth FDA-approved therapy, is set for launch in Q1, 2023.

Heron filed an NDA for its APONVIE (HTX-019) on 11/18/2021. It maintained that HTX-019 had shown bioequivalence in treatment of postoperative nausea and vomiting (PONV) with its CINVANTI (aprepitant). As noted above CINVANTI is approved for chemotherapy-induced nausea and vomiting (CINV).

Heron anticipates a major market opportunity for APONVIE. As described in its release:

Despite advances in postoperative care, nausea and vomiting has remained a challenge for many patients undergoing surgery. There are approximately 65 million diagnostic and surgical procedures at risk of resulting in PONV in the U.S. each year. More than half of these patients are at moderate to high risk of developing PONV. Recent data has also shown that PONV can lead to increases in medical costs and delays in discharge and recovery following procedures. Aprepitant is the first and only NK1 RA to be approved for prevention of PONV based on showing superiority to ondansetron, the current standard of care.

“…. the use of oral aprepitant has grown by almost 80% in the past three years without any promotional efforts. Our IV formulation is designed to directly deliver the active form of the drug, aprepitant, to patients over 30 seconds so it can take effect much more quickly than when taken orally,” …[CEO] Quart… “The HTX-019 NDA was filed with the same FDA division that previously approved CINVANTI without delays.”

During the Call, Quart was highly enthusiastic about APONVIE. He anticipates it having a sales trajectory in line with CINVANTI when Heron launches APONVIE in Q1, 2023. Heron President Poyhonen was similarly upbeat on APONVIE. He characterized its market niche in treatment of PONV as ideally synergistic with Heron’s other commercial therapies.

Heron’s risk profile disqualifies it from consideration for new investment.

With its four approved therapies working to support those who want to take a shot at a high-risk biotech investment, I look at its operational metrics and say no thanks. At this point it is not worth the risk.

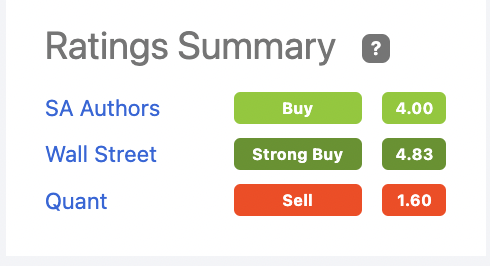

Take a quick look at its Seeking Alpha ratings summary:

seekingalpha.com

Wall Street Analysts have set out price targets from a low of $5.50 to a high of $15.00. With Heron currently (12/19/2022) trading at $2.49, far below its long-term trading range, there may well be some nice trading cash to be picked up. Be that as it may, Heron is not an attractive vehicle. It has not proven any ability to execute on the potential of its therapies.

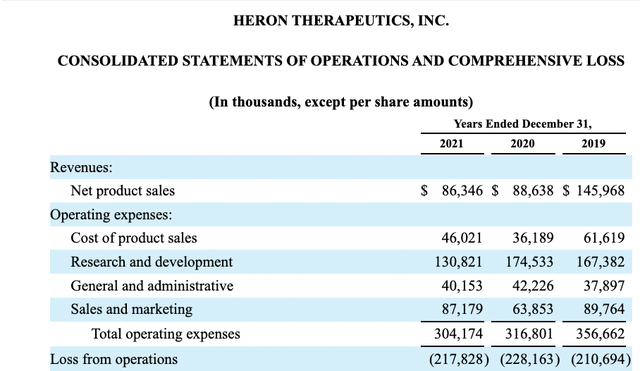

There are manifest risks associated with small biotechs like Heron. The one that bothers me the most is its execution risk. Its operations statements in its most recent 10-K and its 10-Q show aggregate expenses running disproportionately high compared to its revenues.

One look at its operations statement below for 2019-2021 makes me steer clear:

seekinalpha.com

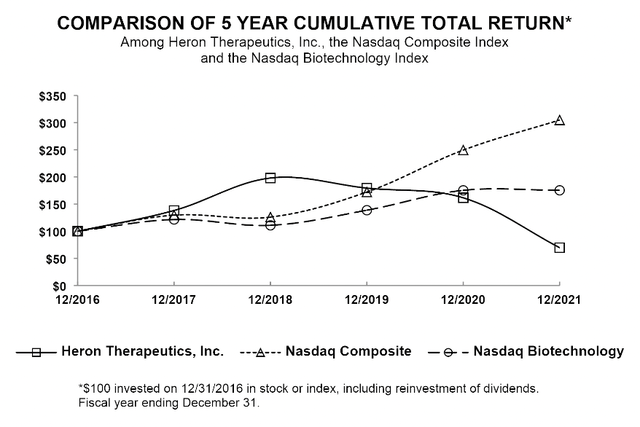

No surprise that shareholders have been taking it on the chin as shown by its 10-K graphic below:

seekingalpha.com

Conclusion

Those having new money to put in the market should invest it elsewhere other than Heron. It has interesting potential but its performance to this date gives little confidence that it can live up to this potential.

Be the first to comment