Justin Sullivan

AT&T Inc. (NYSE:T) is one of the largest telecommunications companies in the world with a market capitalization of more than $120 billion. The company was our top investment recommendation for 2022, discussed here, and has generated almost 46% in total returns since that article versus an 18% decline of the S&P 500 (SP500), meaning a >60% outperformance.

Over the last decade, AT&T has gone through several phases. The first was the conglomerate building phase, the second was the plenty of cash flow phase, and the third was the business reorganization phase. The company is currently in that third phase, and we feel that, as it continues to improve its operations, it has substantial potential.

AT&T Business Priorities

AT&T has continued to focus its business priorities on a smaller and more reorganized business.

The company’s first priority is to grow customer relationships. The company has managed a staggering 2.2 million postpaid 5G net adds and nearly 1 million fiber net adds. The company continues to have an impressive portfolio of assets, supported by its spectrum and assets such as FirstNet, that will enable continued growth.

The company is continuing to work on achieving its run-rate cost savings target, and we expect it to continue that. The company’s asset improvements have offset inflationary impacts. From this cash flow, the company is continuing to invest in its balance sheet, although we’d like to see it reduce debt much further. The company expects $14 billion in 2022 FCF.

The company continues to pay a strong dividend of more than 6%.

AT&T Core Businesses

AT&T is continuing to drive strong returns in the core business that the company is investing in.

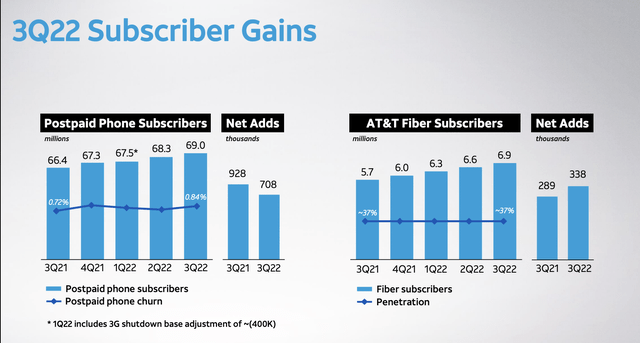

As discussed above, the company had strong net adds in the most recent quarter. The company’s churn has continued to remain low at less than 1%. YoY the company’s postpaid phone subscribers has increased from 66.4 million to 69 million, or a several % increase that we expect the company will be able to increase.

The company’s fiber business is much more exciting to us. The company has been accelerating the pace of net adds and maintaining its overall market share despite substantially expanding the potential locations. We expect the company to continue adding subscribers and investing capital, which will substantially expand revenue.

AT&T Financial Performance

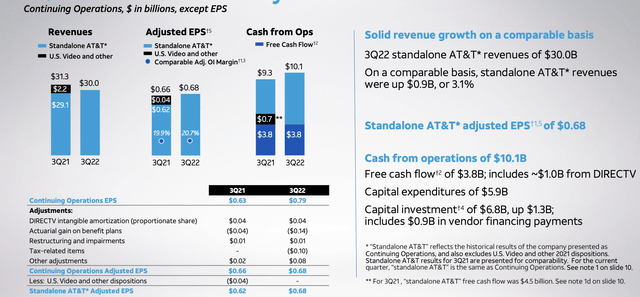

Overall, the company’s financials remain reasonable, but there’s a lot to improve here.

The company managed to grow its revenue YoY while maintaining strong EPS. The company’s free cash flow (“FCF”) from operations increased by almost double-digits YoY to more than $10 billion and the company generated strong FCF (towards its $14 billion annualized target) while investing almost $7 billion in a single quarter within its business.

That’s roughly $25 billion annualized the company is investing in capital expenditures, a massive pile of cash that’ll enable continued business growth for the company.

Our View

AT&T requires patient investors, and while we recommend it as an investment for the next year, we also recommend it for investors who have a longer timeline / perspective on the situation. We expect the company to continue investing heavily in its business while improving its business to expand its FCF. However, there’s no guarantee that that pans out.

Regardless, we do expect the company’s FCF to expand and enable the company to pay down its debt and support future returns. The company’s debt pay downs could enable it to substantially reduce its interest payments and drive other forms of shareholder returns.

Thesis Risk

The largest risk to our thesis is that AT&T has struggled to continue to perform well with its portfolio. The company has yet to show a continued long-term ability to execute and follow its goals. Until the company shows that ability, we see there as being no guarantees that it will continue to outperform or drive strong shareholder returns.

Conclusion

AT&T was a pick that we were proud of for 2022 as the company, which has a traditional history of underperformance, substantially underperformed the market in an incredibly difficult year. The company has continued to proceed towards its goals after the Warner Bros. Discovery (WBD) spinoff, and we expect it to continue.

Going forward, we expect AT&T Inc. to be able to pay down and manage its debt load, reduce interest payments, and increase FCF. The company has an incredibly strong dividend of just over 6%, which will form a strong basis for shareholder returns, while it puts its cash into other forms of more indirect returns. Overall we expect AT&T to continue generating strong returns.

Be the first to comment