piranka/E+ via Getty Images

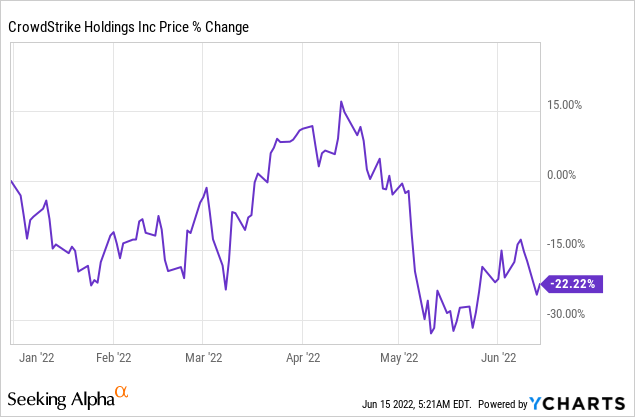

CrowdStrike (NASDAQ:CRWD)’s shares went through a 22% drop in pricing this year, creating a buying opportunity for the cybersecurity business. The company is adding a massive amount of new customers to its Falcon platform and the subscription business is seeing sustained growth. While shares are not cheap, CrowdStrike is profitable on a free cash flow basis and I believe the risk profile remains heavily skewed to the upside over the long term!

CrowdStrike’s subscription business has momentum

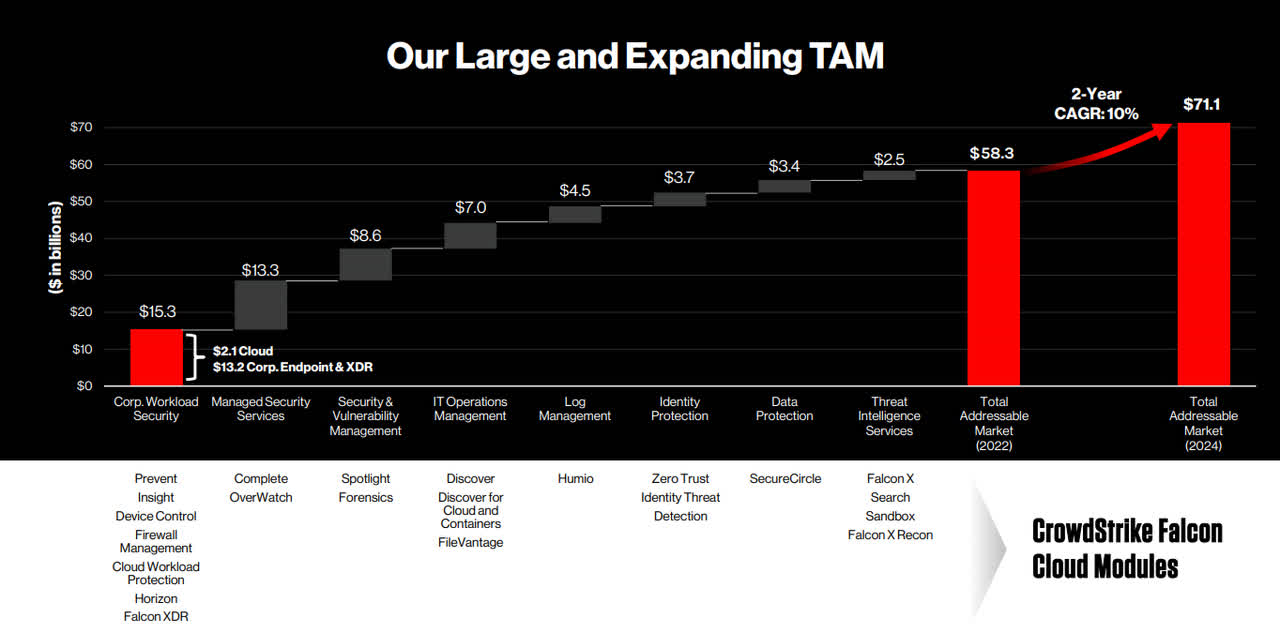

CrowdStrike offers its customers cybersecurity tools to protect them against the latest cyber threats. CrowdStrike’s products and services include identity protection, forensics or threat management, and the company has consistently innovated which helped expand the firm’s total addressable market. CrowdStrike sees a total addressable market of $58.3B for its core products and services which is expected to grow to $71.1B by FY 2024.

CrowdStrike

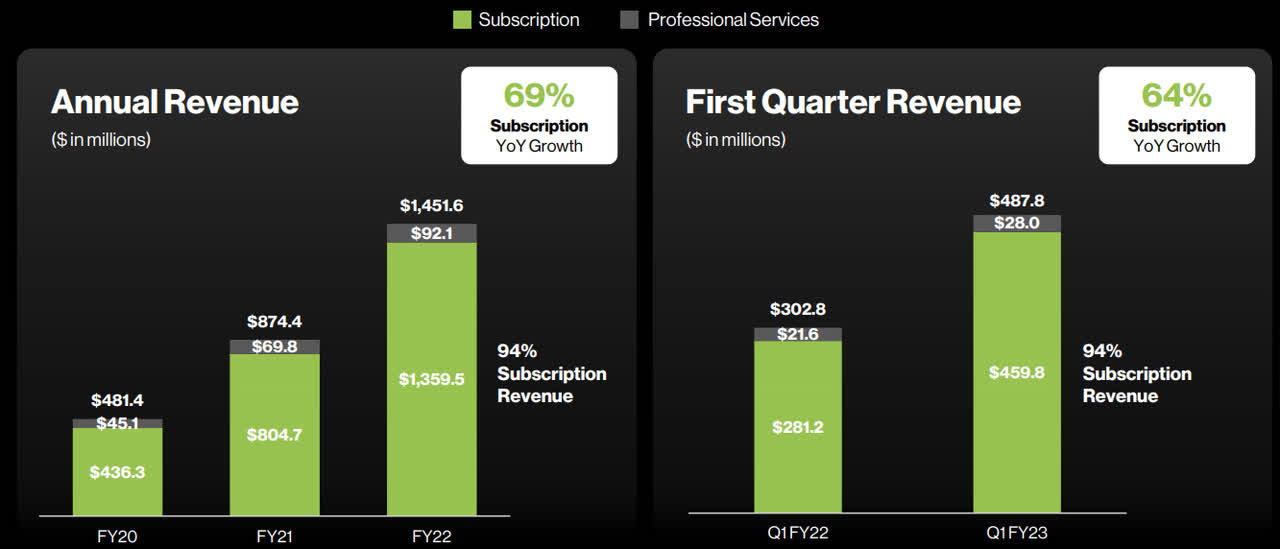

The evolving threat landscape requires companies to consistently upgrade their IT protections which makes CrowdStrike’s cybersecurity business perfect for a subscription model. CrowdStrike’s revenues soared 61% in Q1’23 to $487.8M on strong customer acquisition. CrowdStrike’s subscription revenues, which represented 94% of all revenues in the first quarter, showed 64% year over year growth. A small part of revenues, $28.0M in Q1’23, came from Professional Services which include incident response services, forensic and malware analysis, and attribution analysis. Professional Services are sold independently but CrowdStrike has said that customers that use the firm’s Professional Services frequently upgrade to a subscription to its Falcon cybersecurity platform.

CrowdStrike

Customer acquisition and monetization

CrowdStrike’s strong growth is driven by two factors: The acquisition of new customers as well as higher product spend by existing customers.

To the first point, customer acquisition. CrowdStrike’s Falcon platform, which is supported by cloud-scale artificial intelligence and allows customers to secure workloads, identities and corporate data, is seeing strong customer interest. CrowdStrike ended the last quarter with 17,945 customers in its subscription business, showing 57% year over year growth. The cybersecurity firm added 1,620 net new customers to is ecosystem in the last quarter and a massive 6,525 net new customers over the last twelve months.

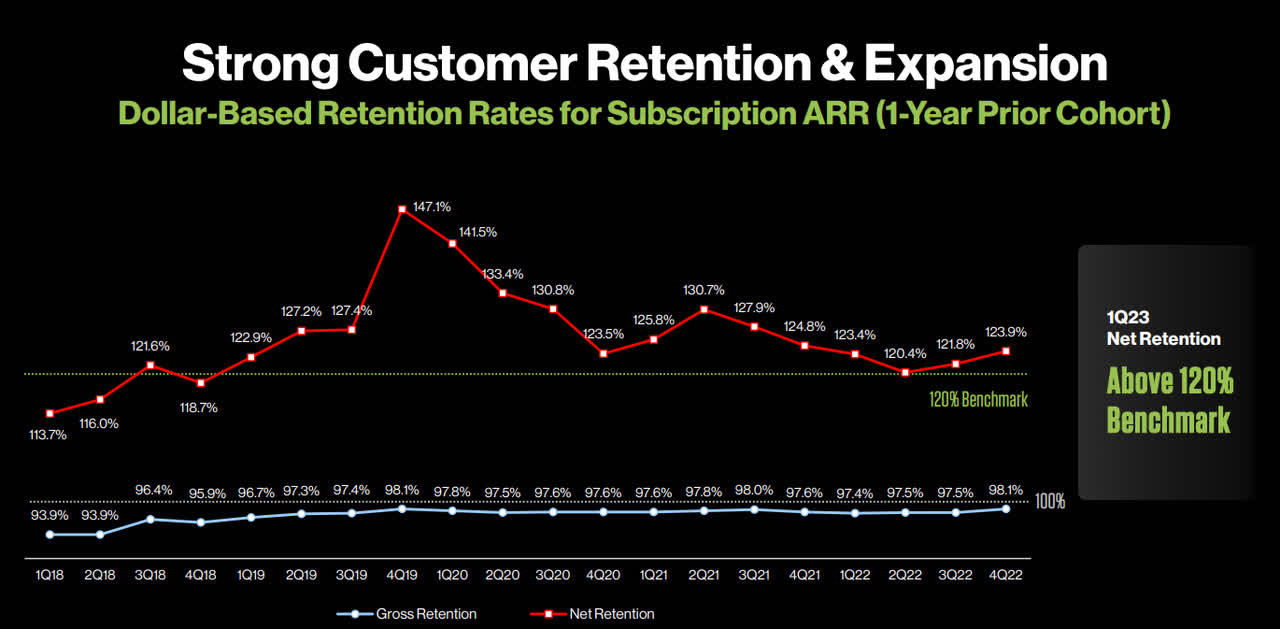

To the second point, customer monetization. Companies in the cloud-space use dollar-based retention rates to measure monetization success. A dollar-based retention rate measures how much existing customers increase their spending on CrowdStrike’s products and services, from one reporting period to the next and it is usually expressed as a percentage. In Q1’23, CrowdStrike’s dollar-based retention rate was 123.9%, showing a sequential improvement of 2.1 PP. This figure tells investors that CrowdStrike’s subscription customers increased their spending by 23.9% compared to the year-earlier period.

CrowdStrike

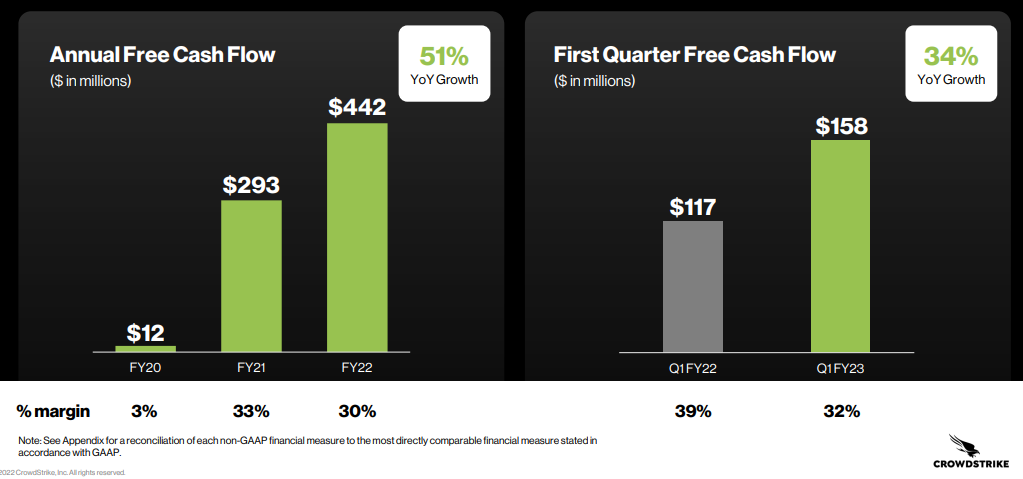

CrowdStrike is profitable on a free cash flow basis, generates margins in excess of 30%

Many cloud-based companies are not profitable, but CrowdStrike is. In the first quarter, CrowdStrike generated $157.5M in free cash flow compared to $117.3M in the year-earlier period, showing 34% year over year growth. What I really like about CrowdStrike is that the company consistently achieves very high free cash flow margins of more than 30%.

CrowdStrike

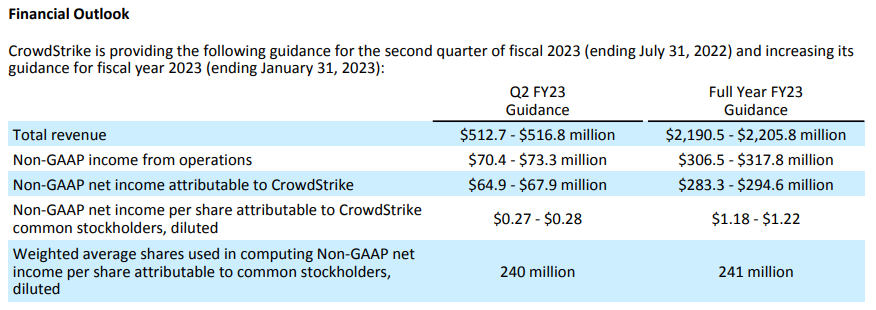

Attractive revenue opportunity in a rapidly evolving cybersecurity market

CrowdStrike’s revenue outlook for FY 2023 calls for 51% year over year revenue growth which is impressive considering that recession fears are growing. CrowdStrike expects revenues between $2.19B and $2.21B in FY 2023 and revenues between $512.7M and $516.8M in Q2’23. The second quarter guidance implies 6% quarter over quarter top line growth.

CrowdStrike

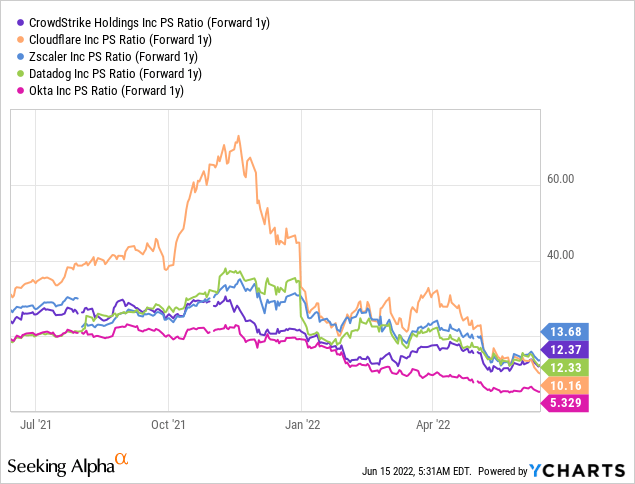

No cybersecurity stock is really cheap since the market expects tremendous revenue growth rates in the future. For CrowdStrike, the market expects the firm to grow revenues to $3.83B by FY 2025 which implies an average annual top line growth rate of 38%. These revenue expectations are reflected in CrowdStrike’s P-S ratio of 12.4 X. The revenue opportunity for CrowdStrike is enormous and the company itself has said that it plans to grow to $5B in annual recurring revenues by 2025. Because the threat environment requires companies to constantly update their security protections, the long-term revenue outlook for CrowdStrike is very bright.

More integrations and security partnerships

Cyberattacks are surging and will likely continue to pose a serious security challenge for companies going forward. This evolving threat landscape creates a huge opportunity for CrowdStrike to expand its platform reach, especially through the CrowdXDR Alliance. This security alliance is a coalition of companies that work together to mitigate risks of cyberattacks and include companies like Okta, ServiceNow, Zscaler, Netskope, Proofpoint and others. Menlo Security, a cloud security leader, just recently joined the alliance. By joining the alliance, Menlo Security’s solutions are going to be integrated into the CrowdStrike Falcon platform, offering CrowdStrike’s customers better threat protection. By integrating the security solutions of other vendors, the Falcon platform could see growing adoption which could ultimately result in growing customer monetization as well.

Risks with CrowdStrike

CrowdStrike’s addressable market is growing and customers are signing on rapidly to the Falcon platform. Cyber threats are constantly evolving and companies spend big money to secure their data infrastructure which indicates attractive growth prospects, especially for CrowdStrike’s SaaS business.

However, in the short term, slowing revenue growth may be a problem for CrowdStrike if companies reduce spending on IT security during a recession. What I also see as a potential risk for CrowdStrike is weakening customer monetization. Currently, the firm’s customer monetization rate looks good, but it could decline if companies decide to cut IT budgets to improve profitability during a recession.

Final thoughts

CrowdStrike’s revenue outlook for FY 2023 is very strong, especially when compared against a deteriorating global growth outlook. CrowdStrike is also solidly profitable regarding free cash flow and FCF margins above 30% show that CrowdStrike is running a very profitable platform business. While the valuation is not cheap, the firm’s expanding addressable market and massive growth potential are reasons to buy the stock!

Be the first to comment