maybefalse/iStock Unreleased via Getty Images

Intro & Thesis

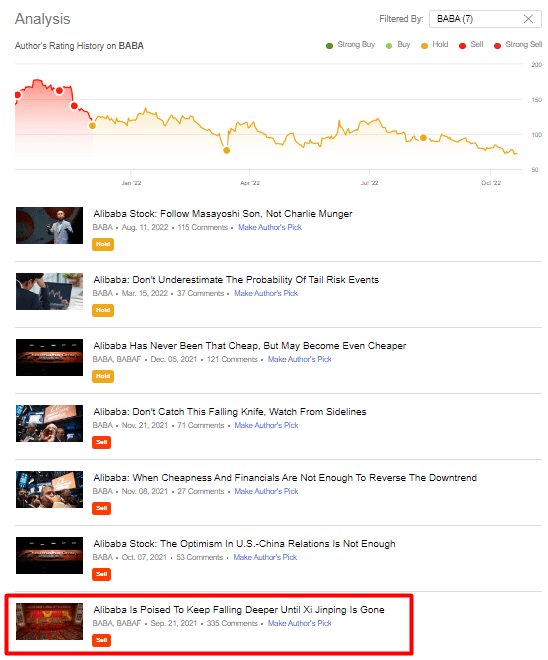

I have been covering Alibaba Group Holding Limited (NYSE:BABA, OTCPK:BABAF) stock on Seeking Alpha since late September 2021 – since then, I have been urging investors to weigh their risks wisely before listening to the buy-the-dippers and getting fooled by the “high growth” of the company and its end-markets.

It all started with my thesis that the company’s stock would likely be under-selling pressure until Chinese President Xi Jinping leaves office. In addition, I talked about the harmfulness of the VIE structure of Chinese stocks as an element of long-term risk that could materialize at any time. As time has passed, it has shown that my thesis continues to prove true:

Seeking Alpha, my coverage of BABA (with notes)

Everyone was aware of the risks without my contribution to the site – a bunch of articles were written before and after my first article about the political risks threatening Alibaba stock. It comes down to how investors deal with these risks – do they avoid, reduce, transfer (hedge), or accept them?

In my opinion, in the case of Chinese stocks, the most correct way to manage existing risks is to use the first 3 options. Personally, I have chosen the first option – I avoid investing in China as long as authoritarianism is on the rise there according to all visible trends. However, it seems that most Western investors have chosen to look at BABA and smaller tech companies in this region through the prism of “acceptance,” trying to open their brokerage account less often or, even worse, buying more shares on severe dips (like the one we see today on Hong-Kong market).

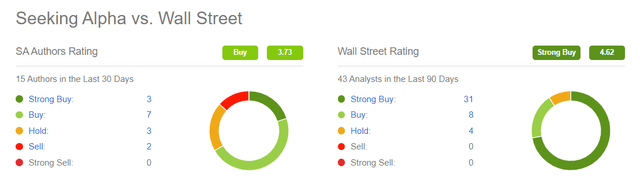

Unfortunately, analysts continue to convince us that “BABA is a great value buy” because: 1) Charlie Munger has added the stock to his portfolio; 2) DCF with various discount rates shows a strong undervaluation – from 50% to 200%+; 3) political risks are overblown; and 4) technicals scream “we are oversold.” What other arguments could there be? In the last 30 days, 10 out of 15 authors have been bullish (or strongly bullish) on Seeking Alpha, while Wall Street has not objected to their theses:

Seeking Alpha, BABA’s main page

And indeed – all the reasons I mentioned above make sense. However, that does not save BABA from falling – it continues to underperform badly, dragging other Chinese stocks with it.

You are probably tired of reading about the Chinese political risk – you already know all about it. However, I have noticed that no one (or only a very small fraction of the authors) writes about currency risks. I think this is a major omission, which I will try to correct. In my opinion, the likely devaluation of the yuan shortly will lead to an even greater decline in the shares of Chinese companies, and especially Alibaba stock, as the flagship of this market. I will also show you what happened in practice to those who bought drawdowns in BABA stock in recent months. Let’s get started.

What’s wrong with the yuan?

As events in the world have unfolded in recent years, many have lost sight of the fact that problems in the Chinese economy are growing – for many, it seemed as if the biggest country in the world would grow forever at an astronomical rate.

The rapid expansion must end sooner or later – when the plane runs out of fuel, it begins to fall. Obviously, China’s fuel tank started to run empty much earlier than most emerging market investors realized – one of the obvious ways out of this situation was to inflate the active part of banks’ balance sheets. Are you still complaining about the U.S. debt load? According to Crescat Capital, since the Global Financial Crisis (“GFC”), Chinese banking sector assets have grown many times faster than any other advanced economy in the world:

Crescat Capital, “Golden Era of Macro Investing” [October 19]![Crescat Capital, "Golden Era of Macro Investing" [October 19]](https://static.seekingalpha.com/uploads/2022/10/24/49513514-16666087176926236.png)

The Chinese banking system has grown almost seven-fold since the Global Financial Crisis, completely dwarfing other major economies. Well, when one of the fastest-growing countries in the world is on the verge of 1) slowing down its long-term growth rates and 2) triggering a credit crisis (not only in real estate), one of the most obvious and logical ways for CCP to solve the problem is to devalue the national currency.

China’s banking assets are thus highly overstated at almost three times GDP. This is four times bigger than the banking imbalances in the US at the peak of the housing bubble just ahead of the Global Financial Crisis. While most market commentators like to say that China has enough foreign currency reserves to avoid a currency crisis, these reserves represent only 8% of its $37 trillion money supply. Hong Kong banks are in even worse shape with banking assets marked up to an impossible-to-believe nine times GDP.

Source: Crescat Capital, October 19th

The long-term impact on China’s current account surplus could be devastating for the Chinese economy, which relies on higher levels of net exports to function efficiently as developed Western nations move away from dependence on China’s manufacturing sector.

At Beyond the Wall Investing, we regularly read the Macro Compass newsletter – in my opinion, one of the most comprehensive sources of macroeconomic analysis on the Internet. Recently, the author of Macro Compass – Alfonso Peccatiello – met with several portfolio managers in London to discuss their latest trading ideas and general thoughts on macroeconomics and the stock market. A macro portfolio manager from a family office shared with him her thoughts on the future of some central banks’ policies. I have tried to summarize her theses by isolating direct quotes from her speech and keeping the main point:

Despite the US and USD accounting for only ~10% of world trades and ~20% of global GDP, the US Dollar takes the lion share of global trade invoicing, payments and most importantly non-US based credit creation (loans and international debt issuance).

As long as US Dollars are organically flowing towards these USD-leveraged foreign entities, the system thrives. But for the last 6-9 months, global trade growth has slowed down and access to cheap USD funding has come to a halt.

Unless the US repo or Treasury market seriously breaks, the path of least resistance seems to be the “death by a thousand cuts”: idiosyncratic events happening at the fringes first (e.g., Turkey) and slowly moving towards the core (e.g., UK pension funds).

So if we’re looking into a “death by a thousand cuts” scenario, where is the next cut? She thinks China will be forced to aggressively devalue.

Source: Macro Compass, October 21 [emphasis added by Alfonso Peccatiello].

We are already seeing the thesis of yuan devaluation coming true in real time – the USDCNY pair has broken through its multi-year local maximum and is rushing higher:

Investing.com, USDCNY pair, author’s notes

The Hong Kong dollar is also at a multi-month high and will probably follow the yuan as soon as the Bank of China resorts to devaluation measures again – as in 1994.

In 1994, when China was forced to restructure its banks, it had to devalue its currency by one-third in a single day. Such an event would be unimaginable by most investors in today’s markets. People tend to forget longer-term history, but China had to reset its monetary system almost ten times in the last century. We believe there is a real risk that the Chinese yuan could severely devalue against the US dollar and gold.

Source: Crescat Capital, October 19th

You may ask – “OK, Danil… but how will the devaluation of the yuan specifically affect Alibaba Group?”

The answer is logical and is in the company’s financial statements:

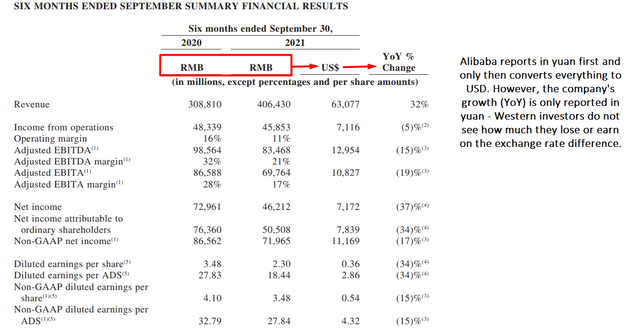

BABA’s FY 2022 Annual Report, author’s notes

Alibaba’s “International retail/wholesale” segments of the total consolidated “Commerce” revenue segment, which accounts for 86% of total revenue, equals only 7% in total. That means it’s obvious that Alibaba makes most of its sales from Chinese buyers (yes, I know that’s obvious). So if the Chinese currency continues to devalue, we will see the company’s revenue growth and profit numbers drop when converted to USD – I assume investors will not be happy about that.

I honestly do not understand why “CTRL +F” of the last 15 articles on Alibaba (regardless of ranking) on Seeking Alpha could only find 1 article that had the words “currency,” “yuan,” or “devaluation” in it – and that was a bullish article stating that the devaluation we are seeing today is temporary and “exaggerated by speculators.”

Bottom Line

Some readers have asked me why I generally do not recommend shorting a stock (and why I don’t go shorting it myself) when I am sure it’s going to fall. The answer is simple – the downside is limited (100%), while growth is not limited by anything (just recall how Antero Resources (AR) grew from its Covid lows).

So I did not recommend then, and do not recommend now, selling short BABA and Chinese technology stocks in general as standalone picks. You can trade medium-term pair ideas and profit from spreads, but a short position that is not hedged by a corresponding long position does not make sense in my opinion in terms of reward/risk ratio.

However, I expect that in the current macro environment, which has been complicated for China by its monetary policy mistakes in recent years, BABA will continue to face pressure from institutional investors seeking to remove the stock from their portfolios as quickly as possible by selling it in large chunks to dip buyers.

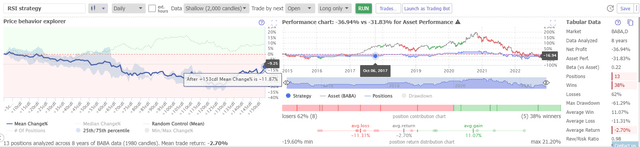

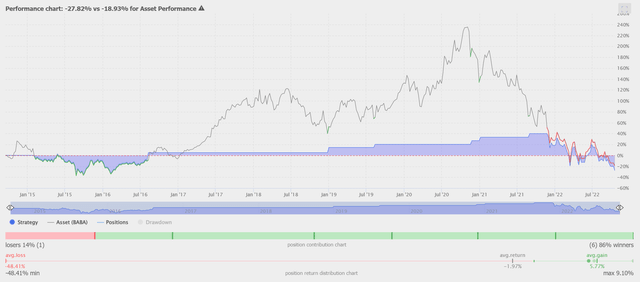

Buy-the-dip does not work when the stock is under such institutional selling pressure. I suggest you look at some back-tested strategies of buying the dip in BABA stock.

In the first case, let’s say I buy BABA at strong drawdowns – e.g., RSI below 35 (sufficiently oversold in my opinion). To have enough observations, I will sell at overbought levels (RSI > 65) to buy again at oversold levels in the future. How has this strategy evolved over the last 8 years? Not well:

TrendSpider, BABA, author’s input conditions

Over 8 years, the investor would have earned a negative return on his/her investment, with a maximum drawdown of 61.29%.

In the second case, let us imagine that I am a more active investor, buying BABA at a weekly drawdown of more than 10% and trying to sell at a 5% rise. This seems like an ideal strategy (albeit with a very poor risk-reward ratio, but still). What would my performance look like? Very poor, actually, even before the November 2021 sell-off began:

While institutional investors are selling, I do not think it makes sense to buy BABA and other Chinese tech stocks from them – U.S. stocks seem to be much more prospective in terms of risk/reward ratio (only in comparative terms, of course – we have to be selective here).

Based on the above, I reiterate my previous Neutral rating on Alibaba Group.

Thanks for reading! Please, share your thoughts in the comments below.

Be the first to comment