Sundry Photography

Thesis

Enphase Energy, Inc. (NASDAQ:ENPH) is scheduled to report its Q2 earnings card on July 26, as the focus has recently returned to renewable energy stocks.

Senator Joe Manchin’s rebuttal of the recent climate package has drawn a sharp rebuke from President Joe Biden. Manchin was justifiably concerned with more spending measures given the current inflation print. However, Biden appears steadfast in his commitment to support the US’ transition to renewable energy, as he signaled the possibility of executive action.

ENPH has been a massive winner for investors over the past five years, as it delivered a 5Y total return CAGR of 198%, significantly outperforming the market.

However, we believe investors sitting on massive gains should consider cutting exposure and not hold the bag any longer. Our valuation model indicates that ENPH’s steep valuation is not sustainable at the current levels.

In addition, we also explained in our previous article that ENPH is in a likely massive distribution phase. Consequently, it could lead to a steep sell-off once the phase is completed.

Accordingly, we reiterate our Sell rating, with a medium-term price target (PT) of $110. It implies a potential downside of 43.6%.

Recessionary Headwinds Could Hamper Its Profitability

Enphase is not immune to the worsening macro headwinds, including the increased risks of a potential recession. Therefore, it could also impact Enphase’s underlying operating model. The company also highlighted these risks in its filings (edited):

These risks include slower economic activity and investment in projects that make use of our products and services. These economic developments, particularly decreased credit availability, have in the past reduced demand for solar products. (Enphase FQ1’22 10-Q)

Furthermore, the company continues to come under pricing pressure, inherent in its business model and competition. As a result, its gross margins trend is expected to continue moderating, as the company accentuated (edited):

The solar power industry has been characterized by declining product prices over time. We have reduced the prices of our products in the past, and we expect to continue to experience pricing pressure for our products in the future, including from our major customers. In addition, we have reduced our prices ahead of planned cost reductions of our products, which has adversely affected our gross margins. (10-Q)

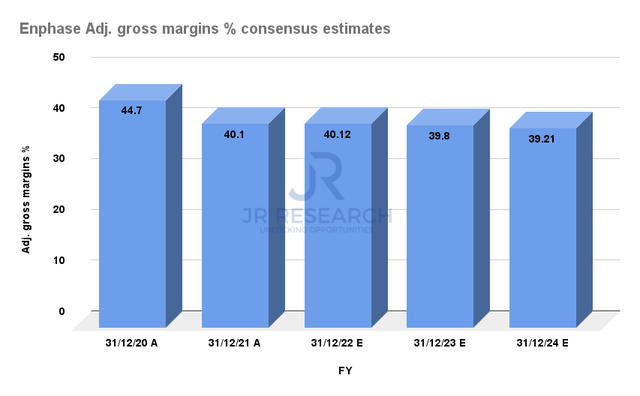

Enphase adjusted gross margins % consensus estimates (S&P Cap IQ)

Accordingly, the consensus estimates (bullish) have also reflected its pricing headwinds. As a result, the Street expects Enphase’s gross margins to fall from FY20’s 44.7% to 39.21% by FY24. Therefore, the company’s ability to drive operating leverage is critical to help sustain its operating margins.

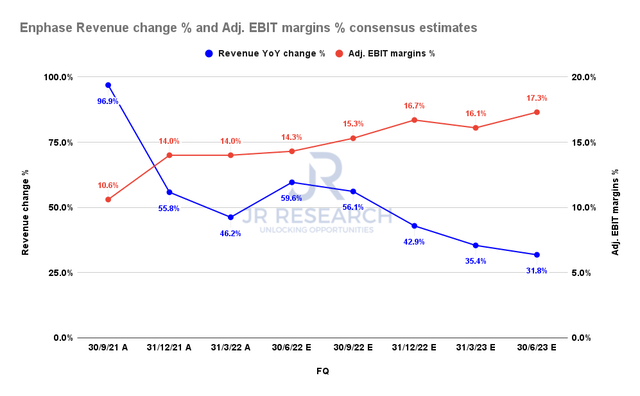

Enphase revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Notwithstanding, the bullish Street analyst expects Enphase to continue gaining operating efficiencies, despite the looming economic slowdown and slower revenue growth through FQ2’23.

Enphase has proven its ability to drive operating profitability. However, the macro headwinds could test its execution in an economic slowdown that could intensify its pricing headwinds. Therefore, urge investors to pay attention to management’s guidance commentary in its Q2 card to discern any likely impact.

Given ENPH’s steep valuation, a significant downward revision to its guidance could result in considerable value compression.

ENPH – Expensive, Expensive, Expensive

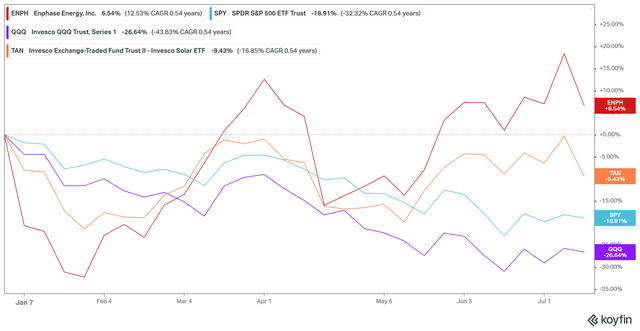

ENPH YTD performance % (Koyfin)

ENPH has outperformed the Solar ETF (TAN) and the market, as seen above in 2022, posting a gain of 6.54%. However, we urge investors to consider its steep valuation, which we believe is unsustainable at the current levels.

| Stock | ENPH |

| Current market cap | $26.32B |

| Hurdle rate [CAGR] | 11% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 4.5% |

| Assumed TTM FCF margin in CQ4’26 | 20% |

| Implied TTM revenue by CQ4’26 | $9.43B |

ENPH reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-perform hurdle rate of 11% to our valuation model. We also used an average free cash flow (FCF) yield of 4.5%. ENPH last traded at an FY24 FCF yield of 2.53%. But we don’t think those yields are sustainable, as the market has consistently rejected buying upside at the current levels, as discussed in our price action thesis.

We then used a blended TTM FCF margin of 20% and derived a TTM revenue target of $9.43B by CQ4’26. Unfortunately, based on the revised consensus estimates, Enphase is expected to miss our revenue target by a mile.

Therefore, we believe the market is eventually setting up ENPH for a steep fall, as its valuation is unsustainable.

Is ENPH Stock A Buy, Sell, Or Hold?

We reiterate our Sell rating on ENPH, with a medium-term PT of $110, implying a potential downside of 43.6% (as of July 15’s close).

We urge investors to use the recent rally to cut exposure if they are sitting on massive gains and rotate to beaten-down tech/growth stocks.

Our valuation model indicates that ENPH’s current valuation is unsustainable. Coupled with the worsening macro headwinds, we don’t encourage investors to add at the current levels until a deep retracement has occurred.

Be the first to comment