jaanalisette

Investment Thesis

Twilio (NYSE:TWLO) is a leading communication service company founded by Jeff Lawson back in 2008. It operates in the CPaaS (Communications Platform as a Service) industry providing communication services for businesses through different channels such as messaging, live streaming, video, emails, push notifications, programmable voice services, and chatbots. It also offers other solutions like cloud contact centers and email marketing campaigns. It is currently the leader in the industry alongside Sweden-based Sinch (OTC:CLCMF) and UK-based Infobip. The CPaaS industry has been growing rapidly as it benefited from the massive expansion in the economy and the acceleration of digital transformation thanks to COVID. According to Gartner, 95% of companies will leverage CPaaS platforms to improve operational efficiency and customer experience digitally by 2025.

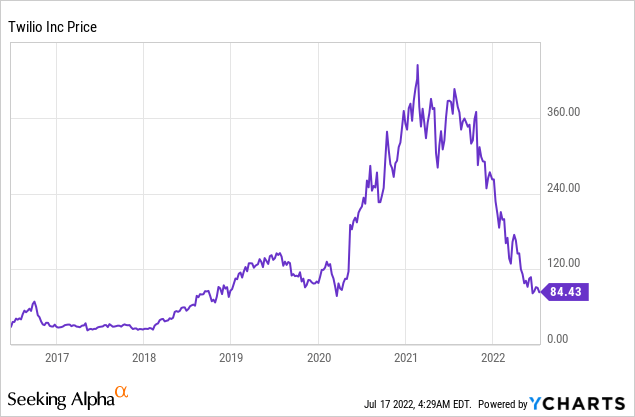

Twilio was one of the best-performing compounders in the last few years. The US-based company went IPO in 2016 at $26.3 a share and saw its share price go up to over $400 in early 2021, representing a whopping 1,500% increase within just 5 years. However, the company got caught in the broad market sell-off last year and shares are now down over 80% from the all-time high. Despite the huge drop in share price, I still believe Twilio is a sell. This is largely due to its heavy exposure to macro headwinds, weak profitability, and inflated valuation compared to peers within the CPaaS industry. The growth of the CPaaS industry is also likely to slow down significantly due to the deterioration of the economy.

Heavily Exposed To Macro Headwinds

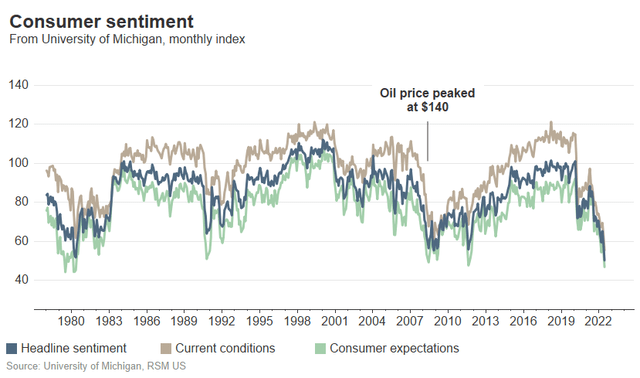

The current uncertainty regarding the macro environment will likely post strong headwinds on Twilio. We are already seeing a significant slowdown in the economy across the board as the inflation rate remains at high levels and supply chain blockage continues. This is worsened by the zero covid policy in China, which reported worse than expected GDP growth for the second quarter. The latest CPI (consumer price index) also came in higher than expected at 9.1%, above the 8.8% consensus. While core CPI (excluding food and energy) increased by 5.9%, compared to the 5.7% estimate. Consumer confidence has been dropping and is currently at levels not seen since the great financial crisis, according to Michigan Consumer Sentiment Data.

Target (TGT) announced earlier that it is lowering income expectations as inflation continues to hurt the company. While other companies like Microsoft (MSFT), Coinbase (COIN), and Tesla (TSLA) are starting to lay off employees. I believe the slowdown in the economy will disproportionally impact Twilio as its business is very cyclical. Unlike other SaaS (subscription as a service) companies with a recurring revenue model and mission-critical products, most of Twilio’s revenue is billed based on usage. Their products are also relatively discretionary unlike services such as cybersecurity and data storage. For example, as fewer people use DoorDash (DASH) in order to save money, DoorDash will have lower messaging and notification volume. This as a result reduces their spending on Twilio. The same goes for other Twilio customers such as Lyft (LYFT) and Deliveroo. As we enter an economic downturn, the demand for communication services will likely continue to drop.

University Of Michigan

Weak Financials

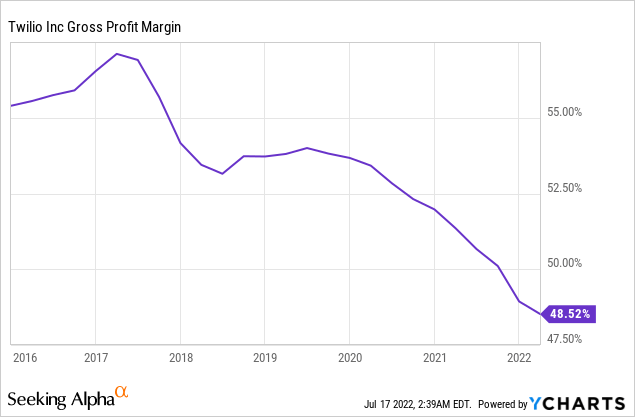

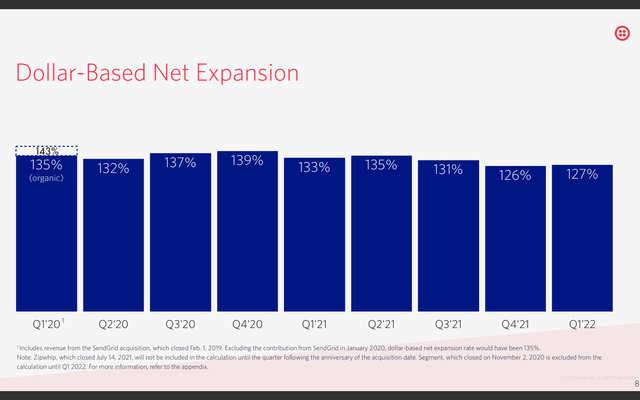

Twilio reported its Q1 earnings back in May. It is still showing strong top-line growth, but gross profit margin and dollar-based net expansion rate keep dropping and profitability remains an issue. The company reported revenue of $875.4 million, up 48% YoY (year over year) compared to $590 million. Active customer accounts increased 14% from 235,000 to 268,000 this quarter. Gross profit was $425 million compared to $298 million a year ago. The gross profit margin dropped once again from 50.5% to 48.5% with cost of revenue up 54.6%. From the chart below, you can see that the gross profit margin has also been dropping substantially over the past few years. This is concerning as it means that the increase in cost of revenue has been outpacing the increase in revenue, indicating bad cost control and weak pricing power. The dollar-based net expansion rate for the quarter was 127%, which has also been trending down in the past few quarters. This means existing customers are now spending less than before, indicating a decrease in demand for communication service products as the economy slows down. The company guided revenue growth to be around 37% for Q2, the lowest in the last 10 quarters.

Despite strong revenue growth, profitability remains a concern. Net loss for the quarter was $(221.6) million, which widened by 7.3% YoY from $(206.5) million. Non-GAAP income from operations was $5 million compared to $17.3 million, down 71.1% YoY. Operating cash flow went from positive $4.5 million to negative $(17.6) million. This is largely due to the increase in research and development and sales and marketing spending, which was up by 37.6% and 36.7% respectively. It is also worth noting that stock-based compensation is also weighing heavily on profitability. Compensation for the quarter was $155.3 million, representing almost 37% of gross profit. The company also expects profitability to continue to weaken. It guided Q2 non-GAAP loss from operations to be negative $(40)million to $(35) million, down from a positive $5 million this quarter. Twilio balance sheet remains very strong. It has $5.2 billion in cash and short-term investments with only $1.3 billion in debt. This will provide them with enough dry powder to handle the current cash burn. However, I think the company will need to find a way to scale efficiently in order to succeed in the long run.

Twilio

Valuation

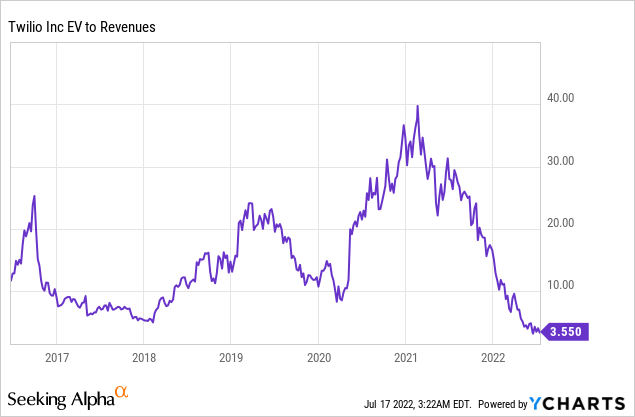

After the massive drop in share price, Twilio is now trading at a historically low valuation, as shown in the first chart below. However, I believe the company is still not cheap due to the nature of its business. I don’t think Twilio should be valued or compared to a SaaS company. Companies like CrowdStrike (CRWD), Okta (OKTA), Cloudflare (NET), and MongoDB (MDB) have mission-critical products with a recurring revenue model. While Twilio has a non-essential product with a usage-based model. Yes, some Twilio products like Flex and Segment can be billed monthly but most services like Voice, Message, and Video are all billed based on usage. This nature of Twilio makes it a lot more vulnerable compared to other SaaS companies therefore I believe a lower valuation is justified.

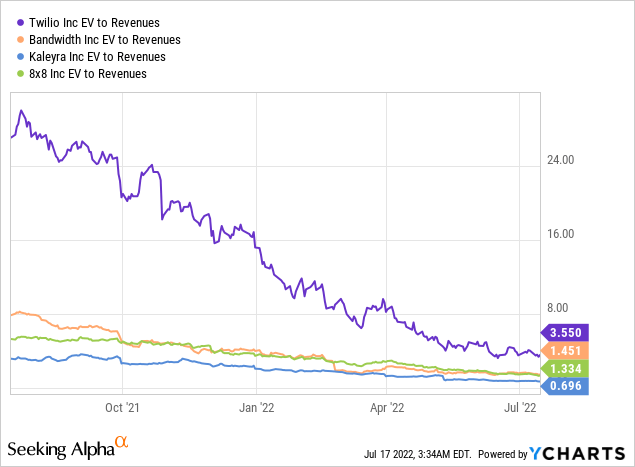

Twilio is now trading at an EV/sales ratio of 3.55x (I am using the EV/sales ratio as the company is still merely profitable with negative cash flow). This is certainly cheap if compared to SaaS companies. However, if we compare Twilio to other public companies within the CPaaS industry, it is actually still trading at a steep premium, as shown in the second chart below. Bandwidth (BAND), 8×8 (EGHT), and Sinch are trading at an EV/sales ratio of around 1.4x, representing a 60.6% discount from Twilio. Kaleyra is even cheaper trading at 0.7x EV/sales, representing an 80% discount. It is worth noting that Sinch, the industry leader only behind Twilio, actually grew revenue by 95.5% in Q1 while trading at a very discounted valuation. I certainly believe a premium should be warranted for Twilio given its leadership position, but the premium should be smaller in my opinion.

Conclusion

In conclusion, I believe despite the drop, Twilio is still a sell at the current price. The company had a good run since its IPO thanks to the broad economic expansion post GFC which significantly increased the demand for CPaaS products and services. However, the growth of the industry will likely hit a speed bump as the economy starts to weaken amid high inflation and rising rates. Twilio is heavily exposed to these macro headwinds as its products are not that essential and have a usage-based model which makes them even more vulnerable. This is reflected in its earnings with the dollar-based net expansion rate dropping. Despite decent top-line growth, profitability is still an issue as operating loss continues to widen. Guidance for the coming quarter also suggests that the worst is yet to come. Despite trading at an all-time low valuation, the company is still trading at a very elevated level compared to peers. Therefore, I believe Twilio is a sell and will revisit it if the company is able to improve its profitability.

Be the first to comment