Viorika/iStock via Getty Images

FISV Half Year Results Review

Fiserv (NASDAQ:FISV) reported half year results. Here are the links to the presentation and to the conference call. Together with the 10-Q these will be my main materials of reference for this article. I assume general knowledge about the company but if you are interested in a more in-depth discussion please refer to my prior articles on Fiserv. Here is my initiation piece and here my take on their full year 2021 results.

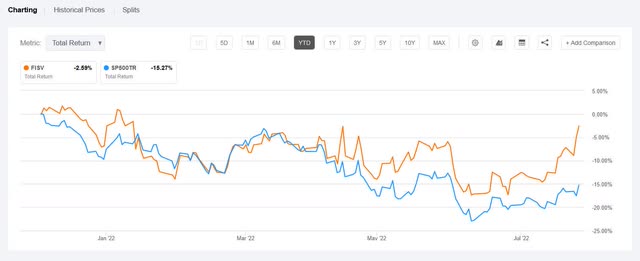

FISV had a tough couple of years in terms of stock performance. But since the start of the year, it showed its defensive qualities in the midst of the market slump thanks to low embedded expectations.

FISV starts outperforming (Seeking Alpha Charting)

Those low expectations also led to a strong upward move after half year results were slightly better than expected. It was pretty much the opposite of the move at full year results. Just like I think the downward move at FY21 results was overdone, I also think that the upward move was a bit too enthusiastic for the results themselves. But I guess given the sizeable upside potential in the stock and the concerns overhanging it was a fair reaction overall.

FISV surprised on the upside especially on revenue growth and had their usual minor beat on adj. EPS.

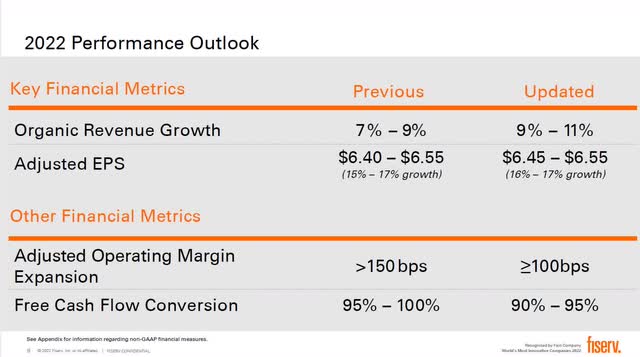

FISV updated guidance (FISV Half Year 2022 presentation)

As one can see FISV also provided updated guidance and the market reacted mainly to the strong upward guidance in revenue and the minor upward tightening of the adjusted EPS range and chose to ignore the more sobering developments for margins and FCF conversion. I will go now into a bit more detail on the main points I think were important.

The Good

Revenue

The big positive is certainly the higher-than-expected revenue growth. Revenue growth expectations for FISV have been in the high single digits. Therefore, showing an organic revenue growth of 12% for the quarter and 11% YTD is a very strong performance.

The standout performer was Merchant Acceptance with a 18% YTD growth rate. This is well ahead of the 11.5% CAGR they projected in their presentation on the merchant segment back in March. Both Clover and Carat grew in low/mid-twenties. Plus, the segment even showed improving margins YTD although in Q2 the trend reversed and margins compressed a little. Nevertheless, a very impressive showing from the two main growth engines of FISV, especially from Carat. If they can keep up Carat having those kind of growth rates that would be a major boost for the company!

Equally impressive although on a lower level was the revenue acceleration in the Fintech segment. This was seen as an old and boring legacy business and I have it bumping along at 4.5% revenue growth in my model. Now they showed a 6% growth YTD and even accelerating through Q2 with 7%. Maybe their Finxact acquisition is already showing up there. Or maybe it is just what they said back at full year results: that Fintech has the largest amount of contracts with a CPI clause which would then only be a temporary growth boost (assuming we get inflation under control). If they can keep that kind of growth it would be a very pleasant surprise.

Payments showed 8% growth in Q2 for an acceptable 6% growth YTD. 8% is at the upper end of the medium term growth guidance of 5-8% but it is just a quarter so far.

It seems FISV was able to capture some inflation benefits on the revenue side as some of their businesses take a percentage cut or have CPI clauses and therefore, benefit from an overall higher price level.

Buybacks

The company bought back over 10m shares in H1/22 for just about $1bn. In addition, they bought back stock for another $400m in July. Therefore, they are easily on track to reduce shares outstanding by 3%+ by year end which is part of their capital allocation strategy to increase adj. EPS. I know, many would like to see debt down a bit more. Me too. But overall, I am still comfortable with them buying back shares now instead of reducing debt. While overall debt stays the same, as operational earnings increase leverage comes down automatically. I actually like it if management shows confidence by buying back shares also in difficult times when the stock trades at depressed valuations.

Unfortunately, buybacks tend to happen in large volume at the peak when everything is just blue sky, and so the stock bought back trades at very high valuations. But all too often once the company/economy faces some challenges and the shares would be cheap the buyback suddenly stops. I am glad to see that this is not the case here. Furthermore, I believe that buying stock at $100 is value accretive.

They increased their revolving credit facility from $3.5bn to $6bn and extended the maturity to 2027. This means even as they do spend basically all their cash on buybacks they will still have the ability to do sizeable acquisitions, should they see an opportunity.

The Bad

Margin compression

While revenue was very strong, margins compressed in Q2 after a decent performance in Q1. Again, Merchant was strong with only a 20bps drop. But Payments dropped by 80bps and Fintech even by 120bps. And this is not just a quarterly hiccup as they lowered they full year guidance by 50bps.

During the conference call they detailed why margins were lower:

The adjusted margin was impacted by a combination of factors, including: first, cost inflation for both labor and material including point-of-sale terminals for our Merchant Acceptance segment and Paper and Plastic for our Payments segment; second, investments related to new acquisitions, including BentoBox and Finxact; and third, continued reinvestment into the business, including wrapping up of the Fiserv First Data integration projects.

Cost inflation is never a good thing and it seems we are now seeing the ugly side of inflation for FISV. Not only does it increase revenue but it also increases costs and leads to margin pressures. I view investments related to new acquisitions as a positive as I assume they are value creative. As for the last point they went into more detail on the call as well:

Additionally, as we’ve talked about in the prepared remarks as well as last quarter, we have this carryover work that we have going on from an integration standpoint. Last year, we dialed those costs out. We added them back to adjusted earnings beginning in January 1 of this year, we stopped dialing that back out.

And therefore, you see those costs hit in Q1. In Q2, they started to ease in the latter part of Q2. They’ll continue to ease at great. So those costs go away. In addition, you get the benefit or the productivity of that integration work. And so, you’ll see a bigger improvement in fourth quarter than you do in third and second half stronger than the first half.

Therefore, while they still guide towards a strong sequential improvement in margins for the second half it seems strongly impacted by First Data integration costs declining strongly in H2 rather than a major operational improvement vs. H1.

Forward Guidance

Granted guidance was increased for revenue and upward tightened for adjusted EPS, but then they grew revenue already by 11% in H1 and 12% in Q2, only to guide to 9-11%. That would indicate that they do not expect the momentum to continue and might even see a slowdown. They do state in their conference call that the lower end of the guidance incorporates a macro slowdown. As I explain under “what to watch out for” I do think there is a sizeable risk of worsening conditions in H2. Therefore, I do view this guidance as prudent but unfortunately not exactly confidence installing.

The same is true for the other parts they guided. Adj. EPS already grew at 17% YTD which means they guided for a potential slowdown. FCF conversion and margin outlook were clearly lowered. Overall guidance was hinting towards a difficult second half which made the strong performance on results all the more surprising to me. But then compared to many other stocks in the market their business still shows remarkable resilience and reliability and maybe that finally gets rewarded by the market.

FCF conversion

FCF conversion was poor at only 65%. While the company already told us at full year results that FCF will be back-end loaded, as they have some major projects going on that will phase out later in the year, the 65% number is still far from their original guidance and consequently they had to lower their forecast for the full year. In the conference call they also detailed the reasons for the low number:

The free cash flow conversion was driven by a combination of: first, increased capital expenditures, particularly in the areas of innovation and integration of newly acquired capabilities; second, increased working capital investment, driven by the very strong revenue growth, including growth in anticipation revenue in Latin America; third, increased inventory to minimize any potential impact to our clients given the risk of supply chain disruption; and fourth, continued investment in software and application development to drive sustainably higher growth across the business.

As readers of my first pieces know I am not surprised by lower FCF conversion rates. If a company grows it needs to invest and also increase working capital. As I mentioned in my first article I modeled increased capex for FISV’s growth phase. And I do not see this as a negative as long as growth follows. What puzzles me is, why management does not acknowledge this.

As for how credible those components are it is hard to tell from the outside. Increased inventory could indeed be the company trying to manage the risk of supply chain disruption or it could be an early sign of demand not being as strong as they expected. For the time being I take their word for it. And whatever the underlying reasons they should be able to release some cash by reducing inventory levels in H2.

The same is true for increased working capital investment. This could simply be a function of growth or maybe a first sign of their customers seeing some liquidity issues and therefore, lengthening their payment periods.

What To Watch Out For

With the Fed raising rates there is certainly a risk of lower consumer spending as the consumer expectations index is now at a fairly low level of 65.3, showing a massive gap to the present situation index at over 141. But this gap closes right now with the present situation index going down. This could negatively impact spending as well as keep some small business owners from investing in new POS equipment right now.

Consumer Confidence (The Conference Board)

In Europe, energy crisis is looming as Russia has cut down its gas exports dramatically and it is unclear how the situation will develop during winter. France is now even thinking about allowing cooking oil to be used as fuel.

This all points to heightened uncertainty and I expect current readings of economic situations by consumers and businesses to align downwards to the already fairly low expectations. This makes for a more subdued and difficult operating environment for the next 12 months in my view. I therefore, have sympathy for FISV trying to play it safe and give a fairly sober revenue guidance given the very good results in H1. It is also worth noting that the strength of the USD due to the decisive Fed action has led to a 2% negative impact on revenue. They back this out on the organic numbers but it still should be noted as it is a real impact for US shareholders. Potential further strengthening of the USD would increase that negative translation effect.

While I believe revenue and adjusted EPS guidance should be met at least at the lower end I am more skeptical with regards to margins and FCF conversion. I believe there is a risk that those might fall short of the projections. Cost increases might be higher than what FISV currently anticipates and if the environment gets more challenging we might see yet another strong increase in payables hampering FCF conversion.

In addition, it will be crucial to watch if Clover slows down, if Carat can keep up its great growth rate and how well the international roll out progresses. Those are the main growth drivers on which my investment case rests.

Summary

FISV beat strongly on revenue and raised guidance. As FISV was never seen as good growth company (mid-to-high single digit revenue growth expectation) this is a very strong signal. However, I do see the positive momentum there at risk in H2 as laid out above.

Furthermore, I feel some of the other developments were not quite as positive, namely margin development and FCF conversion. While the reasons given make sense I do not think they are all that unexpected and should normally therefore be already be incorporated in their guidance. That they had to lower guidance is not optimal.

That said, there was nothing in the results which made me change my overall thesis on the stock and I stick with my buy recommendation (although there might be a better entry point later in the year should the more negative scenarios come into play).

Be the first to comment