dima_zel

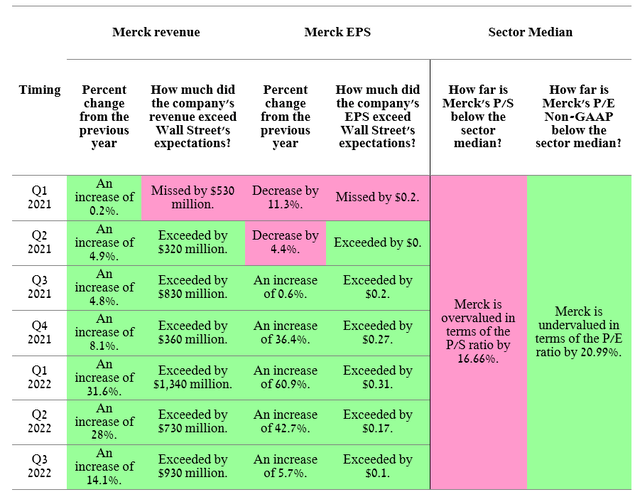

On October 27, 2022, Merck (NYSE:MRK) published its Q3 2022 financial report, which once again demonstrated that the company is capable of beating even the boldest expectations of Wall Street analysts, which ultimately increased investor interest in it. A significant increase in sales of the company’s vaccines and oncology division offset the losses from the lack of sales of the antiviral drug Lagevrio against Covid-19 in the United States and led to a rise in Merck’s share price in line with my expectations. Sales of most of Merck’s medicines show upward dynamics not only compared to the previous year but also relative to Q2 2022, which favorably affects the growth of cash flow and the implementation of a more aggressive R&D policy, which should reduce the risks associated with the loss of exclusivity of some of the company’s blockbusters at the end 2027-2030. Even though the company’s share repurchases have declined in recent quarters, Merck’s high margins are pushing its P/E ratio below the average for healthcare leaders, and thereby showing the correctness of the chosen vector of business development.

Source: Author’s elaboration, based on Investing.com

Merck’s financial position

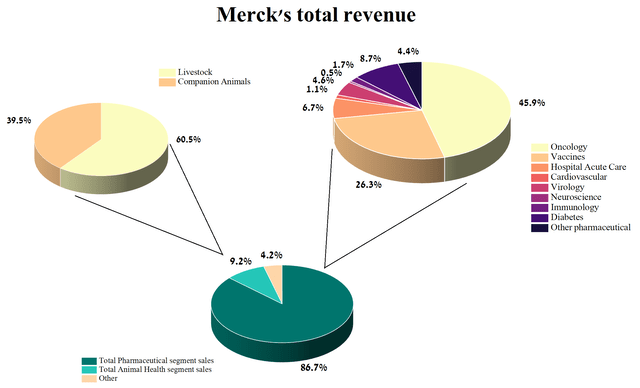

Merck’s business is focused on the development of vaccines and drugs that can effectively fight cancer, respiratory, cardiovascular, and nervous system diseases, etc. With its leading position in various therapeutic areas, Merck’s total revenue was $14,959 million in Q3 2022, an increase of 13.7% compared to the previous year.

Source: Author’s elaboration, based on quarterly securities report

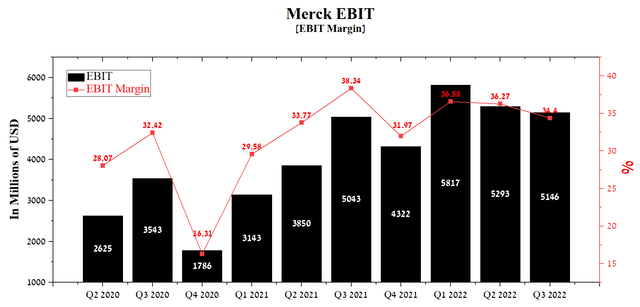

Oncology franchise sales, which include well-known brands such as Keytruda, Lynparza, Lenvima, and Reblozyl, brought Merck 39.8% of the company’s total revenue, and this share has remained stable over the past quarters. With Merck increasing its share of this multi-billion-dollar market, the company’s EBIT is growing year-on-year and amounted to $5,146 million in Q3 2022. In addition, the growth of this indicator was due to several factors, namely the innovative approaches of CEO Robert Davis in doing business and which are manifested in the selection of Merck products that can make a significant leap from the current gold standards of treatment and the conclusion of partnerships with companies whose product candidates are able to expand the company’s influence in fast-growing markets. Merck employees have the necessary professional skills to promote the introduction of next-generation vaccines and medicines into medical practice in the United States, Asia, and Europe faster than competitors, and as a result, their sales dynamics have remained high for many years.

Source: Author’s elaboration, based on Seeking Alpha

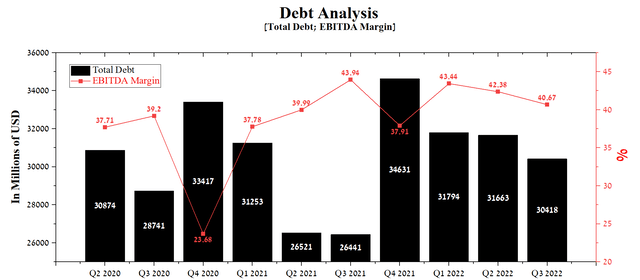

On September 30, Merck announced the acquisition of Acceleron Pharma for a total of $11.5 billion. As a result of financing this deal, the company’s total debt rose to $34.6 billion by the end of Q4 2021. However, since then, this financial indicator has continued to decline quarter by quarter and given the high EBITDA margin, I believe that Merck will not have any problems with redemptions of senior notes or loans.

Source: Author’s elaboration, based on Seeking Alpha

Keytruda continues to take over the cancer therapeutics market

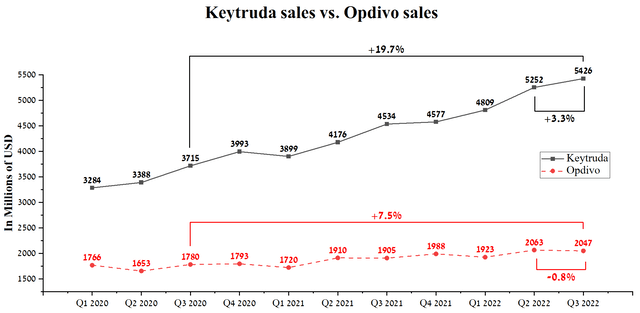

The company’s key mega-blockbuster is Keytruda (pembrolizumab), with global sales of $5,426 million in Q3 2022, up 19.7% year-over-year. While sales of pembrolizumab’s two main competitors, namely Regeneron’s (REGN) Libtayo and Bristol Myers Squibb’s (BMY) Opdivo, are not only significantly behind in revenue, but also do not show the same agility as Merck’s medicine.

Source: Author’s elaboration, based on quarterly securities reports

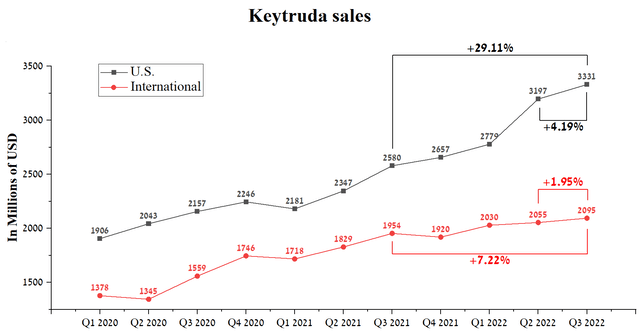

Keytruda’s sales growth has been driven by continued increased demand from physicians who are introducing the medicine to fight certain types of kidney and rectal cancers. In addition, the company has recently begun commercializing a drug for the treatment of high-risk early-stage TNBC and melanoma, one of the most common types of cancer. For example, Keytruda’s revenue was $3,331 million in the US, up 29.1% from Q3 2021. While international sales of Keytruda totaled $2,095 million, showing a more modest year-on-year increase due to lower drug prices outside the US. However, I believe that pembrolizumab’s sales growth will accelerate in Europe and Japan due to the competitive advantage of using Keytruda in the following indications, namely head and neck squamous cell carcinoma and renal cell carcinoma.

Source: Author’s elaboration, based on quarterly securities reports

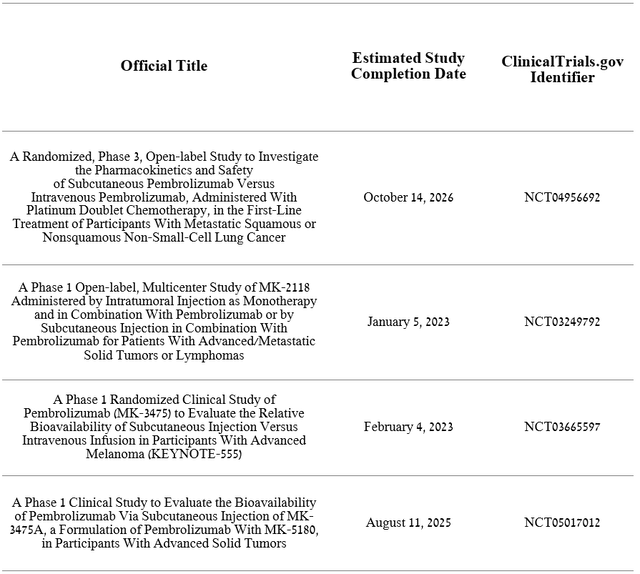

In addition to expanding the use of Keytruda for new indications, Merck is working on a version of the medicine that can be administered subcutaneously, instead of the current intravenous delivery method, to reduce the damage from the appearance of Keytruda biosimilars in 2028. According to a news release on Reuters, patents protecting Keytruda’s subcutaneous formulation could extend its exclusivity until 2040.

The subcutaneous version of Keytruda will have many advantages over the intravenous form of the drug, namely, the time of its administration will be significantly reduced from the current 30 minutes, and patients will be able to self-inject at home, which will reduce their dependence on hospitals. In addition, patients will experience significantly less discomfort associated with intravenous infusion of the drug, and also the subcutaneous form of Keytruda will lead to lower costs for the healthcare system, which will encourage insurance companies to prescribe its branded version, rather than biosimilars.

As a result, the company is conducting several clinical trials to show that the subcutaneous formulation of Keytruda has the same efficacy and similar safety profile as the currently approved version, which is administered to the patient through a vein.

Source: Author’s elaboration, based on clinicaltrials.gov

Merck Approved Medicines Portfolio

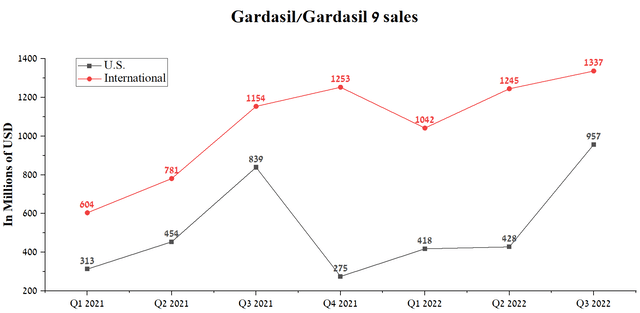

The growth in the vaccines franchise sales also contributed significantly to the company’s revenue, mainly due to the continued positive sales of Gardasil/Gardasil 9, one of the most popular human papillomavirus vaccines. International sales of this vaccine were $1,337 million in Q3 2022, up 15.9% year-over-year, especially due to increased demand from China. In addition, US sales of Gardasil were $957 million, an increase of $118 million from Q3 2021 due to increased government interest in the vaccine.

Source: Author’s elaboration, based on quarterly securities reports

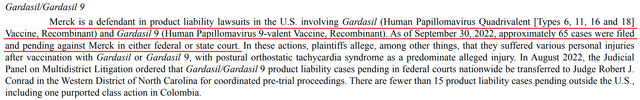

However, investors should be aware that the company is the defendant in several cases in which the plaintiffs allege that Gardasil/Gardasil 9 caused damage to their health. In my estimation, these lawsuits should not cause significant financial damage to the company or slow down the rate of growth in sales of this vaccine.

Source: Author’s elaboration, based on quarterly securities report

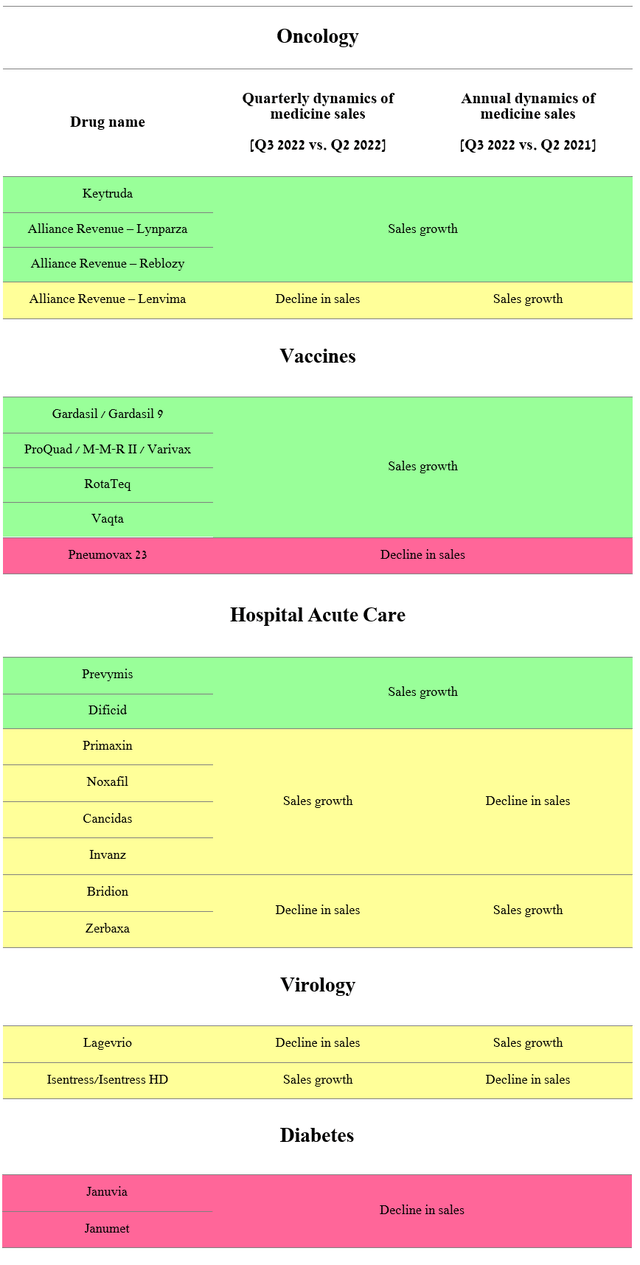

In general, one can observe the following dynamics of sales of Merck medicines from five key therapeutic areas in the 3rd quarter, both relative to the previous year and the quarter.

Source: Author’s elaboration, based on quarterly securities reports

Conclusion

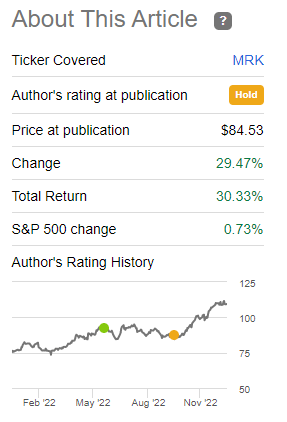

Since writing my last analytics article on Merck in September 2022, the company’s share price has risen by 30%, thus meeting my price target and significantly outperforming the S&P 500 (SPY).

Source: Nathan Aisenstadt – Seeking Alpha

Robert Davis continues to demonstrate high efficiency in managing the company’s business through an innovative approach to M&A policy, which allows for finding some of the most promising product candidates being developed for the treatment of diseases with high unmet medical needs. In the 4th quarter of 2021, Merck closed the acquisition of Acceleron Pharma, a leader in the study of the TGF-beta superfamily of proteins, which play one of the key roles in regulating the recovery and growth of various cell types and thus have great potential in the treatment of cardiovascular and oncological diseases, kidney and blood diseases, etc.

Keytruda, Lynparza, Lenvima, and Reblozyl continue to actively increase their share of the fast-growing cancer therapeutics market, resulting in the company’s oncology franchise revenue of $5,951 million in Q3 2022, an increase of $983 million from the prior year. Moreover, Merck is working on a subcutaneous version of Keytruda instead of the current intravenous delivery method to mitigate the damage of its biosimilars in 2028 and extend pembrolizumab exclusivity through 2040. Given the many benefits of the new formulation, I estimate that the company will have no significant difficulty in persuading insurance companies to prescribe the branded version of Keytruda rather than biosimilars.

The improvement in Merck’s financial position is also positive for the price of the iShares Biotechnology ETF (IBB) and, in my estimation, will allow the company to acquire smaller players in the SPDR S&P Biotech ETF (XBI) that are experiencing downward pressure on their share price due to the Fed’s interest rate hike.

Merck adheres to a policy of increasing dividend payments year after year despite the various economic crises and military conflicts that have increasingly emerged in recent years. Given the company’s higher operating income and revenue growth, successful clinical trial data in partnership with Moderna (MRNA), and the expansion of indications for Keytruda and other blockbusters in recent quarters, I’m raising Merck’s price target from $110 to $135 per share.

Be the first to comment