designprojects

It’s been about 4 months since I wrote my cautionary note on The Greenbrier Companies Inc. (NYSE:GBX), and in that time the shares are down about 31% against a loss of about 14% for the S&P 500. The company has just released earnings, so I thought I’d check back in here to see if it makes sense to buy or not. I’ll make that determination by reviewing the last financials, and by looking at the stock as a thing distinct from the business. I also wrote what were at the time deep out of the money puts that are now very much in the money, so that trade deserves commentary also.

I’m terrible at remembering old saws and bits of ancient wisdom. Is it “buy high, sell low?” Sounds weird, but I’ll look it up on Al Gore’s information superhighway. No. I was wrong. It’s “buy LOW and sell HIGH.” That makes more sense. You profit by collecting the difference between “low” and “high.” Being reminded of this one raises a question, though. How do we “buy low” exactly? Do any of you have a mysterious benefactor who sells you the stocks of perfect, blemish free companies at a price that you might consider “low?” Me neither. In order to “buy low”, we need to do so when others are fearful. That’s why investing well is so hard. Every 11-year-old gets the idea of “buying low” in the abstract, but when it comes to actually pulling the trigger, few of us have the emotional sand necessary. That’s why investing well has been described as “simple but not easy.”

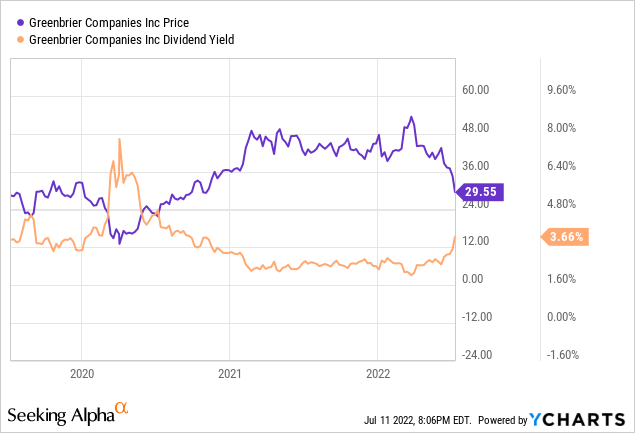

With that as a preamble, I’m going to announce that I’m now buying Greenbrier aggressively. I know it’s not much of a surprise at this point, because the title and the bullet points above stole the surprise, but it is a dramatic shift for me notwithstanding. The company’s latest financial results aren’t actually that bad in my estimation, even when compared to the high water mark of 2019. Additionally, the backlog is now sitting at $3.6 billion, which is the highest it’s been in 6 years. This offers a great deal of visibility into future earnings. Although the capital structure has deteriorated somewhat, I think the dividend is very well covered. Most importantly, though, the shares are now trading at ridiculously low valuations in my view. They’re about 52% cheaper than they were when I last reviewed this name, and the dividend yield has climbed back above 3.6% for the first time in a few years.

Earnings Update

In my previous missive on this name, I mentioned that I was generally happy with the financial results, but the valuation was keeping me away. The company has just released more financial results, obviously, and those deserve comment. I don’t want to trod over old ground, so I’m going to limit my discussion to the most recent period relative to previous periods. If you want to read about my take on the sustainability of the dividend etc., I invite you to read my previous work on this name.

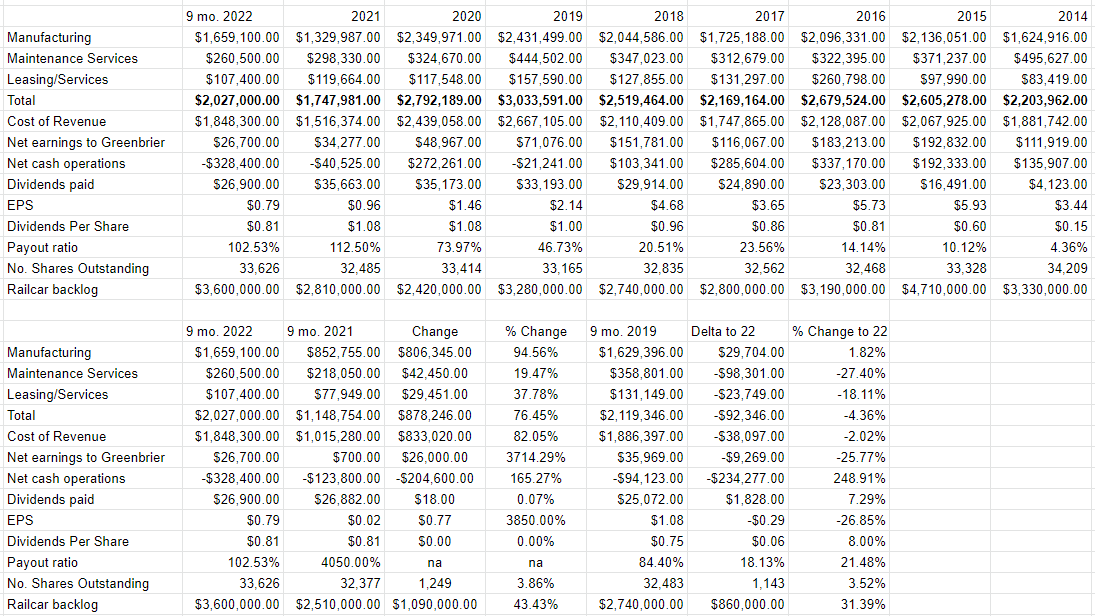

I’d say that the first nine months of this year have actually been rather good. Revenue for the first nine months of this year is up about 94.5%, and net earnings to Greenbrier are up a massive 3700%. Although cost of revenue exploded higher by 27%, margin increased by just shy of 34% because revenue exploded higher. Earnings from operations swung from a loss of $2.1 million last year to a positive $56.5 million this year. Much of that (about $34.3 million) is the consequence of a gain on the disposition of equipment, but even if we strip that out, earnings from operations were much stronger this year than last. This year’s relatively positive performance compared to last year is highlighted further when we note that, in spite of a $36 million income tax benefit last year, net earnings attributable to Greenbrier are up massively to $26.7 million.

It’s not all sunshine and lollipops over at Greenbrier, though. Cash from operations was much lower during the most recent nine months relative to last year. Some may fret about this, but I note that the company paid down about $120 million more in accounts receivables, and inventory costs increased from $92.3 million last year to $224.2 million this year. The rise in inventory costs isn’t a problem specific to Greenbrier.

It’s all well and good to compare the 2022 to 2021, but it’s dangerous leaping to too many conclusions after looking at only 2 data points. Things look far less good when we compare the most recent nine months to the same period in 2019. Revenue was a bit lower in 2022 (down by 4.3%) but net earnings were materially lower, down about a quarter from $35.9 million to $26.7 million. There’s no getting around it. The reason for this relatively soft performance relates to the fact that the company’s wheels & repair, and leasing businesses were materially weaker in 2022 relative to 2019. Revenue from the former was down about 27.4% and for the latter things were off by about 18%. This flowed down the income statement, with the result that margin was $54.2 million (23.27%) lower. Before we get too down on the company, though, we should all take a breath and remember that 2019 was a particularly good year for the company, with revenue that year up over 20% from 2018. So, in fairness, 2022 wasn’t too bad relative to normal performance here in my view. We also need to remember that this company has a backlog well over $3 billion, which gives enormous visibility about future earnings.

Finally, I don’t like the turn the capital structure has taken over the past nine months, with cash down about 30%, and notes payable up by about 25.6% to just over $1.5 billion. That said, I don’t think the change is enough to endanger the dividend and would therefore be happy to buy this stock at the right price.

Greenbrier Financials (Greenbrier investor relations)

The Stock

As my regulars know, I consider the “business” and the “stock” to be quite different things. In case you’re new here, I’ll let you in on this secret, too. I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs, performs value-adding activities on them and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business. It’s also possible that the stock’s movements relate to the crowd’s view about “the market” in general, and have very little to do with what’s going on at the company. While I can’t prove a counterfactual, I think that if the S&P 500 was up since I last wrote about Greenbrier, instead of being down over 13%, Greenbrier would not have fallen as far. So, in some sense, Greenbrier has been “doubly buffeted” by the crowds’ rapidly changing views about the company, and their changing appetite for risky assets in general.

This presents an opportunity because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations.

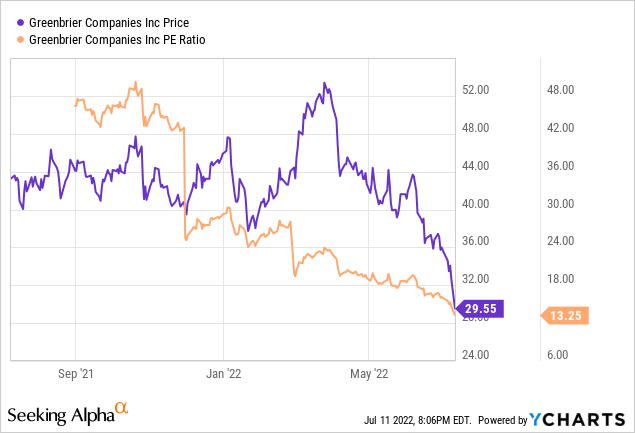

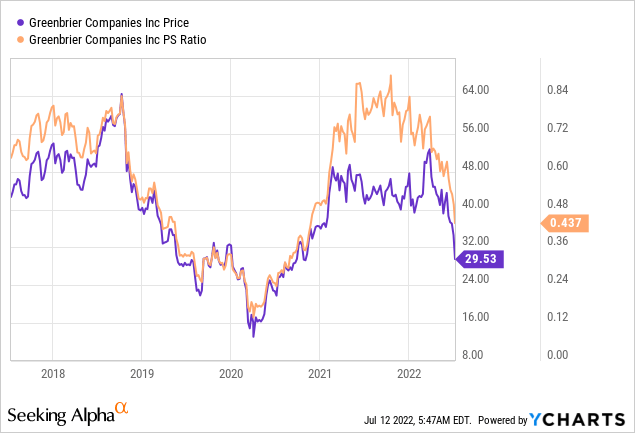

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. Previously, I recommended continuing to avoid the shares because they were trading at a PE of 20.16, and a price to sales of .67. What a difference three months can make, because they’re now trading about 52% cheaper, per the following:

At the same time that investors are paying less, they’re getting more in terms of the dividend yield, per the following:

This is enough for me. The financial performance is acceptable, in my view, and the stock is now trading at the bottom end of its valuation range. I’m going to start buying aggressively at this point. The shares may come down further in price, but I think the 3% plus dividend yield is too rich to pass up.

Options Update

In my previous missive on this name, I suggested that selling what were then deep out of the money puts was a better idea than buying the stock. The stock was trading hands at the time at about $45, and I sold the December strike of $35. I earned $2 for these, and they last traded hands at $7.10. If you’re a regular reader you know that I only ever write puts on companies I want to own at prices I’m willing to pay. I’m comfortable being exercised on these at a net price of $33, so I’m going to remain short these puts. I consider the fact that the market is offering the opportunity to pick up these shares at an even more attractive price to be a bonus.

While I would normally recommend selling puts in addition to buying the stock, I won’t in this case. There’s part of me that thinks the current share price is not long for this world, and that the shares will climb from current levels. Thus, I think the person who sells puts will see them expire, and that’s a positive. The problem is that that upside is limited. When stocks are trading this cheaply, there’s nothing for it in my view but to bite the bullet and buy the stock. For the December puts with a strike of $30 are bid at $2.10 as I type this, but I think the person who buys the stock will enjoy a much greater return, and so when trying to decide between stock and short put, the stock “wins.”

Conclusion

I think we’re currently being presented with one of those rare opportunities to buy a reasonably good business at a very good price. I know it might be emotionally taxing, but I think this is the time we buy. Others are fearful, this is a profitable business that has what I consider to be a sustainable dividend, so it “checks all the boxes” to borrow an American phrase. We’re told to “buy low” and the only way to do that is when things require some courage. I would suggest people muster their courage and take a small position in this business. I think that over time, they’ll be glad that they did.

Be the first to comment