Justin Sullivan

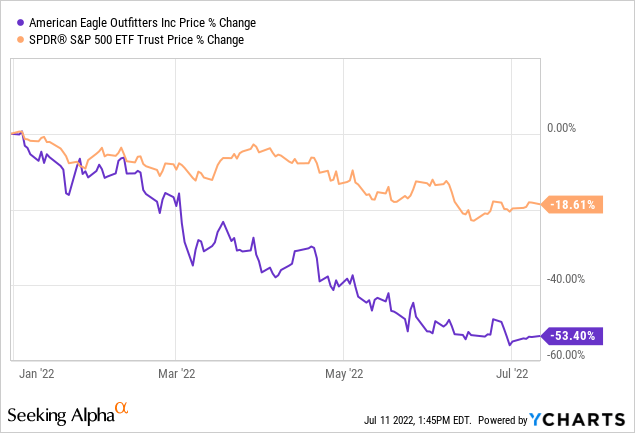

American Eagle Outfitters, Inc. (NYSE:AEO) has lost more than 50% of its market value year to date, while the broader market has only declined by about 19%.

In our opinion, the underperformance may last in the upcoming quarters. However, there are certain factors that make the stock appealing. In this article, we will take a look at some of the pros and cons of investing in AEO now.

Let us start with the cons:

1.) Declining consumer confidence

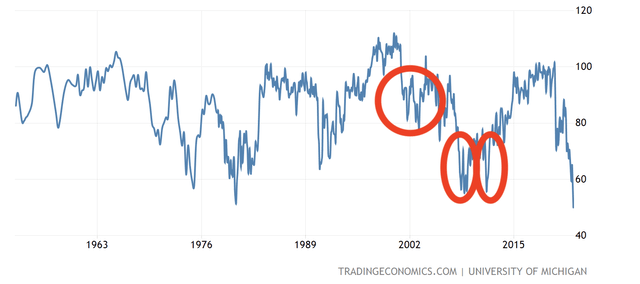

Consumer confidence is often treated as a leading economic indicator, which could be used to predict potential changes in the consumer spending behavior in the near future.

In the past months, consumer confidence has been gradually declining, falling even below levels seen during the financial crisis in 2008-2009. Although consumer spending has remained strong in the first half of 2022, we believe that the low consumer confidence will have a negative impact on spending in the near future. Low consumer confidence normally results in reduced spending on durable, discretionary, non-essential goods. Reduced spending could be a result of either completely eliminating a purchase, delaying the purchase, or switching to a lower cost, more affordable alternative.

So let us actually take a look at how AEO’s stock price has developed during times of low consumer confidence in the last 20 years.

U.S. Consumer Confidence (Tradingeconomics.com)

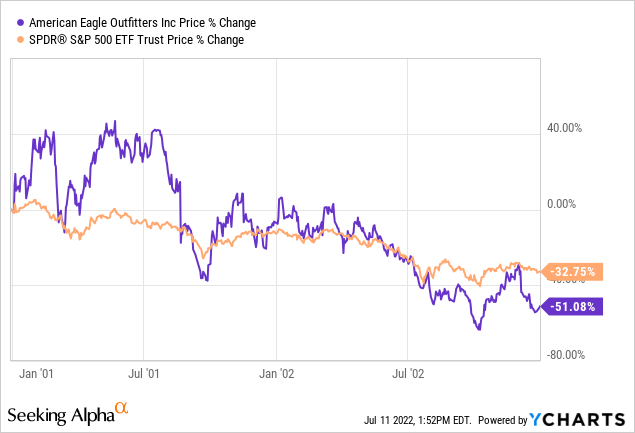

2001-2003

Between 2001 and 2003, AEO lost more than 50% of its market cap, while the S&P500 (SPY) declined by “only” 33%. Although in this period the market performed poorly, AEO performed even worse, and the volatility was also significantly higher.

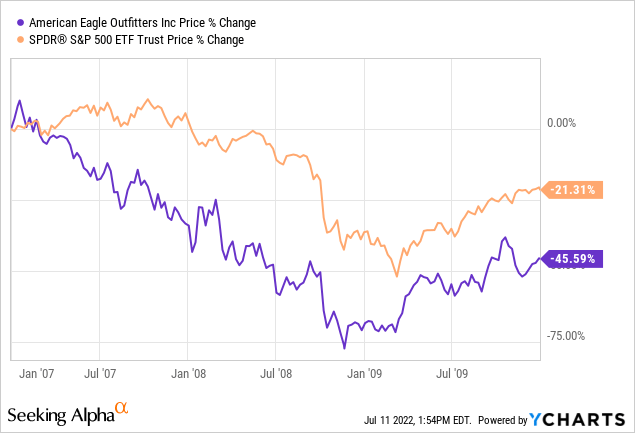

2007-2010

In this time period, AEO once again underperformed the broader market, losing more than 45% in the three-year period. The underperformance with not associated with the financial crisis only. The underperformance started already in early 2007.

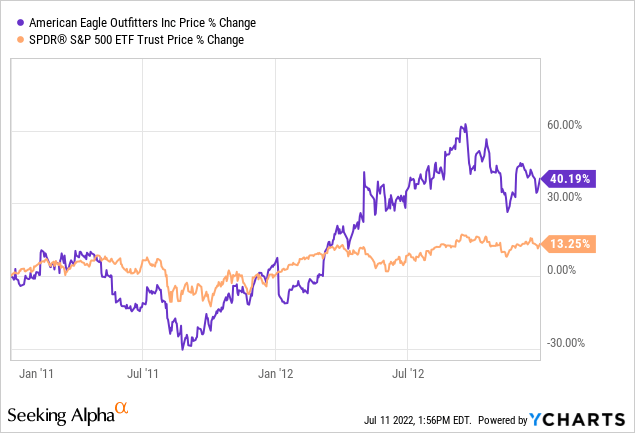

2011-2013

In contrast to the other two periods, between 2011 and 2013, the firm actually outperformed the broader market substantially, driven by the sharp stock price increase in 2012.

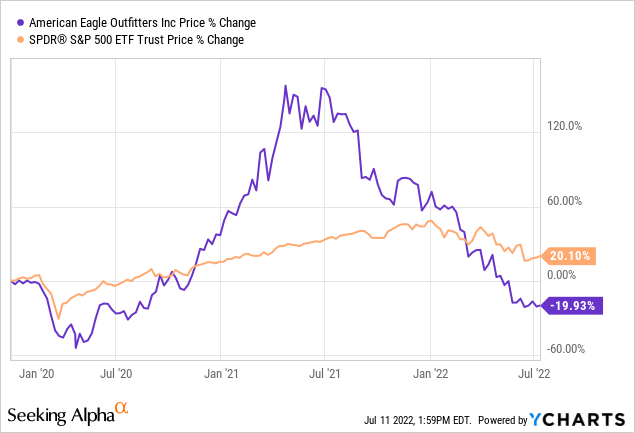

If we look at how AEO has performed between 2020 and 2022, we can see that in the first half of 2020, the period which was largely defined by the impacts of the pandemic, AEO has substantially underperformed. In the first half of 2021, with the easing of COVID restrictions, reopening of the economy and increasing consumer confidence, the firm has done much better. Since the peak in July 2021, the stock price has been gradually declining again, however.

Based on these historic performances, we believe that there is still downside risk. For this reason, we do not recommend starting a new position in AEO now. Let us take a look now at what macroeconomic headwinds could be causing further downside risk in the near term.

2.) Elevated commodity prices

Elevated commodity prices have been causing significant margin contractions for many firms in the first quarter of 2022.

The high oil and gas prices have not only resulted in increased raw material costs but have also caused a substantial increase in freight/ transportation costs.

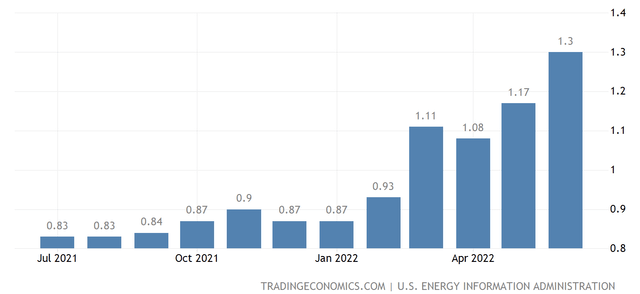

Gasoline Prices (USD/L) (Tradingeconomics.com)

Gasoline prices have been increasing in 2021, but have literally skyrocketed in February 2022, as the geopolitical tension in the Eastern European region started to unfold. As the outcome and duration of this conflict are highly uncertain, we expect the gasoline prices to remain elevated throughout 2022. There has been some positive news from OPEC+ about increasing oil output in July and August by a higher than planned amount in order to increase supply and moderate price. Although prices have slightly come down since the beginning of July, they remain elevated compared to the 2021 levels.

Due to this uncertainty, and its impact on AEO, we remain cautious with investing in AEO right now. Although the firm may be able to partially offset the increased costs by pricing, due to the high competition and declining consumer confidence, we believe that fully offsetting the increased costs is too optimistic in the current market environment.

Let us take a look now at what could actually make AEO’s stock attractive at this point.

1.) Dividend

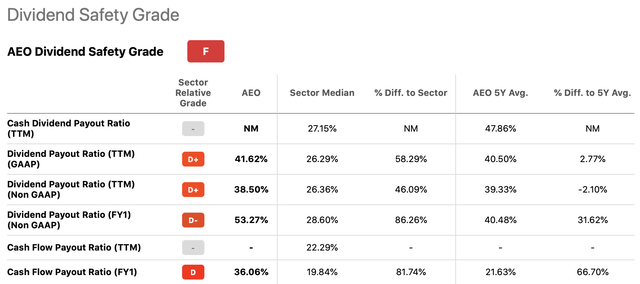

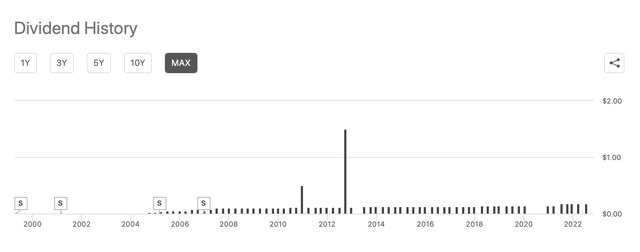

AEO pays a safe and sustainable quarterly dividend of $0.18 per share, which corresponds to an annual dividend yield of about 6.1%. For this reason, we believe that AEO could be a potential addition to a dividend portfolio.

Dividend Safety (Seekingalpha.com)

The dividend safety of AEO actually appears to be very poor compared to the consumer discretionary sector median, due to the high payout ratios. However, when we compare the payout ratios with AEO’s 5-year averages, we see that they are actually more or less in line. While the firm has a higher dividend payout than the sector median, it is not exceptionally high. For this reason, we actually believe that the payout is sustainable, even if demand declines.

We also cannot forget that AEO has a relatively long track record of paying dividends to its shareholders. Since 2017, the firm has been paying dividends each year consecutively, despite pausing the payment in some quarters, especially in 2020.

Dividend History (Seekingalpha.com)

All in all, in our opinion, AEO could be an attractive dividend stock.

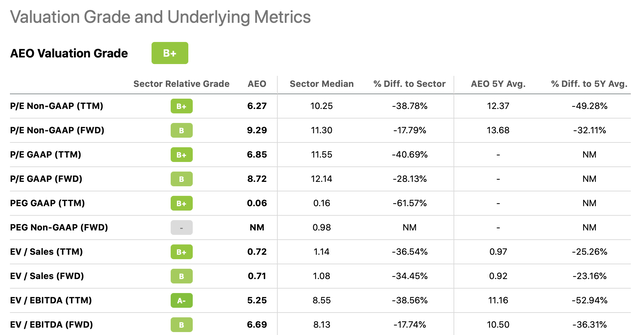

2.) Valuation

Although we believe there is still downside risk, the valuation of the firm already appears reasonable.

Based on a set of traditional price multiples, including price to earnings ratio and EV to EBITDA, the firm seems to be trading at a significant discount. Although there may be headwinds in the near term, and margins may contract, such a discount could already appear attractive.

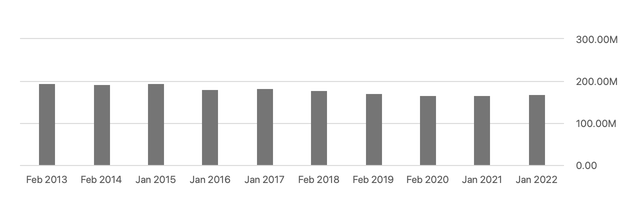

Especially when we take into account AEO’s strong track record of share repurchases.

Shares Outstanding (Seekingalpha.com)

In the last decade, the firm has managed to reduce its number of shares outstanding by as much as 13%, generating additional value for the shareholders. In June, the firm also announced that they intend to strengthen their capital structure by starting an accelerated share repurchase program.

Key takeaways

AEO has shown significant underperformance during two out of three periods in the last 20 years, which were characterized by low consumer confidence. Although past performance is not always reliable to forecast future performance, we believe in the current market environment downside risk still exists.

Macroeconomic headwinds and near-term uncertainties could be fueling margin contractions and the potential worsening of the financial performance in the near term.

On the other hand, the firm appears to be trading at a discount compared to the consumer discretionary sector median and pays an attractive dividend yield of more than 6%.

For these reasons, we rate AEO as “hold” currently.

Be the first to comment