ShadeON/iStock via Getty Images

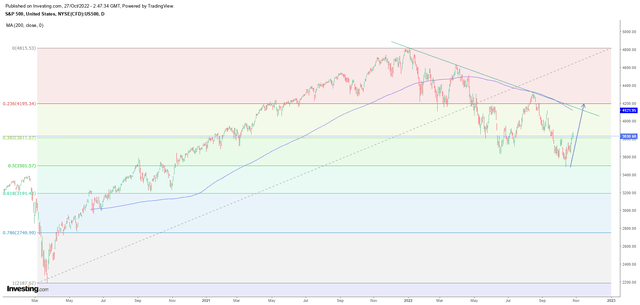

The S&P 500 Index (SP500) has decisively broken above our initial target level of 3,800 in just two weeks since we called this rebound. Despite mixed earnings from Alphabet (GOOG) (GOOGL), Microsoft (MSFT), and Meta (META) triggering a sell-off for the tech-heavy Nasdaq (NDX), the S&P 500 appears to be holding comfortably above 3,800 at the time of writing. Although we foresee further signs of sluggish growth for the remainder of the earnings season, we continue to see the potential for the S&P 500 to achieve our year-end target of 4,200.

Our 4,200 target is based on a longer-term Fibonacci Retracement extending from the S&P 500’s March 2020 low to its all-time high in January 2022. This rally towards 4,200 also coincides with other bullish technicals that will see the S&P 500 testing its 200-Day Moving Average and trendline resistance as shown in the chart above. As such, a successful move to 4,200 would also signal a decisive reversal of the current downtrend, potentially paving the way for the next bull market cycle.

Fed Pivot Narrative Is Premature

The financial media has broadly attributed the latest rally to growing expectations of the Fed pivoting on monetary policy. Not only does this narrative of a Fed pivot seems premature given that we have yet to see conclusive evidence that inflation has been adequately contained, but we also think that a Fed pivot may not even be necessary to justify our bullish outlook on equities. Given that sentiment on equities was extremely bearish to begin with, it shouldn’t come as a surprise that the market would see such a forceful rebound.

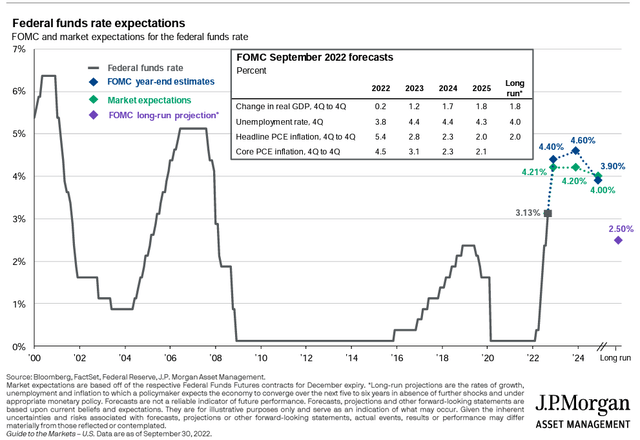

To be sure, we are of the view that inflation has peaked and should continue to moderate in the coming months. However, we expect the Fed to hold policy rates at 4.5% to 4.75% for an extended period of time, quite possibly till late 2023.

Bloomberg, Federal Reserve, J.P. Morgan

Unless there are signs of a sharp slowdown in economic activity that risks a deep economic recession, the Fed is likely to remain focused on fighting inflation for the time being. Even if prices were to remain flat, year-on-year inflation will still take several months to reach the Fed’s 2% inflation target.

Having said that, we believe that conclusive evidence of peak inflation would be sufficient to ignite the next equity bull market. A Fed pivot is not required.

Can The Economy Accommodate Higher Rates?

Given our view that a Fed pivot is unlikely to happen anytime soon, the key question then rests on whether the U.S. economy is resilient enough to accommodate Fed Funds rates of 4.5% to 4.75%.

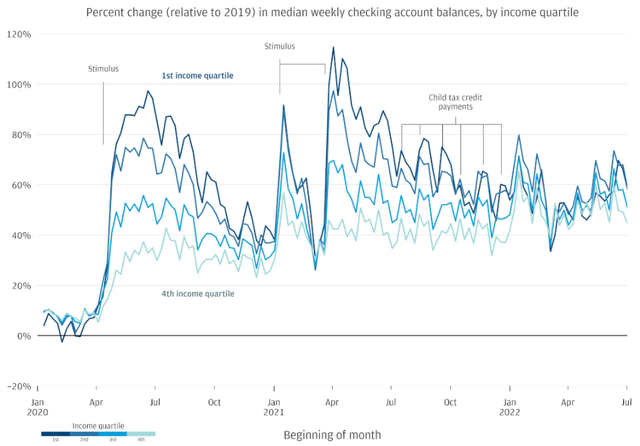

First of all, private consumption makes up close to 70% of the U.S. economy, and the latest data indicate that household balance sheets remain healthy. As the accompanying chart shows, median weekly checking account balances across income levels are substantially higher compared to pre-pandemic levels. Thus, the consumer is definitely in a good position to do the heavy lifting again when sentiment improves.

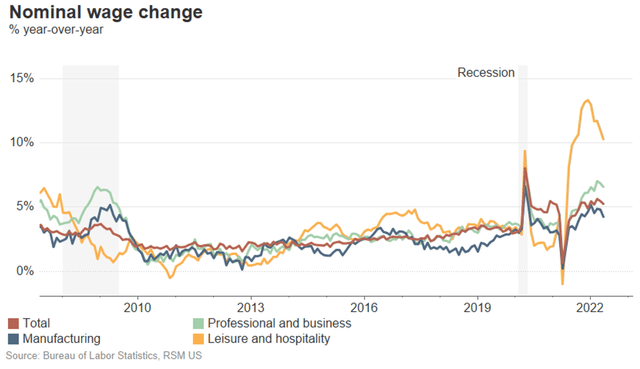

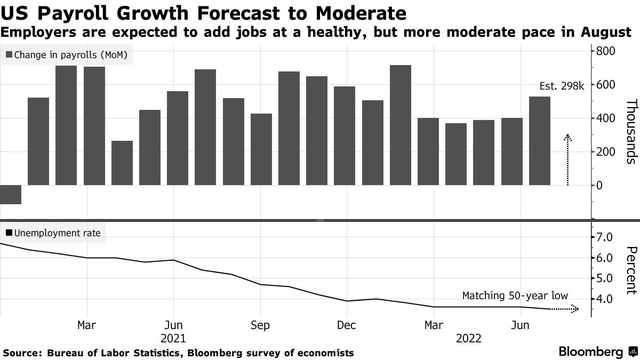

Meanwhile, the U.S. labor market remains favorable for workers with hourly wages picking up since the beginning of the year due to labor shortages. Labor market tightness has become a major factor influencing the Fed’s outlook for inflation and monetary policy. Fed officials are likely acutely aware of the risks that a tight labor market could lead to second-round inflationary pressures and are hoping that aggressive monetary policy will help dampen demand for workers.

Although we are starting to see signs of a cooling economy, the outlook for the labor market remains uncertain as the latest data from the Bureau of Labor Statistics continue to show that there are 1.7 open jobs for every available worker. Most forecasts are calling for a 1% to 2% rise in the unemployment rate in 2023 consistent with a mild and shallow recession.

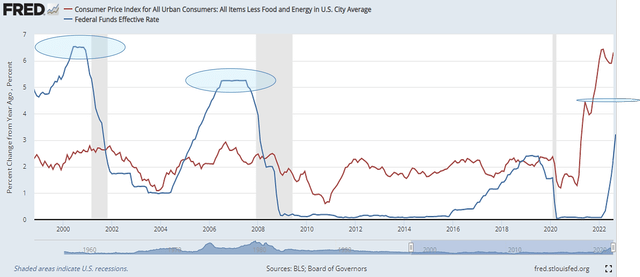

Secondly, we note that higher interest rates are not a new phenomenon for the U.S. economy. Fed Funds Rates were much higher back in 2000 (6.5%) and 2006 (5.25%) but were not the key factor responsible for causing a deep recession.

Therefore, there is little reason to believe that the Fed’s target policy rate of 4.5% to 4.75% in 2023 will necessarily cause a deep recession and a dramatic collapse in equity prices. Equity markets can and have performed well in monetary tightening environments, e.g., (2004-2008) and (2016-2019).

Federal Reserve Economic Data, St. Louis Fed

The Fed’s target policy rate of 4.5% to 4.75% by Q1 2023 also sits well with our outlook for inflation to moderate over the coming months, which should bring real interest rates back into positive territory. The era of ultra-loose monetary policy and negative real interest rates is over, and we should expect interest rates to return to a more neutral level of around 3% going forward.

In Conclusion

We believe the U.S. economy is resilient enough to accommodate Fed Funds Rates of 4.5% to 4.75% given the strength of the labor market. Equity markets have also proven to have performed well in monetary tightening environments in previous cycles. Even without a Fed pivot, we continue to see the potential for the S&P 500 to achieve our year-end target of 4,200.

We maintain our “Strong Buy” rating on the S&P 500 Index.

Be the first to comment