Tinnakorn Jorruang/iStock via Getty Images

Despite the total return of its shares falling by more than 39.8% in the last 12 months, Green Thumb Industries (OTCQX:GTBIF) is an attractive investment for a medium-term hold, and currently it’s valued at a level that makes it a favorable purchase in comparison to other U.S.-based cannabis companies. In short, the bull thesis for Green Thumb is that its plan to massively expand its number of distribution outlets is likely to succeed, resulting in its top line growing and its share price rising sharply between now and 2025 or perhaps even sooner. With a strong balance sheet, a sound growth strategy, and effective positioning in the state-level marijuana markets of the near future, its biggest risk is if the cannabis market gets swamped with excess supply.

But investors may also experience additional upside stemming from the business’ ongoing attempt to build the value of its marijuana brands. That should eventually help to defend its market share from powerful competitors that may not be as finely attuned to the preferences of their customers. Let’s investigate the merits of the bull thesis in more detail, then analyze the stock’s valuation as well as the risks faced by investors.

With a massive retail scale-up in progress, more growth is on the way

Similarly to most multi-state operators (MSOS) in the marijuana industry, Green Thumb has several brands for its cannabis products, enabling it to compete in almost every segment of the market. Likewise, it operates a few different dispensary chains, with some tailored for its medicinal-use segment and others for its adult-use and wellness segments. These two things mean that it has the ability to make a sale to most of the customers in the market for legal cannabis products in the U.S., which makes its total addressable market quite large. In fact, by 2030, management thinks the U.S. legal-use cannabis market could be worth as much as $100 billion annually.

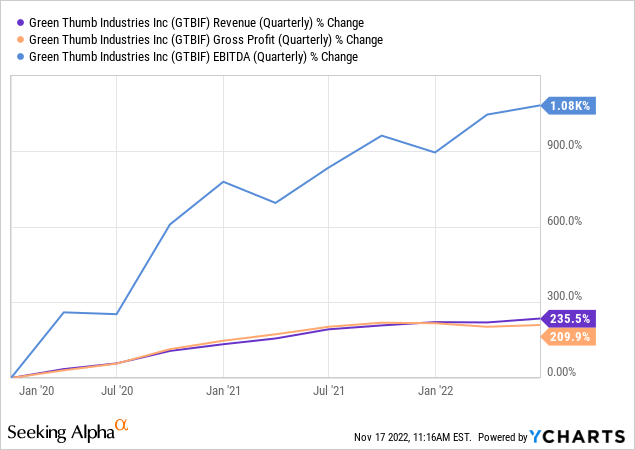

The business is already positioning itself to grab a significant slice of that pie. In its 2021 fiscal year, Green Thumb reported $893.56 million in total revenue and $75.43 million in diluted net income. Since the start of 2020, its quarterly revenue, gross profit, and earnings before interest, taxes, depreciation, and amortization (EBITDA) have all risen sharply, as shown in the chart below:

Driving that demand was falling stigma surrounding cannabis use and climbing nationwide demand for cannabis products. But, the pace of top line growth has stagnated somewhat this year, with its Q3 revenue expanding by only 12% year-over-year, reaching $261 million. In the same period, its quarterly diluted earnings per share (EPS) fell by 50% compared to a year prior to reach $0.04.

Management cites product price compression as offsetting both the impacts of growth in same-store foot traffic and rising unit volume. If price compression continues in its major segments, which if the 2021 cannabis glut in Canada is of any predictive value, it will, investors should expect margins to come under pressure.

Nonetheless, that won’t stop the top line from exploding higher over the next two years. Green Thumb’s retail footprint already gives it access to half of the U.S. population, and it has a presence in a majority of the states that allow for adult-use sales of marijuana, nor to mention in large medicinal-use markets like Florida, Pennsylvania, and Minnesota. It’s also in the process of doubling its number of dispensaries in markets where licenses to grow or sell cannabis are restricted by regulators from 77 to 154. For reference, between the third quarter of 2022 and a year prior, it opened or acquired 12 new locations.

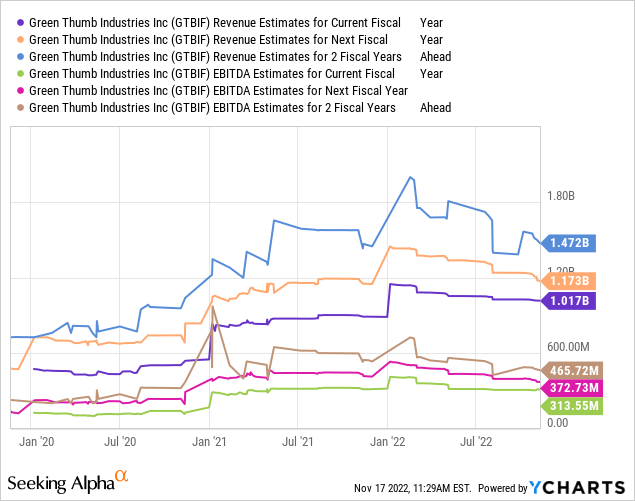

The plans to broaden its retail footprint are likely to be transformational. Just look at the forward estimates for its top line and EBITDA performance pictured below:

The massive scale-up is likely to succeed for a few reasons. First, with $147.26 million in cash and equivalents and consistent quarterly profitability since the start of 2021, it has plenty of money to finance its expansion. Second, it already has a medicinal-use presence in many of the state markets that recently passed adult-use marijuana legalization, and it’s waiting on regulators to give businesses the final go-ahead to commence in several states too. That means it’ll be able to capture the firehose of demand from first-time legal cannabis buyers in places like New York, Virginia, New Jersey, and Connecticut.

And with its distribution networks already set up to serve its medicinal marijuana outlets in those regions, it’ll be significantly easier to open up even more locations. Finally, with a debt-to-equity ratio of only 0.13, and long-term debt of only $254.50 million, the company will have no problem borrowing even more cash if it wants to accelerate the pace of its market penetration.

The valuation is on the cheap side of reasonable

With Green Thumb’s strategic growth plan in full swing, the stock’s valuation is also ripe at the moment. Consider this table depicting its enterprise value (EV) to revenue multiple and its EV to EBITDA ratio in comparison to its major competitors:

|

Company |

EV to Revenue |

EV to EBITDA |

|

Green Thumb Industries |

3.5 |

9.1 |

|

Trulieve Cannabis (OTC: OTCQX:TCNNF) |

2.2 |

13.7 |

|

Curaleaf Holdings (OTC: OTCPK:CURLF) |

4.1 |

18 |

|

Tilray Brands (NASDAQ: TLRY) |

4.4 |

11.7 |

|

Verano Holdings (OTC: OTCQX:VRNOF) |

2.5 |

11.4 |

|

OrganiGram Holdings (NASDAQ: OGI) |

1.6 |

N/A |

|

Cresco Labs (OTC: OTCQX:CRLBF) |

1.6 |

N/A |

Source: Compiled by author with data from Ycharts.

As you can see, the company is middle-of-the-road in terms of its EV to Revenue ratio, and priced quite cheaply in terms of its EV to EBITDA multiple. While it’s true that its valuation fell sharply in the last year as marijuana stocks were punished by a combination of rising interest rates and unfavorable fundamentals among major players, don’t expect the current pricing to last. Between incipient catalysts like further progress with marijuana legalization and the market pricing in any reported progress with the expansion plan, the chance of majorly underperforming earnings expectations is likely to be one of the few situations that could make for a deeper bargain over the next couple of years.

The window to invest won’t be open forever, and there are notable risks too

The key metrics for investors to watch to determine whether Green Thumb’s expansion plans are working or not will be its quarterly revenue and its number of new stores. As soon as newly-opened locations start to contribute to post top line growth, which could take as little time as a quarter or two per store, the market is likely to react aggressively and bid up the business’ shares. When that occurs, expect the share price to be (temporarily) much higher than the actual amount of realized sales growth.

That implies investors will maximize their potential upside by starting their positions sooner rather than later. But, the company’s success is not a given.

From a risk management perspective, the most important issues are competition, and creating the conditions of oversupply. As demonstrated in the Canadian cannabis market last year, oversupply occurs when MSOs scale up their manufacturing output to cope with the anticipation of hot demand until as a group manufacturers significantly overshoot the actual level of demand. For Green Thumb, it’s easy to see how a cannabis glut could occur in light of high expectations about demand in newly-opening state markets, especially when taking the output of its competitors into account. Therefore, investors should interpret news of opening massive new cultivation facilities as a mixed blessing, as the facilities may well need to be closed later on if the market gets flooded.

Aside from oversupply, the risk of competitors contesting Green Thumb’s market share is guaranteed in the long-term. Competition in high-margin product segments like vapes and edibles is likely to be especially fierce, as those are the segments where businesses can add the most value and differentiate their products the most. Plus, in markets where there are a limited number of licenses for the cultivation and sale of cannabis, there is a risk that the company fails to secure a presence in the most lucrative areas.

One effective way to mitigate this risk is for the company to build brands that evoke strong customer loyalty, which is something management has indicated is a priority. Keep an eye on product reviews and any accolades that the cannabis media offers for its branded products to get a sense for how effectively brand-building is coming along.

In light of the above, investors seeking growth within cannabis over the next 12-24 months and who are willing to take on substantial medium-term risks should aim to buy shares of Green Thumb quite soon. Investors looking for a cannabis stock for a long-term hold will also find that it’s priced at an attractive entry point right now, though the expectation of competitive and market-based headwinds may provide another opportunity to start a position in around 18 months, when conditions are likely to be difficult.

Be the first to comment