Spencer Platt/Getty Images News

Israeli holding company, Kenon Holdings Ltd. (NYSE:KEN), has taken a beating on the stock market, despite a track record of profitable growth over the last five years. An analysis of this record will highlight the company’s strength. What will also stand out is that the changes in the energy industry are sustainable and provide a path further future profitability. With an attractive relative valuation and a free cash flow yield of more than 20%, Kenon is very attractive.

Phenomenal Share Price Performance

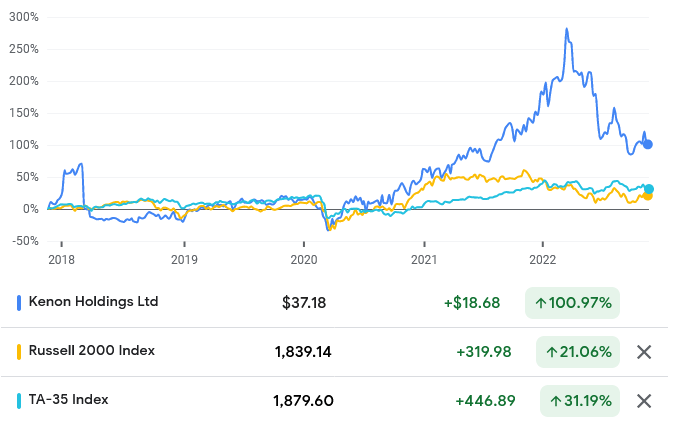

Kenon’s share price has gained 100.97% in the last five years. In that time, the Russell 2000 has gained 21.06%, while the TA-35 has gained 31.19%.

Source: Google Finance

In the year-to-date, Kenon is down 28.29%, while the Russell 2000 is down 19.07%, and the TA-35 is down 5.39%.

Strong Financial Performance

Kenon has four reportable segments: OPC Israel, CPV Group, ZIM Integrated Shipping Services (ZIM), and Quantum. OPC Israel is a wholly owned subsidiary of OPC Energy Ltd. (OPC), an Israeli power company. The CPV Group is a limited partnership owned by OPC, a US power company. ZIM is an Israeli global container shipping company. Quantum is a wholly owned subsidiary of Kenon, through which Kenon owns an interest in Qoros Automotive Co. Ltd., a Chinese automotive company owned by Quantum, the Baoneng Group and Wuhu Chery Automobile Investment Co. Ltd.

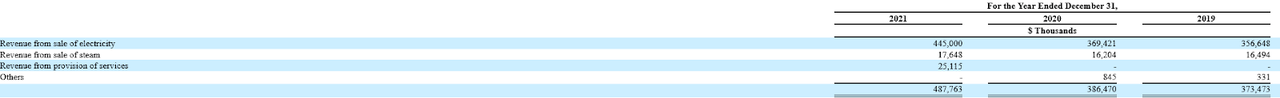

According to the 2021 20-F, typically, electricity sales account for over 90% of revenues. The rest of the company’s revenues stem from the sale of steam (3.6% of revenues in 2021), and the provision of services (5% of revenues in 2021).

Source: 2021 20-F

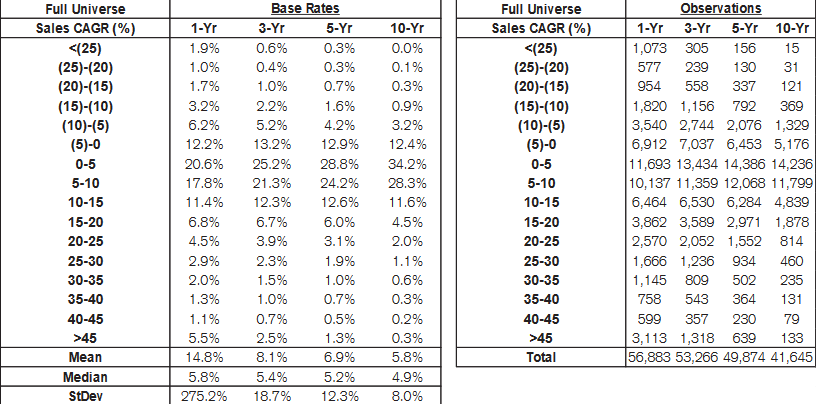

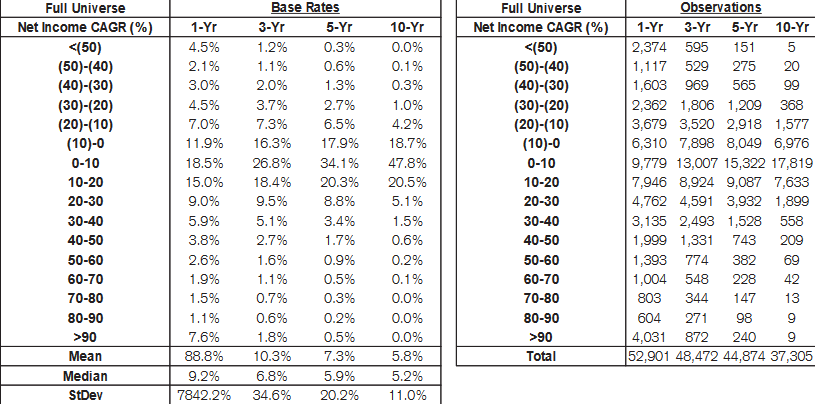

Revenue has grown from $365.7 million in 2017, to $487.8 million in 2021, at a 5-year revenue compound annual growth rate (CAGR) of 5.93%. According to Credit Suisse’s (CS) The Base Rate Book, 24.2% of firms between 1950 and 2015 enjoyed a similar rate of growth over a 5-year period.

Source: Credit Suisse

In the trailing twelve months (TTM), revenues are at around $534.76 million. Revenue is not that difficult to forecast, and consequently, has a rather limited payoff in terms of total shareholder return, with the correlation coefficient between the two being 0.28 for a 5-year period.

Gross profitability declined from 0.027 in 2017 to 0.024 in 2021. This is well below the 0.33 threshold that Robert Novy-Marx found is attractive. In the TTM period, gross profitability has declined further, to 0.022. This is despite gross profits growing at a 5-year gross profits CAGR of 7.51%, from $68.47 million in 2017, to $98.35 million in 2021. In that time, the company’s asset base grew at a 5-year asset CAGR of 10.01%, from over $2.5 billion in 2017, to $4 billion in 2021.

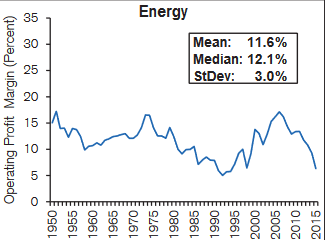

Operating margins have risen from 3.3% in 2017, to 4.6% in 2021. With low margins, cost leadership is obviously important for the company, because the company does not make a lot of money on each unit of electricity it sells, and needs to have a high capital velocity. In the TTM period, operating margins are 4.2%. According to The Base Rate Book, the median operating margin for the energy industry during the 1950 to 2015 period, was 12.1%, while the average was 11.6%.

Source: Credit Suisse

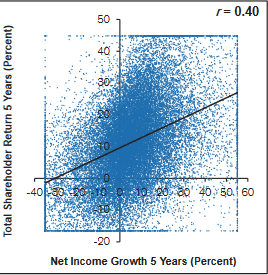

Net income has risen from $236.59 in 2017, to $930.27 in 2021, at a 5-year earnings CAGR of 31.5%. That gives us a base rate of 3.4% of firms with a similar rate of growth over a 5-year period. The mean 5-year earnings CAGR in the 1950 to 2015 period was 7.3%, while the median 5-year earnings CAGR was 5.9%.

Source: Credit Suisse

In the TTM period, net earnings are around $1.48 billion. Net income is much harder to forecast than revenue, but the payoff for doing so is much greater, with a correlation coefficient between net income and total shareholder return, of 0.4 for a 5-year period.

Source: Credit Suisse

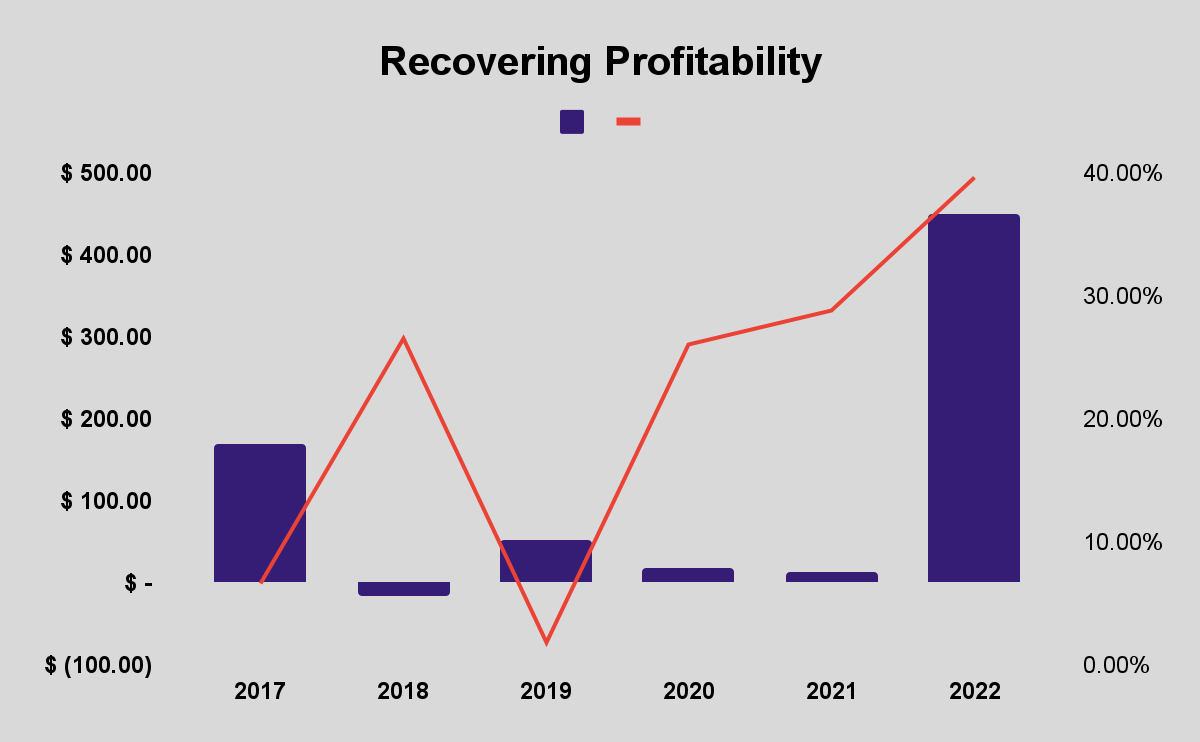

Free cash flow (FCF) plummeted from $168.98 million in 2017, to $14.12 million in 2021. In the TTM period, FCF has recovered strongly, and stands at over $450 million.

The company’s growing profitability is further highlighted by the returns on invested capital (ROIC), which have grown from 6.6% in 2017, to 28.8% in 2021. In the TTM period, ROIC has grown further, to 39.6%.

Source: 20-Fs and own calculations

The link between ROIC and future corporate valuation suggests that Kenon’s future stock market performance is likely to be positive, despite the terrible year that the company has had.

According to the company’s Q2 2022 report, Kenon’s unconsolidated cash position was $1.045 billion as of June 30, 2022, falling to $453 million on August 31, 2022, after the holding company’s participation in OPC’s share offering and a capital reduction paid in July 2022. Kenon expects to receive an additional $112 million in cash in September 2022 after ZIM’s Q2 2022 dividend.

Energy Prices Are Sustainably High

Russia’s invasion of Ukraine and wider global supply chain disruptions, have upended energy markets and led to a surge in energy prices. There does not seem to be a near-term solution to the Russo-Ukrainian War, or even for the supply chain constraints blocking the energy markets. If anything, Russia’s invasion signals the breakup of the old order and our entry into a decade of turbulence, with the risks of a Chinese invasion of Taiwan mounting. Therefore, inefficiencies are going to dominate the market in ways that they have not, in recent decades. Kenon will benefit thanks to its investment in traditional power supply and green energy, thanks to OPC Energy, where it has a 59% stake.

Not only are traditional power supplies likely to remain pricey, but as the world attempts to green its energy supplies and as the West attempts to free itself from dependence on soft-allies and potentially hostile states, demand for renewables is going to increase. Electrical vehicles ((EVs)) are an important part of that. Kenon’s investment in Qoros, where its stake is worth 12% of the company, provides diversification from traditional power and access to a growing market. Qoros already sells various products, Qoros 3 Sedan, Qoros 3 5-door Version, Qoros 3 Urban SUV, Qoros 5 SUV, Qoros 3 GT, Qoros 5S, Qoros 5S Night Elf Hero Version and Qoros 7. Furthermore, Qoros has also unveiled the Qoros 2 SUV Plug-in Hybrid Concept Car, Qoros 5 SUV Q·LECTRIQ, Qoros 3 Q · LECTRIQ Pure Electric Concept, the world’s first running QamFree engine engineering test vehicle, MILE I, MILE II, MILESTONE, etc. Qoros has committed to further enriching “its product line, including new energy vehicles or entering new market segments, so as to continuously present its unique product and brand advantages to consumers”.

Valuation

From a relative position, Kenon has a price-earnings (PE) multiple of 1.35, compared to a PE multiple of 20.54 for the S&P 500 and 45.6 for the Tel Aviv Stock Exchange. The company’s gross profitability is not particularly attractive, as we have seen. Kenon’s FCF yield (FCF/enterprise value) of 22.42%, far higher than the FCF yield of 1.5% of the 2,000 largest firms in the United States as measured by New Constructs. On balance, that suggests that Kenon is a very attractive investment, although it may not be a long-term investment.

Conclusion

Kenon’s financial results over the last five years have been very strong. It is easy to see why the share price has performed so well on the stock market. The nosedive that the share price has taken in recent months seems overly pessimistic, although it is obvious that ZIM’s difficulties have had an important role in driving that pessimism. The changes we have seen in the energy markets seem sustainable and provide the basis for healthy profitability and returns over the next few years. With the share price at an attractive relative multiple, and a very appealing FCF yield, Kenon is a very attractive investment.

Be the first to comment