EUR/USD Price, Chart, and Analysis

- Data and FOMC minutes will set the tone for EUR/USD for the rest of the week.

- EUR/USD continues to eye the longer-dated moving average.

Recommended by Nick Cawley

Get Your Free EUR Forecast

Euro Breaking News: EUR on Offer Despite EZ PMI Upside Surprise

The latest Euro Area flash PMIs beat to the upside this morning but still remain entrenched in contractionary territory. The data suggests the Euro Area economy shrinking by around 0.2% in Q4, and while November’s figures were better-than-expected, a recession looks likely, ’though the latest data provide hope that the scale of the downturn may not be as severe as previously feared’ according to data provider S&P.

Recommended by Nick Cawley

How to Trade EUR/USD

The rest of the day is dominated by US dollar data and the latest FOMC minutes and this will likely drive the pair heading into the holiday-shortened weekend. The latest durable goods data will show new orders placed with manufacturers for hard goods, while the Michigan Consumer Sentiment release will give an update on consumer attitudes and expectations. Later, the FOMC minutes will see the Fed give an updated look at the economy and how the central bank expects to tackle inflation.

For all market-moving economic releases and events, see the DailyFX Calendar

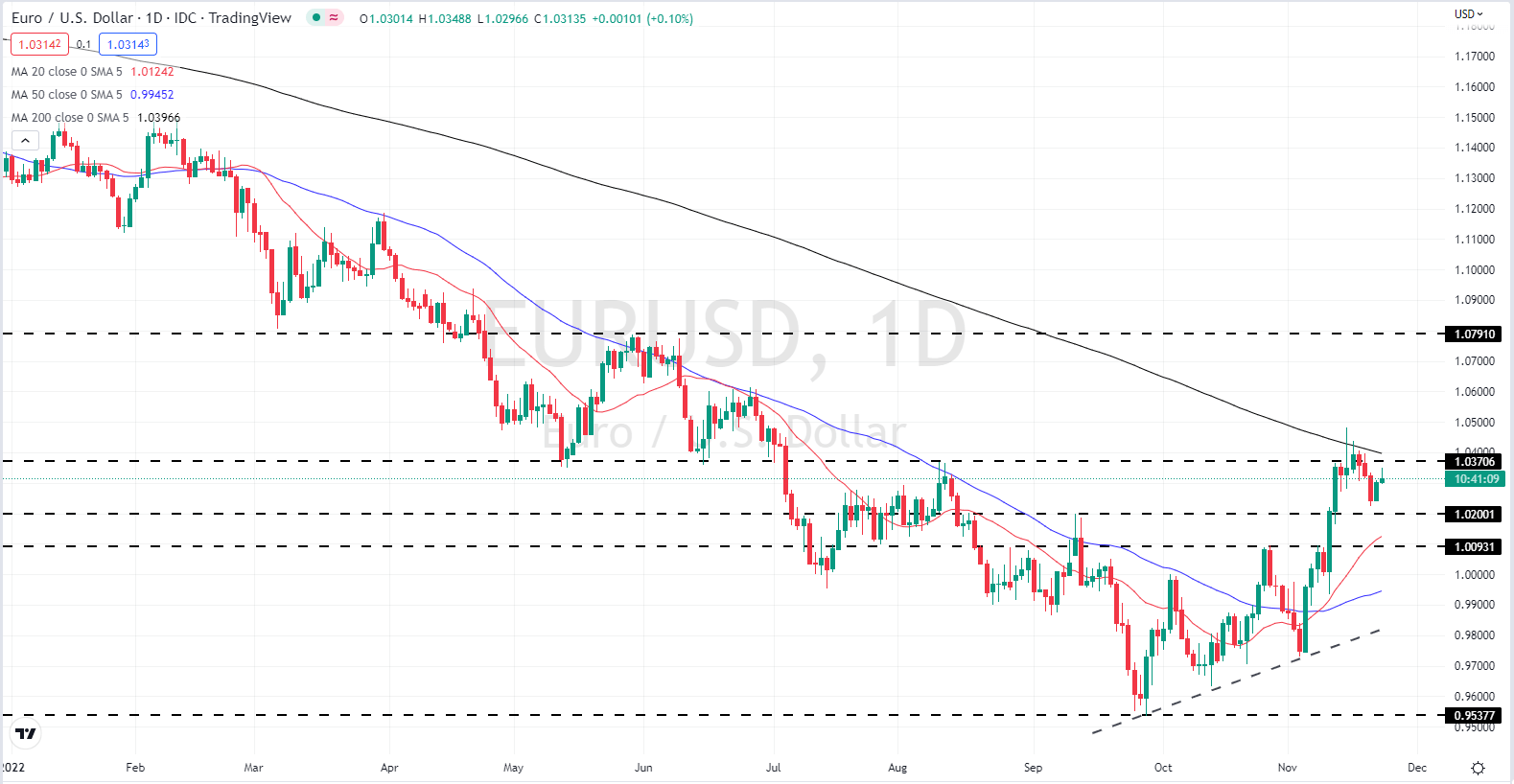

EUR/USD currently changes hands around 1.0315 in quiet trade ahead of the US session. Price action this week has been limited so far with Monday’s low print of 1.0223 being quickly bought back. Today’s high, currently1.0349, has broken a short-term series of lower highs, and if the pair close above 1.0308, Tuesday’s high, then further gains may be seen. Initial resistance sits at 1.0371 before the 200-day moving average comes into play at 1.0402. The pair have not closed this longer-dated ma since mid-June 2021.

A Comprehensive Guide to Using Moving Averages

EUR/USD Daily Price Chart November 23, 2022

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | -10% | 16% | 3% |

| Weekly | 11% | 1% | 5% |

Retail trader data show 43.83% of traders are net-long with the ratio of traders short to long at 1.28 to 1.The number of traders net-long is 9.84% lower than yesterday and 13.21% higher from last week, while the number of traders net-short is 4.61% higher than yesterday and 2.41% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment