inside-studio/iStock via Getty Images

Genfit (NASDAQ:GNFT) is a small (<$200 million market cap) late-stage biopharmaceutical company focused on three franchises: cholestatic diseases, nonalcoholic steatohepatitis (or NASH) diagnostics, and Acute on Chronic Liver Failure (ACLF). Elafibranor (GFT505) was a former hopeful NASH before failing its pivotal trial in 2020. However, the company’s lead drug candidate may prove more formidable in another indication, primary biliary cholangitis (or PBC). Investors would be prudent to keep this biotech in mind and start placing bets up to next quarter.

Pipeline

Having exited the NASH drug arena, Genfit set its sights to providing diagnostic solutions. However, management has reiterated several times they don’t see a “significant market opportunity” for these technologies as long as there isn’t a drug approved for NASH. That may be a reality not before too long, as discussed in recent articles on Madrigal Pharmaceuticals (MDGL) and Intercept Pharmaceuticals (ICPT). According to the “Noncirrhotic Nonalcoholic Steatohepatitis With Liver Fibrosis” 2018 draft guidance from the Food and Drug Administration (FDA), accelerated approval may be secured by demonstrating improvements with any one of the following liver histological endpoints:

- Resolution of steatohepatitis on overall histopathological reading and no worsening of liver fibrosis on NASH Clinical Research Network (or CRN) fibrosis score. Resolution of steatohepatitis is defined as absent fatty liver disease or isolated or simple steatosis without steatohepatitis and a NASH CRN activity score (NAS) score of 0-1 for inflammation, 0 for ballooning, and any value for steatosis [NASH-EP]

- Improvement in liver fibrosis greater than or equal to one stage (NASH CRN fibrosis score) and no worsening of steatohepatitis (defined as no increase in NAS for ballooning, inflammation, or steatosis) [Fibrosis-EP]

- Both resolution of steatohepatitis and improvement in fibrosis (as defined above)

Despite some companies’ claims, there is no advanced candidate conclusively capable of achieving #3. Madrigal’s resmetirom is the leading “anti-NASH” contender. The pivotal MAESTRO-NASH Q4 readout is a widely anticipated event in the NASH space, with longs hoping it hits at least the NASH-EP. In the opposite end of the spectrum, Intercept’s obeticholic acid or OCA is the top purely antifibrotic agent. OCA had secured the Fibrosis-EP more than 2 years ago in the pivotal REGENERATE trial, but the FDA wanted “additional post-interim analysis efficacy and safety data”. Intercept is resubmitting the OCA new drug application including the suggested analyses by the end of this year. One or both drugs could be on the market as early as next year.

OCA has actually been sold as Ocaliva since 2016. Up until then, ursodeoxycholic acid (UDCA) was the only FDA-approved therapy for PBC and is still the first-line. Ocaliva is now used in combination with UDCA in patients with an inadequate response to UDCA or as monotherapy in patients unable to tolerate UDCA. Approval was gained based on its pivotal trial’s primary endpoint (or PEP) of response rate at Month 12, where response was defined as a composite of three criteria: alkaline phosphatase (or ALP) less than 1.67-times the upper limit of normal (or ULN), total bilirubin less than or equal to ULN, and an ALP decrease of at least 15%. Patients were randomized to receive either Ocaliva 10 mg once daily for the entire 12 months of the trial, Ocaliva titration (5 mg once daily for the initial 6 months, with the option to increase to 10 mg once daily for the last 6 months), or placebo. A significantly higher percentage of patients achieved a response (Table 1; p < 0.0001) from the Ocaliva arms versus placebo.

|

Table 1 |

Ocaliva 10 mg |

Ocaliva titration |

Placebo |

|

Primary Composite Endpoint |

|||

|

Responder rate, Month 12 (%) |

48 |

46 |

10 |

|

Components of Primary Endpoint |

|||

|

ALP less than 1.67-times ULN (%) |

55 |

47 |

16 |

|

Decrease in ALP of at least 15% (%) |

78 |

77 |

29 |

|

Total bilirubin less than or equal to ULN (%) |

82 |

89 |

78 |

Previously, an international multicenter, randomized, double-blind, placebo-controlled Phase 2 trial evaluated elafibranor, a PPARα and PPARδ agonist, for the treatment of non-cirrhotic patients with PBC and an incomplete response to UDCA. The PEP was relative % change in serum ALP levels from baseline to Week 12. However, one of its secondary EPs was a composite EP equivalent to Ocaliva’s pivotal PEP except in duration. Significantly more patients achieved this 12-week composite EP in the elafibranor 80 mg group compared to the placebo group (66.7% vs. 6.7%, p < 0.01). Ninety-three percent of elafibranor 80 patients had ≥20% reductions of ALP compared to only 6.7% in the placebo arm (p < 0.001).

If these results are confirmed in the Phase 3 study and it is subsequently approved, elafibranor will be a legitimate competitor in the PBC market, as some of its advantages over Ocaliva have been apparent from the beginning. The ELATIVE Phase 3 trial in PBC successfully completed patient recruitment in June 2022. Because the PEP is the effect of elafibranor 80 mg/day on cholestasis after 52 weeks of treatment, the company has a short time frame for analysis if they are to report the topline data on schedule.

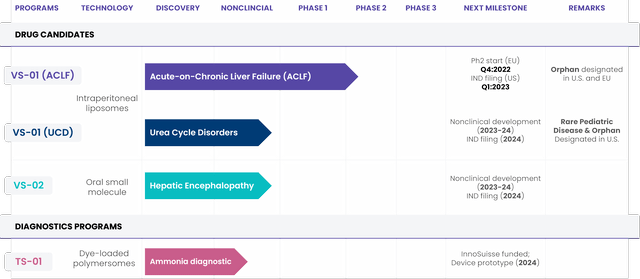

For its third franchise, Genfit acquired Versantis on September 19 along with its own pipeline (Figure 1). VS-01 has received Orphan Drug Designation (ODD) in ACLF by the FDA and the European Medicines Agency. A Phase 2a trial is starting this quarter in Europe, while an Investigational New Drug Application (or IND) is set to be filed with the FDA next quarter.

Figure 1. Versantis pipeline

Versantis

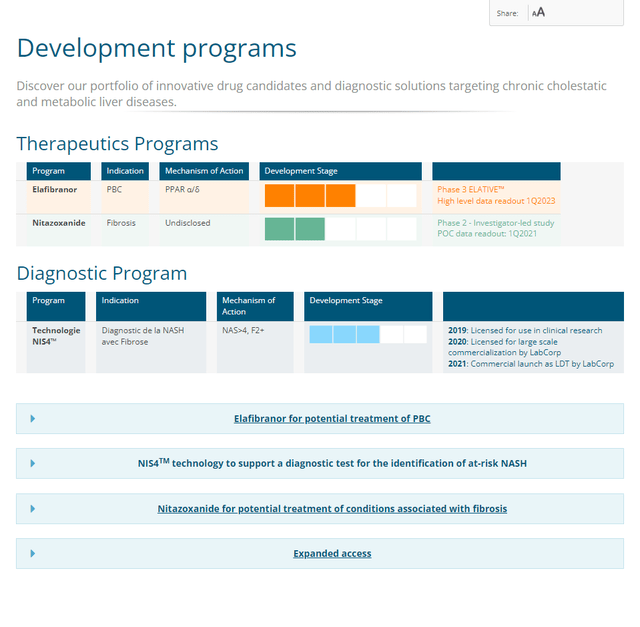

Nitazoxanide (or NTZ) has Phase 1 results in patients with hepatic impairment that was promised as early as last quarter but supposedly be disclosed in the coming month. However, the fact that the study completed in April and the company website still lists the 2021 fibrosis Phase 2 for which details were never disclosed (Figure 2) doesn’t inspire much confidence.

Figure 2. Genfit pipeline (accessed 11/22/22)

GENFIT

Missing from this outdated picture is ezurpimtrostat (GNS561), a novel autophagy/PPT1 inhibitor. In December 2021, Genfit had acquired the rights from Genoscience Pharma to develop and commercialize ezurpimtrostat in the United States, Canada and Europe as a treatment of cholangiocarcinoma, for which the FDA granted ODD last September 13.

Financials

The CHF40.0 million which Genfit paid on September 29 for the acquisition of Versantis accounted for most of the company’s negative cash flow from €209.1 million as of June 30 to €163.6 million. As this included Versantis’ cash and equivalents of €5.1 million, the implied burn was €10.6 million.

Similarly, for the half-year ended June 30, cash decreased from €258.8 million as of December 31, 2021 to €209.1 million as of June 30, but this counted €24 million VAT on the €120 million upfront payment received under the Ipsen (OTCPK:IPSEY) out-licensing of elafibranor’s global rights. H1 operating expenses were closer to €26.5 million and net loss was €10.4 million. Therefore, it is reasonable to believe management’s claims that they have sufficient funding to develop their current programs for approximately seven quarters.

Risks and Takeaways

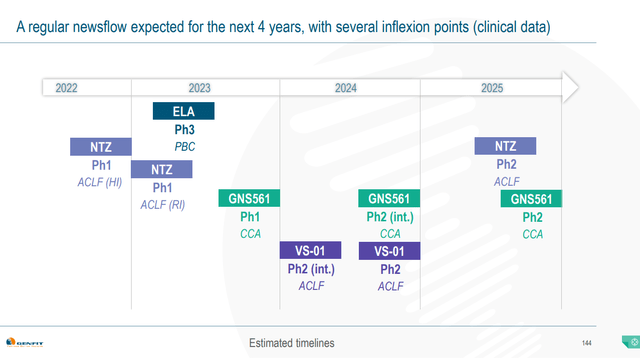

Genfit is a biotech with no approved products and recognized revenue since December is primarily coming from the €40 million in residual deferred income from the Ipsen deal. Barring an acquisition of another advanced drug candidate, elafibranor is the company’s only potential revenue generator in the next 4 years (Figure 3). Two quarters without major catalysts may be too long a wait for some investors. On the other hand, the ELATIVE readout is a binary event but heavily leans toward success and from then, Ipsen does the heavy lifting.

Figure 3. Genfit clinical timelines

GENFIT – NYC Pipeline Day Presentation

Be the first to comment