swissmediavision/E+ via Getty Images

Right now, every investor wants the “sure thing.” In a period of remarkable volatility, appetite to invest in small and mid-cap stocks is understandably very low – but at the same time, this is also the segment of the market where business fundamentals and stock price movements this year are the most misaligned.

I’d encourage investors to take a hard second look at GoPro (NASDAQ:GPRO) in particular. This action-camera maker has benefited from stabilizing demand this year amid a normalization in travel trends, while long-term moves toward a bigger subscription base help to tilt the company’s margin story upward.

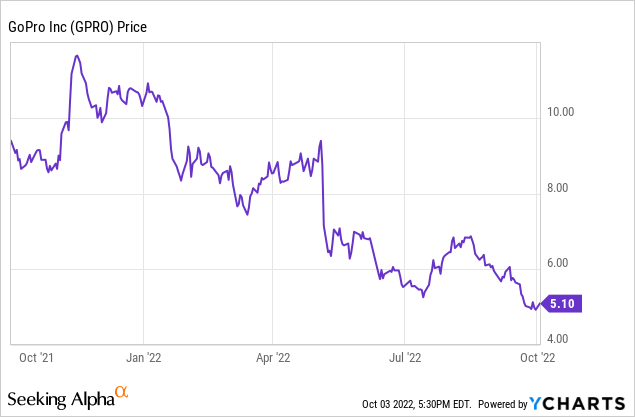

Year to date, GoPro’s share price has declined by more than 50% – which, in my view, is not at all in keeping with the company’s sturdy execution to date.

I remain bullish on GoPro stock heading into the final quarter of a dismal 2022, and I believe the business is rather misunderstood rather than actually weak. In particular, after seeing Q2 results and management commentary that revenue deceleration is driven largely by partners’ inventory reduction actions (which was largely expected, and more of a macro statement than GoPro specific) and that sell-through still outperformed expectations, I think the bull case for GoPro is quite secure.

As a refresher for investors newer to this name, here are the key bullish drivers for GoPro:

- High-end camera sales. GoPro now has three versions of its flagship camera in its lineup (from the HERO 10 to the HERO 8), ostensibly to capture buyers at every price point. Yet ASPs have been gradually climbing upward, and now ~90% of GoPro’s sales are from cameras priced above $300 (up from about two-thirds in the prior year).

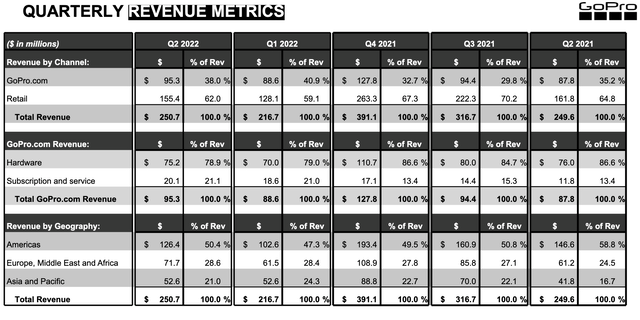

- Successful e-commerce execution. Historically, GoPro has relied heavily on channel partners and resellers to drive sales, and typically at hefty trade discounts. The company made full use of the pandemic to execute on an online-first strategy, and sales on GoPro.com are contributing a record amount to GoPro’s revenue mix.

- Subscription offerings are taking center stage. GoPro continues to see its subscriber base expand, and a new app offering (QUIK) at $10/year offers a limited subset of the $50/year GoPro subscription and has a chance to reach even more subscribers.

- Travel tailwinds. As the world moves on past COVID-19 and borders re-open for travel, demand for GoPro cameras (largely used as travel accessories) should benefit from macro tailwinds.

- Substantial profitability gains, driven by e-commerce gross margin benefits, subscription revenue mix increase, and headcount reductions.

The bottom line here: GoPro has continued to exercise a strong hold over its niche camera market. With eight straight quarters of positive adjusted EBITDA under its belt, plus continued strong sell-through trends as well as drivers for gross margin lifts, there’s a substantial opportunity for GoPro to regain lost ground once market pessimism clears up.

Q2 download

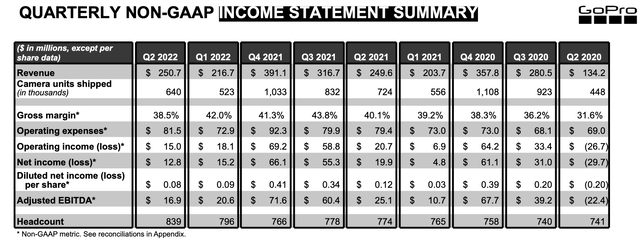

Let’s now cover the highlights of GoPro’s second quarter results in greater detail. The key metrics are shown in the slide below:

GoPro Q2 highlights (GoPro Q2 earnings deck)

GoPro’s revenue in Q2 was flat y/y at $250.7 million. This decelerated relative to 6% y/y growth in Q1, but came in ahead of Wall Street’s expectations of $238.7 million (-4% y/y) by a four-point margin, as well as the company’s own internal guidance of $235-$245 million.

As GoPro already prefaced when issuing the guidance in Q1, this story is mainly driven by partner inventory reduction. Ahead of a shakier macro environment, resellers are draining channel inventory so they aren’t caught holding slow-moving, potentially obsolete units.

This trend is expected to continue bleeding over into the second half of the year. Per CFO Brian McGee’s prepared remarks on the Q2 earnings call:

Our Q3 and full-year 2022 outlook consider several key macro dynamics impacting our business. As has been widely reported, Big Box retailers are actively reducing their inventory along with weeks of supply. In terms of retail Big Box channel inventory, we believe we are well-positioned at approximately 9 to 10 weeks of inventory.

However, we expect retailers to generally reduce weeks of inventory in the second half which could impact our sales into the channel.”

The good news here: inventory reduction is a one-time headwind; once partners get inventory levels down to desired levels, revenue will be more in-line with sell-through trends. And ultimately it’s sell-through that determines long-run demand. And on this front, the company is reporting that sell-through is outpacing expectations and still growing. Again from McGee’s commentary:

Furthermore, on the demand side, through July, we are running ahead of projected demand and sell through which is encouraging well disruptive quarter outlook. We expect ASPs in 2022 to increase 8% over 2021. We continue to effectively manage supply chain, the third quarter camera secured and the fourth quarter pipeline is well-developed.”

We note as well that subscription revenue continues to reach new heights. Subscription revenue of $20.1 million grew 70% y/y and represented a record 8% of revenue. Going forward, a great contribution of subscription revenue will not only improve margins, but also smooth out the lumpiness of hardware revenue from situations like partners’ inventory drain decisions.

GoPro Q2 revenue mix (GoPro Q2 earnings deck)

We note as well that GoPro maintained positive adjusted EBITDA of $16.9 million, representing a respectable 7% margin – though this is down three points from 10% in the year-ago Q2, driven by component-related inflation and rising opex costs. It’s worthwhile to note that GoPro has increased its target for annual opex reduction by roughly $15 million, representing roughly 1% of trailing twelve-month revenue.

Key takeaways

Despite recent pessimism aimed mainly at small-cap stocks and the tech sector in general, GoPro is still holding up as a niche hardware manufacturer with a loyal customer base and a path to growing both margins and revenue. Take advantage of the recent dip to enter into a cheap position.

Be the first to comment