Douglas Rissing

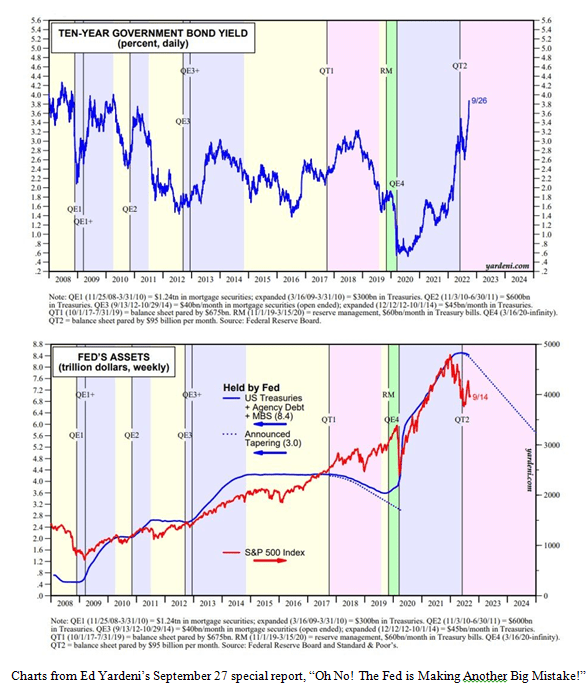

Last week, the 2-year Treasury rate rose above 4.3%, the 10-year Treasury rose above 3.9%, and mortgage rates topped 7%, their highest level in 20 years! These charts released by Ed Yardeni illustrated that the Fed, by reducing its balance sheet by $95 billion per month, has sent the 10-year rate substantially higher. The title of his report (“Oh No! The Fed Is Making Another Big Mistake!”) implies this is a horrible mistake.

10-Yr Government Bond Yield; Fed’s Assets (Author)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Fortunately, on Wednesday, the Bank of England rode to our rescue when it implemented emergency actions due to a “material risk to UK financial stability” by suspending its program to sell gilts (British bonds). The Bank of England then said it would buy long-term bonds on “whatever scale is necessary” to promote financial stability. After the BoE announcement, 30-year bond yields fell by a full 1%, from 5% to 4%. Furthermore, bond yields from all around the world fell on the perception that other central banks would soon follow the Bank of England and implement more quantitative easing (i.e., bond buying). On Wednesday, 10-year U.S. Treasuries retreated from a peak of 3.964% to 3.7% and closed Friday at 3.8%.

Even though the Bank of England recently raised key interest rates 0.5% to 2.25%, traders now anticipate another 0.75% rate increase to 3%. The British media has been very critical of new Prime Minister Liz Truss’ proposed tax cuts – which also provide extensive relief for sky-high electricity rates – but frankly, if too many people cannot pay their utility bills, Britain will have a serious problem, and Prime Minister Truss must do something to stimulate economic growth. However, due to a plunging British pound that hit an all-time low to the U.S. dollar (at $1.0379), everything Britain imports is now more expensive, so the Bank of England will have to hike rates further to stabilize the pound and squelch soaring inflation.

Elections are taking place around the world this year, but the two key leadership positions are not open to democratic elections. The current leaders in China and Russia have become extremely authoritarian. I, for one, will be very interested to see if both Xi Jinping and Vladimir Putin dare to show up at the G20 meeting that is scheduled in Bali, Indonesia in mid-November. Interestingly, both Xi and Putin have been reluctant to travel due to their respective domestic problems. The world needs to prepare for potential leadership changes in Russia and China in upcoming years, since neither Xi or Putin are in total control of their respective citizens.

An emerging theory in China is that Xi Jinping’s “Covid Zero” lockdown policy in key provinces is mostly a cover for President Xi to squelch opposition after dispatching tanks to disrupt demonstrations by bank depositors who were upset that they could not withdraw their savings from the People’s Bank of China.

The Communist Party will meet in mid-October to select new leadership for the party’s Central Committee, the 25-person Politburo and the 7-person Politburo Standing Committee. President Xi Jinping is vying for an unprecedented third term after his predecessors stepped down after just two consecutive 5-year terms. It will be interesting to see if Xi can survive a vote of confidence from the Central Committee after several missteps.

News on Some of Our Stocks as We Approach Earnings Season

The Porsche (OTCPK:POAHY) IPO opened trading on the Frankfurt exchange last week and it was a big hit, as the stock rose 4% above the IPO price after being oversubscribed by almost 2-to-1. For those of you who own Volkswagen AG (OTCPK:VWAGY), VW will spin off Porsche shares or cash in a special distribution on October 4th.

I think Porsche has the potential to reach Tesla (TSLA)-like valuations (now trading at 48 times 2023 earnings estimates), since it has record-high operating margins and its 2023 Macan EV should be a top seller. Porsche is trading at about 15 times forecasted earnings vs. the 31 times forecasted 2023 earnings for Ferrari (RACE) and 46 times earnings for Tesla, so there is plenty of appreciation potential for Porsche.

Our energy stocks firmed up last week, as Hurricane Ian curtailed crude oil production and refining in the Gulf of Mexico. Additionally, the Nord Stream 1 pipeline was sabotaged (by parties unknown, so far), suffering a major leak in the Baltic Sea that is visible from the air, so Europe is now cut off from all Russian natural gas and panic is starting to set in. Thermostats will have to be turned down lower this winter, so it will be interesting to see what temperature the European Union (EU) will mandate.

Our average large-cap growth stock is now characterized by 64% annual sales growth and 474% annual earnings growth, so we’re excited about the upcoming earnings announcement season beginning in mid-October. Furthermore, the analyst community has revised their consensus earnings estimate 22.3% higher in the past three months. Our average large-cap growth stock is now trading at only 9.8 times median trailing earnings and 7.3 median 2023 forecasted earnings. Furthermore, our average large-cap growth stock’s dividend has risen by 152% in the past year. Due to these spectacular fundamental characteristics, I expect our growth stocks to break out in the upcoming weeks and be a silver lining in the stock market.

As I go down the capitalization ladder, the price-to-earnings ratios get even lower. Many small- and mid-capitalization stocks are more “domestic”, and so, they are not being impeded by a strong U.S. dollar. The big story during the third-quarter announcement season will be how many large multinational stocks are being impeded by a strong U.S. dollar, which just hit an all-time high against the British pound.

Navellier & Associates Inc. owns Volkswagen Ag. (VWAGY), in managed accounts and a few accounts own Tesla (TSLA), per client request in managed accounts. Louis Navellier and his family own Volkswagen Ag. (VWAGY) via a Navellier managed account. He does not own Tesla (TSLA) personally.

Most U.S. Economic Statistics Say “No Recession in the Third Quarter”

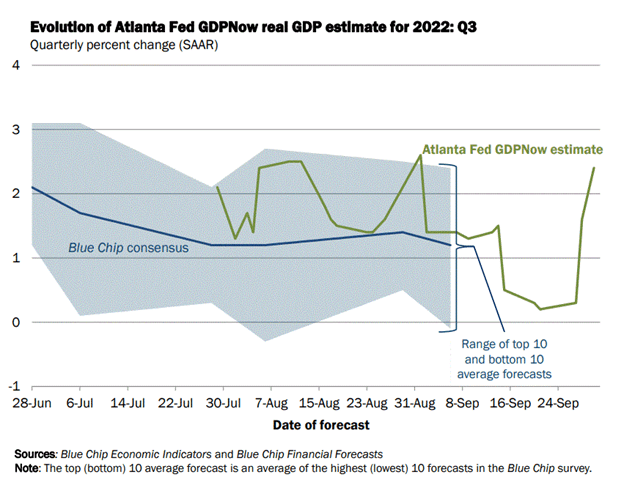

The economic news last week came in better than most economists anticipated, so it will be interesting to see if some economists revise their GDP estimates higher. Last Tuesday, the Atlanta Fed left its third-quarter GDP estimate unchanged at an anemic (but positive) +0.3% annual pace, but on Friday, the Atlanta Fed shocked economists with a giant leap to +2.4% on the last day of the quarter, even though Hurricane Ian is expected to hinder GDP growth by an estimated 0.3% in the third quarter and 0.1% in the fourth quarter.

Evolution Of Atlanta Fed GDPNow Real GDP Estimate For 2022: Q3 (Author)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Speaking of GDP, the Commerce Department made its third and final revision to second-quarter GDP on Thursday. According to traditional definitions, the U.S. was in a recession during the first half of 2022, since U.S. GDP contracted at a 0.6% annual pace in the second quarter after contracting in the first quarter as well.

Although Treasury Secretary Janet Yellen initially blamed inventory depletion for the second-quarter GDP contraction, she has been conspicuously silent recently. This is probably because Fed Chair Jerome Powell is now being blamed for any recession, so the heat is off Yellen for now. Nonetheless, all this recession talk amidst higher interest rates basically ensures a big change in Congress in the upcoming mid-term elections.

Last Tuesday, the Commerce Department announced that durable goods orders declined 0.2% in August, which is a negative number but much better than the economists’ consensus estimate of a 0.5% decrease. Vehicle orders rose 0.3% in August, while aircraft orders fell 18.5%, which put huge downward pressure on durable goods. Excluding the volatile transportation component, durable goods orders actually rose 0.2%.

The silver lining was that business spending on durable goods (“core” capital goods) rose 1.3% in August and a robust +9.7% in the past 12 months, which is an encouraging sign. New orders declined 0.9% in August, following a revised 0.1% drop in July, so that provides evidence that order backlogs are diminishing.

Also on Tuesday, the Conference Board reported that its consumer confidence index rose to a 5-month high of 108 in September, up from a revised 103.6 in August and substantially higher than economists’ consensus estimates of 104.6. Falling gasoline prices and a strong job market were cited as the primary reason that consumer confidence was better than economists expected. The “present situation” component, which is indicative of current business conditions, rose to 149.6 in September, up from 145.3 in August. The “consumer expectation” component rose to 80.3 in September, up from 75.8 in August, which bodes well for continued strong consumer spending. Overall, the surge in consumer confidence was a pleasant surprise.

The biggest surprise last week was that the Commerce Department announced on Tuesday that new home sales surged 28.8% to an annual pace of 685,000 in August, up from a revised 532,000 annual pace in July and substantially higher than economists’ consensus estimate of a 500,000 annual pace. This was the second-largest monthly surge ever recorded, led by a 66.7% monthly surge in the Northeast. Median home prices declined to $436,800 in August, down from a record $458,200 set back in April. In the past 12 months, new home sales have declined 0.1% and are far below the peak 1.04 million annual sales pace in August 2020.

The Labor Department on Thursday announced that initial claims for unemployment declined to 193,000 in the latest week, down from a revised 209,000 in the previous week. Continuing unemployment claims declined to 1.347 million, down from a revised 1.376 in the previous week. Clearly, the labor market remains healthy, but Hurricane Ian is expected to distort next week’s unemployment statistics, at least temporarily.

Finally, the Commerce Department on Friday reported that personal income rose 0.4% in August vs. a revised 0.2% decline in July. The Fed’s favorite inflation indicator, namely, the Personal Consumption Expenditure (PCE) index, decelerated to a 6.2% annual pace in August. Unfortunately, the core PCE rose to a 4.9% annual pace in August, up from a 4.7% rate in July, so inflation is becoming more established.

Speaking of inflation, the European Union (EU) statistics agency on Friday announced that consumer prices have risen 10% in the past year, the highest rate since EU inflation statistics began. (There are longer inflation series for individual countries, and Germany said its inflation in September was the highest since late 1951!) Higher energy prices and weak currencies that cause commodity inflation continue to torment the EU, so EU energy ministers are proceeding with plans to cap energy prices and tax energy companies on windfall profits, but I worry that might result in continued energy shortages.

All content above represents the opinion of Louis Navellier of Navellier & Associates, Inc.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment