BrianAJackson

Introduction

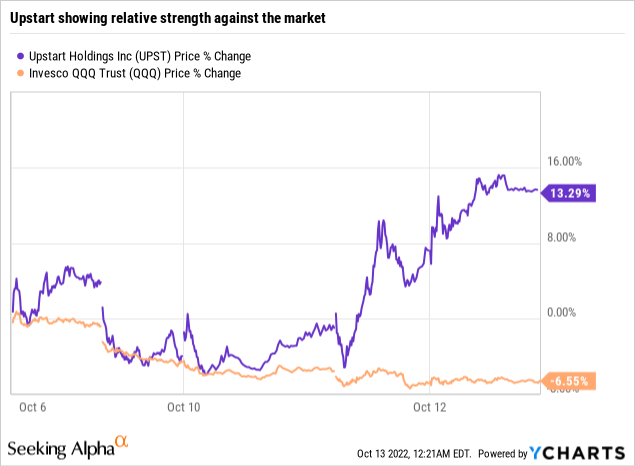

Over the last week or so, Upstart’s (NASDAQ:UPST) stock has bounced up by +13.29% on no specific news, whilst the broader technology index has sunk lower, with the QQQ ETF (QQQ) down by -6.55% [as of 12th Oct 2022].

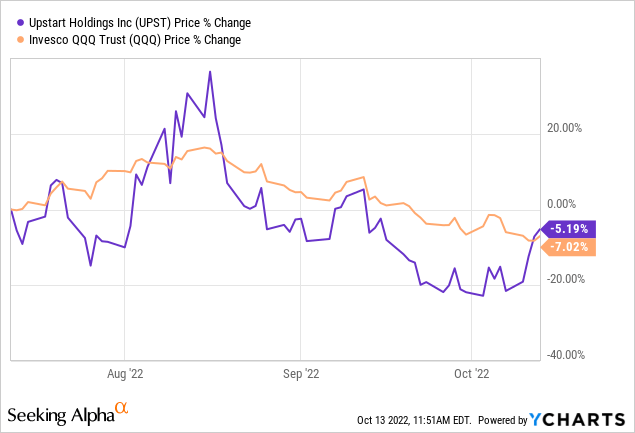

Interestingly, Upstart has been outperforming QQQ over 1-month and 3-month timeframes, too. This relative strength could be construed as a tell-tale sign of a local bottom in the stock (at least a tradable one) as Upstart heads into a pivotal earnings report in early November.

In recent months, we have talked about Upstart multiple times and highlighted positive and negative developments for this early-stage company. If you are interested in learning about my investment thesis and proactive risk management strategies for Upstart, please feel free to refer to these notes:

In this article, I share my understanding of Upstart’s relative strength and expectations for its upcoming Q3 report.

What’s driving Upstart’s Relative Strength?

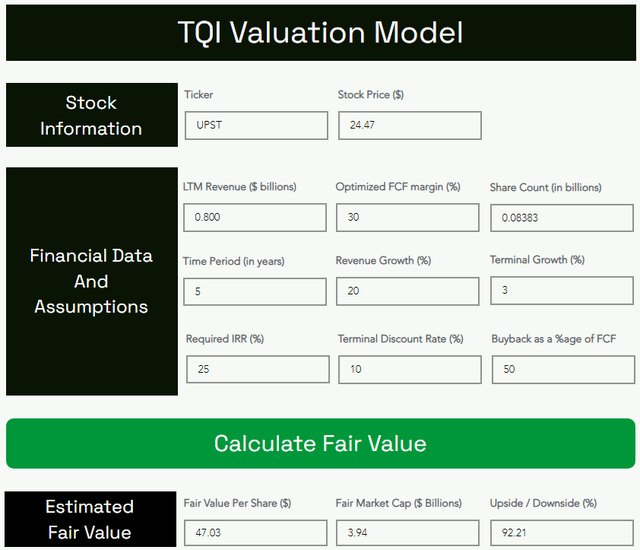

Generally, I like to see stocks rising, especially when I happen to own them. In the case of Upstart, it remains one of my larger positions, and hence, I am elated to see Upstart’s stock show strength against the market. With a fair value of $47, Upstart is still deeply undervalued, and I hope to see it at that level soon.

TQI Valuation Model (www.tqig.org)

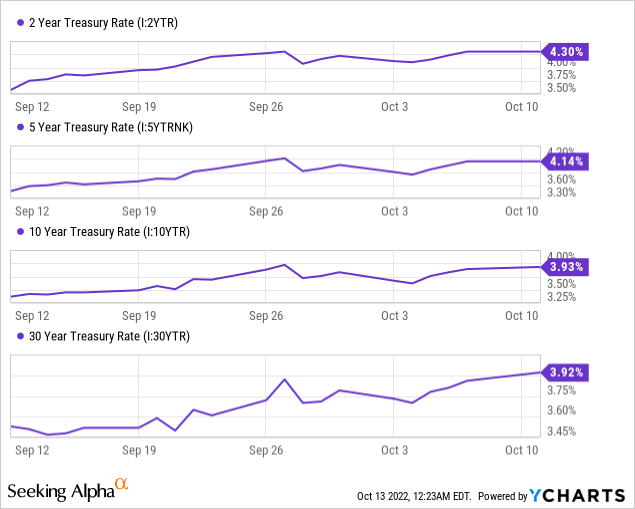

While I really want to believe that Upstart is set to realize its fair value, I don’t see how it could do so in a rapidly-rising rate environment. The latest CPI report (CPI up 8.2% y/y, Core CPI up 0.6% m/m) served as evidence for inflation being persistent, which means the Fed is likely to keep at it, i.e., keep raising interest rates and withdrawing liquidity [quantitative tightening] to fight inflation.

Rapid increases in treasury rates caught Upstart’s management off guard in Q1 and Q2 of 2022, with Upstart left holding the bag on millions of dollars worth of loans (& consequently dumping most of them despite big losses). Upstart’s management has had to flip-flop between business models a couple of times now, and it is still unclear if its marketplace’s funding constraints are easing. In recent weeks, treasury rates have been climbing higher, and the Fed is likely to remain hawkish for the foreseeable future. Hence, the market dynamics for Upstart’s business appear to be unconducive.

On Wednesday, Upstart announced the release of its Q3 2022 earnings report:

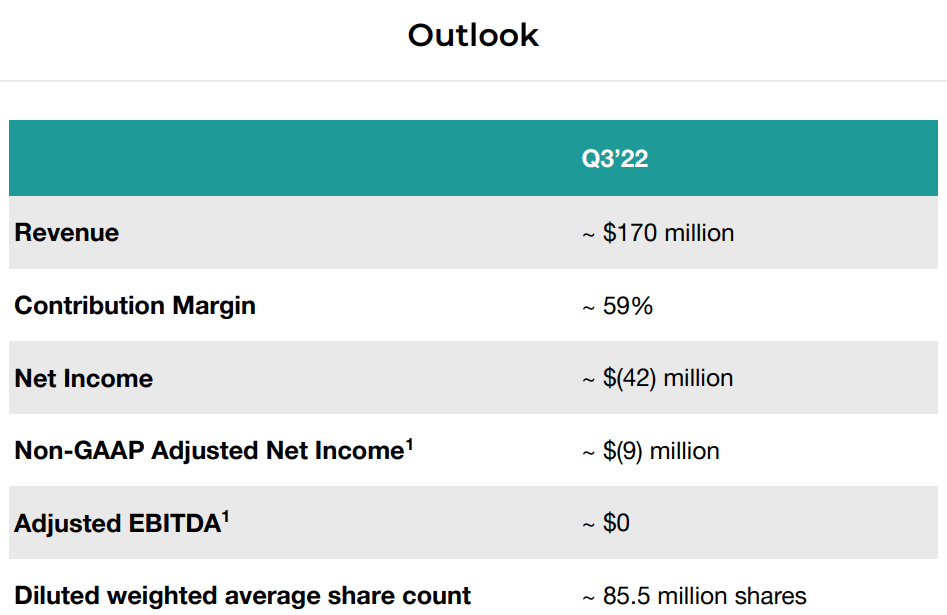

While assessing Upstart’s Q2 results, I felt that management’s Q3 outlook for revenues of $170M was a “kitchen-sink” guide, a low bar that Upstart could beat easily. Since we haven’t had a pre-announcement this time around, I think we are unlikely to face a repeat of the Q2 horror show.

Upstart Q2 Earnings Presentation

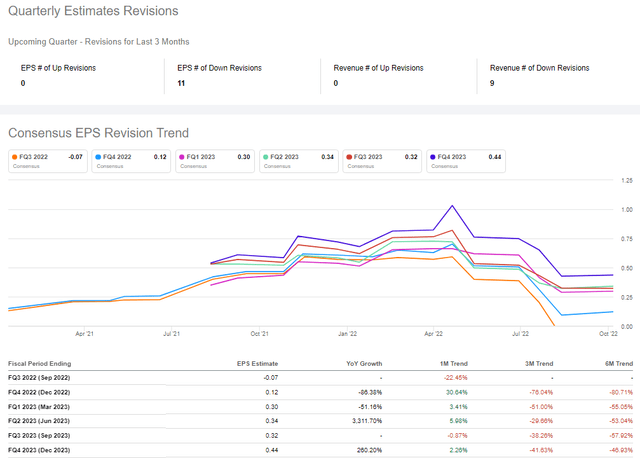

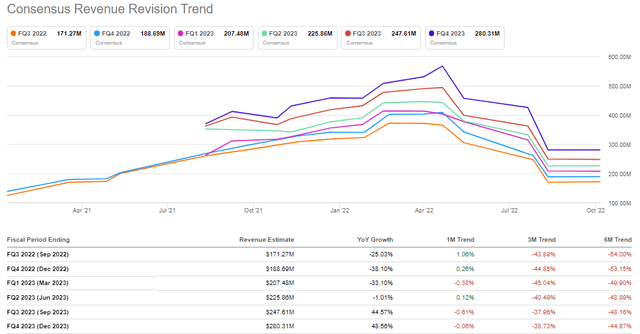

The consensus analyst estimate for Upstart’s Q3 revenue is $171M (a slight beat on management’s guide), whilst the EPS estimate is -$0.07 per share. Over the last six months, both of these metrics have been revised lower quite ferociously, and these future estimates may be lowered further if Upstart’s Q3 report disappoints. On the other hand, Upstart is trading at a forward PE of 17.7x, and any hint of a rebound in origination volumes could spark a wave of upwards earning revisions and analyst upgrades for the stock.

Seeking Alpha

Seeking Alpha

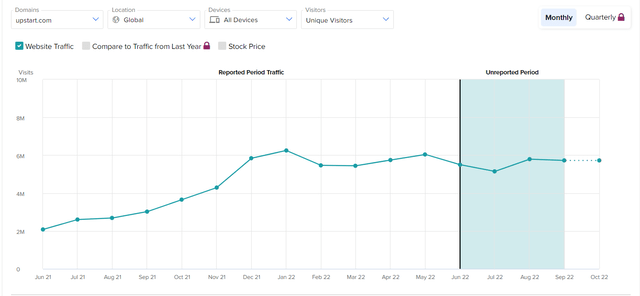

The earnings revisions are trending lower and do not explain the relative strength in Upstart’s stock. However, I still think Upstart’s stock could be moving higher in anticipation of a stronger-than-expected (or less-worse-than-feared) earnings report for Q3. After all, Upstart’s website traffic rebounded sharply in August and stayed flattish in September, and this data point could mean Upstart’s management guidance [issued in early August] was overly negative. In the past, Upstart’s revenue has aligned well with website traffic data, but this relationship was broken in Q2 as marketplace funding constraints led to a sharp drop-off in conversion rates from 24.4% in Q2 2021 (and 21.4% in Q1 2022) to 13.3% in Q2 2022. Hence, I don’t think website traffic data necessarily gives us a fair reflection of Upstart’s origination volumes. Regardless, this data point is a positive one.

TipRanks

As you know, the market is forward-looking, and at some point, it will look beyond the Fed’s quantitative tightening program. But is it doing so already? And is it right to do so? My answer to both those questions is – “I don’t know“.

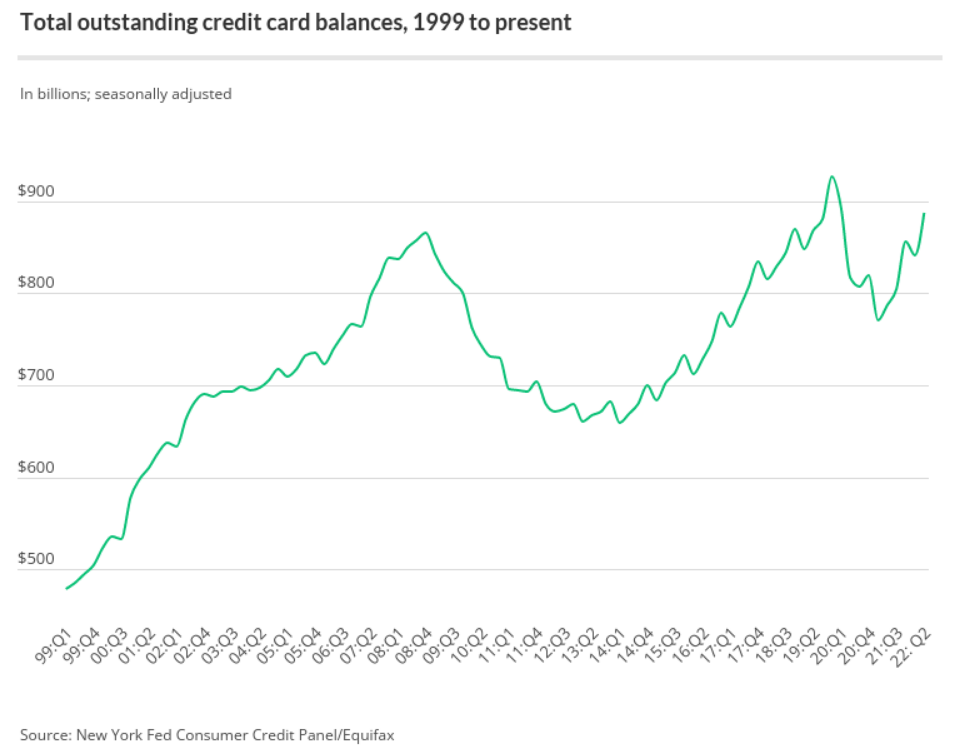

Rather, I think the market is looking at rising credit card balances in the United States as an indication of an improved demand environment for personal loans in the near to medium term.

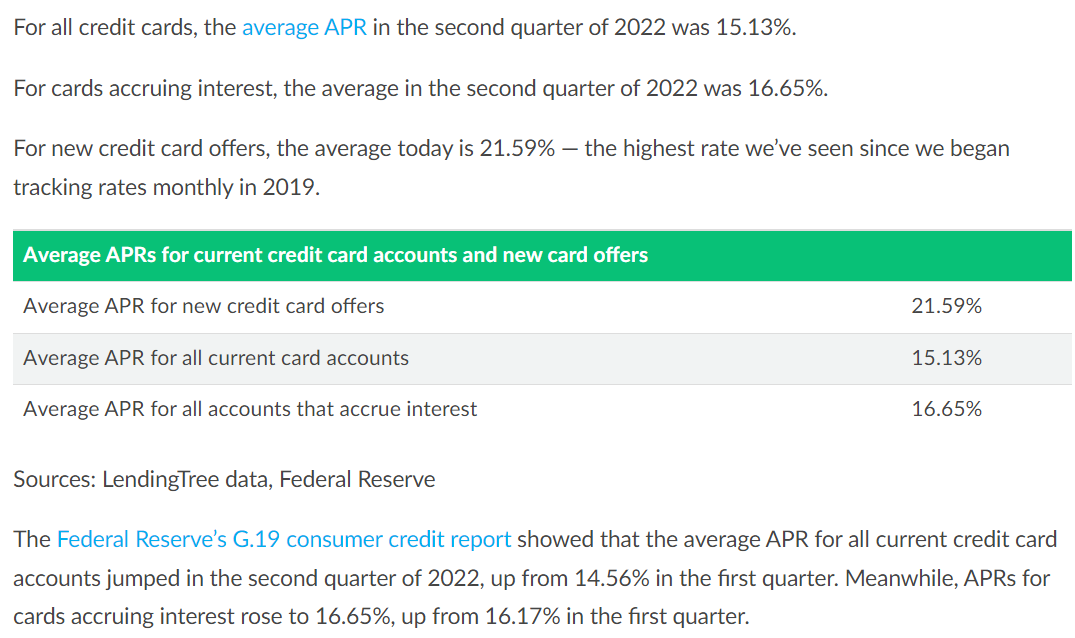

LendingTree

LendingTree

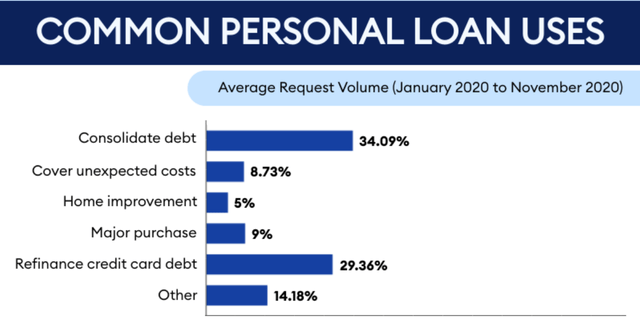

Despite rapidly-rising interest rates, Americans are taking on more credit card debt, and we know where that’s headed. Credit card debt consolidation is one of the primary drivers of new personal loan originations, and so this credit card debt data can be considered a positive for Upstart.

Forbes

I can’t be sure, but the market is probably looking at this data and saying that Upstart’s origination volumes could rebound even at higher interest rates once the debt markets unfreeze. Lending is a function of risk/reward, and if the reward is large enough, creditors will take on the risk of lending. The rate hike cycle will probably end sometime in early to mid-2023, and a stable rate environment will lead to an unfreezing of debt markets. This should result in the abatement of Upstart’s marketplace funding constraints to some extent and lead to a rebound in origination volumes. I think Upstart’s relative strength is Mr. Market looking to price in the scenario I just laid out.

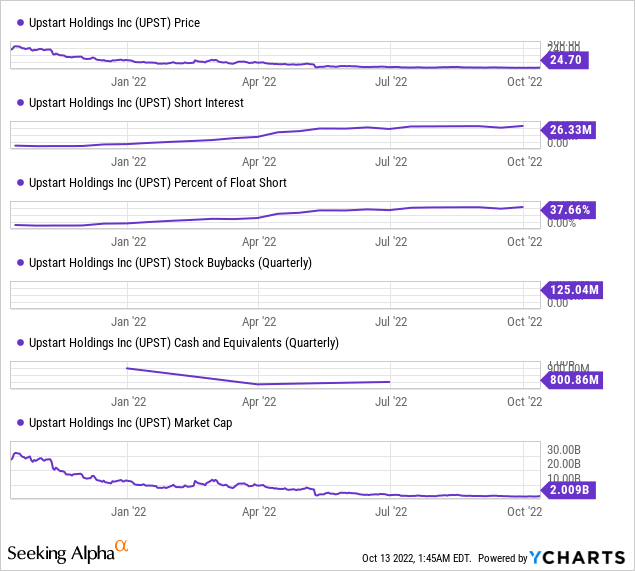

Lastly, I can see one more potential driver for Upstart’s recent bullish price action. After months of a downtrend, short-selling Upstart has reached a new zenith. With more than 26M shares sold short, ~37% of Upstart’s float is currently shorted. That’s too extreme for a business operating at breakeven operational cash flows whilst holding $800M in cash (~40% of market cap). Furthermore, $375M of this cash is still available for stock buybacks [after $125M worth of stock was repurchased in Q2], and the management should (and could) be executing this buyback program aggressively in Q3, given Upstart’s depressed valuation. The float is getting smaller by the quarter, and short-sellers could easily end up getting squeezed here, and maybe Upstart’s relative strength is an early indication of a potential near-term short-squeeze.

Final Thoughts

As an investor, I am happy to see Upstart’s relative strength; however, after a series of disappointing quarters and consideration of current macro conditions, I don’t expect to see any fireworks from the company in Q3 or Q4. With that said, no pre-announcement this time around means we won’t get a repeat of the Q2 shocker. While solid website traffic data and increased credit card debt don’t necessarily imply a stronger-than-expected Q3 for Upstart, I am optimistic about Upstart meeting their guidance.

As we know, Upstart is trading well below its fair value. With the short interest at 26M shares (37% percent of the float sold short), better-than-expected or even less-worse-than-feared numbers could send UPST stock soaring. That said, Upstart’s business model is hinged on the credit cycle, and FED’s ongoing QT (quantitative tightening) program will likely continue to hurt Upstart for the foreseeable. Once the Fed pivots (pauses), Upstart’s business should start recovering, but the next couple of quarters remain pivotal (and I don’t expect to see any fireworks).

While I said this last time around, I feel it must be repeated:

As a long-term investor, I continue to believe in Upstart’s vision of transforming the credit industry with artificial intelligence, and I truly hope that Upstart can succeed where predecessors like LendingClub have failed. Nothing is guaranteed in investing, but Upstart is one of those generational bets that can end up disrupting a multi-trillion-dollar industry. While Upstart is facing several headwinds, the company has enough liquidity ($800M in cash) to get through this debt cycle downturn. The fact that Upstart is not burning cash (operating near FCF breakeven) helps. If Upstart’s AI proves its ability to price credit risk better than traditional FICO-based models, we can expect explosive volume growth at Upstart over the next few years. However, investors may need to wait patiently for the credit markets to unfreeze, which may not happen until the Fed pivots (slows or reverses its quantitative tightening program). And in this period, Upstart’s management is likely to be forced into raising balance sheet risk to support lending volumes.

Marketplace funding constraints and the risk of Upstart being left holding a big bag of bad loans are sending shockwaves into Upstart’s investor base that was primarily betting on a marketplace business with massive scalability and no balance sheet risk. With the financial performance set to get worse amid rising balance sheet risk, Upstart’s stock may suffer more pain in the near term.

Considering the asymmetric risk/reward on offer, I continue to like Upstart as a long-term buy at ~$24. However, I am taking this high-risk, high-reward bet with an insurance policy, i.e., an options-based hedging strategy. Since early May, I have been hedged on most of my portfolio in a similar vein to Upstart, and this proactive risk management has enabled me to protect my wealth, increase holdings in my highest conviction ideas with little to no additional capital, and sleep well at night during this vicious bear market of 2022.

Despite Upstart showing relative strength against the market, I am keeping my hedges in place. If you are interested in learning about my positioning for Upstart, you can find it in the note linked above. In my view, Upstart remains a high-risk, high-reward bet for bold, long-term investors. If you are worried about near-term downside, consider using proactive risk management (options-based hedging) strategies or accumulate the stock using a 6-12 month DCA (dollar-cost averaging) plan.

Key Takeaway: I rate Upstart stock a ‘Strong Buy’ for long-term investors at $24.

Thanks for reading, and happy investing. Please let me know if you have any thoughts, questions, or concerns in the comments section below or send me a direct message on SA.

Be the first to comment