JHVEPhoto

Continuing down the regional bank road, this report examines M&T Bank Corporation (NYSE:MTB). Founded in 1856 as Manufacturers and Traders Bank in Buffalo, New York by Pascal Pratt and Bronson Rumsey to finance durable manufacturing equipment, the company today boasts over 1,000 branches and 2,200 ATMs across 12 states from Maine to Virginia. The company completed its largest acquisition to date earlier this year, the $8.3 billion purchase of People’s United Bank.

It looks like the stock price has gotten ahead of itself heading into the latter part of this year. With a challenging economic backdrop, the recent results of the merger look okay from a year-over-year growth perspective. However, the bottom line numbers this year are somewhat disappointing.

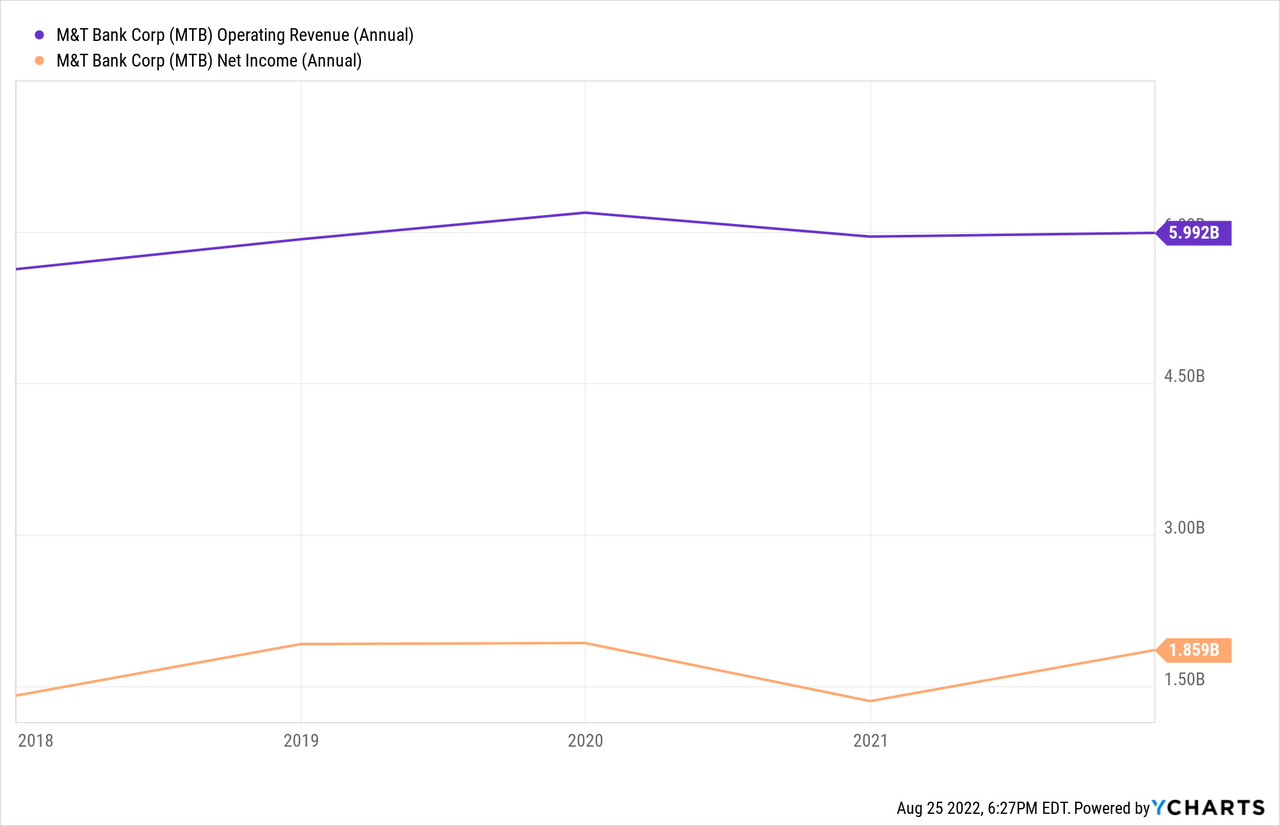

Income Statement

Because of the acquisition this year of People’s United Bank, the results from the past couple of years are not exactly comparable to this year’s results. Nonetheless, I present them here as an indicator of past operating performance and to look for clues as to how the company may perform going forward.

Beginning with net interest income in 2021, interest income decreased 6.1% (not good), while interest expense decreased over 65% (very good) from 2020. This resulted in a decrease of 1.1% in net interest income, which is fairly consistent with the other banks I have reviewed recently. Management cited the decline was due to a narrowing of the interest rate margin during the year. The average rate on assets declined 59 basis points, while the average rate on liabilities declined 29 basis points. This trend continued through the first quarter of this year, as net interest income declined 8% from the first quarter of 2021 (and this was before the People’s United acquisition closed). For the first half of 2022, however, net interest income has increased 20%, primarily due to the higher level of earning assets from the People’s United transaction. The net interest margin turned more favorable in the second quarter, as the average rate on assets increased 40 basis points, compared to a 7 basis point increase in the rate on liabilities. Interestingly, the percentage of total revenues from net interest income was at the highest level for the first half of this year since 2018 at 67.6% of total net revenues. This is above the average of 66% over the past five years.

| 2020 | 2021 | YTD 2022 | 5-yr CAGR | |

| Interest income | $4.2B | $3.9B | $2.4B | +0.2% |

| Interest expense | $0.3B | $0.1B | $78M | (23%) |

| Net interest income | $3.9B | $3.8B | $2.3B | +2.0% |

| NII % of net revenues | 64.9% | 63.8% | 67.6% |

66.0% (5-yr avg.) |

Source: sec.gov, company filings

The company’s non-interest revenues have shown steady 3.5% annual growth over the past five years. Growth has been led by mortgage banking revenues and the trust business in recent years. However, the challenges in the mortgage business across the industry are painfully evident at M&T, as mortgage revenues are down 29% YTD compared to the first half of 2021. Total non-interest revenues increased by 9.1% compared to the first half of 2021, mainly due to the acquisition. Excluding the acquisition, total non-interest revenues would have shown a slight gain, year over year. The trust business and brokerage services have shown solid growth.

The activity surrounding the provision for credit losses is interesting. For the full year 2021, the company reported a benefit of $75 million, the first benefit from loan losses since at least 2013. At the time, the company said the benefit was due to “improvements in economic conditions and forecasts throughout 2021” which led to the provision recapture. However, in the company’s Q2 10-Q, management considered:

risks associated with rising inflation, including a slight reduction of economic growth projections as compared with the immediately preceding quarter and continued concerns about commercial real estate values in the hospitality and office building sectors.

The company booked a provision for loan losses of $302 million, including $242 million on loans obtained in the People’s United acquisition. Here is another bank that has confirmed a quick turnaround in the economy in just six months this year. Certainly, investors should keep their eyes on what management has to say about the economic outlook and borrowers in the third quarter reports.

On the expense side, the company has historically done a good job managing non-interest expenses. However, things are not looking as good this year. Compensation is the largest expense category for financial firms. At MTB, the compensation expense ratio has averaged 0.31 over the past five years, with 2021 coming in at 0.34, slightly higher than average. This has been a trend at the regional banks I have examined, as labor costs and benefits seem to be picking up. Through the first half of 2022, the ratio was 0.39, well above the latest full year results.

The efficiency ratio, a measure of overall expenses, has averaged 0.57 over the past five years, with 2021 finishing at 0.60. Higher salaries and benefits, outside data and software, FDIC assessments and professional services were noted as the drivers of higher spend in 2021. Through the first six months of this year, the efficiency ratio was 0.69, well above recent trends. Included in the Q2 results were merger-related expenses of $223 million. Despite the merger-related expenses, the expenses still ran above trend due to higher salaries and benefits and outside data and software costs. Year-to-date 2022 expenses are 32% higher than the first half of 2021, while net revenues are only 16.5% higher than last year, resulting in net income 36% lower than the first half of 2021. This is an area of concern for me as we wait for the rest of the year to unfold.

The bottom-line net income numbers have historically been really strong for MTB. Operating margins have averaged 39% over the past five years, with 2021 coming in at 41%; however, the company did have that loan loss benefit mentioned above. If the 2021 benefit was a pre-pandemic average loss provision, operating margin would have been about 37%, slightly lower than the historical average. Operating margin for the first half of this year was 22%, primarily due to the higher spend discussed above. Q1 was okay at 33%, but it fell off in Q2 at just 14%.

Five-year net income for common stockholders has increased at 7.8% annually, with EPS increasing at a very strong 12% annually over the same period. In the first half of 2022, net income decreased 41% to $1.1 billion, while EPS decreased 45% to $3.70 per share, compared to the first half of 2021.

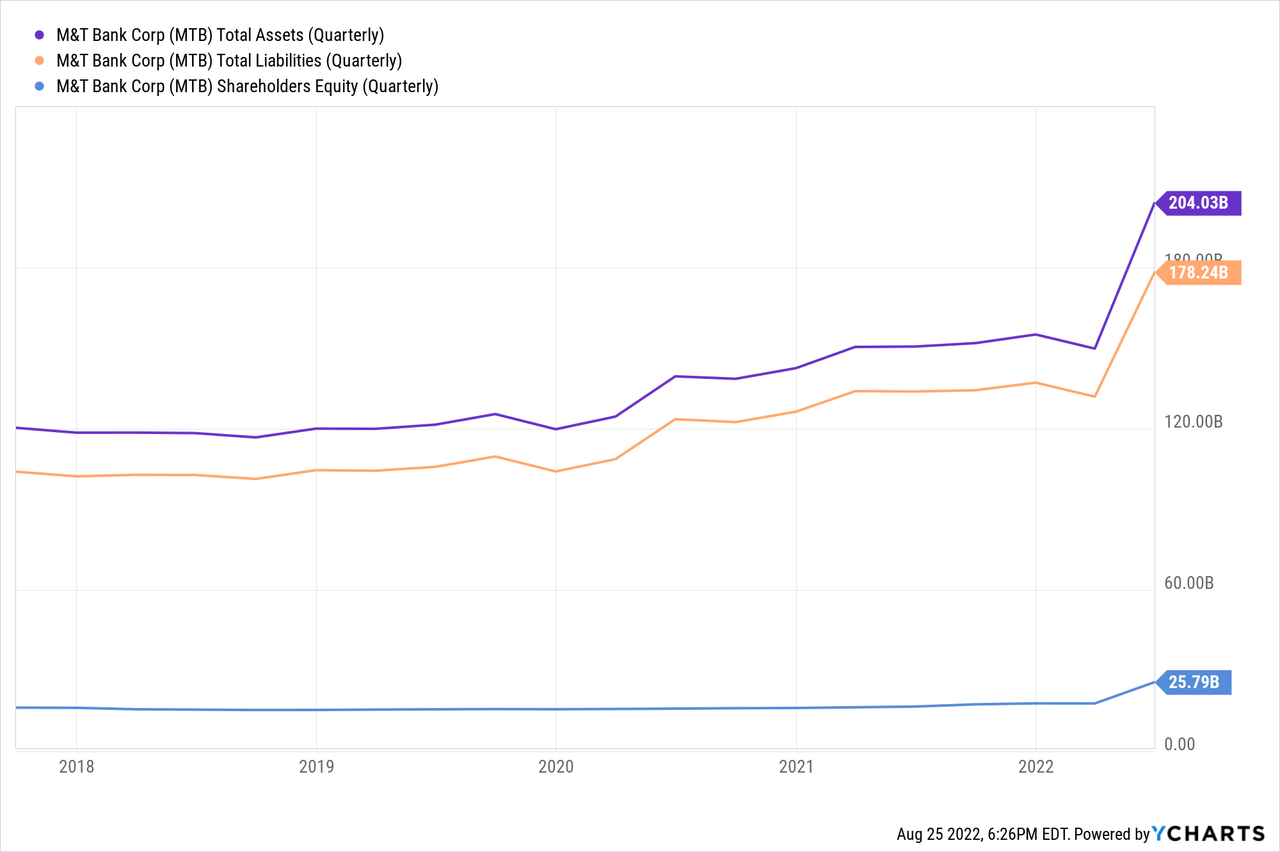

Balance Sheet

Looking at the balance sheet, total assets have increased 4.7% annually over the five-year period ending in 2021. Over this same period, loan growth has been basically flat. This is quite a bit lower than the other banks I have reviewed and is an area of concern going forward. The loan business should be better than flat over this period of time, particularly given the strong deposit growth the bank has produced. Following the acquisition, the total assets reported at the end of Q2 2022 were $204 billion, compared to $155 billion at the end of 2021 before the merger. Total liabilities have outpaced asset growth, though, with a 5.1% annual growth over the five-year period. Deposits have been strong, with a 6.6% annual growth rate over this time frame.

Notably, long-term debt has decreased 18% annually over the past five years, from over $8 billion to just $3.5 billion at the end of 2021. Total borrowings have increased slightly post-merger, but still well below the levels seen years ago.

Finally, shareholders’ equity has increased 1.7% annually, primarily driven by an increased reliance on preferred stock as a source of capital, which is consistent with other companies I have reviewed. Additionally, common equity and tangible common equity have both increased 1.2% and 1.8%, respectively, over the past five years. Post-merger, equity is $25.8 billion, compared to $17.9 billion at the end of the previous year. The company used a combination of preferred and common stock to fund the People’s United acquisition. The transaction added $8.4 billion to the bank’s common shareholders’ equity and $261 million to preferred equity. The company did repurchase $600 million of common stock in the most recent quarter, and the Board of Directors authorized a program to repurchase another $3 billion of common stock.

Ratios

Return on equity averaged 10.3% in the years prior to the 2020 pandemic. After falling in 2020, ROE rebounded to 10.9% in 2021. At the end of Q2, ROE was 5.3% due to reduced net income in the first half of the year and higher equity from the acquisition. Return on common equity has followed the same trend, declining from 12.9% in 2019 to 11.4% in 2021. At the end of Q2, ROCE was 5.3%.

Debt to equity has steadily decreased, from a high of 0.78 in 2015 to just 0.20 at the end of 2021. Similarly, debt to total assets has decreased from 0.10 in 2015 to 0.02 in 2021. Interest coverage ratios have been strong over the past several years.

Loan Quality

I do not see any glaring issues with loan quality. Net charge-offs in 2021 were just 0.20% of loans. But investors need to keep in mind the comment earlier about management noting concerns about commercial real estate.

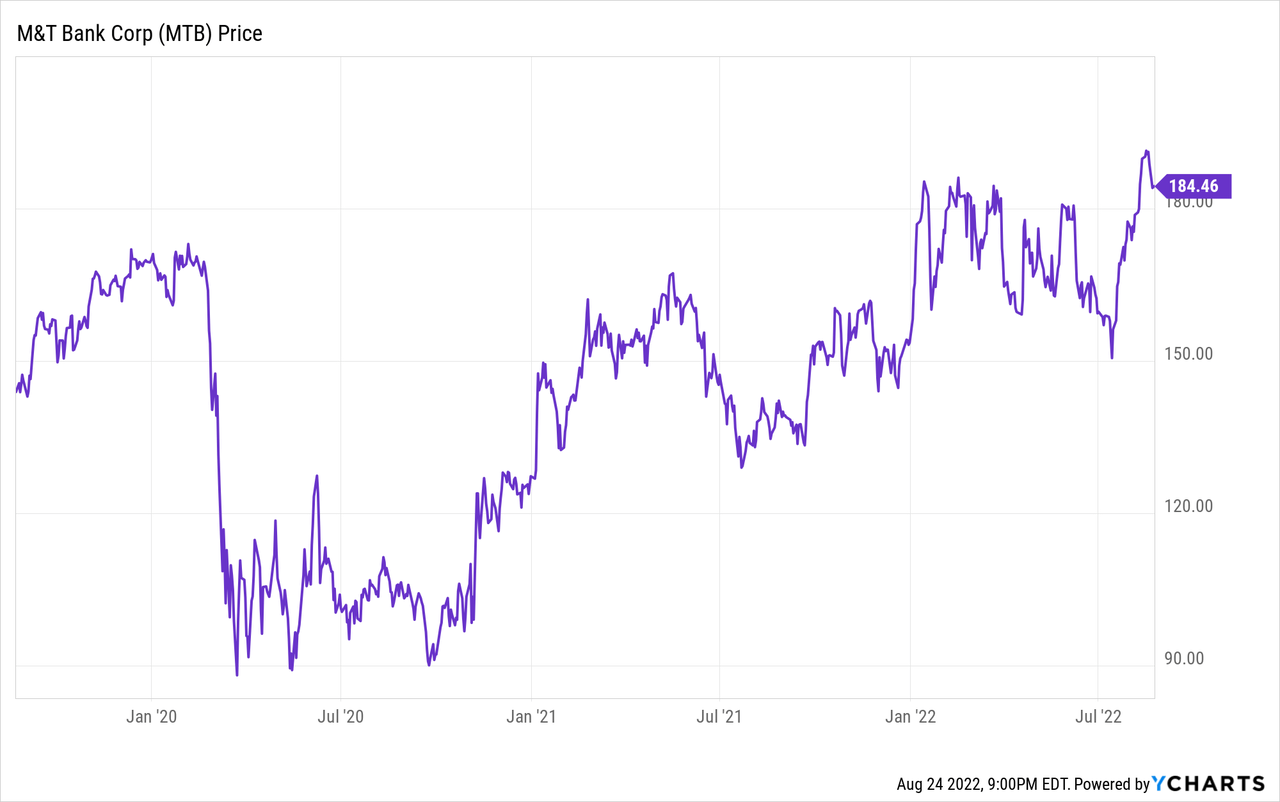

Stock Performance and Valuation

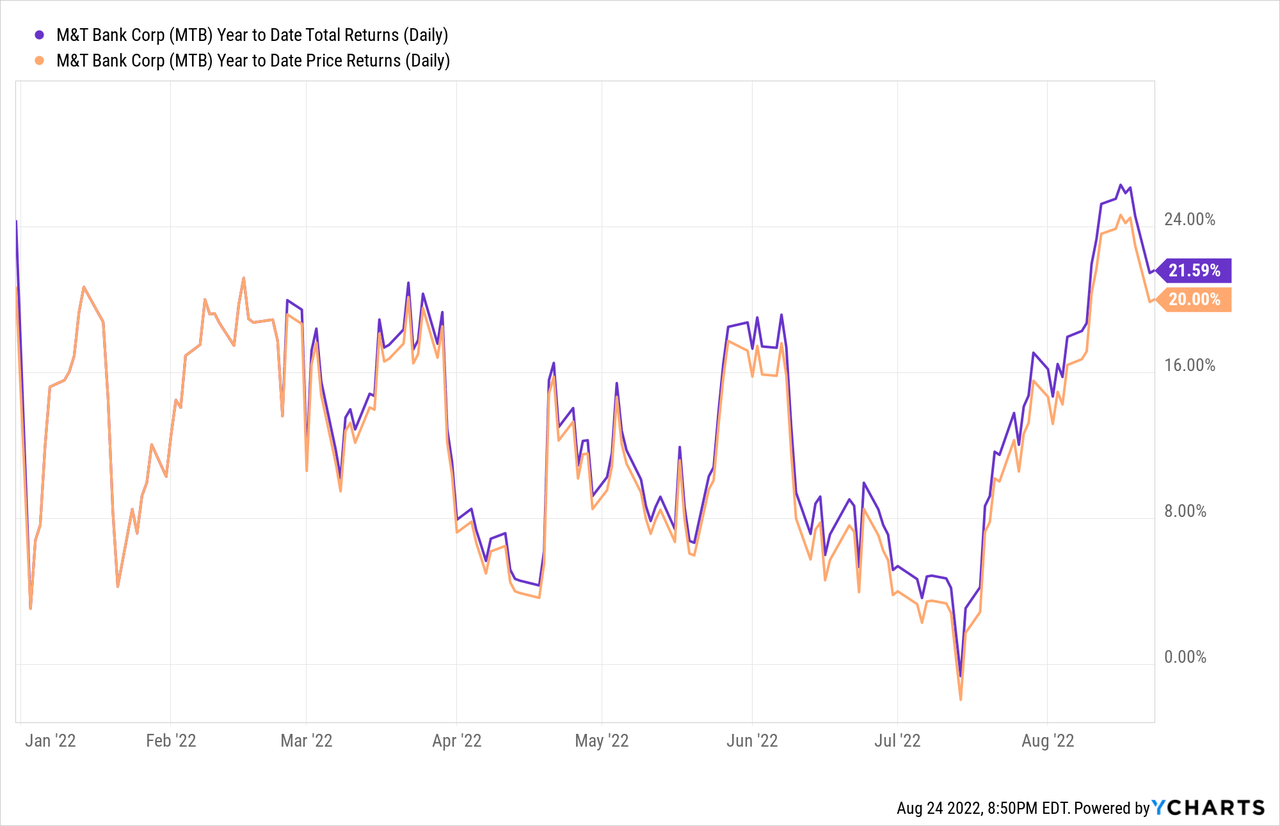

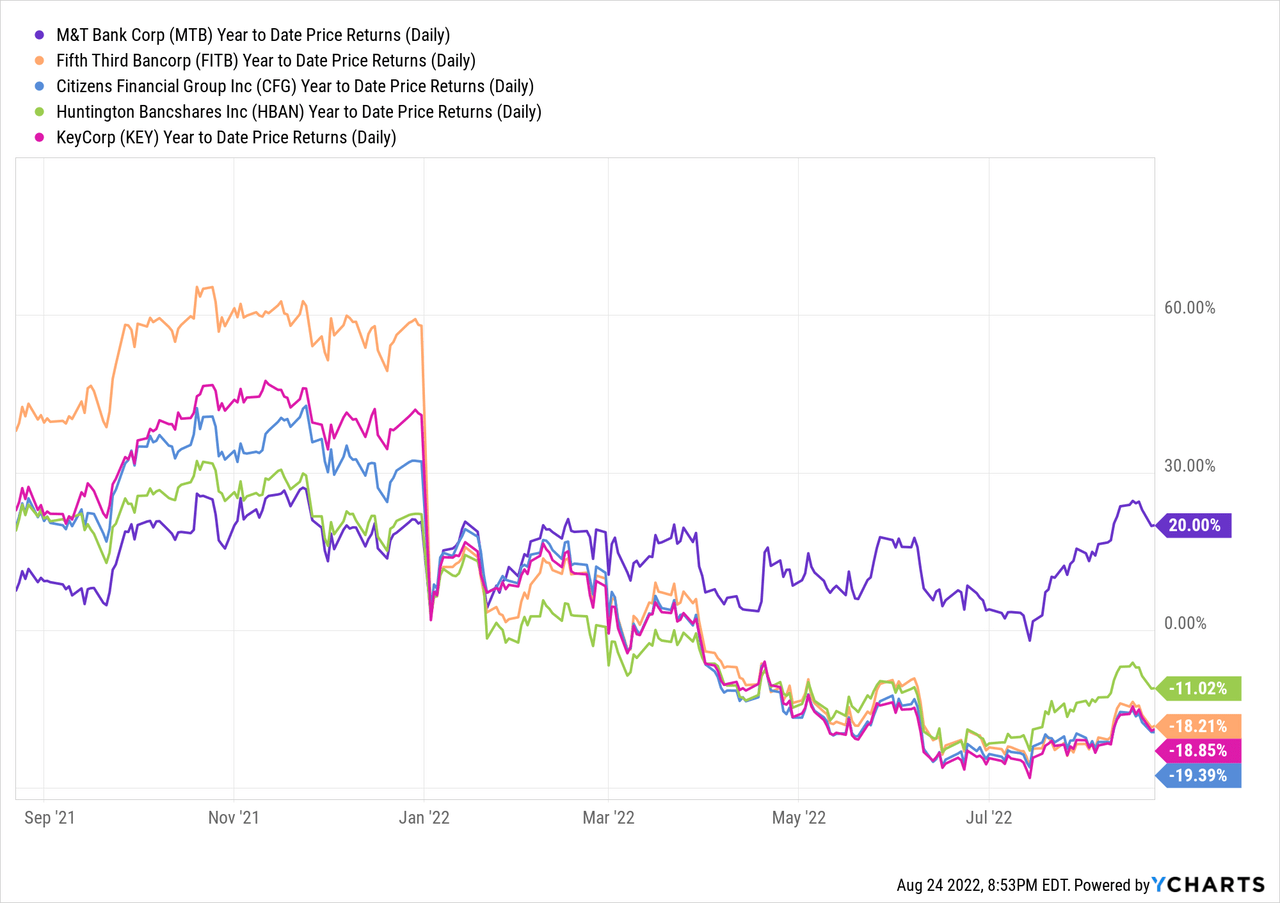

MTB is another good, quality regional bank. The stock has done very well this year as it is up 20% on a YTD basis:

Compared to several of its peers, MTB has outperformed on a YTD basis:

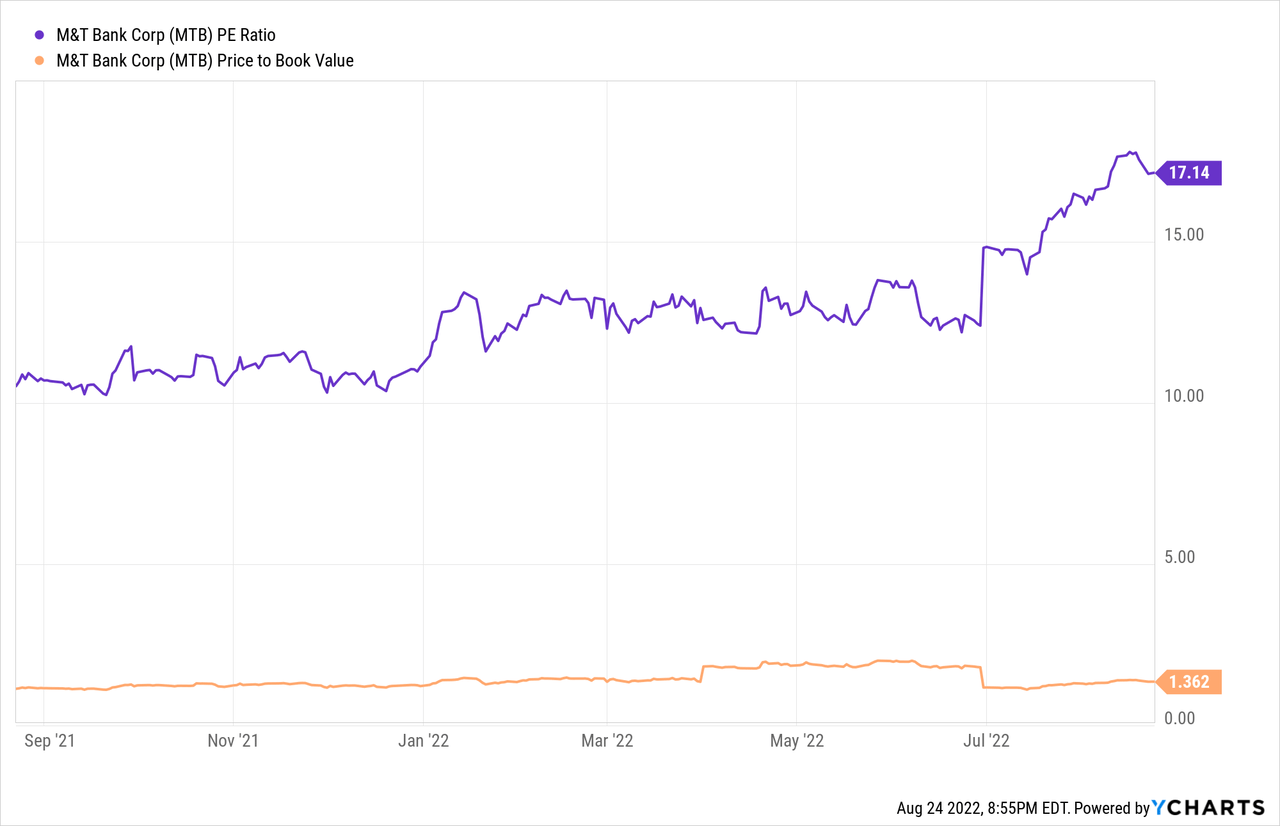

At a recent price of $184.34, the stock is trading at 17.1x last twelve months earnings with a 1.4x book value ratio.

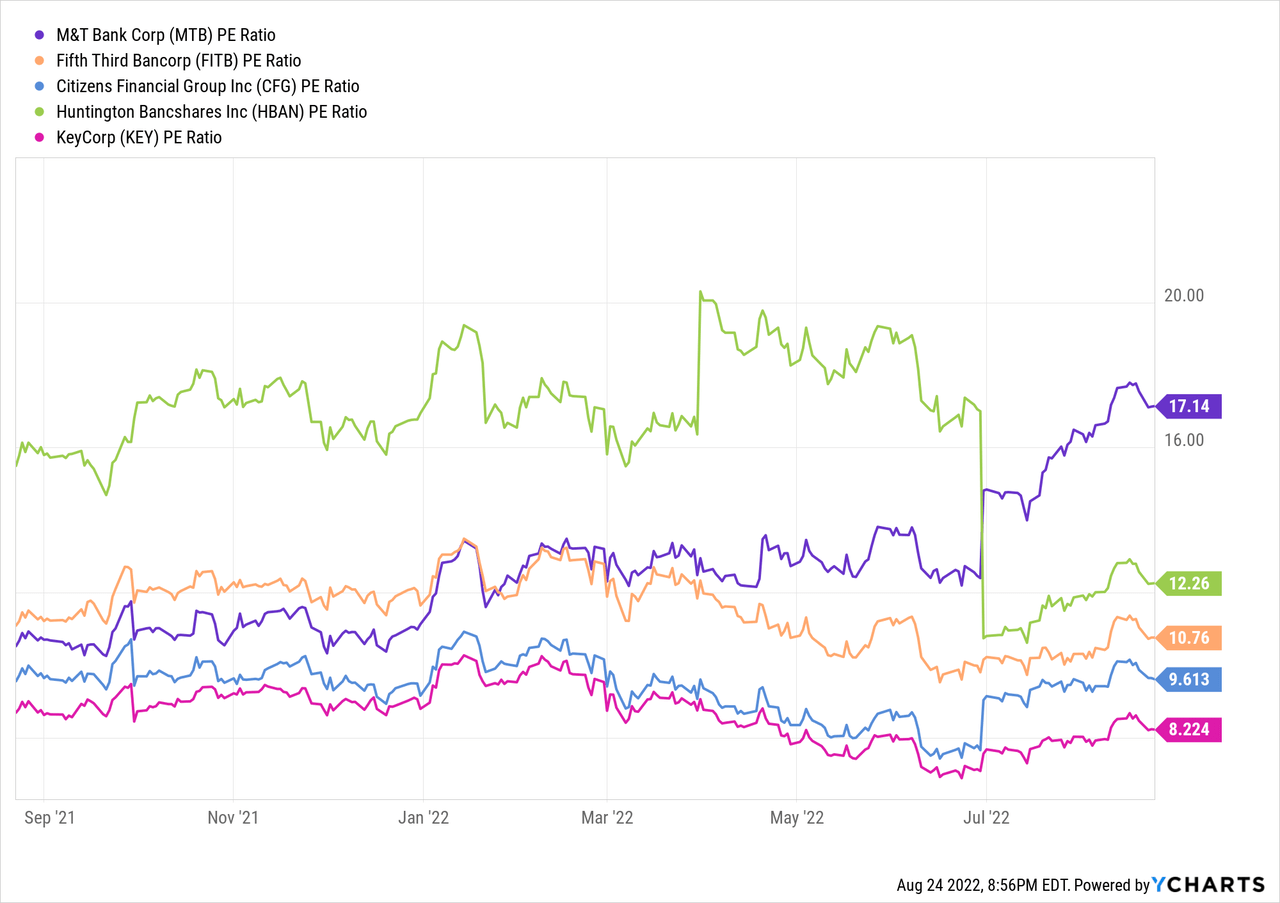

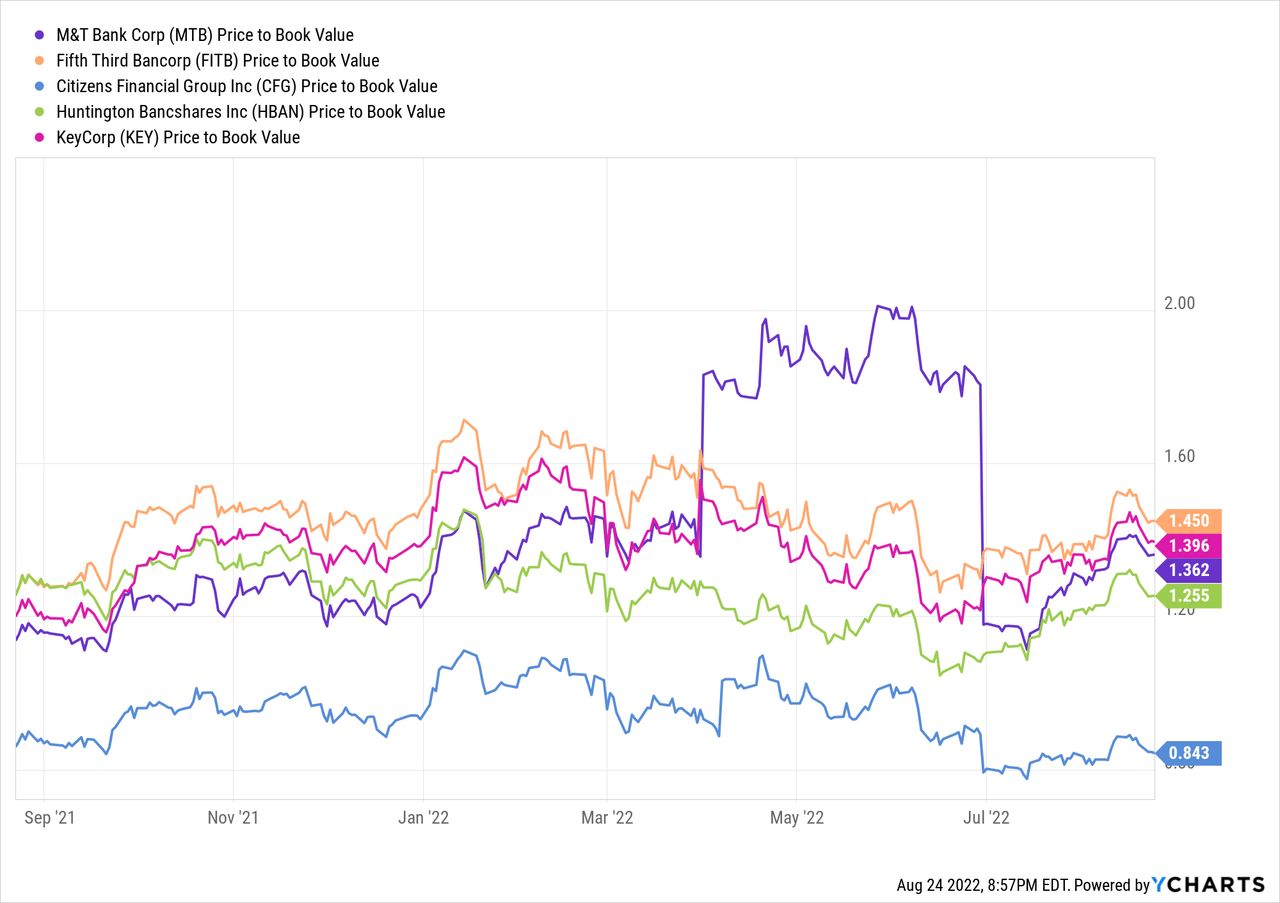

The P/E ratio is well above the five-year average, while the P/B is about at the five-year average. Compared to its peers, MTB has the highest P/E ratio and an above-average P/B ratio:

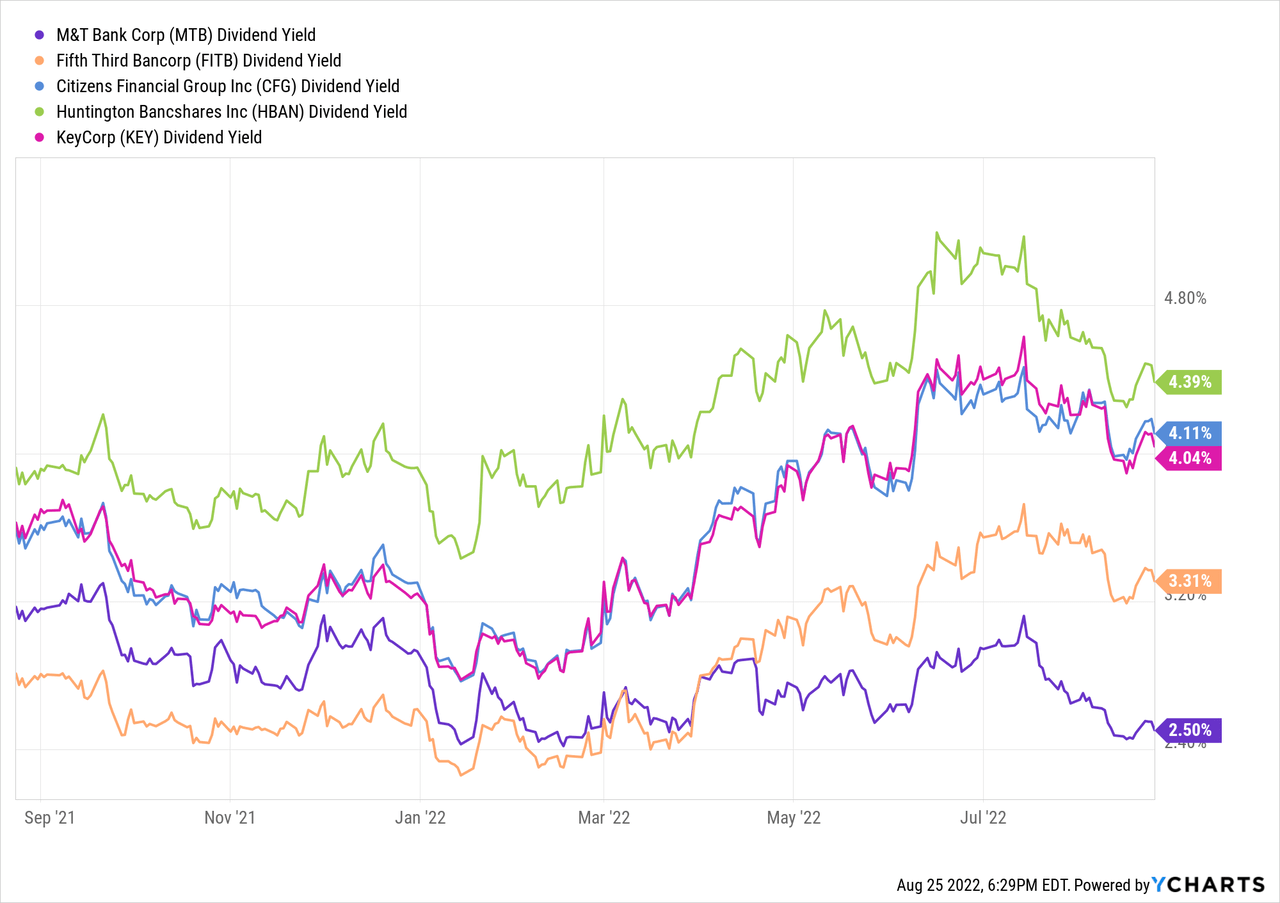

The company pays a generous dividend, although the current yield is below the peer average:

Using a variety of valuation methods, the fair value for this stock is about $150, so the stock is currently overpriced. With a yield of 2.50%, which is below the peer average, and with the economic backdrop not necessarily improving, I think investors would be wise to look elsewhere for regional bank exposure. For investors who are sitting on gains, it might be good to take some money off the table. I like the company, although I do not like how the expenses have really jumped up this year. At the next sell-off into the 150s, which is about a 19% decline from the current price, I think investors would be in a good position for future gains. Also, at that level and with the current expected dividend, the yield would be a much more reasonable 3.2%. Still below the peer group, but better. The company does like to repurchase stock and the dividend is very safe. The price is just too rich for me at these levels. Also, given the economic backdrop, I think investors could do better with another regional bank stock.

M&T Bank is another good, strong regional bank. With the recent acquisition of People’s United, the company has expanded further into the New England market. However, at these prices, the margin of error has decreased substantially as the stock is at the highest levels in about three years. The price is high, and I am not comfortable buying what looks to be the most expensive stock in the group.

Be the first to comment