KangeStudio/iStock via Getty Images

Earnings of Amalgamated Financial Corp. (NASDAQ:AMAL) will continue to surge through the end of 2023. Strong loan growth will likely be the chief catalyst for earnings in the next year and a half. Further, moderate margin expansion will support the bottom line. On the other hand, higher provisioning for expected loan losses will constrain earnings growth. Overall, I’m expecting Amalgamated Financial to report earnings of $2.35 per share for 2022, up 40% year-over-year. For 2023, I’m expecting earnings to grow by a further 12% to $2.63 per share. The year-end target price is quite close to the current market price. Therefore, I’m adopting a hold rating on Amalgamated Financial Corp.

Loan Growth to Decelerate from Second Quarter’s Unsustainable Level

Amalgamated Financial’s loan book grew by an outstanding 10% in the first half of 2022, or 20% annualized, which is quite unusual given the historical trend. Going forward, loan growth will likely remain at a decent level due to team expansion plans. Amalgamated Financial is planning to invest in talent, which should further propel loan growth. This hiring would be broad-based and ‘across critical roles’, as mentioned in the earnings presentation.

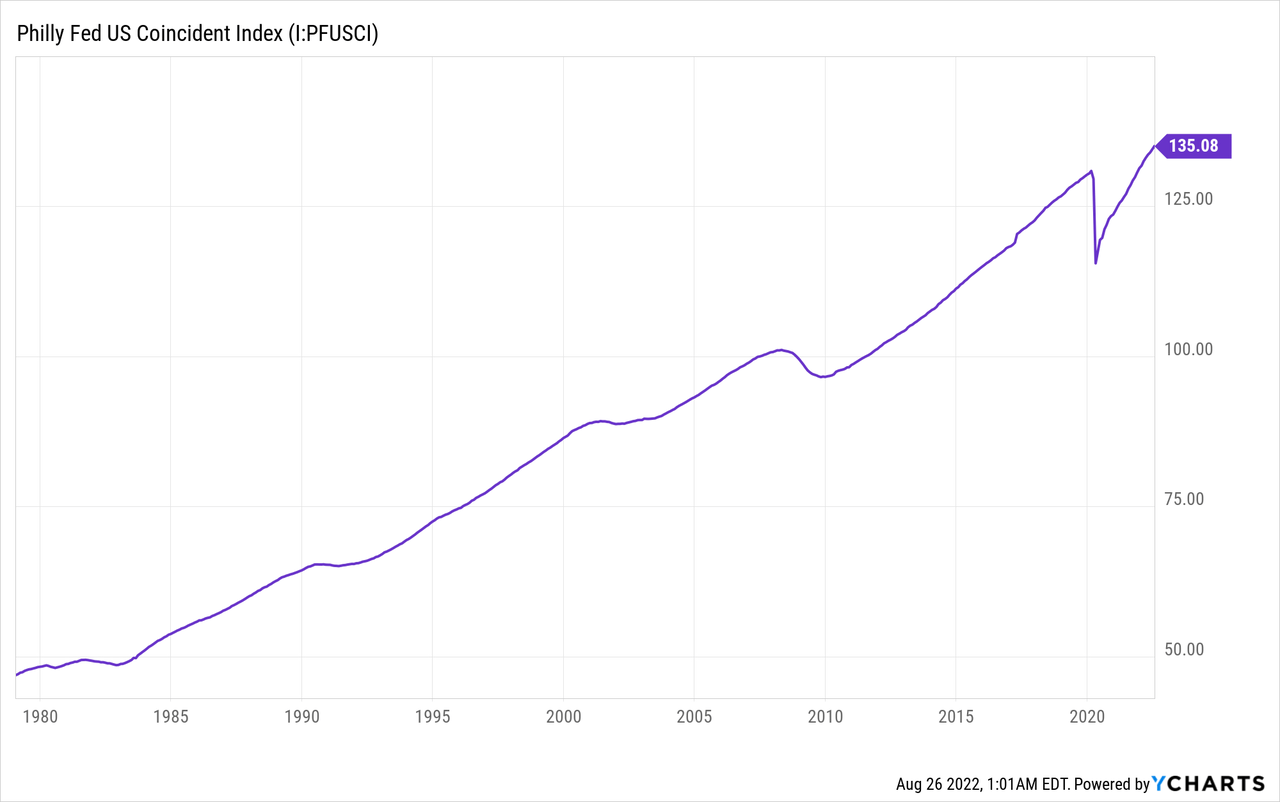

Amalgamated Financial has a well-diversified loan portfolio with various types of loans, from residential real estate to commercial and industrial loans to consumer solar loans. Geographically as well, Amalgamated Financial is very diverse with its digital banking platform offering banking services across the country. Physically, however, Amalgamated Financial is present in only New York City, Washington D.C., and San Francisco. Given the profile of the company’s portfolio, the U.S. coincident index is a good gauge of credit demand as it is broad-based and includes several economic indicators. As shown below, the index is in a good place in a historical context.

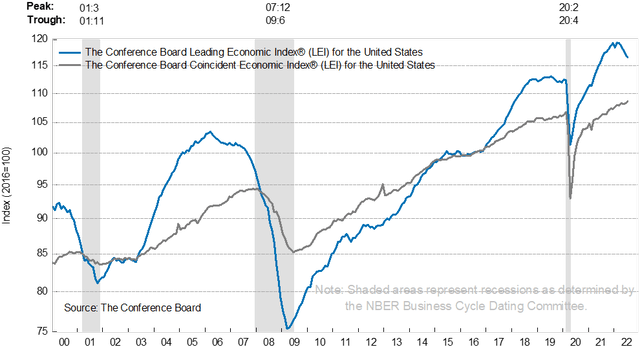

The Conference Board’s Leading Economic Index is also an appropriate indicator of credit demand. This index, however, presents a less rosy picture of the economic outlook, which is bad news for credit demand.

Given the mixed economic outlook, I’m expecting loan growth to decelerate to 8% annualized in the second half of 2022. For 2023, I’m expecting further deceleration to 4%.

Margin to Expand Moderately due to Rising Interest Rates

Amalgamated Financial’s net interest margin expanded by 27 basis points during the second quarter of 2022 mostly due to loan growth. The rising rate environment also contributed to the increase in the margin, but to a limited extent.

As can be gleaned from information given in the second quarter’s 10-Q filing, only around 30% of the loan portfolio will re-price or mature within a year. Further, only around 32% of the securities portfolio carries variable rates, as mentioned in the presentation. Therefore, the average earning asset yield is not very responsive to rate hikes.

Fortunately, the deposit cost is also quite sticky. Non-interest-bearing deposits made up a whopping 54% of total deposits at the end of June 2022. These deposits will restrain the average deposit cost as market interest rates rise.

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing show that a 200-basis points hike in interest rates could boost the net interest income by 6.9% over twelve months. Considering these factors, I’m expecting the margin to increase by ten basis points in the second half of 2022, before stabilizing in 2023.

Higher-than-Average Provisioning Likely

Allowances were 161.8% of nonaccrual loans at the end of June 2022. This coverage seems a bit tight, but I’m not too concerned because a majority of the loans are backed by real estate. Additionally, most of Amalgamated Financial’s loans are based on fixed rates. Therefore, higher interest rates will not hurt the debt servicing ability of a majority of the company’s borrowers.

However, high inflation could lead to financial stress for borrowers; consequently, it could damage the portfolio’s credit quality. Further, like other banks, Amalgamated Financial may want to bolster its reserves due to the threats of a recession.

Considering these factors, I’m expecting the provision expense to be slightly above average for the second half of 2022 and full-year 2023. I’m expecting the net provision expense to make up around 0.31% of total loans (annualized) in each quarter till the end of 2023. In comparison, the net provision expense averaged 0.27% of total loans in the last three years.

Expecting Earnings to Surge by 40%

Earnings of Amalgamated Financial will likely surge this year mostly on the back of strong loan growth. Further, the subdued margin expansion will support the bottom line. On the other hand, higher provisioning will restrict earnings growth. Overall, I’m expecting Amalgamated Financial to report earnings of $2.35 per share for 2022, up 40% year-over-year. For 2023, I’m expecting the company to report earnings of $2.63 per share, up 12% year-over-year. The following table shows my income statement estimates.

| FY19 | FY20 | FY21 | FY22E | FY23E | ||||||

| Income Statement | ||||||||||

| Net interest income | 167 | 180 | 174 | 225 | 248 | |||||

| Provision for loan losses | 4 | 25 | (0) | 11 | 12 | |||||

| Non-interest income | 29 | 41 | 28 | 29 | 30 | |||||

| Non-interest expense | 128 | 134 | 132 | 145 | 156 | |||||

| Net income – Common Sh. | 47 | 46 | 53 | 73 | 82 | |||||

| EPS – Diluted ($) | 1.47 | 1.48 | 1.68 | 2.35 | 2.63 | |||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Erosion in Equity Book Value Likely

Due to a large balance of fixed-rate available-for-sale securities, Amalgamated Financial’s equity book value has plunged so far this year. As interest rates increased, the market value of the available-for-sale securities declined, leading to sizable unrealized losses. These losses skipped the income statement and flowed into the equity account through other comprehensive income, as per relevant accounting standards. Amalgamated Financial’s tangible book value dropped to $15.69 per share at the end of June 2022 from $17.56 per share at the end of December 2021.

Going forward, the tangible book value will slip further as I’m anticipating a 150 basis points hike in interest rate in the second half of 2022 (including the 75 basis points raise in July). However, as mentioned in the presentation, Amalgamated Financial transferred $277.3 million of available-for-sale securities into the held-to-maturity portfolio during the second quarter to reduce potential mark-to-market volatility. This transference will reduce the impact on the equity book value. Further, retained earnings, as discussed above, will support the book value per share. The following table shows my balance sheet estimates.

| FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | |||||

| Net Loans | 3,439 | 3,447 | 3,276 | 3,755 | 3,907 |

| Growth of Net Loans | NA | 0.2% | (5.0)% | 14.6% | 4.1% |

| Other Earning Assets | 1,635 | 2,088 | 3,289 | 3,858 | 4,015 |

| Deposits | 4,641 | 5,339 | 6,356 | 7,438 | 7,740 |

| Borrowings and Sub-Debt | 137 | 53 | 132 | 131 | 136 |

| Common equity | 491 | 536 | 564 | 531 | 601 |

| Book Value Per Share ($) | 15.2 | 17.2 | 17.9 | 17.0 | 19.3 |

| Tangible BVPS ($) | 14.6 | 16.6 | 17.4 | 16.5 | 18.7 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Current Market Price is Close to the Year-End Target Price

Amalgamated Financial is offering a dividend yield of 1.8% at the current quarterly dividend rate of $0.10 per share. The earnings and dividend estimates suggest a payout ratio of 15% for 2022, which is below the three-year average of 19%. Although there is room for a dividend hike, I’ve decided to assume no change in the dividend to remain on the safe side. As it is, the payout history is not long enough to determine what payout the management is comfortable with.

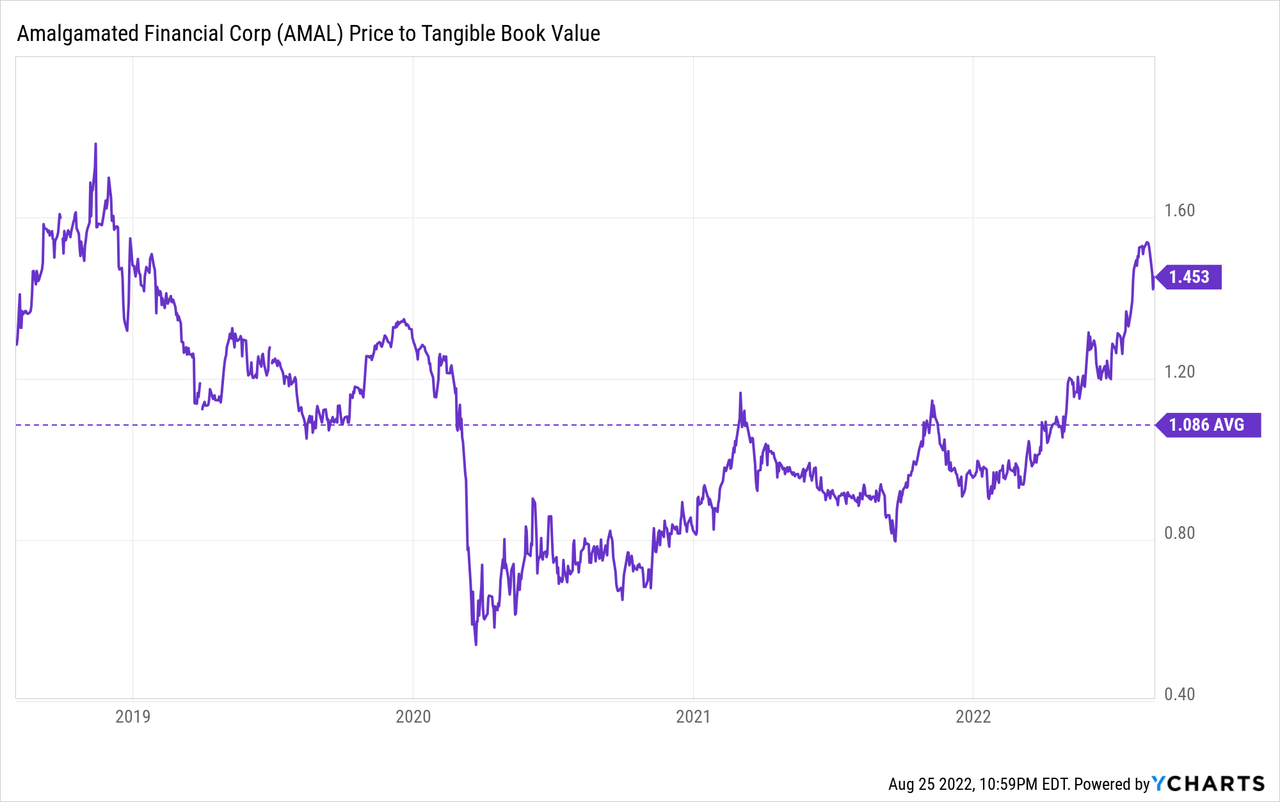

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Amalgamated Financial. The stock has traded at an average P/TB ratio of 1.09 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $16.5 gives a target price of $17.9 for the end of 2022. This price target implies a 21.4% downside from the August 25 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.89x | 0.99x | 1.09x | 1.19x | 1.29x |

| TBVPS – Dec 2022 ($) | 16.5 | 16.5 | 16.5 | 16.5 | 16.5 |

| Target Price ($) | 14.6 | 16.3 | 17.9 | 19.6 | 21.2 |

| Market Price ($) | 22.8 | 22.8 | 22.8 | 22.8 | 22.8 |

| Upside/(Downside) | (35.9)% | (28.6)% | (21.4)% | (14.2)% | (6.9)% |

| Source: Author’s Estimates |

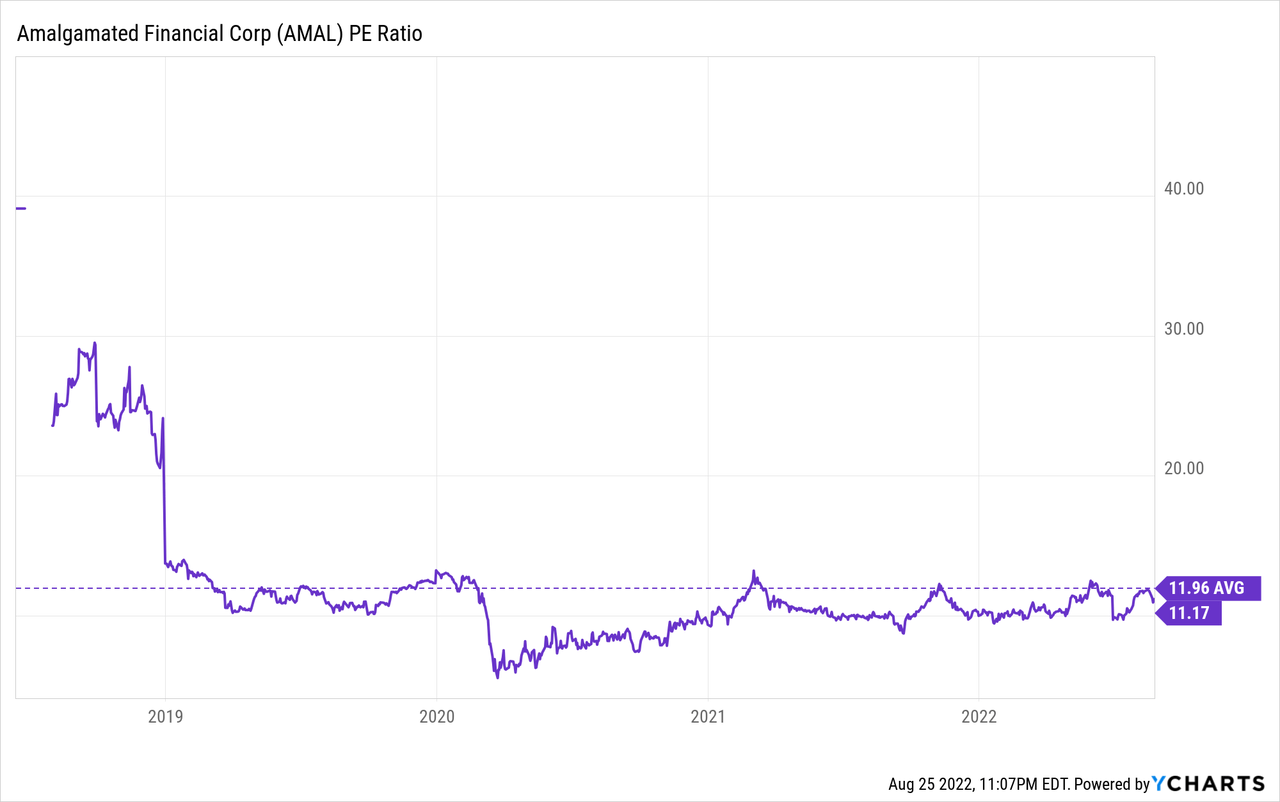

The stock has traded at an average P/E ratio of around 12.0x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $2.35 gives a target price of $28.1 for the end of 2022. This price target implies a 23.4% upside from the August 25 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.0x | 11.0x | 12.0x | 13.0x | 14.0x |

| EPS 2022 ($) | 2.35 | 2.35 | 2.35 | 2.35 | 2.35 |

| Target Price ($) | 23.4 | 25.8 | 28.1 | 30.5 | 32.8 |

| Market Price ($) | 22.8 | 22.8 | 22.8 | 22.8 | 22.8 |

| Upside/(Downside) | 2.8% | 13.1% | 23.4% | 33.7% | 44.0% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $23.0, which implies a 1.0% upside from the current market price. Adding the forward dividend yield gives a total expected return of 2.8%. Hence, I’m adopting a hold rating on Amalgamated Financial Corporation.

Be the first to comment