RapidEye/iStock via Getty Images

Look Out! Hot CPI Report

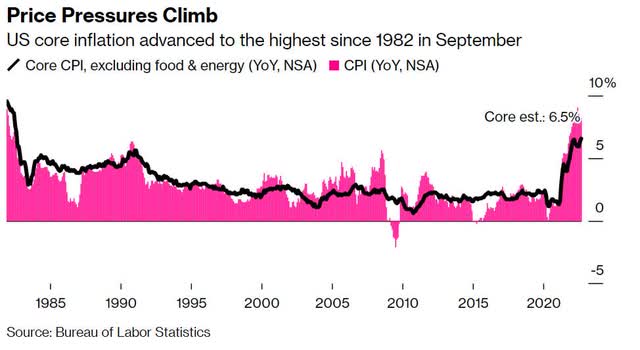

The fight against inflation persists, as volatility initially sent the major markets down after releasing October CPI data. Core figures which exclude food and energy sent the markets into a tailspin, showcasing:

-

Overall CPI jumped 0.4% from August figures and increased to 8.2% from last year

-

Core inflation increased to 6.6%, a new 40-year high from its 1982 level.

-

Shelter costs have risen 0.7% since August

As pricing pressures continue to climb, the slowdown in economic growth is highlighted by some of the root cause variables like shelter, which is not indicative of the true environment. Shelter and real-time rents may be coming down, but on an annual basis, they’re up 6.7%, the highest on record.

Core Inflation Pricing Pressures Chart (Bureau of Labor Statistics, Bloomberg)

The CPI data, which is lagged and not reflective of the current market environment, is troublesome from the monetary policy standpoint because the Fed is ignoring the headline. Housing continues to show year-over-year and month-over-month increases. And what impacts consumers the most are food, energy, and shelter. And while the price increases for food and energy are too volatile, the Fed continuing to exclude them from CPI, only focusing on the core, proves troublesome for monetary policy.

So what is core inflation, and why are energy and food excluded?

Core inflation represents the long-term change in the price of goods and services, whereby more volatile and transitory price changes like food and energy tend to be excluded. The Fed’s traditional approach of their exclusion may have worked in a normal market environment, but food and energy are the major headlines today. Considering that consumer spending is 70% of GDP, with food and energy consumption comprising some of the largest expenses at the current levels that have been elevated for so long, this noise is no longer just noise.

When inflation is not transitory and is elevated as a naggingly persistent headline with a larger impact on consumers than just simply core, the Fed is in a position where it will continue to hold a hard line on raising rates. I consistently say to heed the warnings regarding stocks with poor metrics at risk of performing badly. As we’re seeing in the whipsawing of the markets, energy, and food are big contributors to inflation. The warning signs are front and center.

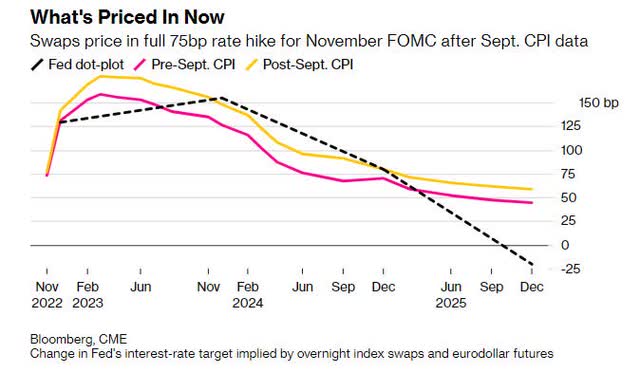

The market had quickly priced in higher than currently projected Fed increases, with the fed funds peaking in late 2023 at 4.864%, which is another 25 to 50 basis points higher than expected before CPI came out.

Fed Change in Interest Rate Targets (Bloomberg, CME)

So, we’re anticipating more hawkish increases between now and the remainder of the year, putting significant pressure on interest rates, Treasuries, bonds, and growth-oriented and less profitable tech stocks and stocks in general. Globally, central banks have been behind the curve, and the U.S. Fed’s inflation battle has investors uncertain about the future. And where food and energy are excluded from core CPI despite their elevated persistence, perhaps the Fed should consider including them for a more accurate attempt at taming inflation, especially when inflation has proven not to be transitory. Over the last year, CPI price increases have resulted in price upticks as follows:

Once again, hotter-than-expected CPI data for October and the upcoming November Fed meeting supports another 75 basis point hike –it may be higher. With these rising costs, investors want investments that can hedge against inflation, offering income and upside as portfolio gains continue to wither away. Stocks with recession-resilient characteristics like essential goods and services and the ability to pass costs onto consumers, coupled with Strong Buy ratings, can make for an excellent portfolio rescue in a down market. My five stock picks are fundamentally strong, with solid earnings projections and an excellent profitability, making a case for an investment rescue option.

5 Top Stocks According to Quant Ratings to Buy Now

“Sticky” costs of living (food, healthcare, and shelter, to name a few) have pressured the Fed to raise rates. The markets – especially growth and tech stocks – are sensitive to the hikes, which can impact companies’ growth and profits. Building a portfolio with stocks that can weather such storms offers an opportunity to hedge against inflation. I’ve selected five stocks below with strong financials and excellent overall Quant Ratings & Factor Grades to complement their Strong Buy ratings.

1. Genworth Financial, Inc. (GNW)

-

Market Capitalization: $2.07B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/13): 1 out of 660

-

Quant Industry Ranking (as of 10/13): 1 out of 22

Genworth Financial, an S&P 400 company offering insurance and mortgage products globally, is also a Top Stock Under $10. Operating in three segments: Enact, which offers mortgage insurance products, Life Insurance, and Runoff, GNW has a rich history. Founded as The Life Insurance Company of Virginia in 1871, this stock is recommended based on our quant model and supported by technical indicators and fundamental analysis.

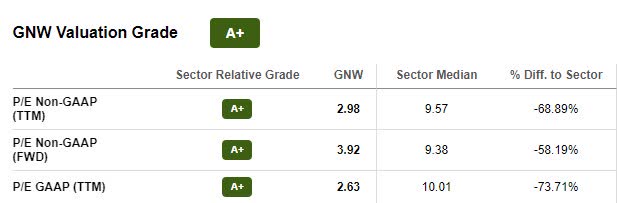

GNW Valuation & Momentum

Trading under $5 per share and with an A+ Valuation Grade, GNW offers excellent value compared to competitors and ranks number one out of 22 in the life and health insurance industry. GNW has a forward P/E ratio of 3.92x, a -58.19% difference to the sector, and a trailing EV/EBITDA of 2.30x, showcasing its substantial discount.

GNW Valuation Grade (Seeking Alpha Premium)

In addition to excellent valuation, GNW is also on a bullish trend, outperforming its sector peers quarterly. Over six- and nine-month price performance, GNW has outperformed its sector by more than 2x and 3x, respectively. Analysts are calling the stock Overbought, as investors have been actively purchasing shares, thus increasing the price.

Genworth Stock Growth & Profitability

Genworth Financial has had solid growth over the last several quarters, including the recent Q2 2022. Despite a nearly 5% decline in revenue from $1.87B, EPS of $0.34 beat by $0.04, and the company is adjusting to volatility and economic conditions affecting the markets, which have resulted in financial losses driven by the equity markets.

GNW EPS & Revisions (Seeking Alpha Premium)

GNW’s strong financial performance has allowed them to continue to advance towards strategic priorities, including last year’s successful execution of an IPO offering of its subsidiary, Enact Holdings, a top provider of private mortgage insurance through insurance subsidiaries.

“ 15,306,960 shares of Enact common stock were sold in the IPO, including the full exercise by the underwriters of their over-allotment option to purchase 1,996,560 shares at a price to the public of $19.00 per share. Enact is now trading on the Nasdaq Global Select Market under the ticker symbol “ACT” –PR Newswire.

Despite a slowing housing market, Enact has managed to continue strong operating performance and deliver shareholder returns that include stock price appreciation and dividends of +19% for Q2 2022. GNW’s insurance in force saw an increase of 9% YoY, resulting from strong new insurance and rising mortgage rates. With the continued increase in rates, there may be some slowing bond calls and commercial mortgage loan prepayments. “But we will benefit from our inflation-protected and floating rate securities, portfolio yields will also benefit as we’re able to reinvest new money at higher rates,” said Dan Sheehan, Genworth Financial CFO. As insurance benefits from higher interest rates, so does the energy sector. My next four picks are a great way to fuel up a portfolio.

2. W&T Offshore Inc. (WTI)

-

Market Capitalization: $1B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/13): 1 out of 249

-

Quant Industry Ranking (as of 10/13): 1 out of 71

Oil & Gas exploration company W&T Offshore Inc. is headquartered in Houston, TX, and has more than 43 working interests throughout the U.S., including the Gulf of Mexico. If you’re looking for confidence in a stock, look no further than W&T’s CEO Tracy Krohn, who holds one-third or 48 million shares of the company’s stock.

“This kind of insider ownership is not something you often see in energy, which has allowed WTI to pursue growth initiatives at a time when most public E&Ps are focused on capital returns, reflecting their belief of what will best grow shareholder value,” writes Kingdom Capital, Seeking Alpha author.

This oil and gas company is rising with great overall metrics, including valuation, growth, profitability, momentum, and analyst revisions. Despite some headwinds posed by a whistleblower scrutinizing the company’s cybersecurity management, WTI’s momentum remains bullish, aiding its strong outlook.

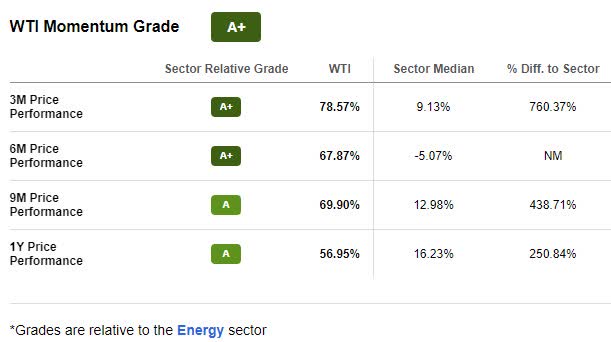

WTI Valuation & Momentum

WTI is undervalued with a forward P/E ratio of 5.33x, a -34% difference to the sector, and has extremely bearish momentum. Over the last year, the stock price has increased by more than 67%.

WTI Momentum Grade (Seeking Alpha Premium)

Despite the plunge in crude oil over the last few weeks from highs earlier this year, WTI posted record free cash flow for Q2 and has been one of the top energy and natural resources gainers over the last five days, showcasing why it’s one of my Strong Buy-rated stocks. Year-to-date, the stock is +108.83% and continues to outperform its sector peers quarterly, as showcased in the momentum grades above. Let’s dive into its growth and profitability.

WTI Growth and Profitability

Strong top- and bottom-line earnings for Q2 showcased some of the company’s best quarterly results. With an EPS of $0.85 that beat by $0.49 and revenue of $273.81M that beat by 106.14% YoY.

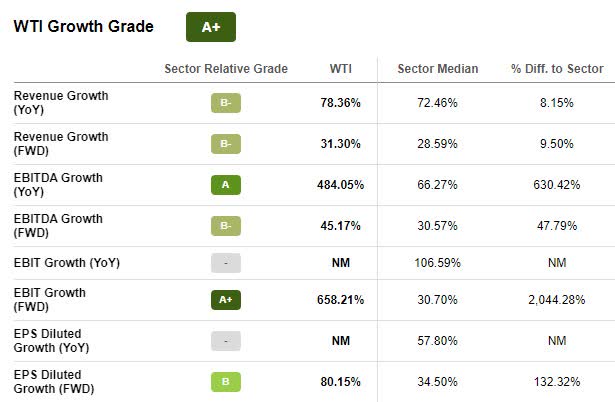

WTI Growth Grade (Seeking Alpha Premium)

WTI’s adjusted EBITDA was more than 3x its first quarter, and free cash flow was almost five times higher, for $234M. With debt reduction and production up 12% from the previous quarter to 42.4 (PH) barrels per day coupled with favorable pricing, WTI has generated $383.7M of adjusted EBITDA in the first half of 2022. Looking ahead to Q3:

“We’re increasing our full-year production guidance by 2% at the midpoint to 39,500 to 42,000 barrels of oil equivalent per day, and that reflects the continued strength of our production base and the benefit of the acquisitions we’ve closed so far this year…with a strong balance sheet and a meaningful amount of cash on hand, we will continue to evaluate accretive acquisition opportunities to meet our criteria, while systematically paying down debt.” –Tracy Krohn, WTI CEO.

3. YPF Sociedad Anónima (YPF)

-

Market Capitalization: $5.35B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/13): 2 out of 249

-

Quant Industry Ranking (as of 10/13): 1 out of 19

Integrated oil and gas company YPF Sociedad Anónima is another one of my top quant-ranked stocks and engages in up- and downstream activities. Headquartered in Buenos Aires, Argentina, the company comes at a great valuation, offering tremendous upside potential by recently agreeing to work with Petronas to develop the world’s largest shale gas reserve and fourth largest shale oil reserve, Vaca Muerta. Although the stock comes with some political risks from the difficult macro environment of Argentina that involves capital controls, infrastructure, and interference regarding exports, the nation has plans to double production between 2026 and 2030. As Seeking Alpha author Ricardo Fernandez writes:

“YPF is recuperating pricing power and margins, spending US$4bn in CAPEX and targeting to double oil and gas production by 2026 while exports could be on the horizon. The equity market seems enthused with shares tripling since July 2022 as production grew.”

Let’s dive into YPF’s recent earnings.

YPF Growth & Profitability

As the largest company in terms of revenues in Argentina, YPF’s largest shareholder is the Argentinian Government, with a 51% stake, and the remaining 49% trades within the NYSE (80%) and BYMA (20%). With the opportunity to reach new highs in total crude and natural gas, the development of Vaca Muerta offers an upside for this stock, whereby the reactivation of Gas Andes will allow oil and gas exports to neighboring Chile.

YPF Profitability Grade (Seeking Alpha Premium)

In addition to an uptick in exports and rapid CAPEX conversion, second quarter EPS of $2.01 beat by $2.01, and revenue of $4.86B beat by 45.02% YoY. With solid operational and financial performance, YPF continued to expand its profitability and adjusted EBITDA by 54% from the prior quarter YoY. For the ninth consecutive quarter, the company has strong free cash flow and accumulated over $700M in the first half of 2022 to strengthen its balance sheet. In addition to solid financials, YPF comes at a great price with stellar momentum.

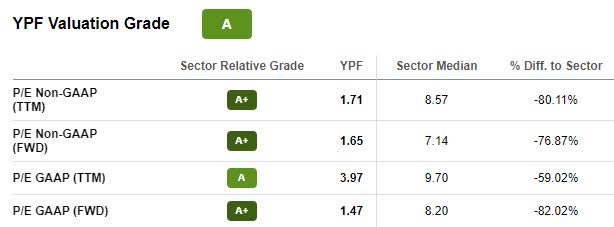

YPF Valuation & Momentum

YPF maintains a solid A valuation and is bullishly trending with excellent momentum. Not only is the stock trading under $10 per share, YTD, but it is also up +70%, and over the last year, +49%. The stock’s forward P/E ratio of 1.65x showcases a -76.87% difference to the sector and forward EV/Sales of 0.71x, nearly 60% below the sector, indicating that YPF comes at an extreme discount.

YPF Valuation (Seeking Alpha Premium)

In addition to its stellar valuation, YPF has outperformed its sector peers quarterly and has maintained this trend over the last year. After hiking its CAPEX forecasts by nearly 10%, “Going forward, we expect to continue with the strategy that we have been deploying during most of the year…the result of better performance than anticipated in the first half,” said Alejandro Lew, CFO. With so much untapped potential to look forward to, investors should consider this as a potential stock for portfolio, along with my next two energy giants.

4. Exxon Mobil (XOM)

-

Market Capitalization: $408.43B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/13): 3 out of 249

-

Quant Industry Ranking (as of 10/13): 2 out of 19

Given its global presence, significant market cap, and solid reputation, I’ve written about energy behemoth Exxon Mobil before. SA Quant has had a consistent Strong Buy on the stock for over a year when the stock was $54. We are sticking with the Strong Buy rating at $101. When investing in oil and natural gas, Exxon is one of the first names that comes to mind for many investors, especially when capitalizing on its YTD surge in the price of 60%. A Top Energy Stock to watch, XOM has excellent fundamentals, despite trading at a premium valuation (D+ grade).

XOM Valuation & Momentum

Possessing a forward P/E ratio of 8.06x, Exxon’s -1.59% is just a slight discount. However, forward EV/Sales of 1.00x and its forward Price/Sales of 0.93x collectively highlight the stock is trading at a relative to its sector peers.

Exxon Mobil Momentum Grade (Seeking Alpha Premium)

XOM also possesses solid momentum. With a 200-day upward moving average, the stock is strongly bullish. Analysts call the stock Overbought, a great indication that investors are actively purchasing shares to drive the stock higher. Given this performance and its A+ profitability grade, let’s dive into XOM’s growth and profitability metrics to outline why this stock is a great option to fuel a portfolio.

XOM Growth & Profitability

Like most large fuel companies, XOM has taken advantage of the robust refining environment, increasing fuel costs in an inflationary environment, offering the perfect tailwinds to maintain its A+ cash hoard of $63.97B. The company’s latest earnings beat top and bottom-line results.

EPS of $4.14 beat by $0.29, and revenue of $115.68B experienced a whopping +70% YoY increase. For the full year, their Permian Basin is expected to achieve 25% production growth, expansion is taking place in their Beaumont and Gulf Coast portfolios resulting in more than 17% or 250,000 barrels per day for Q1 2023.

“Our investments over the last 5 years are paying off today and helping to meet the needs of families everywhere with greater supply than otherwise would be the case. While progressing investments in our traditional businesses, we are also advancing a portfolio of opportunities consistent with our core capabilities in low-carbon solutions. We expect that these 2 will pay off in the years ahead for our shareholders and for our environment.” –Darren Woods, Exxon CEO.

Despite the volatility that comes with oil prices, crude oil rose for its fourth straight session last week after OPEC+ announced plans to cut production by two million barrels per day.

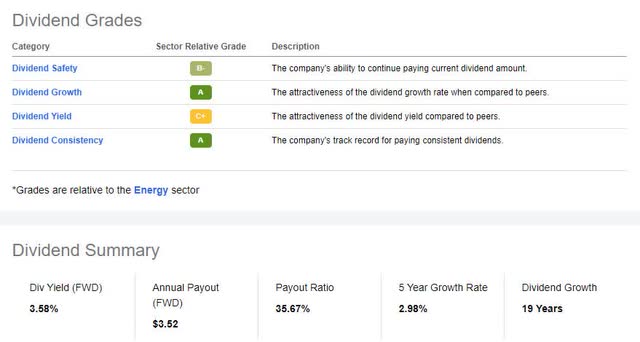

XOM Stock Dividend Scorecard (Seeking Alpha Premium)

With supply-demand factors in play, XOM continues to have a solid outlook. Not only does XOM have a strong cash flow that allows it to maintain its consecutive dividend payment for nearly 40 years, its forward Dividend yield of 3.58% and a solid dividend safety grade showcase a stock that should continue to pay a dividend for the foreseeable future. With goals of working towards a greener community, Exxon is focused on its emissions reduction plan and continues to outperform major indexes while also being the optimal long-term dividend play and inflation hedge.

5. BP p.l.c. (BP)

-

Market Capitalization: $91.83B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/13): 4 out of 249

-

Quant Industry Ranking (as of 10/13): 3 out of 19

Headquartered in London, England, BP p.l.c. is the last of my energy picks. A global energy giant that operates through multiple segments, including the production and trading of natural gas, it also offers biofuels and operates gas & low-carbon energy. The macro-environment for oil and gas is tremendous for the short term, given the rise in energy prices and the latest CPI figures, energy stands to benefit in this high inflationary environment. Like Exxon Mobil, BP offers a solid forward yield of 4.81% and has paid a consecutive dividend for ten years. After another solid earnings beat, BP declared a $0.06/share dividend, a 10% increase, accelerating its share repurchases. One of its most attractive characteristics is its extremely discounted valuation, and the stock possesses solid momentum, which we’ll dive into next.

BP Valuation & Momentum

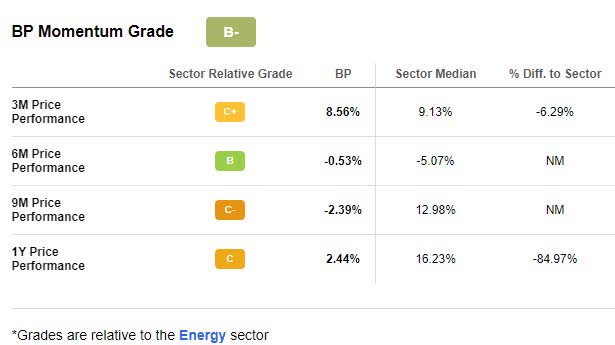

BP currently trades at $31.15 per share and has a trailing Non-GAAP P/E ratio of 4.44x, nearly 50% below the sector. In addition, its forward EV/Sales ratio of 0.54x is -69.50%, and its forward EV/EBITDA is 2.26x, a -56.01% difference to the sector, showcasing that the stock comes at an extremely discounted price.

BP Momentum Grade (Seeking Alpha Premium)

On a longer-term uptrend, BP’s momentum is strongly bullish, possessing a B- momentum grade. Over the last year, the stock is +6.71% and +13%YTD. With a $31.16B cash hoard and $6.6B excess cash flow, it’s no surprise the company continues to beat earnings estimates. Let’s dive into BP’s Q2 growth and profitability.

BP Growth & Profitability

BP continues reaffirming its guidance by beating estimates. Second quarter EPS of $2.61 beat by $0.48, and revenue of $67.87B beat by 86.10% YoY. During Q2, BP generated $10.9B of operating cash flow, focused on reducing debt, and doubled its refining margins to an average of $45.50 per barrel.

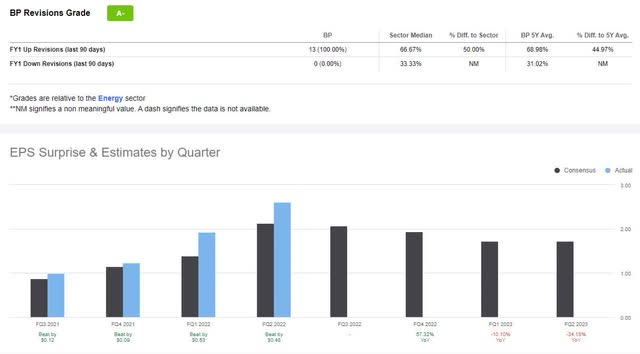

BP Stock EPS & Revisions Grades (Seeking Alpha Premium)

The strong results have allowed 13 analysts to give FY1 Up revisions over the last 90 days. With the company’s priority to the shareholders, BP’s strong financials and cash balance resulted in its 10% increase in the quarterly dividend, proving why BP should be a portfolio consideration. Not only is BP rated a Strong Buy,

“Our strategy in oil and gas is to maximize returns and cash flow, creating resilience through lower costs, higher margins, and lower operating emissions, focusing on the best barrels, and high-grading through divestments and at the right time and for the right value…results show our portfolio doing what it is supposed to do, capturing the upside from higher prices,” said Bernard Looney, BP p.l.c. CEO.

Conclusion

GNW, WTI, YPF, XOM, and BP are Strong Buy stocks according to our quant ratings. Consider all five for a portfolio to combat inflation. As inflation and market volatility eats into portfolio returns, my picks offer solid value and growth despite this highly volatile market. Demand for energy remains incredibly strong. As reported by SA News yesterday, Crude oil reverses early losses to score big gains on tight distillate supplies. US commercial stocks of distillate fuel (diesel and heating oil) are at perilously low levels ahead of winter. Even spot ultra-low sulfur diesel is up almost 60% from one year ago. Each of the recommended stocks has strong fundamentals, significant cash from operations, stellar profitability, and undisputed demand for their products that should propel stock price performance in the future. In this volatile environment, it’s crucial to consider the fundamentals when selecting stocks. You can also use Seeking Alpha’s ‘Ratings Screener‘ to quickly identify the stocks with the strongest investment characteristics.

Be the first to comment