KanawatTH/iStock via Getty Images

The Vanguard Mid-Cap Value ETF (NYSEARCA:VOE) is an exchange-traded fund whose benchmark index is the CRSP US Mid Cap Value Index. The fund’s purpose is essentially to invest in “mid-capitalization value stocks” (i.e., mid-cap stocks that trade at low prices relative to book values, earnings, dividends, and sales), solely within the United States equity market.

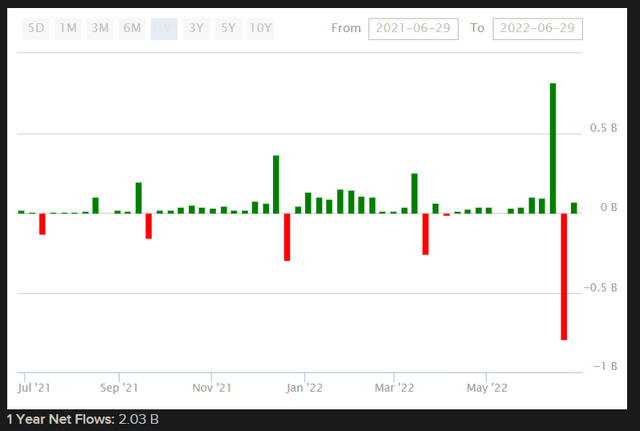

CRSP are rather limited in the information they present to the public in terms of financial ratios and such. However, Vanguard themselves are more helpful. VOE had a reported 201 holdings as of May 2022 month-end, with a price/earnings ratio of 15.2x and a price/book ratio of 2.4x. Return on equity was quoted as being 11.1%, which is quite low in comparison to mainstream U.S. equity funds. Total assets were $29.6 billion, following net inflows of circa $2 billion over the past year (as illustrated below).

Vanguard are one of the more popular providers; nevertheless, VOE is evidently a popular fund, and it has done well to attract large net inflows over the past year (notwithstanding a volatile 2022 for fund flows, especially recently). Value stocks tend to do better than tech/growth stocks when rates are rising as they have recently. Arguably mid-caps are not as well positioned as large caps during higher inflationary regimes (inflation expectations ramped this year). On the other hand, inflation expectations and rates have both fallen more recently, which means value stocks are perhaps less well positioned at present. Further, there are plenty of talks of a potential recession in the medium term; this could be good for value stocks in mature industries, but perhaps not as good for mid-cap stocks, which might lack the pricing power of the businesses of large-cap stocks.

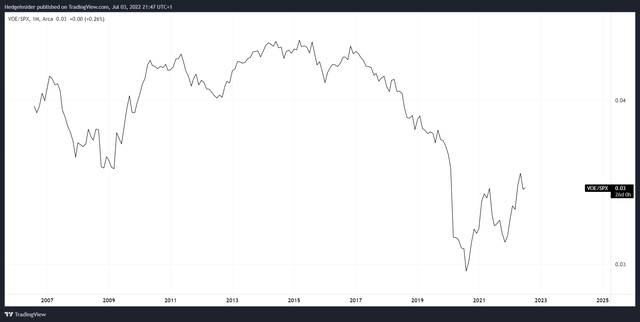

The five-year beta for VOE is 1.06x, which is quite low, although the ratio of VOE to the S&P 500 Index (a popular U.S. equity benchmark) suggests VOE struggles to out-perform sustainably.

TradingView.com

Nevertheless, there is some potential for mean reversion and thus some out-performance from current levels. The difficulty is that the underlying return on equity is not particularly high, so even if it possible for the valuation of VOE to expand based on underlying earnings, unless earnings dramatically out-perform in the long run (i.e., the portfolio’s return on equity suddenly lifts sustainably, which is unlikely), it is improbable that VOE will be able to beat the most productive businesses in corporate America that make the major equity indices (such as, indeed, the S&P 500).

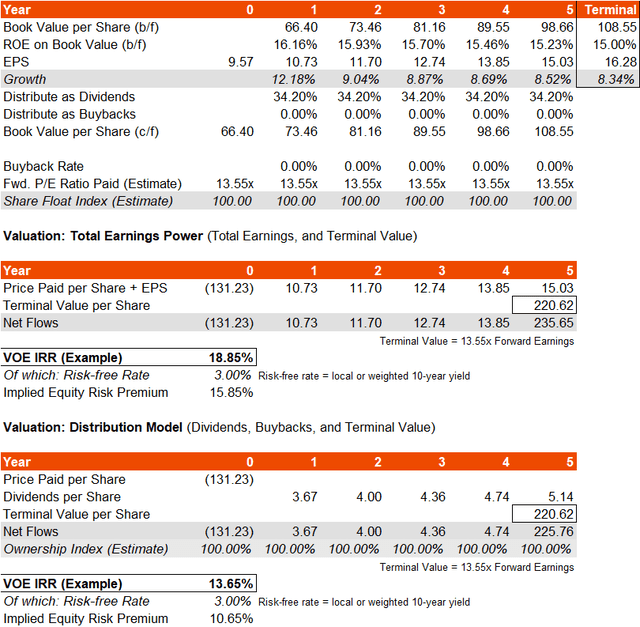

Morningstar peg three- to five-year earnings growth rates at 17.46% for VOE’s portfolio as of recent, which is noticeably high. The forward price/earnings ratio presented is 13.55x, with a price/book ratio of 2.19x (as of May month-end). The implied forward return on equity is 16.16%, which is safely higher than Vanguard’s figure (discussed earlier, presumably on a trailing basis). The dividend yield is placed at 2.25%, suggesting roughly a third of earnings are distributed as dividends.

If I assume a lower three- to five-year earnings growth rate of about 10%, driven by a softening return on equity from 16% on a forward one-year basis to circa 15% over the next few years, and no material share buyback programs, we can generate a fairly generous looking IRR gauge as follows.

The implied IRR is in the range of 13.65-18.85%, leaving a fairly hefty underlying equity risk premium of 10-16%, based on a 10-year risk-free rate of about 3% (about where the U.S. 10-year yield is trading at the time of writing). On a fund beta of 1.06x, that suggests VOE is cheap. The forward price/earnings ratio of 13.55x is low, especially based on projected earnings growth rates. It implies a forward earnings yield of 7.38%. Even on steady-state 2% earnings growth from here, that would assume an ERP of well over 6%, which again seems high for a reasonably well diversified fund (no position in the portfolio is worth more than 2% of the overall fund’s assets).

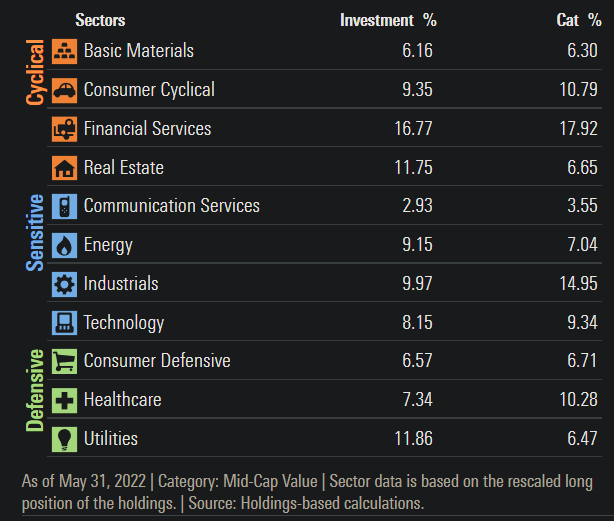

Sector exposures are quite balanced too, with Financial Services at 17%, Real Estate at 12%, and Utilities at 12%. I would concede that these are fairly low-growth, mature sectors. It is perhaps natural that stocks in these sorts of sectors are awarded low multiples.

Morningstar.com

It is probable that the portfolio will do fairly well, and not even get hit too hard by a recession, but that also consensus earnings growth estimates are probably overstated. I don’t imagine the portfolio-wide return on equity is likely to escape higher or at least not sustainably. However, it seems as though even a softening return on equity over the next few years could generate a strong IRR in the region of 13-19% per my calculations above, and that there could be an additional boost to the IRR should we see some earnings multiple expansion here, which seems possible.

However, it is worth considering another scenario. In a harsher recessionary scenario, in which earnings growth drops to a contraction of -10% in year one, followed by 0% earnings growth, and then a jump into the subsequent business cycle (plus growth quickly trailing off to 2% per annum thereafter), VOE could fall quite steeply. It would depend on how the market would want to value the VOE portfolio. In this harsher scenario, downside could actually be quite limited on a total earnings power basis (almost as if the present price already assumes this scenario). On the other hand, VOE could fall by up to 50% or so from present prices, if the market were concerned about VOE’s lower dividend potential.

In reality, in a recession, long-term rates in the United States would be even lower than 3% on the long end. So, tighter dividend yields would probably not be what markets would be concerned with. Mid-cap stocks are probably more likely selected for their growth potential. On the other hand, it appears that VOE is invested in mature sectors with limited growth potential. So, you have mid-cap risk with lower growth potential; not a particularly appealing combination. It seems as though the market has already priced in lower earnings growth versus consensus, and that the market is valuing VOE on the basis of its underlying earnings and return on equity rather than its forward dividend yield. Investors would likely go elsewhere for dividends; by investing in stocks with higher dividend distribution rates.

So, my impression is that VOE is pessimistically priced for a recession, and that if earnings results roll in at between a third and a half of the consensus, the fund is likely to do very well. It is probable that analysts’ current estimates for VOE’s portfolio are overstated, but that does not mean the forward IRR for VOE investors over the next few years will not be high. There is some room for out-performance over the next year or so, and so I would be cautiously bullish. It is not a bad idea to buy funds whose portfolios are being priced for a negative scenario.

Be the first to comment