byllwill/E+ via Getty Images

Investors in Tesla (NASDAQ:TSLA) in the first half fell off a cliff. Many of those are almost worshippers of visionary Tesla CEO Elon Musk but that could make them the equivalent of lemmings if they continue with their mass belief that Tesla’s stock price has nowhere to go but up. They did so in the first half and saw the price drop from $1,199.78 at the close on January 3, 2022 – the first day of trading this year – to $673.42 on June 30. That is a crash of 43.9% compared with that disastrous first half performance of the S&P500 which was down 20.6%! In the context of time, that was the S&P500’s worst first half performance since 1970!

Conversely few had the vision or courage to invest in natural gas and specifically in my favourite Antero Resources (NYSE:AR). I had the vision or courage – or luck! – to buy in around 3 years ago at $2.43 so I was up over 1,100% by June 30. This year it started out at $17.73 and closed on June 30 at $30.65. That increase of 72.8% compares nicely with S&P500’s drop of 20.6%. AR’s high for the year so far was on June 7 when it closed at $48.31 – up 172%!

If only I had sold then but I convinced myself there was more upside to come!

I remain convinced that there is more of that to come as well as being convinced that Tesla will continue going down making it an ideal target to short so I will start with…

Tesla

I shall try to keep my words short too as I have written at length previously why Tesla is a strong sell. It remains that way but Elon Musk’s cult following analysed in that linked Salon article, shows us why some will keep buying making it a near sure money winner for short investors.

My articles are these, starting from the first to the most recent:

Tesla Is Driving Investors Autonomously Into A Crash

Tesla’ Battery Is Running Flat

The first article was published on November 16 last year when the stock price was at $1,054. 73 and the PE was a crazy 332. When the last article came out on June 21, this year, the price was down to $704 – a crash of 33% – and the PE was down to 88 – down 73% – but still way too high when compared with other major car makers;

Their figures were:

- Ford (F) P/E 3.95

- General Motors (GM) P/E 5.3

- VW (OTCPK:VLKAF) P/E 3.91

- Toyota (TM) P/E 10

In between each article the decline continued and so did one thing that stood out among the many making comments on each article: the majority believed the stock price has nowhere to go but up. And few had any reasons other than faith in Elon Musk for their belief – some of who were quite rude to those who agreed with my points. They surely must make shorting Tesla an obvious choice for others.

Of course I and those who agreed may be proven wrong but points arising since show that the tide will not stop going out for a long time yet.

Tesla’s future sales and market share will fall. Bloomberg NEF projects that plug-in vehicle sales will rise from 6.6 million in 2021 to 20.6 million in 2025. Plug-in vehicles are predicted to make up 23% of new passenger vehicle sales globally in 2025, up from just under 10% in 2021. Three-quarters of those will be fully electric meaning that 15.45 million globally will be pure EVs such as Tesla’s. Today Tesla has around 70% of the US EV market. That Bloomberg/BofA forecast says that by then Tesla’s share will plunge to around 11%.

I cannot make those numbers work for Tesla. 11% of 15.45 million is 1.7 million EVs. According to Electrek Tesla will likely have a production capacity of more than four million electric cars per year by 2025.

If both BofA and Electrek prove to be right then Tesla will be making 2.3 million cars more than it can sell or its gigafactories will be on part time working.

By then many more makers will have EVs on the road. GM and Ford are said to be US market leaders then and VW’s CEO reckons his company will be bigger in EV sales worldwide in 2025 according to this CNBC report. He would talk up his own company but competition is coming from ICE car makers plus many new ones wanting a slice of the EV market – China alone has around 30 of those.

That might not be good for Tesla but it will for AR as those cars need recharging and much of that will add demand for more gas from AR and others to produce the electricity!

Billions are being poured into making batteries as well by ICE car makers and others so in the not too distant future there will be overcapacity in EV and battery making just as there has been for many years for ICEs so EV prices will tumble.

Tesla growth stalled in the 2nd quarter blamed on supply chain shortages and shutdowns in China bringing total deliveries of 564,000 in the first half of the year making it a huge challenge to hit the 1.5m full-year delivery target Musk set in April. That lousy 2nd quarter performance was probably known in advance by Tesla’s board chairman, Robyn Denholm, who was a big insider seller in early June.

Bitcoin losses to come. Early in 2021 Musk bought $1.5 billion of Bitcoin at a price of about $36,000 according to Barron’s. As I write the price is $18, 913.98 down 47% on that buy price. That means a profit loss of $700 million that has to be recognised at some point. It is also a pure cash loss if it gets sold.

Solar panels. Musk bought out a loss making solar panel company owned by relatives which caused an unsuccessful legal claim by Tesla shareholders. It remains loss making and that will worsen now the Biden administration is dropping tariffs on cheap solar panels made in parts of Asia including China. this has yet to show in the results.

Recalls continue to pile up. Reuters has just reported that the German road traffic agency has ordered a recall for that applies to 59,000 cars.

I could go on but said I would be short on words. I hope these and the links to other articles show that Tesla can be a winner for those that short it.

I shall be a bit long on words for my personal long investment bet…

Antero Resources

Antero Resources is one of the largest natural gas and natural gas liquids producers in the US with a large portfolio of repeatable, low cost, liquids-rich drilling opportunities in two of the premier North American shale plays, the Marcellus and the Utica shales. From an environmental view point I also like the fact that AR is not a big gas flarer and it cleans the water it uses for fracking. Importantly too, it is a major shareholder in Antero Midstream (AM) with a holding of 29%.

That is of vital importance because AM gives it the transportation pipelines out to LNG export hubs and US LNG exports are set to grow dramatically as many EU countries wean themselves off Russian supplied natural gas. Putin’s invasion of Ukraine has been a rude awakening for many countries, like Germany, who trusted him to the point that Russia accounts for 25 to 40% of gas supplies.

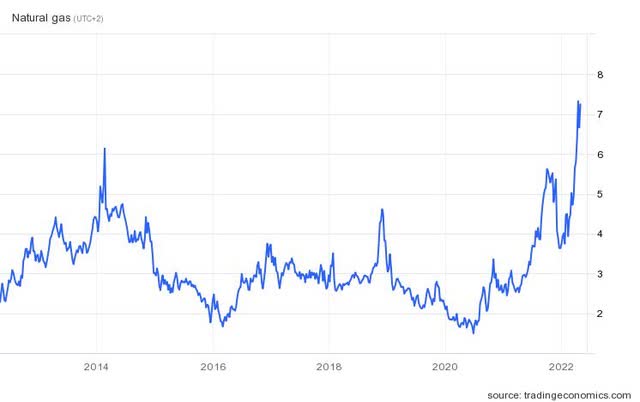

Even prior to that invasion world demand and insufficient supply had driven natural gas prices outside the US much higher than those inside, but a combination of those things drove US NYMEX prices to long term highs:

Natgas price chart (tradingeconomics.com )

That is until recently when an explosion and fire at the Freeport LNG export terminal put that out of action for several months and with it the ability to continue exporting nearly 20% of all US LNG. That only affected around 5% of AR’s gas production but they and other suppliers to that terminal now have to find customers at home until those LNG exports can start again. (For the sake of brevity I shall simply use the word gas for the rest of this article.)

It also drove down the Nymex price from down to the last price of $5.4, a bit below where it was in 2014. Then AR’s stock price high was over $60 – today $31. It hit the highest point since then on June 7 at $48. Then came that fire and the crash down along with all other US gas producers.

That fire aside, either the price in 2014 was over the top or the price today much too low. I cannot remember the macro circumstances then but they are far better today that perhaps at any time since there start of the US shale gas revolution in 2005.

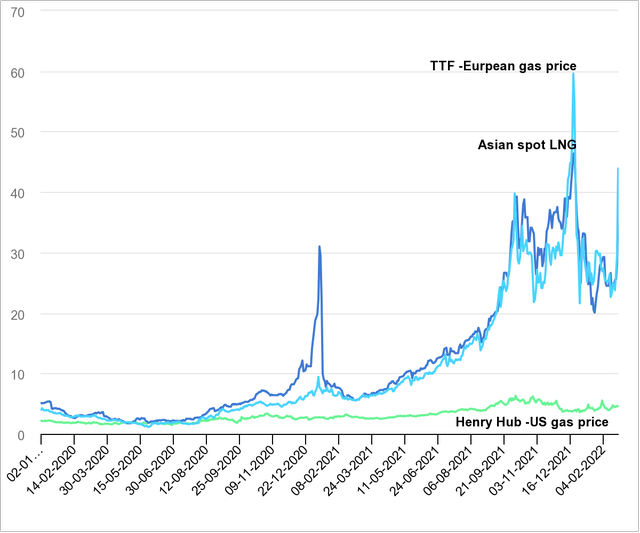

This chart of gas prices worldwide is an indicator of that…

iea

AR is also a big NGL producer – the 2nd largest in the US – and exports of those continue as normal. There is a huge a growing market for NGLs to provide ethylene because it is used for many things, such as…

- Polyethylene (Plastics) – used to make food packaging, bottles, bags, and other plastics-based goods.

- Ethylene Oxide / Ethylene Glycol – becomes polyester for textiles, as well as antifreeze for aircraft engines and wings.

- Ethylene Dichloride – this, in turn, becomes a vinyl product used in PVC pipes, siding, medical devices, and clothing.

- Styrene – synthetic rubber found in tyres, as well as foam insulation

Those wanting details of AR’s financial position can find them in their last published report.

Demand

Demand for natural gas has been growing in many parts of the world for several years. Coal fired power stations have been converted to use gas in the US and elsewhere. Those power stations are getting added demand to recharge the many EVs – including Tesla’s – that are already on the road with many more to come.

In many countries that gas is supplied in LNG form.

Japan and South Korea. Both are big importers of LNG, Japan being the world’s largest in 2021. China might overtake it this year.

China and India These two countries rank highly too and unlike countries in the west they have continued to invest in new power generation. Much of that has been coal fired and they are now trying to clean up environmentally by converting to gas, adding to demand for imported LNG as they have little gas of their own. The Chinese Government-owned entity, Sinopec, sees domestic natural gas demand rising to 395 billion cubic meters in 2022, up from an estimated 360 billion cubic meters in 2021, for another year of ~10% consumption growth. Sinopec sees domestic production growing 10 billion cubic meters annually, suggesting the country will rely on imports to supply ~2/3rds of demand growth. China already has more EVs on the road than any other country and their batteries have to be recharged and more will be so with gas produced electricity to replace filthy coal that is killing many people there.

EU and UK leaders have dug their citizens into an energy shortage hole.

The UK stopped maintaining gas storage facilities because wind would suffice and now it has a shortage of both.

That failure to plan properly has left the EU dependent on Russia for up to 40% of its gas and now Putin’s war on Ukraine has led to a panic to reduce that dependence providing opportunities for US LNG companies. Likewise, the UK that is reliant for nearly 50% of its gas from the very mature UK Continental Shelf.

Once the Freeport LNG plant is repaired and other facilities being built come on stream AR is well placed to supply more gas to those.

The United States currently has around 100 million tons of LNG export capacity, with another 20 million tons under construction and expected to come online by 2025. There are also a dozen or so projects that have export approvals by the Department of Energy and are permitted by the Federal Energy Regulatory Commission. These projects await the final touches to start construction: an equity investor, a financier, or credit-worthy customers (whose presence can help attract investors or finance). Combined, their export capacity is 187 million tons.

AR is a major shareholder in Antero Midstream with a holding of 29%. AM gives it the transportation pipelines out to LNG export hubs. AM’s facilities connect with others and can get gas and NGLs to the coast for export to countries in great need of both. Pipelines are of crucial importance given the difficulty getting new pipelines built in the US today and those pipelines can be converted to carry hydrogen as well one day.

AR also needs AM’s near 9% dividend for its cash flow so that means it has a strong chance for being safe given the concomitant fact that high gas prices look likely to be with us for several years to come.

Supply from major LNG exporter Australia is facing problems. Woodside (WDS) is one of Australia’s biggest exporter and it plans take one of its trains at North West Shelf LNG permanently offline in 2024 due to depleting feed gas supplies! And the Greens there have filed a legal suit to stop all at another major Woodside LNG export facility

Shell has constant problems at its giant floating Prelude LNG facility on the Australian coast as this JPT report shows.

Threats. The biggest one short term is that Freeport LNG terminal. Regulators will be very cautious about letting it resume service. The gas not going out via that could cause a glut in the US that will reduce prices further especially if there is a mild winter in the US. Perhaps in anticipation of that producers maybe reducing output – Baker Hughes reported that there were two less gas rigs in service last week.

The Long and the Short of it

Export problems are relatively short term and given violent weather conditions now due to climate change there could be a severe winter in the US meaning more gas will be needed. That should keep prices around current levels at which AR is very profitable. Once that LNG export facility is back online and new ones are completed demand will shoot up and so will prices.

A have long been long Antero Resources and will stay long. I recommend others do so too. I can see the stock price going back to this year’s high of $48 by year end – giving a gain of over 50% from now – and higher next year.

I have advised selling Tesla since late last year and been right. I like the cars but do not like the stock market valuation. The PE at 92 is still crazily high and there is no way profits can grow into that given the many challenges facing it that I mention above and in the linked articles. I can see that first half-crash of 43.9% being repeated in the second half leading to a year end price of $382.

In short, go long AR and short Tesla.

Be the first to comment