double_p

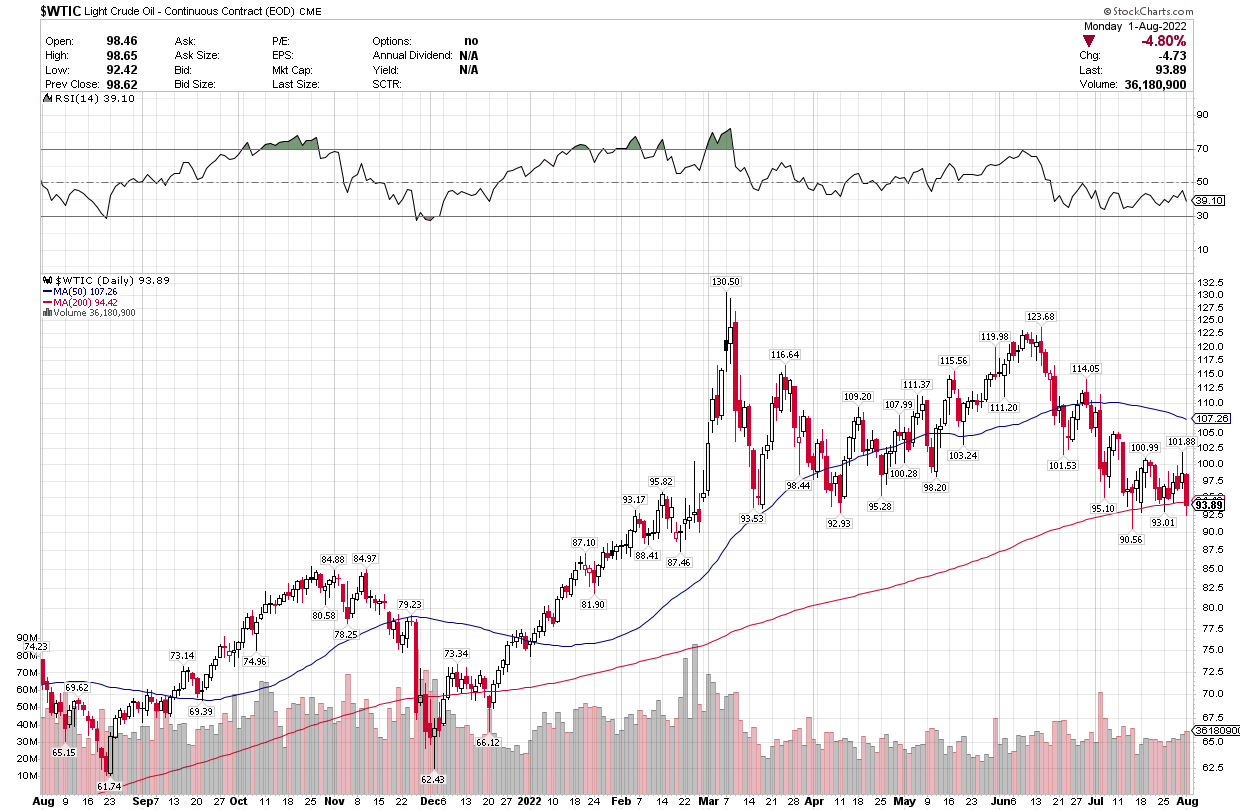

Yesterday was relatively uneventful in the markets, which I would call a win given the huge gains from last week. Crude oil fell nearly 5% to $93.89 per barrel, which also resulted in the world’s most important commodity breaking below a key long-term moving average, suggesting there are lower prices still to come. Gas prices are following, as many states are now seeing a $3 handle again at the pump. The bears will say that falling oil prices are an indication that demand is slumping because a recession is on the way. I contend that speculators are dumping oil futures contracts because the trade that followed Russia’s invasion of Ukraine has run its course. This means lower headline inflation numbers in the months ahead.

Finviz

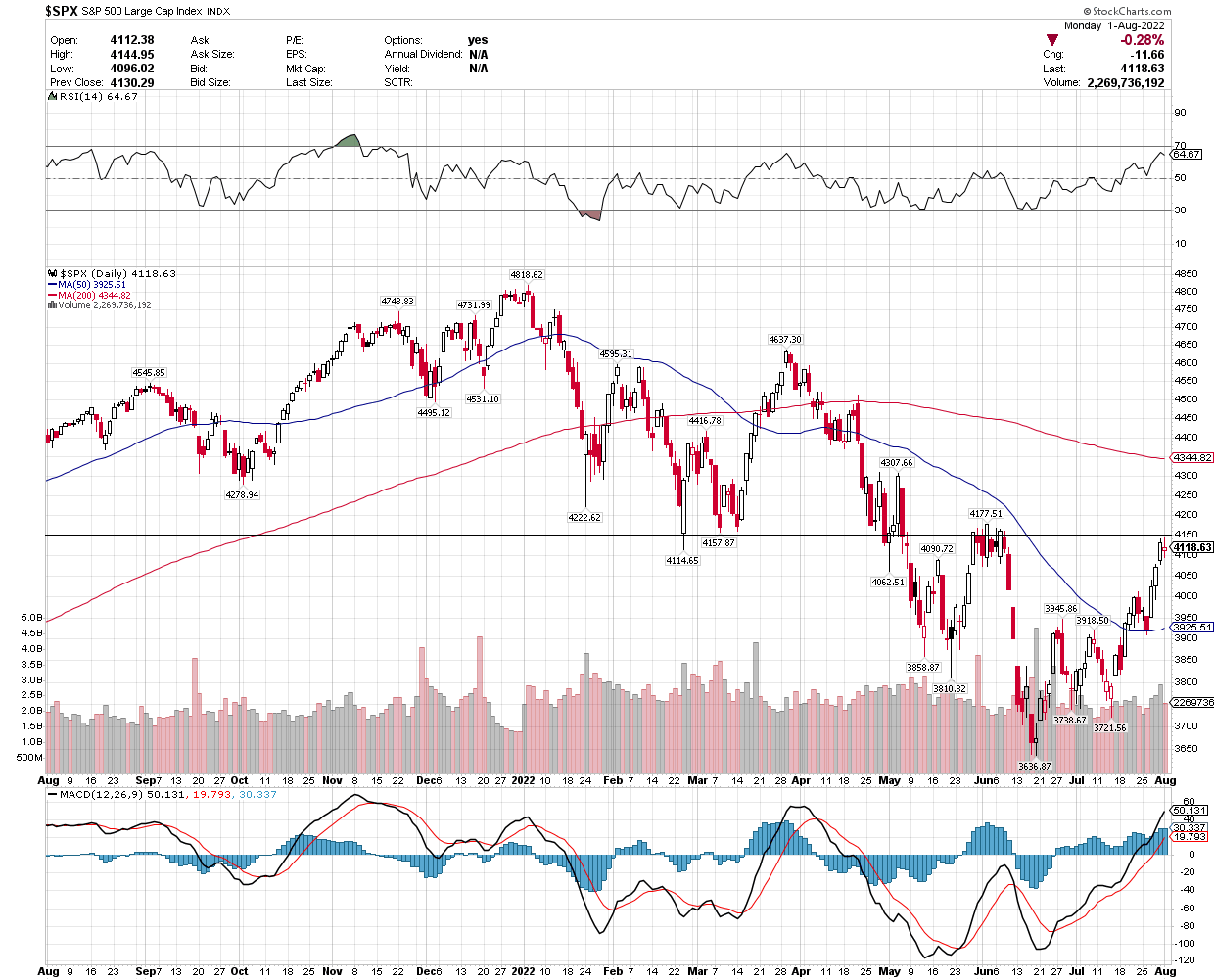

Regardless, the bears on Wall Street will not give up without a fight. Mike Wilson, the chief strategist at Morgan Stanley, called July’s market performance a bear-market bounce that investors should evade before time runs out. His counterpart at Bank of America feels the same way. Savita Subramanian asserted that July was a bear-market rally that will be short-lived. I disagree on the basis that the bears need a recession to undercut the June lows in the major market indexes, but the evidence of an official economic contraction is not in the cards at this point.

Stockcharts

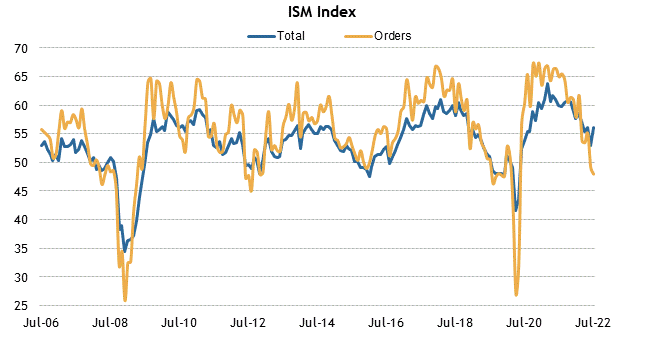

To the contrary, the Institute for Supply Management issued its manufacturing survey results for July, which showed that the manufacturing sector continues to expand with a reading of 52.8%. Any number above 50% indicates expansion. Granted, the growth rate is slowing from the ongoing shift in consumer preferences from goods to services, but it is still growing. Furthermore, this slowdown is helping companies catch up on order backlogs and improving the supplier deliveries index, which eases the pressure on supply chains and reduces inflation. To that point, inflationary pressures continue to ease with the largest monthly drop in the prices paid sub-index since June 2010. The ISM Manufacturing Index is a microcosm of a soft landing.

Briefing.com

The slowdown in the rate of growth, as well as reduced expectations for additional rate hikes, is starting to weaken the U.S. dollar. If it continues, this could be an important tailwind for corporate earnings during the second half of the year when it could not be needed more. With approximately 40% of S&P 500 earnings coming from overseas, the approximate 10% increase in the value of the dollar reduced profits by more than 4%. Therefore, a reversal in dollar strength would increase the value of overseas revenues for U.S. corporations and boost earnings in a similar proportion.

Finviz

I noted the overbought nature of the major market indexes on a short-term basis in yesterday’s report, which should lead to a healthy pullback in risk asset prices. It looks like the excuse today will be House Speaker Nancy Pelosi’s scheduled visit to Taiwan, which China has indicated will have unspecified consequences. Such saber rattling does not give me too much concern, as it is more of an excuse to take money off the table than a justifiable reason to sell risk assets.

The Technical Picture

Falling just shy of my targeted range of 4,150-4,200, I think a pullback in the S&P 500 to the now rising 50-day moving average would be constructive after the tremendous July run.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment