Sjo/iStock Unreleased via Getty Images

Investment thesis

Ferrari (NYSE:RACE) once again delivered outstanding results in Q2 2022, making the company a wealth compounder that keeps on beating expectations. I started explaining my bull thesis on Ferrari in May, showing how the company has a moat in the automotive industry: it manufactures a unique product that makes the brand one of the most valuable in world; it has a strategy to sell always one car less than there is demand for, in order to preserve exclusivity; and thanks to its high-performance extremely luxurious cars, the company has enormous pricing power that enables it to offset inflation or any other unexpected cost. Finally, part of Ferrari’s moat is linked to its niche of customers: high-net-worth individuals whose number is increasing and whose desire to drive a prancing horse car is always there to be satisfied.

Furthermore, in a second article I started considering Ferrari as a stock that is worth owning in a dividend growth portfolio. The yield is not very high, since it is currently at 0.7% and the free cash flow yield is around 2%. However, since Ferrari started paying its dividend, the dividend moved up from $0.51 in 2016 to $1.47 last April, which is almost a 3x. To this, Ferrari has started adding a buyback program that is rewarding shareholders even more.

A high-quality product, a difficult-to-attack moat, and shareholder returns are all factors that, when combined to the great financial results Ferrari is able to deliver, make the stock always worth a look.

2Q And 1H Results

In its report, Ferrari published these numbers.

Ferrari shipped 3,455 units, up 28% YoY. For the first six months, shipments were 6,705 units, up 23% YoY.

The prancing horse reached net revenues for the quarter of €1.3 billion (vs. €1.25 billion expected), up 24.9% YoY. EBITDA for the quarter was €446 million, up 15.5% YoY and EBIT reached €323 million, up 17.8% YoY. EBITDA and EBIT margin continue being impressive, at 34.6% and 25% respectively. Net profit was €251 million which equals to an EPS of €1.36 for the quarter, up 23% YoY (and up 9.6% vs. €1.24 expected). Industrial free cash flow generation was of €79 million.

For the first six months of the year, the results are equally impressive with total net revenues of €2.47 billion, up 19% YoY, an EBITDA of €869 million and a margin of 35.1%, an EBIT of €630 million with margins at 25.4%, net profit at €490 million, and EPS at €2.66, up 20% YoY.

All geographic regions contributed positively in the quarter with the Americas up 62.2% YoY and China more than doubling total shipments for the quarter compared to the same quarter last year (358 vs. 192).

Net revenues from Cars and spare parts accounted for €1.1 billion (up 25% YoY), while the revenues from Engines decreased due to the fact that the contract with Maserati is approaching its expiration date in 2023. However, sponsorship revenues were up 29.5% thanks to a better Formula 1 ranking I talked about in my first article.

What about the expenses? Capex and R&D are under control. The former was €166 million for the quarter and €298 for the first half vs. (€166 million in Q2 2021 and €317 million in 1H 2021); the latter was €230 million for the quarter and €464 million for the first six months (vs. €226 million in Q2 2021 and €452 million in 1H 2021). This shows that Ferrari can manage its cost very well and in a predictable manner.

While Ferrari’s previous guidance for the year had forecast net revenues of €4.8 billion (up 11% from €4.3 billion in 2021), the company has now raised its full-year guidance by €100 million, with an expected EBITDA of €1.7 billion, an EBIT of €1.15 billion, EPS in the €4.80-4.90 range and industrial FCF more than €650 million.

However, with these numbers and a solid trend of overdelivering on estimates, I think we can forecast total revenues at €5 billion, with an EBITDA around €1.8 billion and an EBIT of €1.25 billion. EPS could come in at €4.90-5.00 and the FCF could be around €700 million.

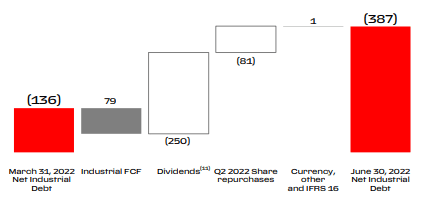

Net industrial debt, which excludes the debt and cash related to the financial services, increased from €297 million at the end of 2021 to €387 million at the end of the first half. Net debt of financial activities accounts for €1.17 billion. Now, the net industrial debt is almost completely covered by the EBIT of this past quarter. If we sum up the two debts, we have a total net debt of €1.56 billion at the end of June vs. €1.29 billion at the end of 2021. However, as shown from the bridge graph below, the increase in debt is due to a decrease in cash of more than €300 million paid in dividends and buybacks. So, it doesn’t worry me at all as the company will build back its cash position in the next quarters as it has always done after every Q2 in the past years.

Ferrari Q2 2022 Results Presentation

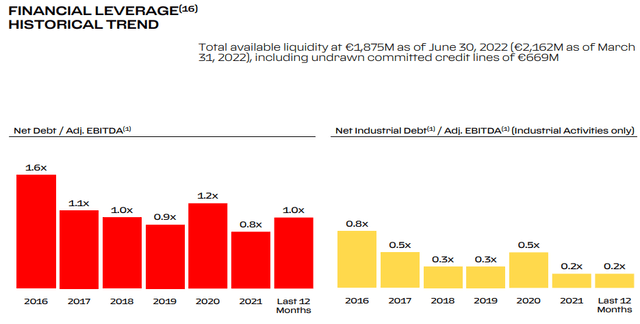

One of the most important graphs I like to see about a company is how it is financially leveraged. Ferrari has made it clear that it is going to keep its debt/EBITDA ratio well under control and it will probably end the year with a ratio lower than 1, meaning that one year’s EBITDA summed to the total available cash on the balance sheet is enough to repay the company’s whole debt. This is a conservative balance sheet that, as a shareholder, I like to see as it doesn’t put into any danger the company and its ability to return capital to investors.

Ferrari Q2 2022 Results Presentation

Let’s get to one of the primary keys to measure Ferrari’s performance: free cash flow. This quarter it was down 29.5% from €113 million to €79 million. However, for the first six months of the year, Ferrari’s FCF is at €378 million vs. €260 million in 2021 which is a 45% increase. As outlined in the results presentation, this quarter’s FCF was down because of a higher tax payment due to 2021 balance and first 2022 installment. Capex was, as seen, in line with last year’s and didn’t affect much this metric.

Valuation

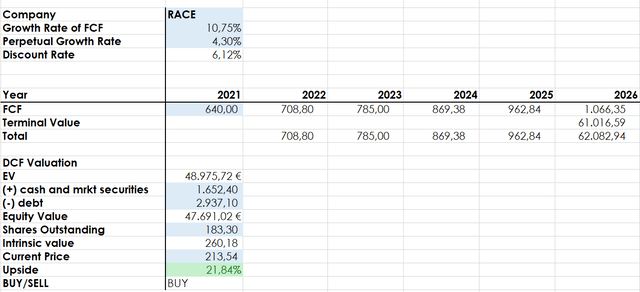

One of the main arguments against the stock is that it is expensive at a 40 PE and a price/FCF of 25. However, these are metrics that reward a company for its moat, its quality and its reliability, which, in times of uncertainty, are to be factored in as aspects that do deserve a premium. Not by chance, Ferrari has outperformed the broader market, while being priced expensively and it has been so far rare to pick up the stock at so called cheap valuations. However, I do think Ferrari now is not too expensive. Here is my discounted cash flow model. Compared to my past estimates, I used a lower discount rate as I think that Ferrari is deserving more and more a premium. I am expecting over the next five years to see Ferrari’s FCF to grow at around 10% a year and then keep on growing at just more than 4%. It might seem generous, but Ferrari has the strength to keep up with these numbers. As we can see, I still reach a price target of $260 which is a 21% upside from today’s valuation. This is why I rate the stock as a buy.

Author, with data from SA and Ferrari

At the moment, Seeking Alpha Quant metrics assign Ferrari an A- ranking for Momentum, and this might make some investors wait until this fades away. However, as a shareholder, I must say it is very hard to pick up this stock at depressed valuations as it is generally trending upwards. Thus, to build my position, which is not yet fully completed, I am simply dollar cost averaging in and I would advise long-term investors to use the same strategy.

Be the first to comment