Sundry Photography

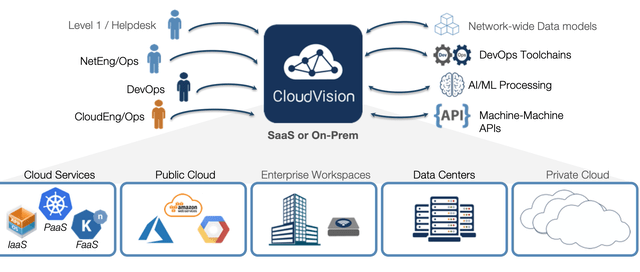

Arista Networks (NYSE:ANET) is a leading provider of high performance IT Networking equipment for Datacenters and Campus environments. The company has over 8000 customers and even supplies the “Cloud Titans” such as Meta (META) and Microsoft (MSFT) with high powered switches for their data centers. Arista has generated blistering growth in the second quarter and beat top and bottom line growth estimates. In addition, the company has high margins and best in class technology, which acts as a competitive advantage. Let’s dive into the Business Model, Financials and Valuation for the juicy details.

$4 Trillion Market Opportunity

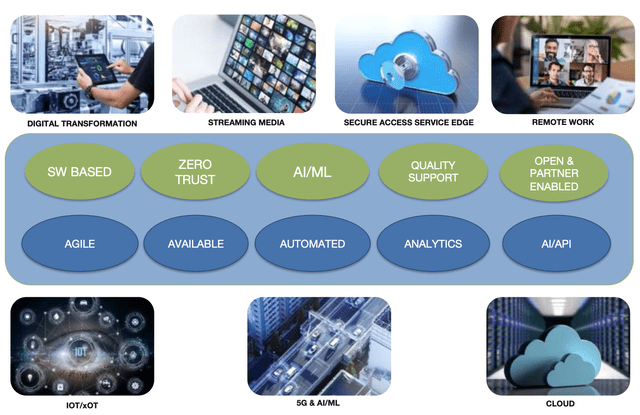

Arista Networks is poised to ride the growth in at least seven converging technology industries. The most prevalent is the “Digital Transformation” of enterprises. Large organizations are moving their on-premises data center to the cloud, in order to become more agile and lower operating costs long term. This secular shift was accelerated by the pandemic and the industry is forecasted to hit a staggering $3.8 trillion by 2028, growing at a blistering 22.1% CAGR.

Arista TAM (Investor Day Presentation Aug 2022)

Other growth industries include; Streaming Media, Edge Cloud, Remote Work, IoT (internet of Things), 5G, AI and many more.

Tech Business Model

Arista networks is a leader in high performance data center switches. In simple terms, you can think of “Switches” as the building blocks of a Network that connect together for communication.

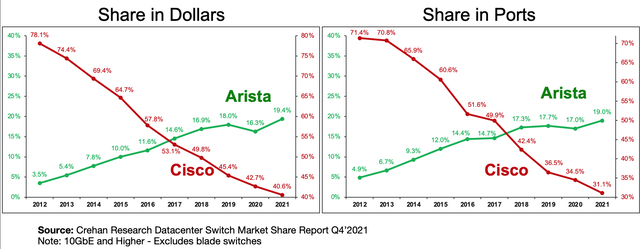

Cisco was known has the go to provider for Switches, however Arista is rapidly gaining market share and offers a better solution for high performance use cases such as Data Centers. As you can see from the charts below, Arista has increased its “Share of Dollars” and also “Share of Ports”, while Cisco has been declining.

Arista Vs Cisco (Investor Presentation August 2022)

Competitive Advantage (Microsoft and Meta Partners)

As mentioned in the introduction, Arista supplies data center equipment (Switches) to “Cloud Titans” such as Microsoft and Meta who management states are “very special customers” and each expected to be 10% of their total revenue.

At Microsoft, Arista’s Switches are deployed in all layers of their network across the entire “Spine and Leaf” architecture. In addition to Microsoft’s Local Area Network (LAN) and Cloud Edge. Arista has even partnered with the Microsoft to create a Data Center Interconnect (DCI) layer, which is used to connect Data Centers together and is now the “gold standard” in the industry.

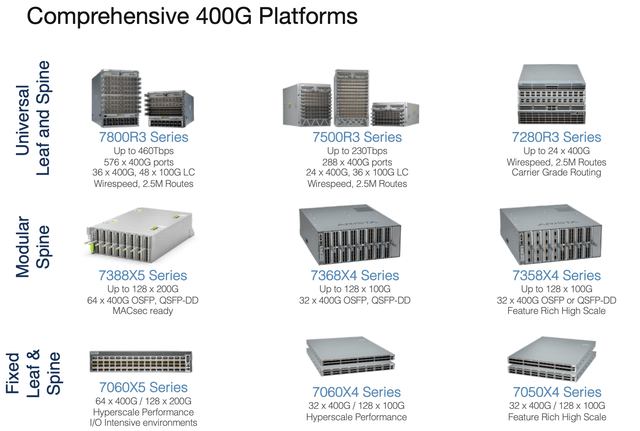

Arista is deeply embedded with Microsoft and they even have an engineering partnership to develop and test the next generation of 400G switches which are astonishingly powerful.

400G Platforms (Investor Presentation August 2022)

For Meta, Arista has supplied their Data Centers with products since the “early days” and have codeveloped multiple products with them. I believe this “co-development” with both Meta and Microsoft gives the company a competitive advantage over other industry players.

“Cloud Titans” are the company’s largest vertical followed by Enterprises, cloud specialty providers and Financial industry players.

Best in Class Products

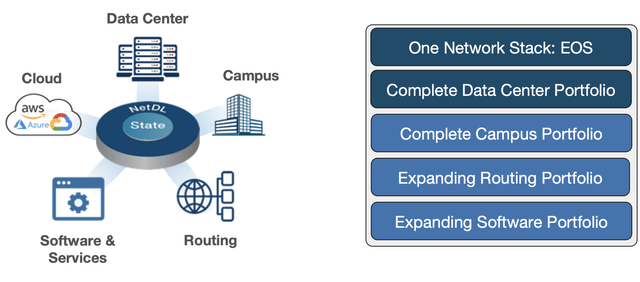

Arista has built out a “Complete” Data Center portfolio, Campus Portfolio and they are now expanding their Routing and Software Portfolio.

Arista Product segments (Investor Presentation August 2022)

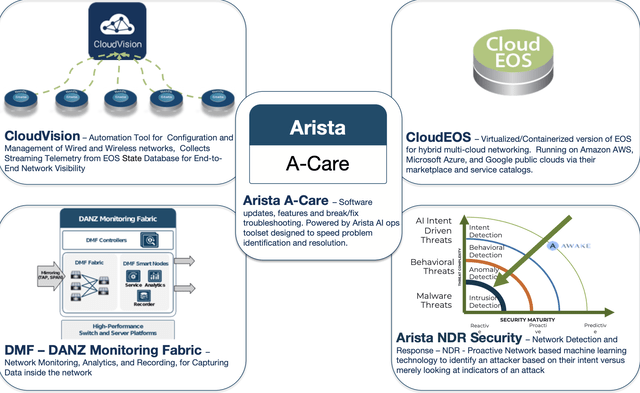

A unique aspect of Arista is the only networking company to offer a consistent operating model for Cloud, Enterprise or Service Provider. The core of its Platform is its Extensible Operating System (EOS™) which is a scalable operating system that enables more efficient maintenance, security and fault finding when compared to traditional systems.

CloudVision is an automation tool which gives users a “Vision” into the state of their IT infrastructure. This includes easy configuration options and the ability for telemetry data to be easily captured.

For example, in the 2nd quarter of 2022 the company won a contract for overall Data Center architecture and CloudVision was a “Key Decision” factor for the customer, according to Arista’s management.

CloudVision (Investor Presentation August 2022)

Arista’s support network (A-Care) is also best in class and the company has an high NPS (Net Promoter Score). In addition to being a Gartner Magic Quadrant leader in Data Center Networking.

Arista Care (Investor Presentation August 2022)

In the first half of 2022, Arista completed two small acquisitions to increase its switching and security expertise. One of the acquisitions was a company called Untangle which is an edge threat management solution.

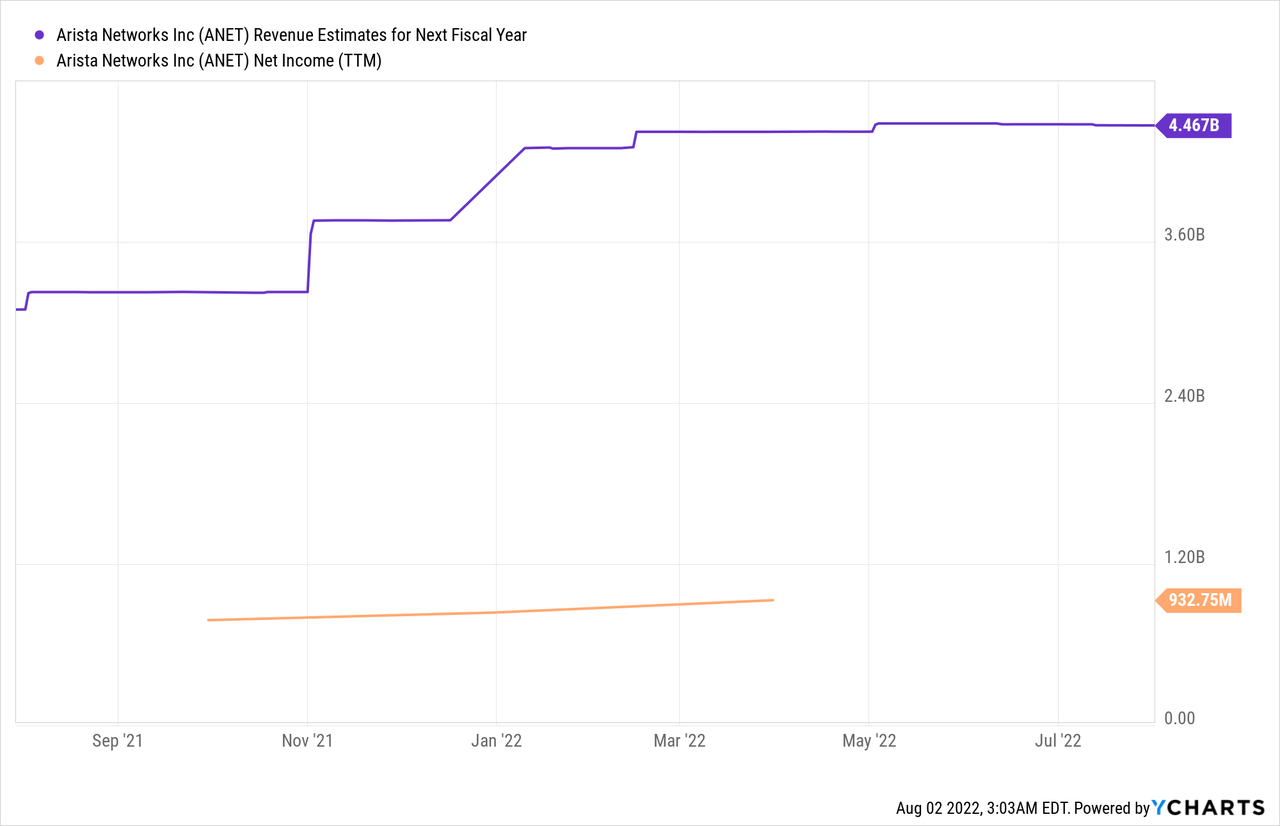

Growing Financials

Arista Networks announced strong financials for the second quarter of 2022. Revenue popped to $1.052 billion, up a blistering 48.75% year-over-year and up 20% over the prior quarter. This smashed analyst expectations by $72 million. This growth was driven by strong US revenues with their “Cloud Titan” customers such as Meta and Microsoft. International revenues thus made up a smaller portion of revenues this quarter at 20% of total, less than the 24% in the prior quarter. Service and Subscription revenue made up 17.6% of total revenue, this was down slightly from the 19.2% in the prior quarter. However, this was driven by stronger product revenue growth and more “consistent” Service and Subscription revenue growth, thus, it’s not an issue.

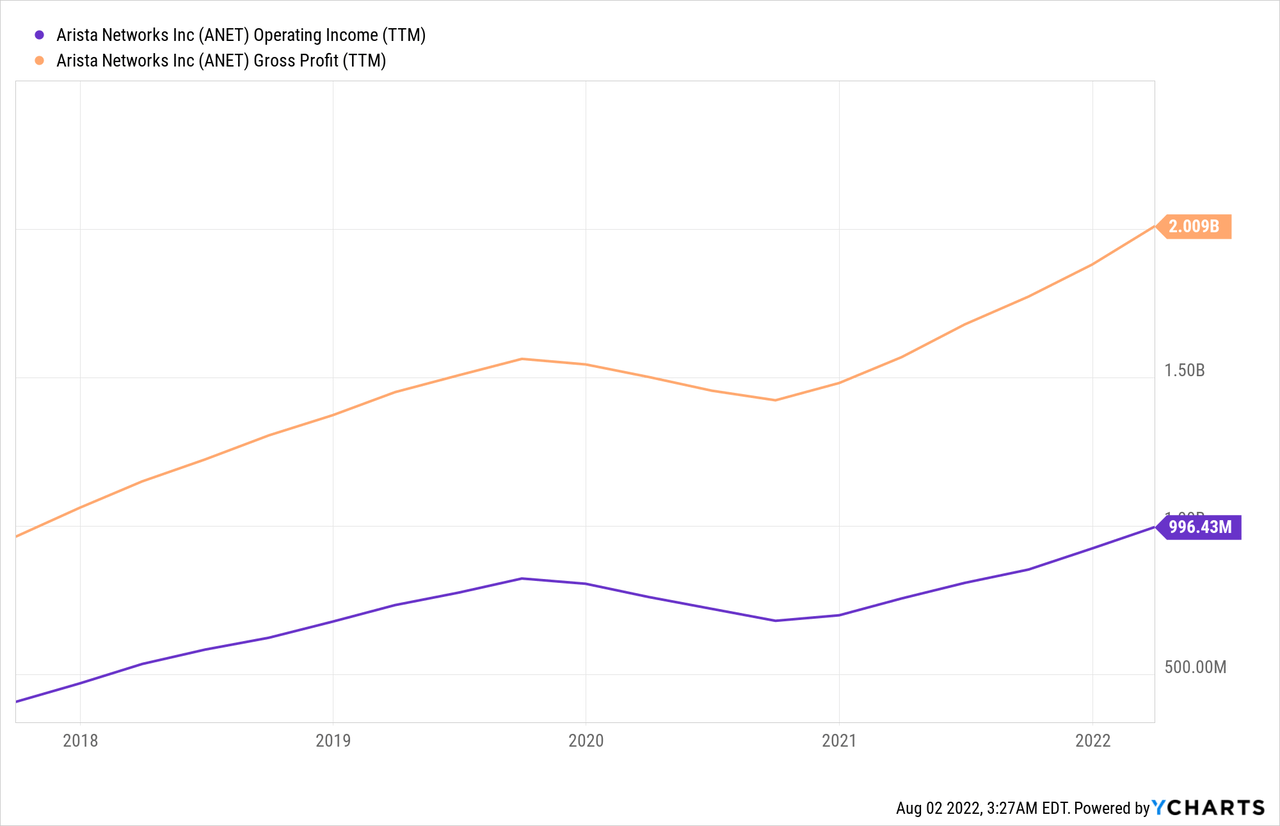

Arista Networks generates high gross margins overall of over 60%. In the second quarter of 2022, its Gross margin was 61.9% which was at the top end of managements guidance but slightly lower than prior quarters. This was driven by a higher mix of Cloud Titan revenue and rising supply chain costs.

According to the CFO (Ita Brennan),

Overall, demand in the quarter was healthy with strength across all areas of the business. The supply environment remains challenging with ongoing supplier decommits constraining shipments and requiring higher cost broker purchases and expedite fees.

This was surprisingly positive, but also realistic given many companies are reporting poor demand across areas.

Despite rising costs in many areas, Arista’s Operating Expenses were flat compared to the last quarter at $226.1 million or 21.5% of Revenue. This was fantastic to see and shows the company has high Operating Leverage moving forward. For the uninitiated “Operating Leverage” is a company’s ability to keep its fixed costs the same while increasing revenue. With the majority of expenses been managements choice as opposed to being thrust upon them. For instance, the company decided to increase its investment into R&D by 14.1% to $148 million, which was mainly driven by increased headcount. However, they decided to decrease Sales and Marketing Expenses slightly to $63.1 million (6% of revenue) down from $66.2 million in the prior quarter. While General and Administrative expenses (the costs that are hard to control) was pretty much flat at $15 million and only makes up a slither of revenue at 1.4%.

Due to its high revenue growth and handle on operating expenses, it’s no surprise the company generated strong operating income of $425.5 million, which equates to ~40% of its revenue, which is fabulous As you can see from the chart above the trend has been upwards over the past few years, with a slight dip during the pandemic.

Earnings Per Share (EPS) was strong at $1.08, which beat analyst expectations by $0.16 and was up a rapid 59% year-over-year.

Arista Networks has a fortress balance sheet with cash, cash equivalents and investments of ~$2.9 billion. In addition to total debt of less than $57.5 million. Given the company completed two acquisitions for $158.9 million, its balance sheet is rock solid.

Management showed confident and bought back $483.7 million of stock at an average price of $101 per share. Management still has $307 million of stock authorised to buy back, after a major $1 billion buyback program announced in October 2021.

Advanced Valuation

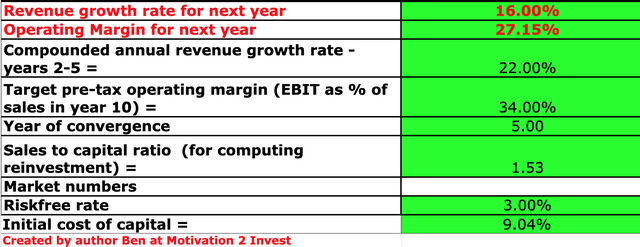

In order to value Arista Networks, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted its growth rate to dip to just a 16% growth rate for next year, given the macroeconomic environment. In the future I am forecasting a 22% growth rate over the next 2 to 5 years. This is higher than some analyst estimates, but still much lower than the ~48% growth rate generated this past year.

Arista Stock Valuation (created by author Ben at Motivation 2 Invest)

I have also forecasted the company’s operating margin to increase to 34% over the next 5 years, as the company benefits from its high operating leverage discussed previously. Note, this operating margin is based up trailing 12-month figures and includes an adjustment for R&D expenses, which I have capitalized. For extra accuracy, I have taken into account the company’s effective tax rate which was approximately 20.9%.

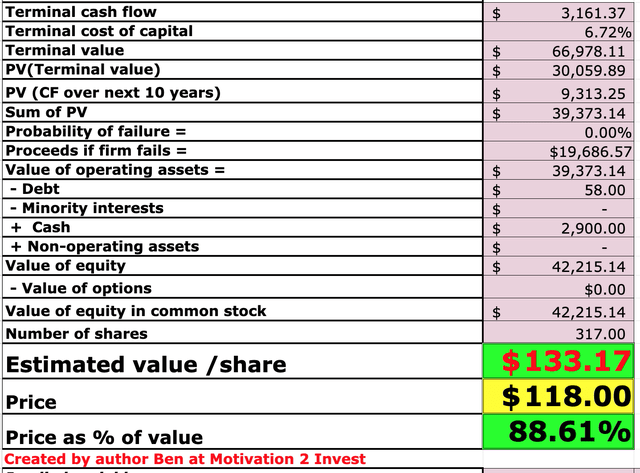

Arista Stock Valuation 1 (created by author Ben at Motivation 2 Invest)

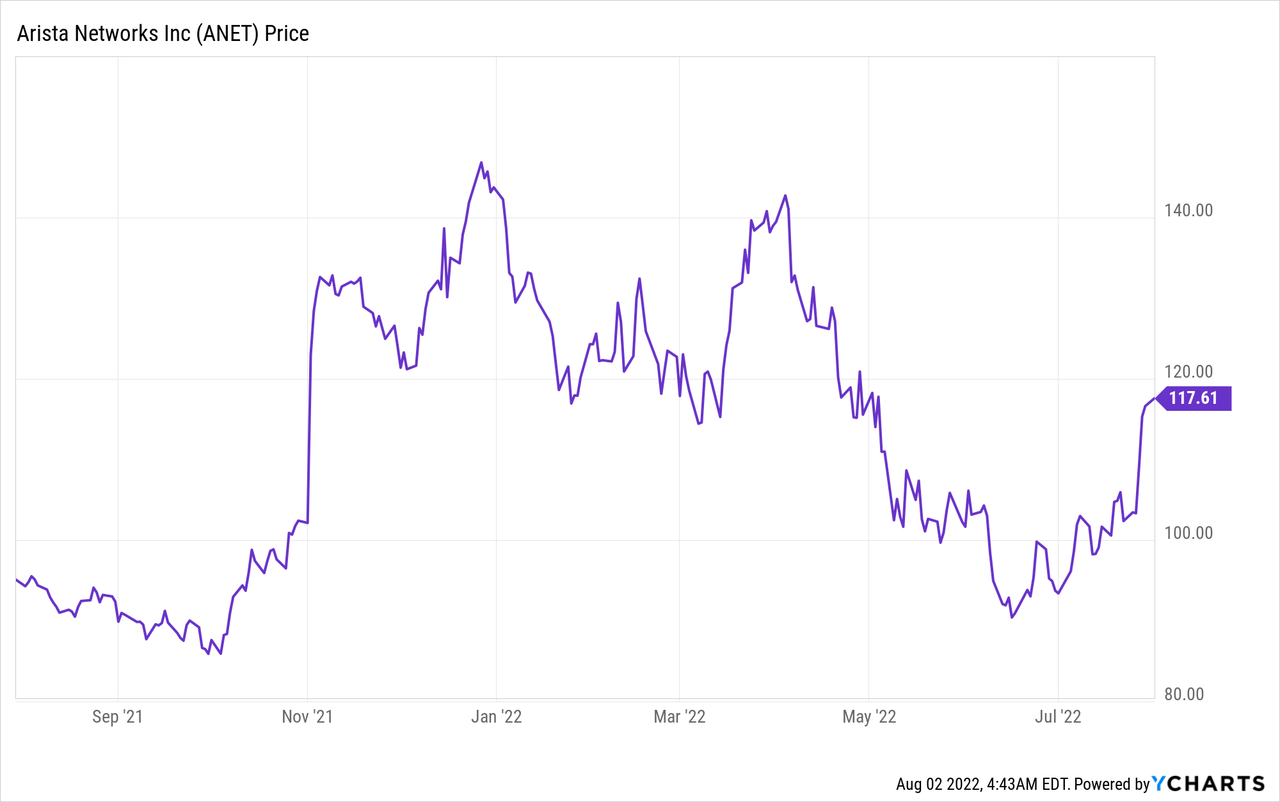

Given these factors I get a fair value of $133/share, the stock is trading at $118/share at the time of writing and thus is ~11% undervalued.

Note: After a fantastic quarter, the stock looks to be moving by +5% in pre market trading and thus, by the time you read this post I imagine the stock will be in “fairly valued” territory.

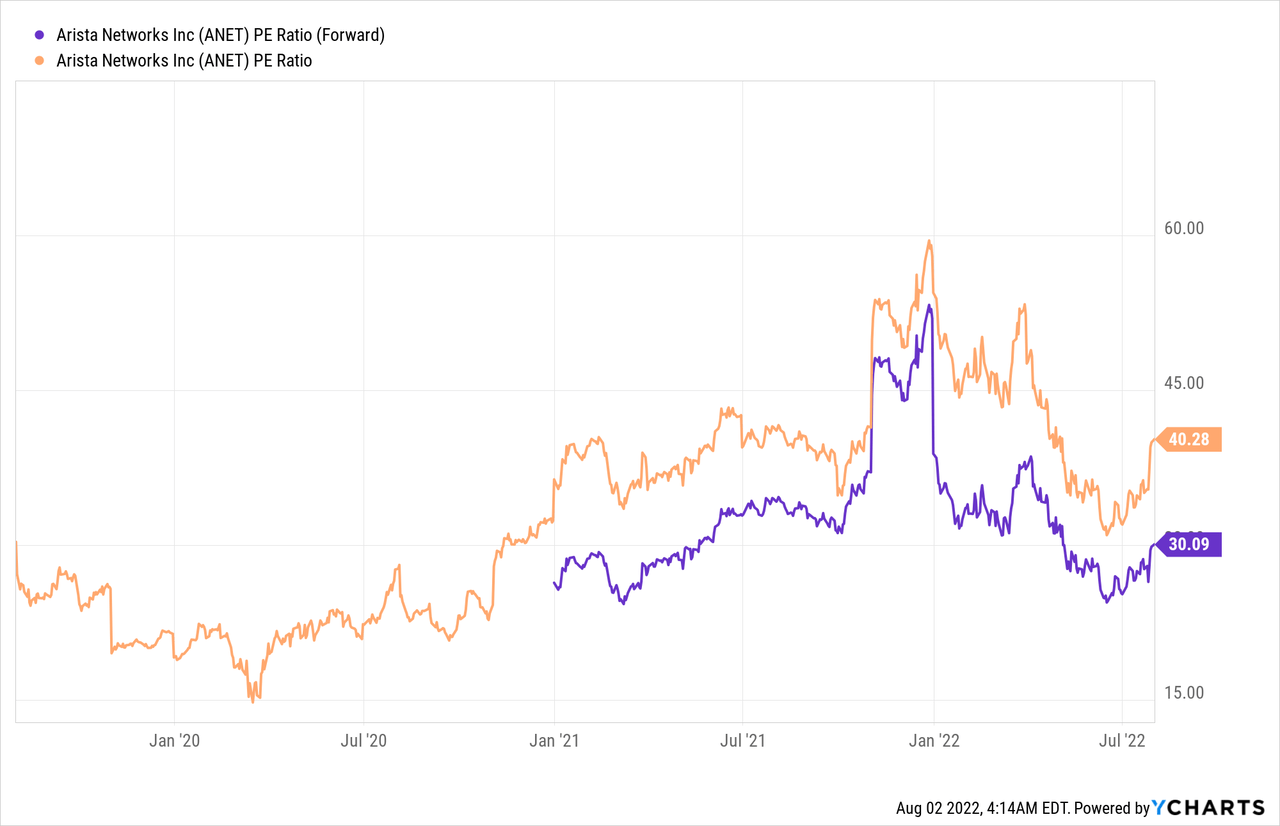

As an extra datapoint, Arista is trading at a PE Ratio (FWD) = 35, which is not exactly cheap relative to the “IT sector” mean of 22. However, it is ~3% cheaper than its 5-year average.

Risks

IT spending Cutback

The high inflation, rising interest rate and supply chain constrained environment is causing many companies to temporarily cut back on expenses. Meta and many other tech companies have announced hiring slowdowns. In addition, many “Cloud Titans” such as Microsoft and Google, have announced to be extending the life of their server and network assets from four years to six years. For instance, Microsoft CFO stated:

“Investments in our software that increased efficiencies in how we operate our server and network equipment as well as advances in technology have resulted in lives extending beyond historical accounting useful lives”

Thus, actions such as these will directly impact companies such as Arista, as delayed IT spending will hit its growth rate.

Final Thoughts On ANET

Arista Networks is a tremendous company which is poised to benefit from the growth in high powered computing for Datacenters. The company has generated blistering growth in most recent year, it has high margins and the stock is “fairly valued”. I do expect a slowdown in growth in the next year as companies adjust expenses, however in the future years I expect growth to remain strong due to the mammoth market opportunity.

Be the first to comment