G0d4ather

Russ Koesterich, Managing Director and Portfolio Manager, of the Global Allocation team details what needs to change for bonds to be an effective hedge again.

At a time when investors desperately need a way to hedge equity risk, their most reliable tool is still broken: bonds. While bond yields have steadied in recent weeks, economic and financial conditions are still not supportive of bonds resuming their role as a hedge.

I last discussed bonds as a hedge in March. At the time I suggested that while the war in Ukraine created a “safe-haven” bid, bonds still had a pair of problems: inflation and the Federal Reserve. Until inflation really slows, bonds remain as much a source of risk as a hedge.

To be fair, some things have changed since March. Bond prices have tumbled, and yields have risen. U.S. 10-year nominal yields are 1% higher and real — i.e., inflation-adjusted — yields have risen by approximately 1.2%, with real yields now above the post-global financial crisis (GFC) average. Nor are bonds the only asset class that has struggled. The S&P 500 has lost about 15% since the March peak.

Both stocks and bonds are reacting to stubbornly higher prices and tighter financial conditions. Headline inflation has remained at multi-decades highs. And while core prices have slowed, various measures of core inflation remain at more than double the Fed’s stated target.

With the Fed still struggling to lower inflation, financial conditions have continued to tighten. One measure of this, the Goldman Sachs Financial Conditions Index, is now suggesting the tightest financial conditions since the spring of 2020. This dynamic continues to create a significant headwind for stocks, bonds, and the broader economy.

Still not working when needed most

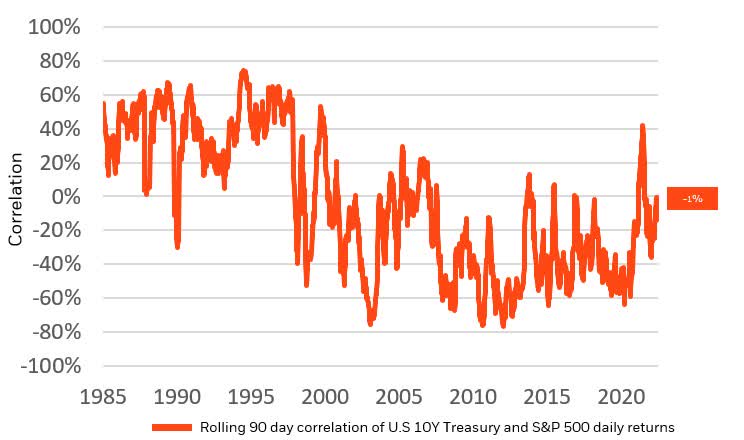

With inflation high and the Fed locked into a tightening cycle, stock/bond correlations remain materially higher than the post-GFC norm (see Chart 1). This translates into bonds being more likely to fall than rise when stocks drop. Since the start of the year, long duration bonds fell an average of -0.1% on days when the S&P 500 is lower. When stocks really tumble, bond losses tend to be even worse. There have been 11 days when the S&P 500 has declined by 2% or more. On those occasions, the average return for long duration U.S. Treasuries has been roughly -0.60%.

Correlation of bond and equity returns

Notes: the line shows the correlation of daily U.S. 10y Treasury returns and S&P 500 over a rolling 90-day period. RO-191915 (Refinitiv Datastream, chart by BlackRock Investment Institute, Jun 22, 2022 )

When to add back?

While bonds are still not behaving as a reliable hedge, it is reasonable to ask if the backup in yields will start to change this dynamic? My view is yields either need to be moderately higher or inflation lower for things to change. The other variable to watch is the source of equity risk. If stocks are moving lower, as has been the case all year, because valuations are contracting, bonds are unlikely to work. However, if recession fears continue to build, implying lower earnings, this could flip the stock/bond relationship back to negative. In other words, investors should focus on some combination of weaker economic data, a sharper deceleration in inflation and/or modestly higher yields. Until one or more of these conditions change, bonds are unlikely to resume their role as a reliable hedge.

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment